Toast is revolutionising the restaurant sector by integrating financial services seamlessly into its restaurant management and Point of Sale (PoS) solutions. Beyond its innovative software and hardware offerings, Toast leverages embedded finance to offer a suite of financial products, including loans, payment processing, and insurance, tailored specifically for restaurant businesses. Dive into our report to explore how Toast Capital is transforming B2B finance, making financial management more accessible and affordable for restaurateurs.

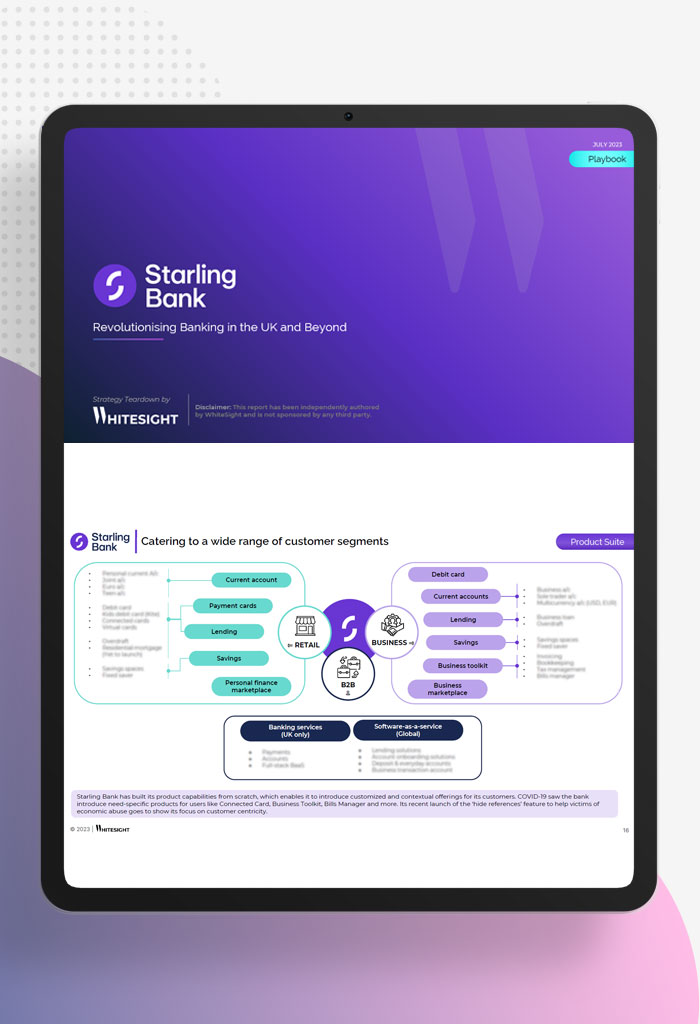

Explore the journey of Starling Bank, a digital disruptor in the UK banking industry. With over 3.6 million customers, Starling aims to transition from a challenger fintech to a credible “grownup” bank. The report highlights their success in enhancing banking services, collaborating with fintech partners, expanding business banking, and global expansion through banking technology.

Stripe is leading the fintech revolution, empowering a diverse range of businesses globally. Discover the tactics fueling Stripe’s fintech success in our 50-page report. Unravel their strategy including bets on creators’ economy, omnichannel commerce, digital assets & web3, embedded finance, and Generative AI.

Explore Revolut’s extraordinary growth, its journey towards obtaining a banking licence in the UK, the challenges encountered, and the actions taken to overcome these obstacles.

WhiteSight delves into the dynamic world of digital finance, bringing you an update from January to April 2023. We examine key events and trends in the current landscape through strategic partnerships, pioneering products, regulatory progress, and a myriad of other ingenious moves.

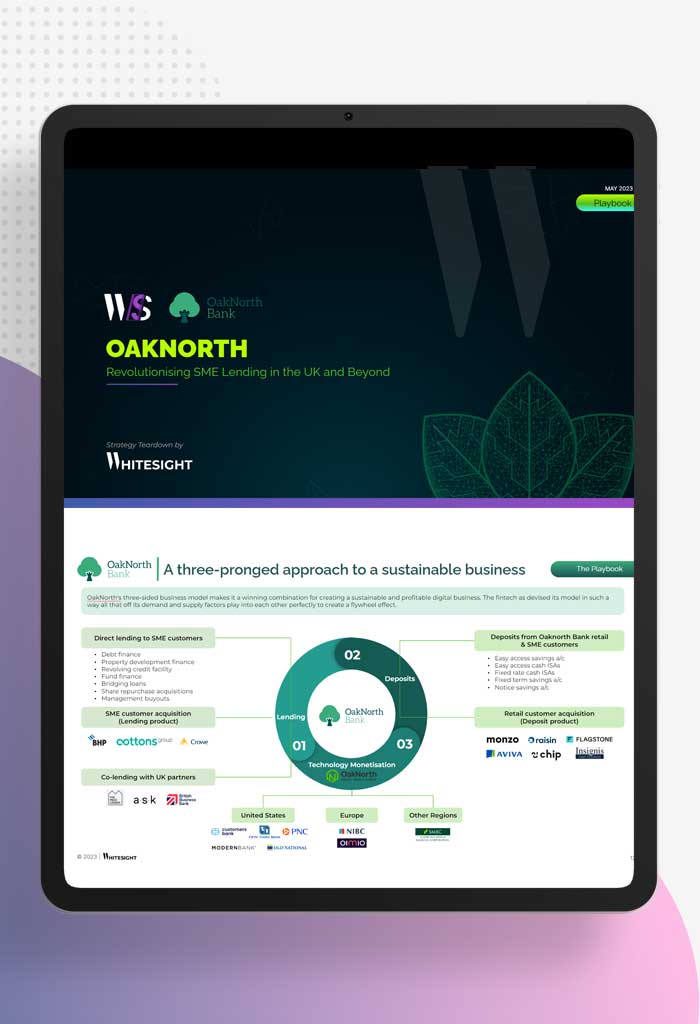

Explore OakNorth’s blueprint for building a tech-first bank that caters to the SME powerhouses of the UK. The report provides a detailed analysis of the bank’s three-pronged approach to cracking the elusive profitability code and building a fintech business that is making an impact in the world.

Since the inception of Apple Pay in 2014, Apple has been at the forefront of bigtechs exploring the integration of financial services into their existing ecosystems, progressively introducing a gamut of financial offerings. Traversing through the events that have led to its present-day strategic position, discover how Apple is poised to construct a solid business model based on its financial offerings that could serve as a formidable foundation for its future endeavours.

Embedded finance is experiencing an unprecedented surge in availability across multiple consumer touchpoints, enabling businesses to offer enhanced customer experiences and generate new revenue streams. Explore the progress in the embedded finance through the first quarter of 2023 across use cases, product launches, investments, partnerships, regulatory oversight, and more.

With the world rapidly evolving and adopting new trends along the way, customers demand innovative products like never before, while also seeking protection from the escalating threat of online fraud. In tandem, businesses are seeking to adapt their operations and payment collection methods to keep pace with the changing landscape.

The financial industry started the new year with the groundbreaking approach of open finance – an innovative paradigm that has captivated banks, financial institutions, and non-banking players alike, who are all eager to explore new revenue models that can provide a more inclusive and transparent financial system. This shift is due in part to regulators who are re-evaluating their positions to enhance the user experience and provide value-added solutions, while also prioritising the accountability and data protection aspects that come with the use of open data.

2022 has been a year of two contrasting halves in the FinTech world. The first quarter of 2022, carrying the momentum from 2021, started with a bang with several Digital Banking and Digital Payments firms raising 100M+ funding rounds with eye-popping valuations. Since Q1 2022, FinTech valuations in both private and public markets have suffered a swift and massive correction over the last three quarters of 2022.

If there’s one thing that can be agreed upon, it is that 2022 has been a year of many lessons. Natural disasters brought upon by climate change set the tone for what will become the new normal and emphasised the push for sustainable practices in all aspects of life and economies.

Toast is revolutionising the restaurant sector by integrating financial services seamlessly into its restaurant management and Point of…

Explore the journey of Starling Bank, a digital disruptor in the UK banking industry. With over 3.6 million…

Stripe is leading the fintech revolution, empowering a diverse range of businesses globally. Discover the tactics fueling Stripe’s…

Explore Revolut’s extraordinary growth, its journey towards obtaining a banking licence in the UK, the challenges encountered, and…

WhiteSight delves into the dynamic world of digital finance, bringing you an update from January to April 2023. We examine…

Explore OakNorth’s blueprint for building a tech-first bank that caters to the SME powerhouses of the UK. The…