Tinkoff Bank | Neo-Bank Strategy Deep Dive

Description

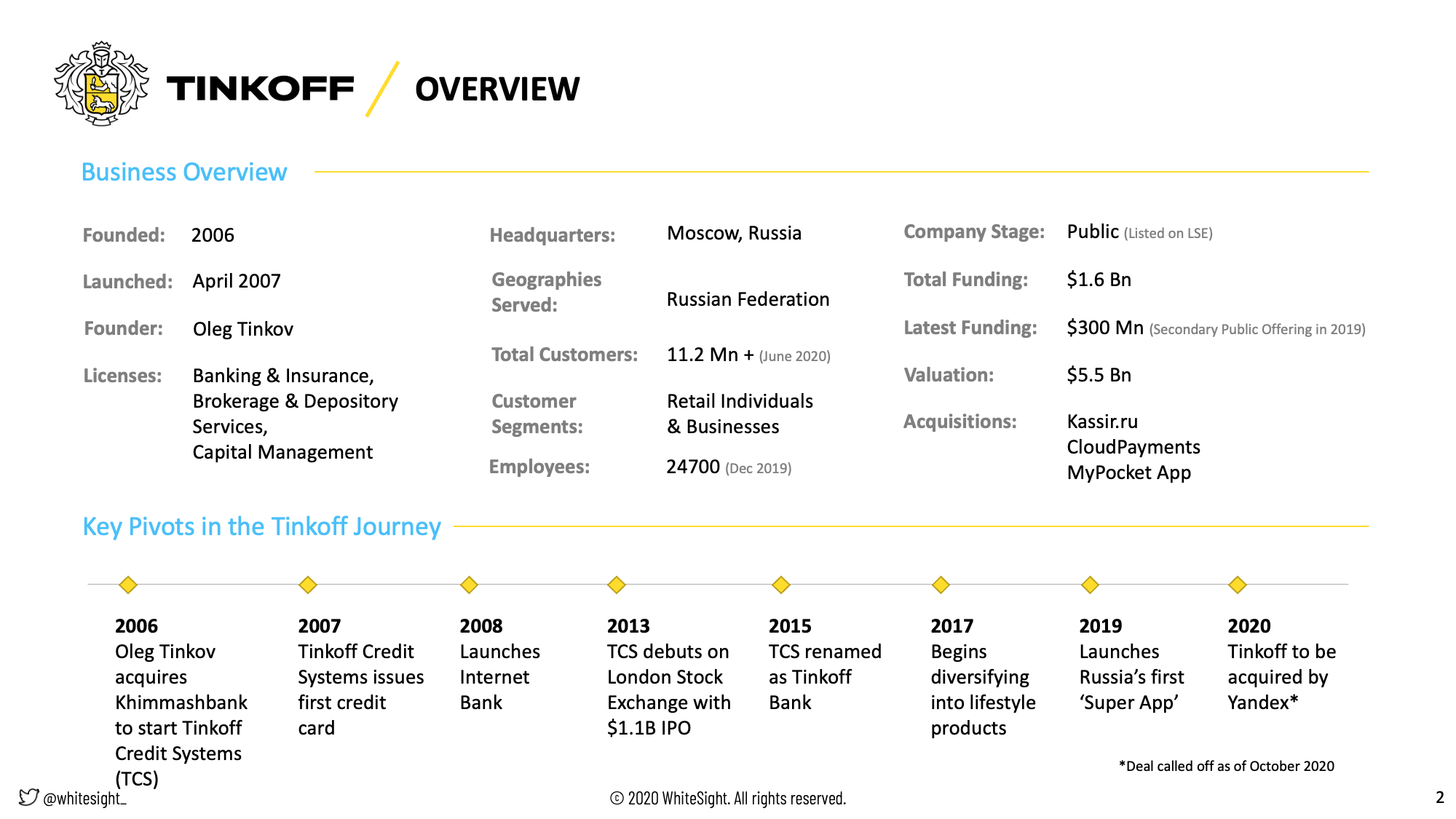

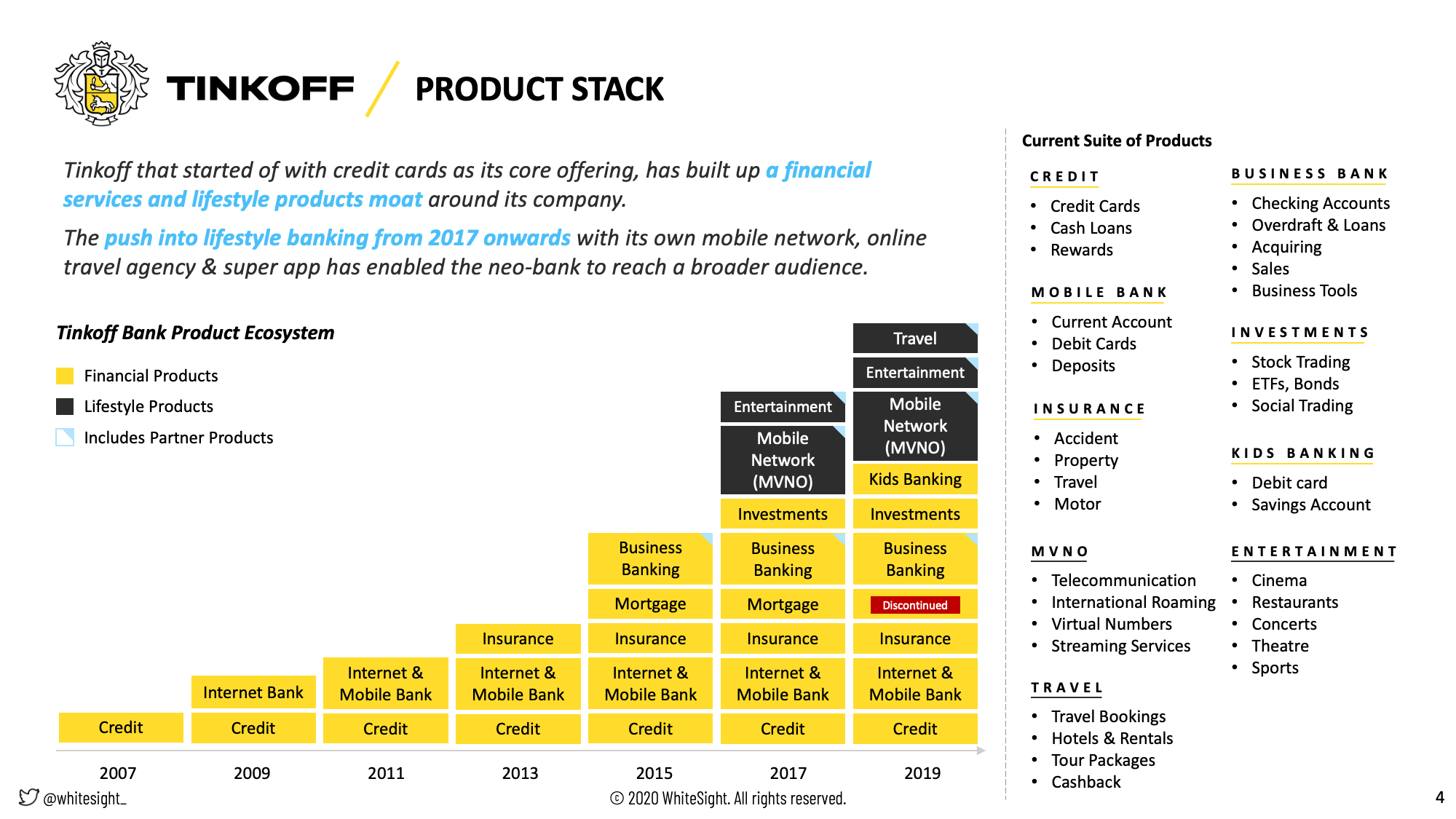

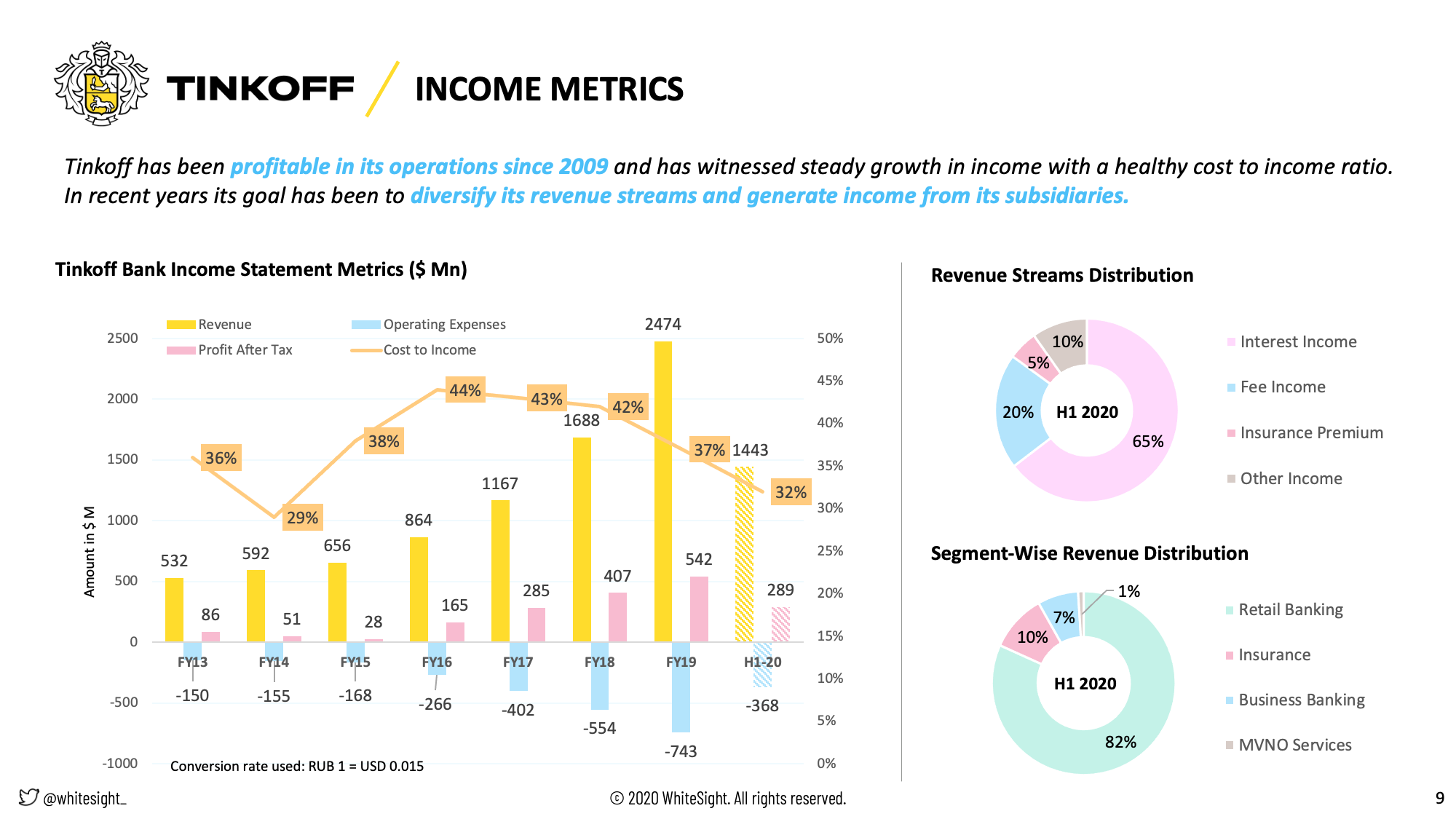

Tinkoff has managed to do what only a select few #neobanks have done so far – become profitable and successfully so, from its 3rd year of operations way back in 2009.

The neo-bank has pioneered #LifestyleBanking in Russia by bundling value-added services like travel & entertainment bookings, a mobile network and a Jack-of-all-trades #SuperApp to cater to every financial & day-to-day lifestyle need.

All these achievements are pretty evident through their numbers:

11.2 million users as of June 2020, with an impressive 6.1 million monthly active users.

A strong $5.6 billion valuation on the London Stock Exchange.

Increase in share of non-credit revenues from 30% to 37% in H1 2020n

Net profit ratio of 22% and a healthy cost to income ratio of 37% for FY19n

#Tinkoff has emerged as the dark horse in the neo-banks race and it isn’t slowing down anytime soon from the looks of it.

Already a subscriber? Log in to Access

Radar Subscription Plan

Radar Subscription PlanYour perfect fintech research companion – select a package that aligns with your aspiration

Not Ready to Subscribe?

Begin your fintech adventure free of charge-set forth with our complimentary offering.

Related Reports

Toast is revolutionising the restaurant sector by integrating financial services seamlessly into its restaurant management and Point of…

Dive into how Open Banking is shaking things up in the MENA region’s financial scene. It’s all about sparking collaboration…

Explore the journey of Starling Bank, a digital disruptor in the UK banking industry. With over 3.6 million…

Stripe is leading the fintech revolution, empowering a diverse range of businesses globally. Discover the tactics fueling Stripe’s…

Explore Revolut’s extraordinary growth, its journey towards obtaining a banking licence in the UK, the challenges encountered, and…

WhiteSight delves into the dynamic world of digital finance, bringing you an update from January to April 2023. We examine…

Explore OakNorth’s blueprint for building a tech-first bank that caters to the SME powerhouses of the UK. The…

Since the inception of Apple Pay in 2014, Apple has been at the forefront of bigtechs exploring the…

WhiteSight joins forces with Toqio to delve into the heart of the Banking-as-a-Service (BaaS) market in the UK and Europe,…

Embedded finance is experiencing an unprecedented surge in availability across multiple consumer touchpoints, enabling businesses to offer enhanced customer experiences…

With the world rapidly evolving and adopting new trends along the way, customers demand innovative products like never before, while…

The financial industry started the new year with the groundbreaking approach of open finance – an innovative paradigm that has…