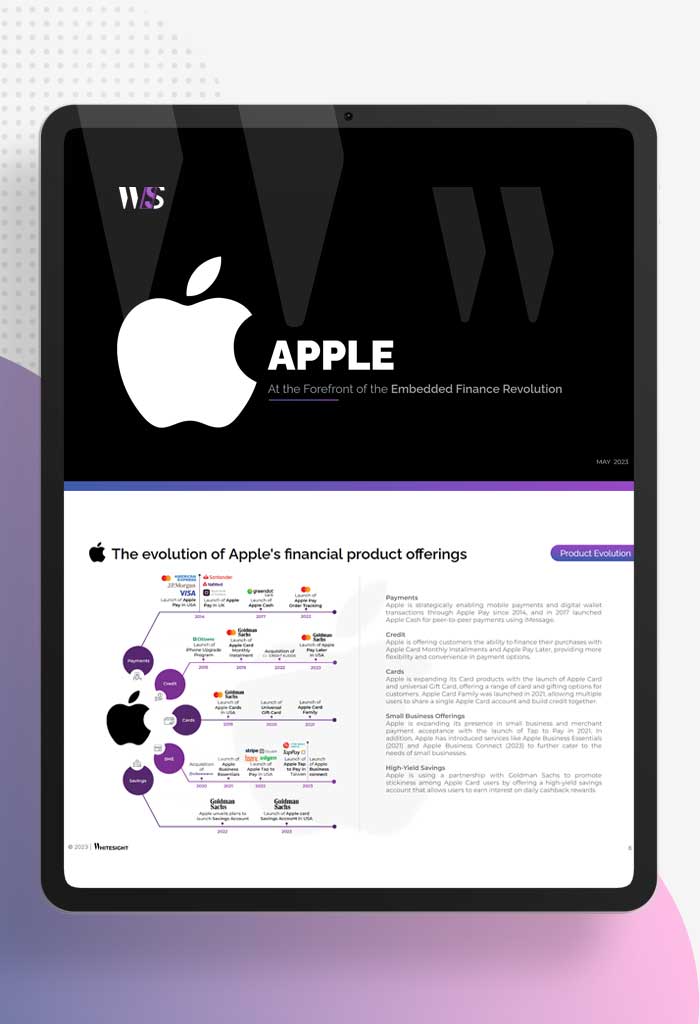

Since the inception of Apple Pay in 2014, Apple has been at the forefront of bigtechs exploring the…

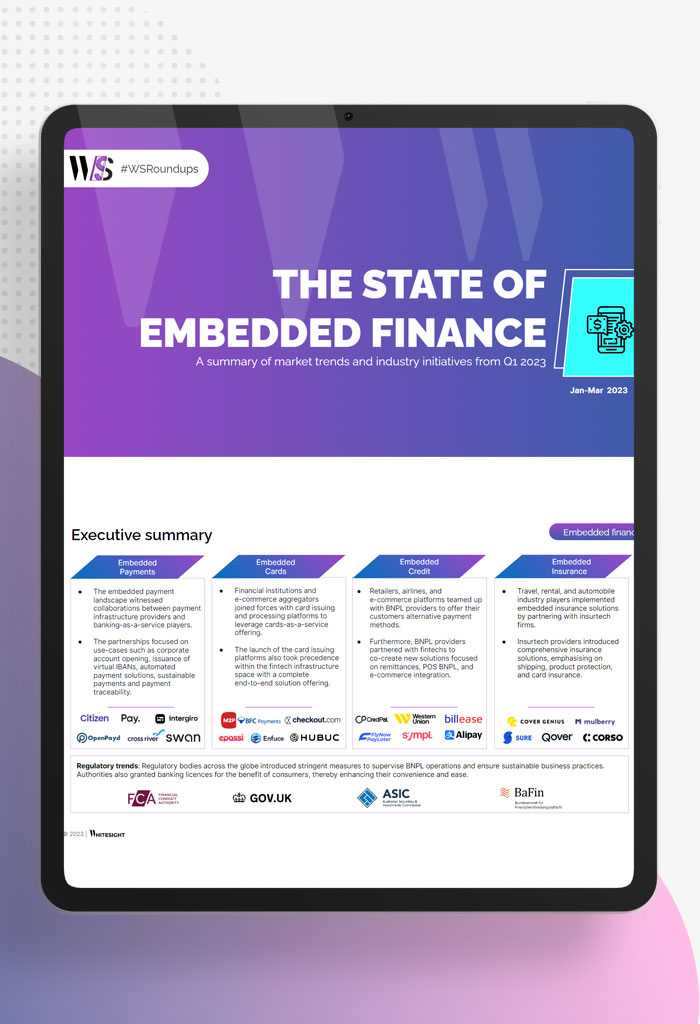

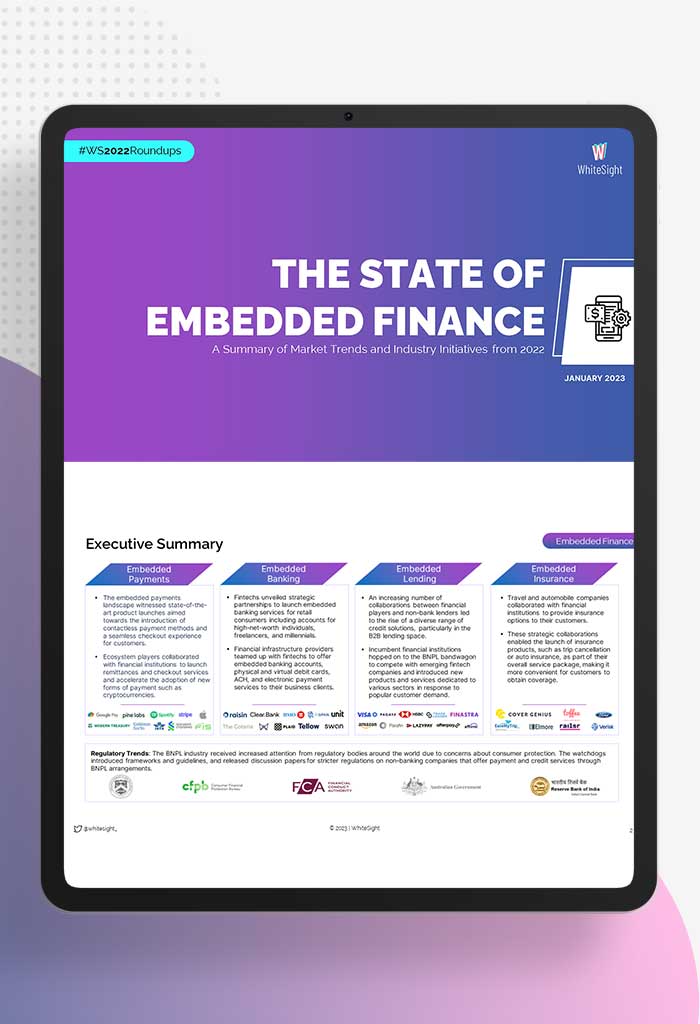

Embedded finance is experiencing an unprecedented surge in availability across multiple consumer touchpoints, enabling businesses to offer enhanced customer experiences…

With the world rapidly evolving and adopting new trends along the way, customers demand innovative products like never before, while…

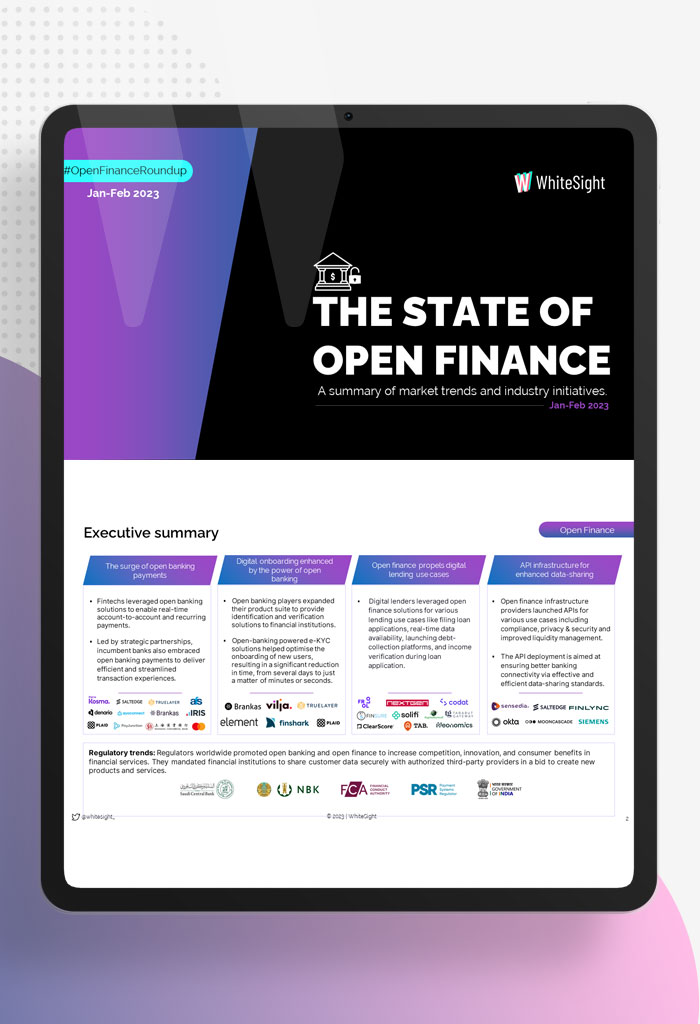

The financial industry started the new year with the groundbreaking approach of open finance – an innovative paradigm that has…

The Innovation Playbook is a visual guidebook designed to transport readers on a journey through time and technology, connecting the…

Embedded finance has emerged as one of the top buzzwords in fintech. Companies are discovering innovative ways of delivering financial…