Banks, Blockchains, and the American Blueprint

The dollar has been the world’s anchor - and the U.S. is determined that digital assets will not change that

For more than a century, the American dream has been underpinned by financial leadership. From the dollar’s reserve status to the global dominance of Wall Street, every cycle of innovation has reinforced U.S. power in markets. Now, with crypto reshaping how money moves, the question is sharper than ever: will the U.S. defend its place at the centre, or will new players tilt the balance?

The signs suggest America will fight to stay on top. Donald Trump’s administration has openly embraced crypto, and investors have poured billions into Bitcoin ETFs. But the real story is how aggressively U.S. institutions – from fintech disruptors to the largest banks – are pulling digital assets into the mainstream.

The Wide Lens and the Close-Up

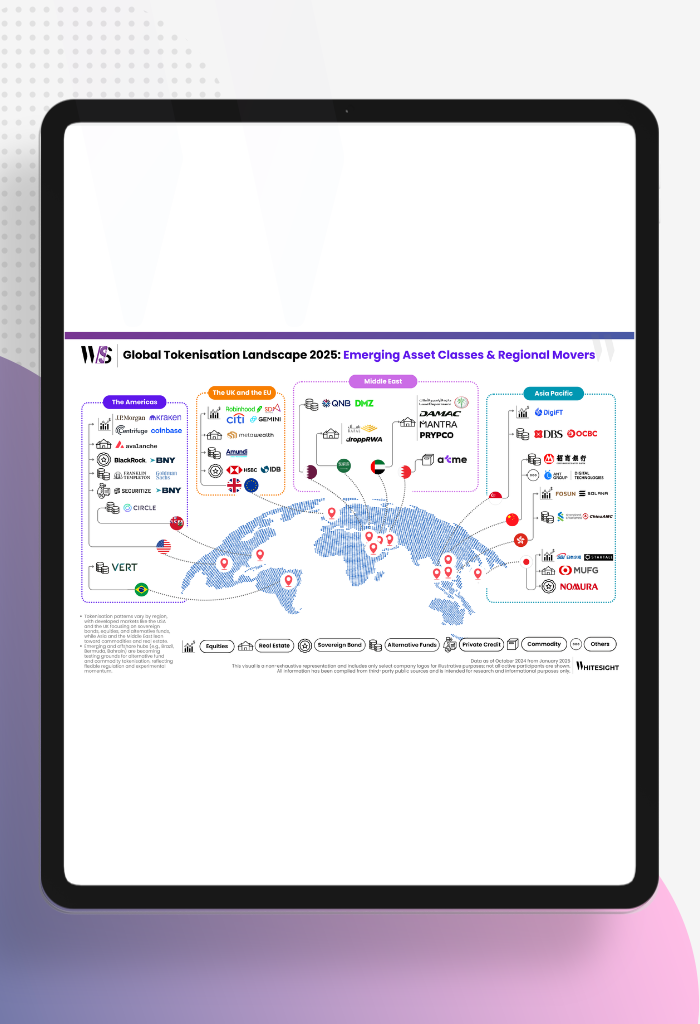

Zoomed out, the U.S. is signaling that crypto is a part of its national finance. In July 2025, the US House of Representatives passed three crypto-related bills: the GENIUS Act (stablecoin regulation), the CLARITY Act (market structure), and the CBDC Anti-Surveillance State Act (prohibiting Federal Reserve issuance of a digital dollar without approval). Additionally, Coinbase became a symbol of this mainstreaming – joining the S&P 500 list. Crypto companies from exchanges to infrastructure players have also gone public, pulling the sector into the heart of American capital markets. Policy is now catching up to that momentum, and banks are under pressure to act.

Zoomed in, the cracks were already visible. Wealth clients were buying Bitcoin on Coinbase and Kraken, outside the reach of private banks. Fintechs like Stripe and Checkout.com, crypto platforms such as Coinbase, and even global players like Visa have begun using USDC for settlement in certain markets, proving that alternative rails can bypass traditional clearing in niche but growing segments. Developers on Ethereum and Solana were issuing tokenized assets directly, from pilot securities to experimental bonds, proving that tokenization no longer needed a bank to exist. None of these use cases yet match the scale or trust of traditional finance, but they revealed a shift that banks could not ignore. Wall Street’s urgency is now about bringing these activities back under its roof: regulated, capitalised, and scaled.

Where Banks Are Moving:

JPMorgan:

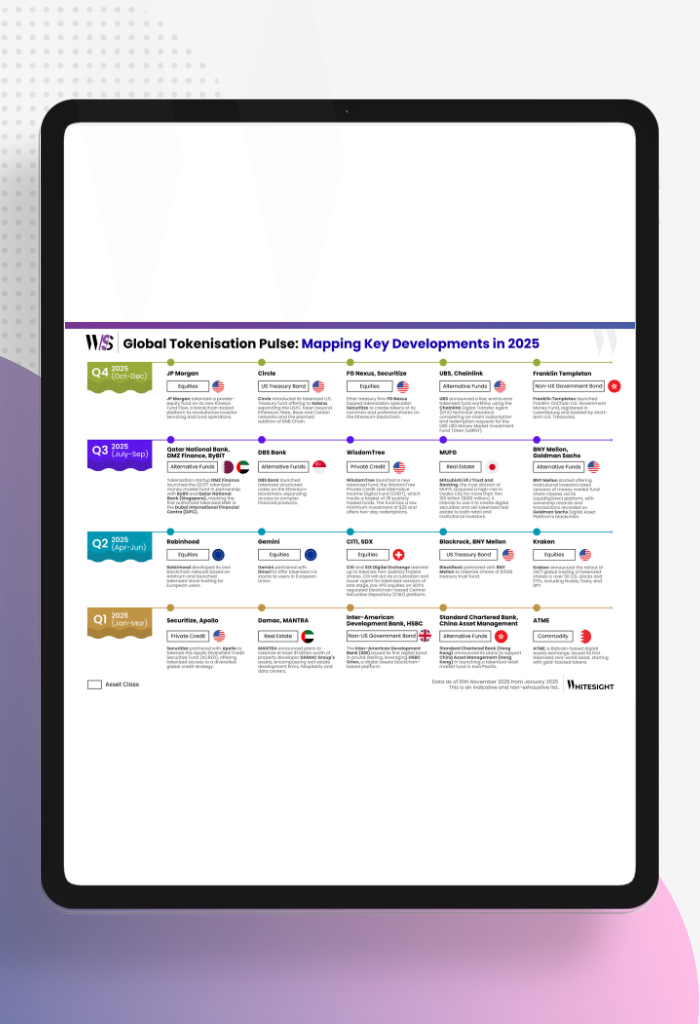

JPMorgan is building the broadest digital asset play among U.S. banks, spanning money, payments, and collateral. The launch of JPMD, a bank-issued deposit token on Coinbase’s Base blockchain, signaled its intent to bridge stablecoins and regulated deposits with a compliant, interest-bearing token. At the same time, JPM Coin extended into euro payments, programmable settlement, and a cross-border validation link with Visa. Add pilots in tokenized collateral and carbon credits, and the strategy becomes clear: reduce friction in settlement, make capital more liquid, and anchor JPMorgan’s dominance in wholesale markets.

Citi:

Citi is leaning into tokenization as a natural extension of its transaction banking DNA. Through its CIDAP platform and pilots with Wellington and WisdomTree, Citi is embedding itself deeper into the infrastructure corporates and asset managers rely on. The risk for Citi was not losing retail investors but losing relevance in the flows of global capital. Tokenization is its way of staying indispensable to institutional clients.

Goldman Sachs:

Goldman’s focus on tokenized money market funds reflects its strength in capital markets innovation. The logic is simple: money market funds are already central to institutional liquidity, and tokenizing them demonstrates efficiency where scale is undeniable. Goldman is positioning tokenization as an upgrade to products its clients already use every day.

Morgan Stanley:

Morgan Stanley is making wealth the cornerstone of its digital asset entry. By embeddingBitcoin ETFs directly into advisor platforms, it is preventing client drift toward exchanges and fintech brokers. The calculation is defensive but crucial: preserving advisory relationships ensures distribution revenues stay intact, even as clients seek crypto exposure.

PNC:

For PNC, scale was the limiting factor. Rather than build infrastructure, it integrated custody through Coinbase. The move is pragmatic – giving clients access to digital assets without the cost of internal development. For a regional bank, the goal is less about leading innovation and more about staying relevant in a rapidly shifting market.

What Was Broken and What Banks Aim to Fix

The moves by U.S. banks map directly to long-standing weaknesses in the financial system.

- Custody leakage → Reclaimed through regulated safekeeping.

- Distribution margins under pressure → Defended with tokenized funds and ETFs.

- Collateral inefficiency → Addressed through tokenization platforms.

- Settlement delays → Reduced by JPM Coin and programmable payments.

- Wealth client drift → Prevented by embedding ETFs into advisory.

Together, these initiatives show how banks are turning digital assets into tools for repair – fixing cracks in custody, efficiency, and distribution rather than chasing speculative upside.

Decoding the Shift

The U.S. model reflects its DNA. Banks are packaging digital assets into market-ready products, moving faster where demand is visible, and ensuring flows remain under Wall Street’s control. Others are building new models, but America’s message is simple: the race for digital money will be run on its terms, and most likely, in its markets.

The next phase will test whether this approach is enough. Europe is rebuilding its financial plumbing, and Asia is piloting and scaling tokenization across entire markets. The U.S. is betting that distribution, liquidity, and investor demand will matter more than infrastructure in deciding who wins. If that bet holds, digital assets won’t replace Wall Street – they will become the next layer of it.

Supercharge your Fintech IQ with WhiteSight Radar

Join Radar for exclusive member benefits and access to expert reports, industry trend breakdowns, and insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond.

Be the First to Know About the Next Big Fintech Strategies!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn and subscribe to our Future of Fintech Newsletter to be the first to know about the Next Big Fintech Strategies.

Author

Anjali Singh

Research Analyst- Fintech & Digital Asset

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts