How Banks Are Building the Digital Asset Future

Tracking the pathways to institutional digital finance

For decades, banks controlled finance end-to-end. They owned custody, dictated settlement, and intermediated every flow. Digital assets have cracked that monopoly. Custody has slipped to crypto exchanges. Stablecoins proved that money could move without SWIFT. Developers issued tokenized assets without waiting for clearing houses.

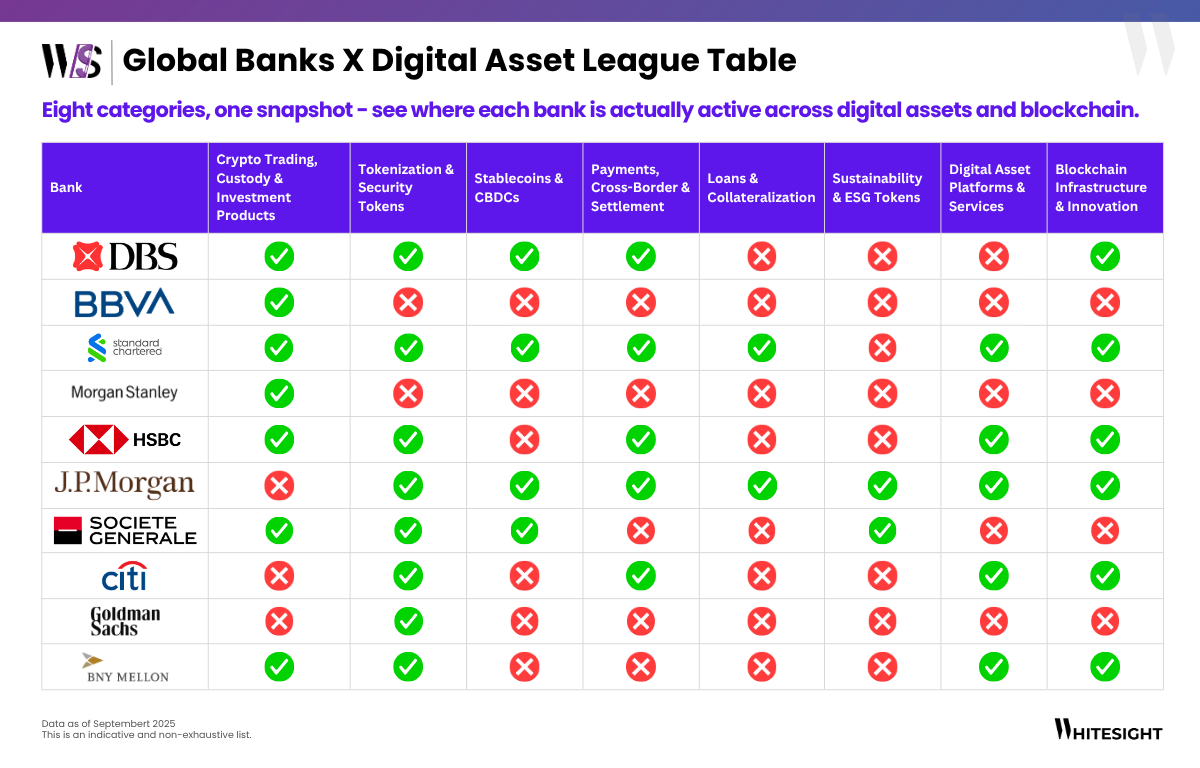

That is the context for our Global Banks x Digital Asset League Table. Eight categories, one snapshot. It does not just show who is active, but why certain moves matter more than others, and where the gaps still remain.

This is also the third layer in our series. We began with Europe, where regulation and diversity shape adoption. Then we moved to the U.S., where markets and politics are pulling digital assets into the mainstream. In Asia, pilots in tokenization, settlement, and gold-backed assets are testing how quickly digital rails can scale in practice. Now we zoom out and focus on activities themselves – custody, tokenization, settlement, sustainability – to ask the sharper questions: which moves count, why are banks choosing them, and what pressure points are still unresolved?

Before that, have a look at how Banks in Europe Go Big on Digital Assets; Digital Assets are becoming the New Banking Map of Asia; Blockchains, and the American Blueprint.

The Puzzle: What’s on the Board

Custody and trading → universal, defensive.

Custody is the ground floor of finance. For years, banks resisted it in crypto, ceding ground to Coinbase, Gemini, and Anchorage. That reluctance is now backfiring. Clients moved assets elsewhere, and trust slipped outside the perimeter. BNY, Citi, and PNC have since stepped back in to make sure the first step in the digital asset journey still runs through them.

Tokenization → selective but strategic.

Unlike custody, tokenization is not universal. It solves a very specific pain point: collateral inefficiency. By converting assets into programmable tokens, banks unlock liquidity that used to sit idle. Citi, JPMorgan, SocGen, and HSBC are at the forefront because balance sheet efficiency is existential in capital markets. Ignoring tokenization does not mean irrelevance, but it does mean carrying higher costs than peers who optimize in real time.

Payments and settlement carry fewer players, but higher stakes

Beyond JPM Coin, few banks are making serious moves here. That is surprising, given the costs at stake: SWIFT delays and T+2 settlement norms tie up trillions in working capital. Programmable, real-time settlement has the power to reshape liquidity standards globally.

Sustainability tokens remain almost blank.

Despite the surge in ESG finance, most banks have kept their digital experiments away from sustainability. DBS, Standard Chartered, and SocGen are early exceptions, but the rest of the map is empty. Without regulatory pressure, ESG-linked tokens have been treated as optional, even as corporate clients grow louder in demanding credible action.

Infrastructure and R&D stay in the background.

Banks like DBS, Standard Chartered, and HSBC are investing in blockchain research. These moves are not revenue-driven today, but they are option-building for tomorrow. When interoperability standards solidify and regulatory requirements catch up, the banks with deeper technical muscle will have a structural advantage.

The league table shows a pattern: banks move fastest where revenue is under threat, slower where coordination is needed, and rarely in areas where incentives are not yet clear.

The Power Map: Clustering Intent

The puzzle comes into sharper focus if we cluster intent.

- Market-facing moves: custody, ETFs, and trading. These defend distribution and keep clients inside the bank. Morgan Stanley embedding Bitcoin ETFs into its wealth channel is less innovation and more insurance, preventing wealthy clients from drifting to Coinbase.

- Infrastructure-facing plays: tokenization, collateral, and settlement. These are quiet but transformational. Citi’s CIDAP or JPMorgan’s collateral pilots are not about experimentation; they are about shaving billions off capital costs and proving that programmable finance can improve efficiency at scale.

- Future-facing options: ESG tokens and blockchain R&D. Not urgent for revenue today, but critical if regulations or corporate clients demand them tomorrow. DBS experimenting with sustainability tokens, for example, is a hedge for when green finance turns from a reporting metric to a programmable flow.

This map highlights the logic: defend the frontlines, optimize the plumbing, and buy options for what comes next.

Why These Choices

The activities may look varied, but the motivations converge around fixing old weaknesses. Custody leakage had to be addressed before clients migrated permanently to crypto-native custodians.

Distribution margins, already thinning in funds, pushed banks to embrace tokenized ETFs as a way to protect their grip on investment flows.

Collateral inefficiency – assets stuck idle across balance sheets – made tokenization platforms a necessity for those exposed to wholesale markets.

Settlement delays, with trillions trapped in reconciliation, created demand for solutions like JPM Coin to release liquidity and reduce costs.

Wealth clients, tempted by brokerages and fintechs, needed to be anchored with ETFs inside private banking and advisory. And ESG credibility gaps, growing louder with investors, encouraged early pilots in sustainability tokens to test how green finance could move beyond reports into programmable rails.

These moves are patching cracks in the architecture before those cracks become exits for clients and capital.

Geography Still Shapes the Game

Even in an activity-first view, geography still matters.

U.S. banks are flow-driven. Custody, ETFs, and distribution dominate their strategies, reflecting America’s market-first DNA. Asia’s banks are infrastructure-focused. DBS and Standard Chartered treat blockchain as plumbing, positioning for settlement and tokenization at scale. And, Europe’s banks remain cautious but deliberate. Their plays are shaped by MiCA’s rules and the looming digital euro, pushing them into carefully designed pilots.

The global map looks fragmented, but the logic is consistent: each region solves for its own pressure points, while collectively pushing banking closer to digital rails.

The Road Ahead

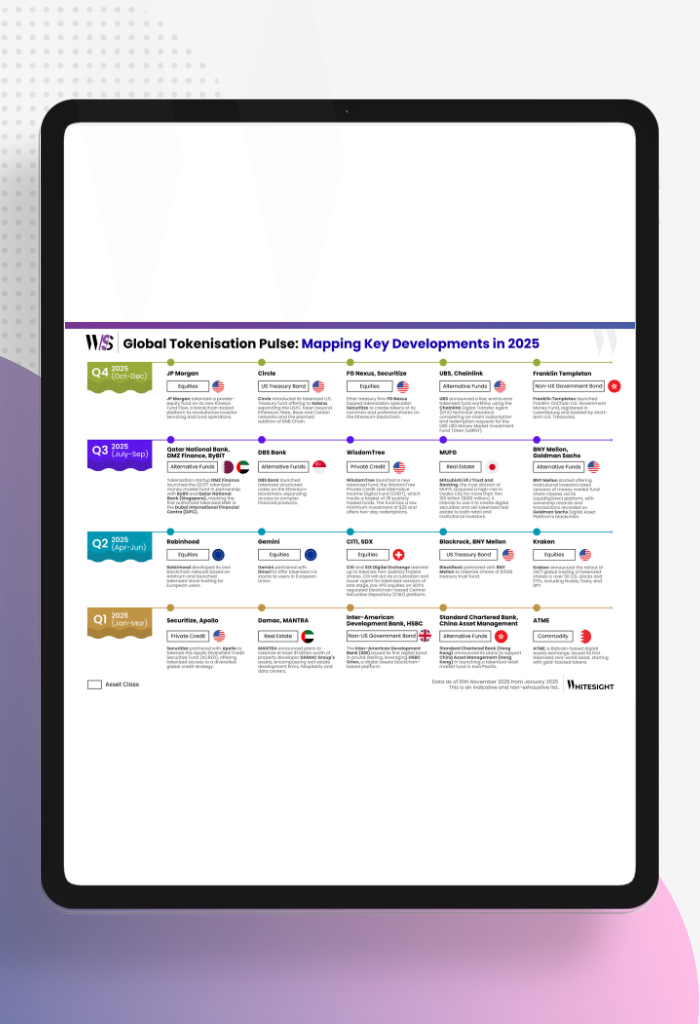

Digital assets have moved past the proof-of-concept stage – the test ahead is scale. Custody may decide whether flows return to banks or remain in the hands of crypto-native custodians. Tokenization could rewire capital markets if it moves from pilots to the core of issuance and collateral. New settlement rails might change the very tempo of liquidity, shifting how capital is unlocked and deployed. And ESG tokens, if they mature, would push sustainability from glossy reports into programmable transactions that actually move money.

The open question is whether banks are using digital assets to rebuild their control – or whether the technology itself will loosen it. If these bets converge, banks could entrench their role at the center of global finance for another generation. If they fragment, the door stays open for crypto-native firms and new intermediaries to keep pulling flows away.

Supercharge your Fintech IQ with WhiteSight Radar

Join Radar for exclusive member benefits and access to expert reports, industry trend breakdowns, and insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond.

Be the First to Know About the Next Big Fintech Strategies!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn and subscribe to our Future of Fintech Newsletter to be the first to know about the Next Big Fintech Strategies.

Author

Anjali Singh

Research Analyst- Fintech & Digital Asset

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts