OakNorth’s Challenger Bank Playbook

May 16, 2023

OakNorth’s Challenger Bank Playbook

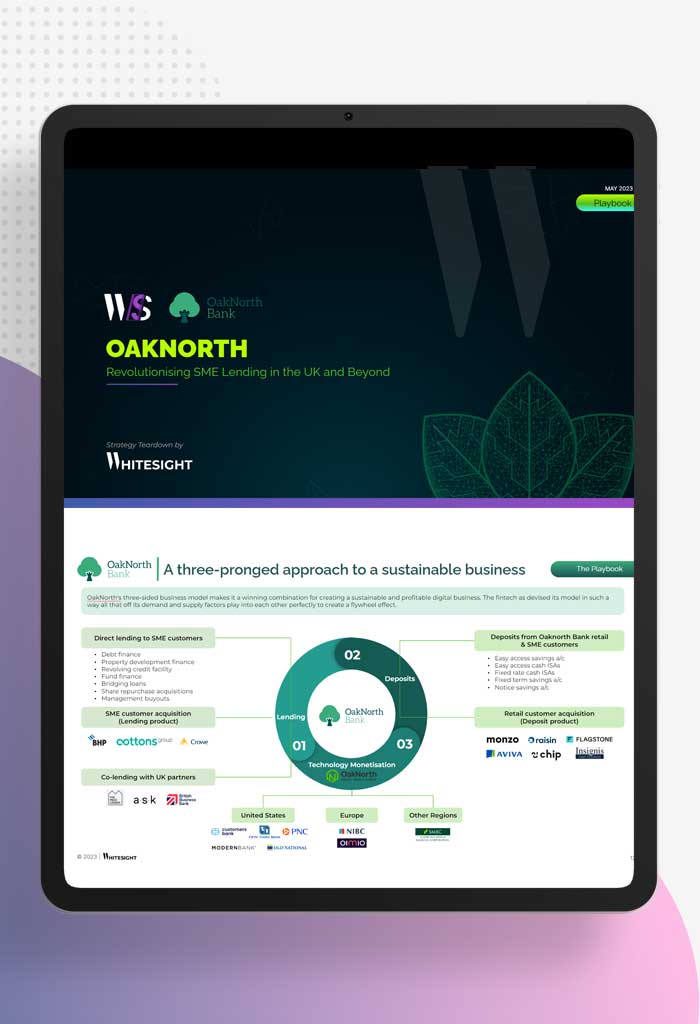

Explore OakNorth’s blueprint for building a tech-first bank that caters to the SME powerhouses of the UK. The report provides a detailed analysis of the bank’s three-pronged approach to cracking the elusive profitability code and building a fintech business that is making an impact in the world.

$99 $49

Description

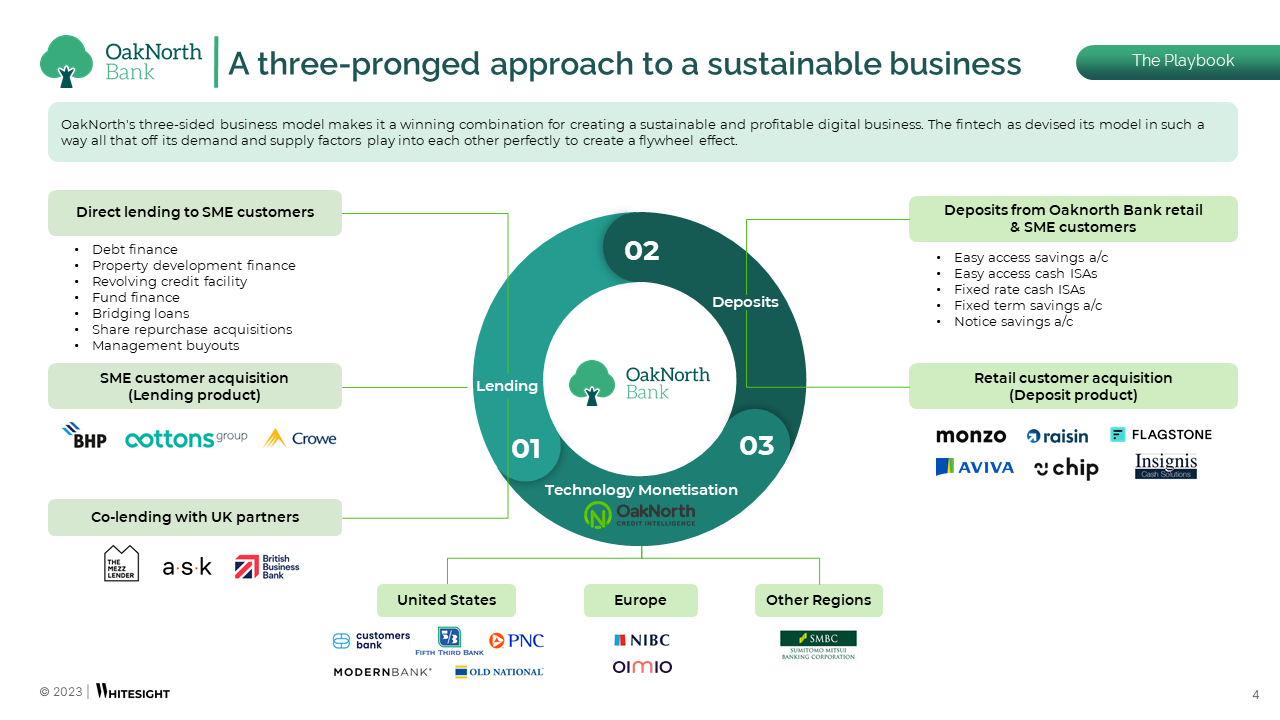

OakNorth has emerged as a standout in the fintech realm due to its exceptional business model that not only ensures profitability, scalability, and growth but also sets it apart from other challenger banks in the UK and digital banks worldwide.

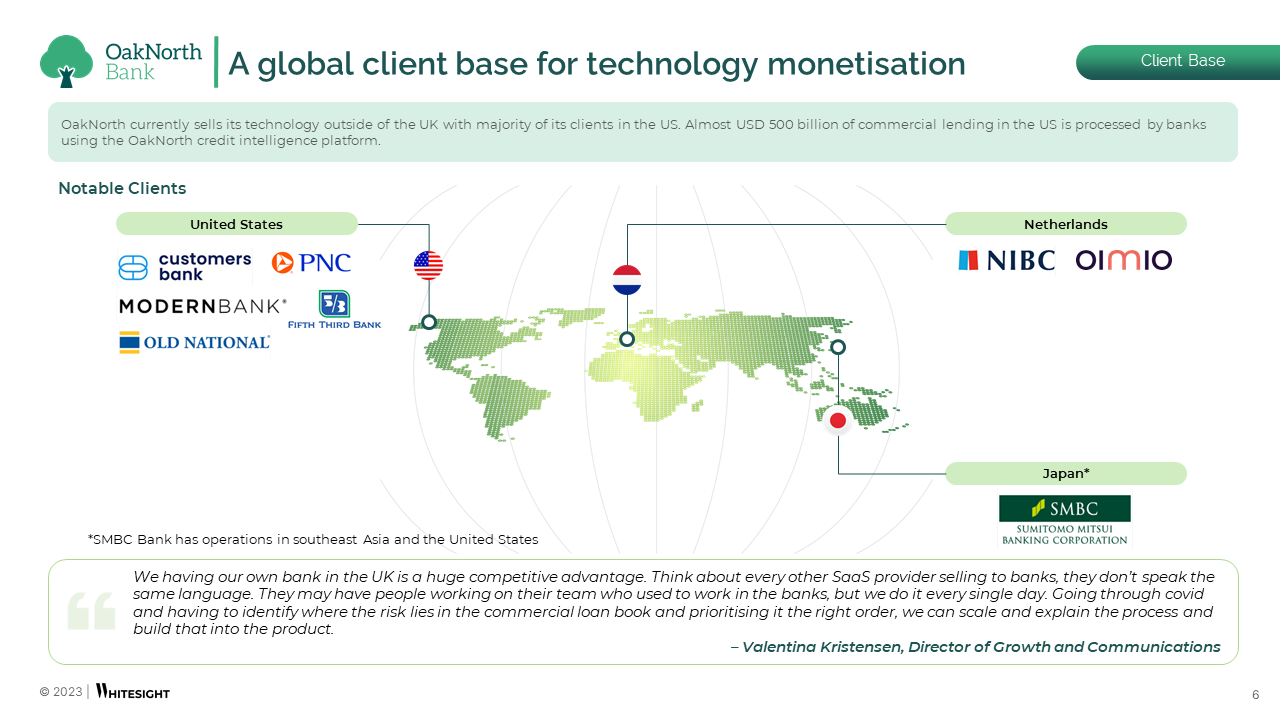

While many challengers and neobanks struggle to turn a profit, OakNorth has cracked the profitability code early on by combining its lending operations to mid-corporates in the UK with the licensing of its cutting-edge technology to banks across the US, Europe, and Asia. This dual approach not only generates revenue from lending but also unlocks substantial income from technology licensing, propelling OakNorth forward as a profitable, scalable, and growth-centric force in the financial landscape.

Dive into the secrets behind OakNorth’s remarkable growth and the recipe for its profitability and scale across aspects such as:

- The three-pronged OakNorth playbook

- The deposits strategy: Knowing when to build and when to partner

- The lending strategy: Catering to the missing middle of the UK economy

- The platform strategy: Enabling more banks to lend efficiently through proprietary technology

Already a subscriber? Log in to Access

Radar Subscription Plan

Radar Subscription PlanYour perfect fintech research companion – select a package that aligns with your aspiration

Not Ready to Subscribe?

Begin your fintech adventure free of charge-set forth with our complimentary offering.

Related Reports

Toast is revolutionising the restaurant sector by integrating financial services seamlessly into its restaurant management and Point of…

Dive into how Open Banking is shaking things up in the MENA region’s financial scene. It’s all about sparking collaboration…

Explore the journey of Starling Bank, a digital disruptor in the UK banking industry. With over 3.6 million…

Stripe is leading the fintech revolution, empowering a diverse range of businesses globally. Discover the tactics fueling Stripe’s…

Explore Revolut’s extraordinary growth, its journey towards obtaining a banking licence in the UK, the challenges encountered, and…

WhiteSight delves into the dynamic world of digital finance, bringing you an update from January to April 2023. We examine…

Explore OakNorth’s blueprint for building a tech-first bank that caters to the SME powerhouses of the UK. The…

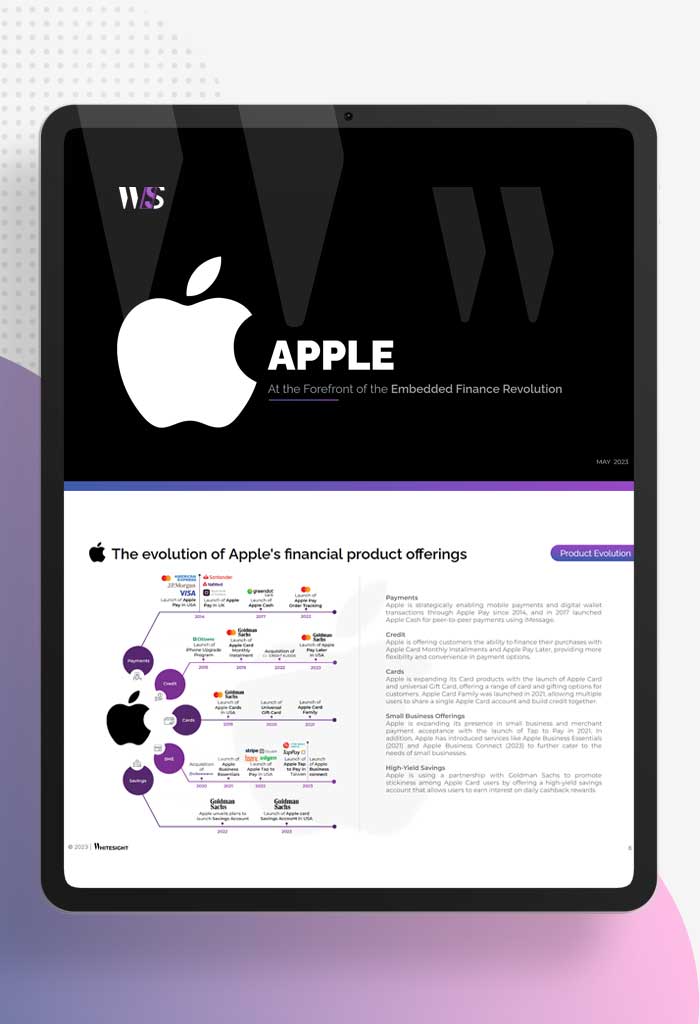

Since the inception of Apple Pay in 2014, Apple has been at the forefront of bigtechs exploring the…

WhiteSight joins forces with Toqio to delve into the heart of the Banking-as-a-Service (BaaS) market in the UK and Europe,…

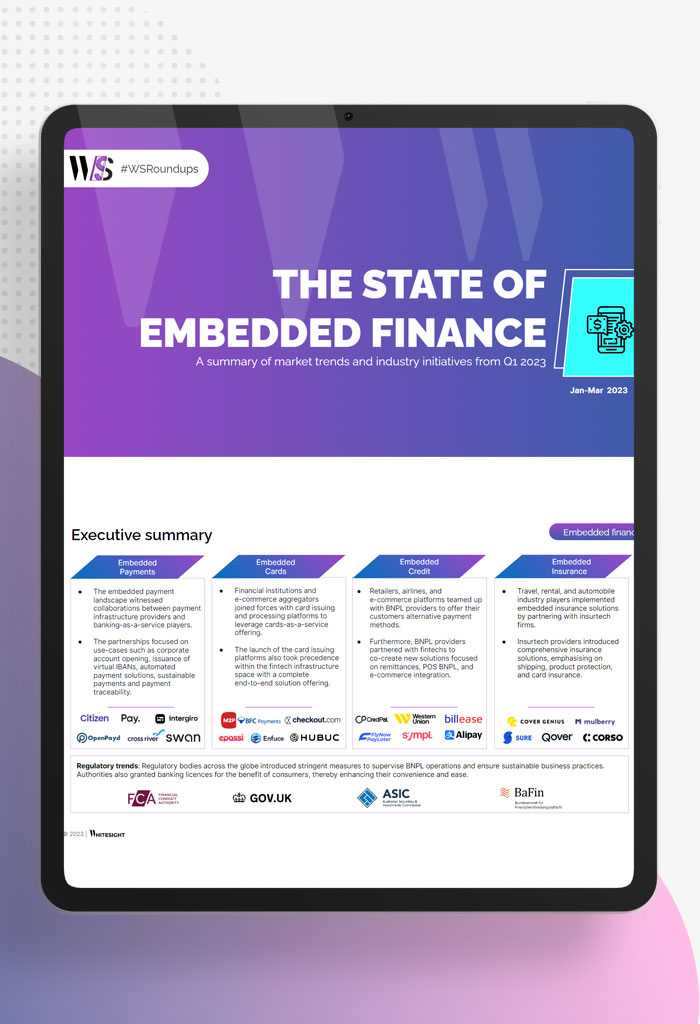

Embedded finance is experiencing an unprecedented surge in availability across multiple consumer touchpoints, enabling businesses to offer enhanced customer experiences…

With the world rapidly evolving and adopting new trends along the way, customers demand innovative products like never before, while…

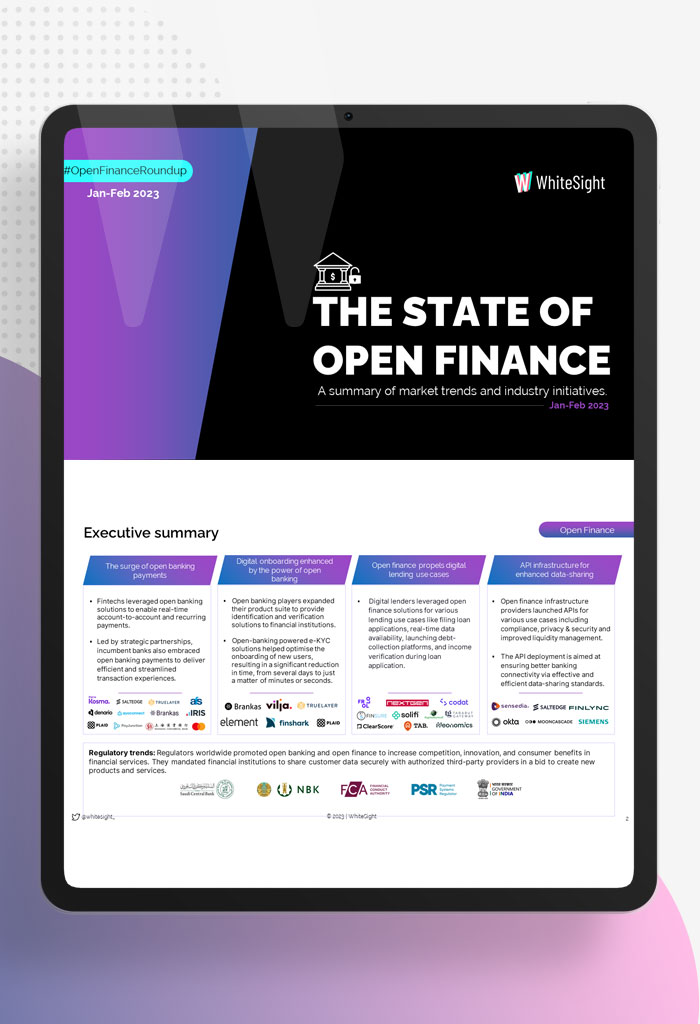

The financial industry started the new year with the groundbreaking approach of open finance – an innovative paradigm that has…