Ethereum Turns 10: A Decade of Decentralized Evolution

Marking a decade of redefining money, markets, and digital value

Ethereum turning 10 is a milestone in blockchain history and a testament to the network’s transformation into a resilient, multi-dimensional ecosystem. Over the decade, Ethereum has scaled into the second-largest crypto economy with a market capitalization of $506B, demonstrating enduring demand, robust utility, and a self-reinforcing ecosystem that continues to expand in scope.

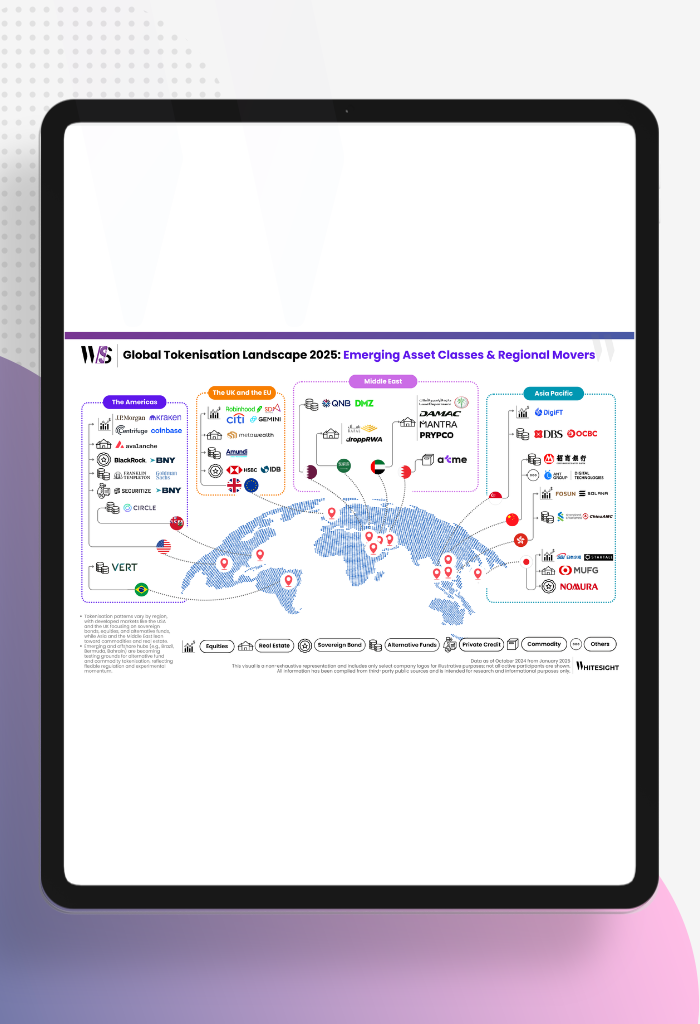

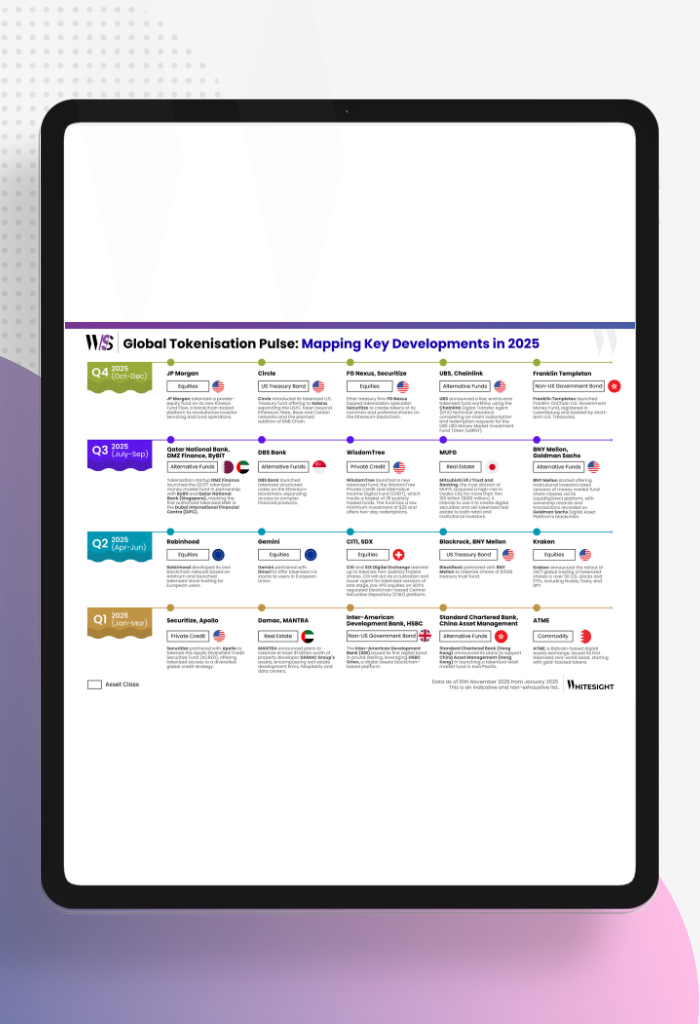

- A financial superstructure anchored on-chain: Ethereum today secures $154B in stablecoins and $87B in DeFi assets, representing roughly 60% of global DeFi activity. Together, they make Ethereum the central nervous system for programmable finance, where liquidity, lending, and settlement coexist on a single interoperable layer. With ~55% of Real-World Asset (RWA) tokenization also occurring on Ethereum, the network is the default financial infrastructure of the digital economy.

- Transforming scalability through Layer-2 innovation: The past decade saw Ethereum handle nearly 2.9B transactions across 330M unique addresses. This growth, instead of overwhelming the base layer, has been absorbed through 106 Layer-2 networks, driving a 20x increase in throughput capacity. This layered architecture reflects a maturing technological design where efficiency gains are realized without compromising decentralization, further reinforced by the 99.84% energy reduction post-Merge, a rare example of scaling aligned with sustainability.

- Security, resilience, and ecosystem reinforcement: Ethereum’s security is underpinned by 1.1 million validators and 36 million ETH staked, nearly a third of its total supply. This vast, globally distributed base makes the network exceptionally difficult to compromise, giving it one of the strongest security foundations in the blockchain world. What makes this even more powerful is how it works in synergy with the rapid growth of over 100 Layer-2 networks.

Ethereum at 10 shows that decentralized platforms can evolve into robust, multi-trillion-dollar economies, offering a blueprint for businesses exploring tokenized assets, financial interoperability, and scalable blockchain-native ecosystems.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts