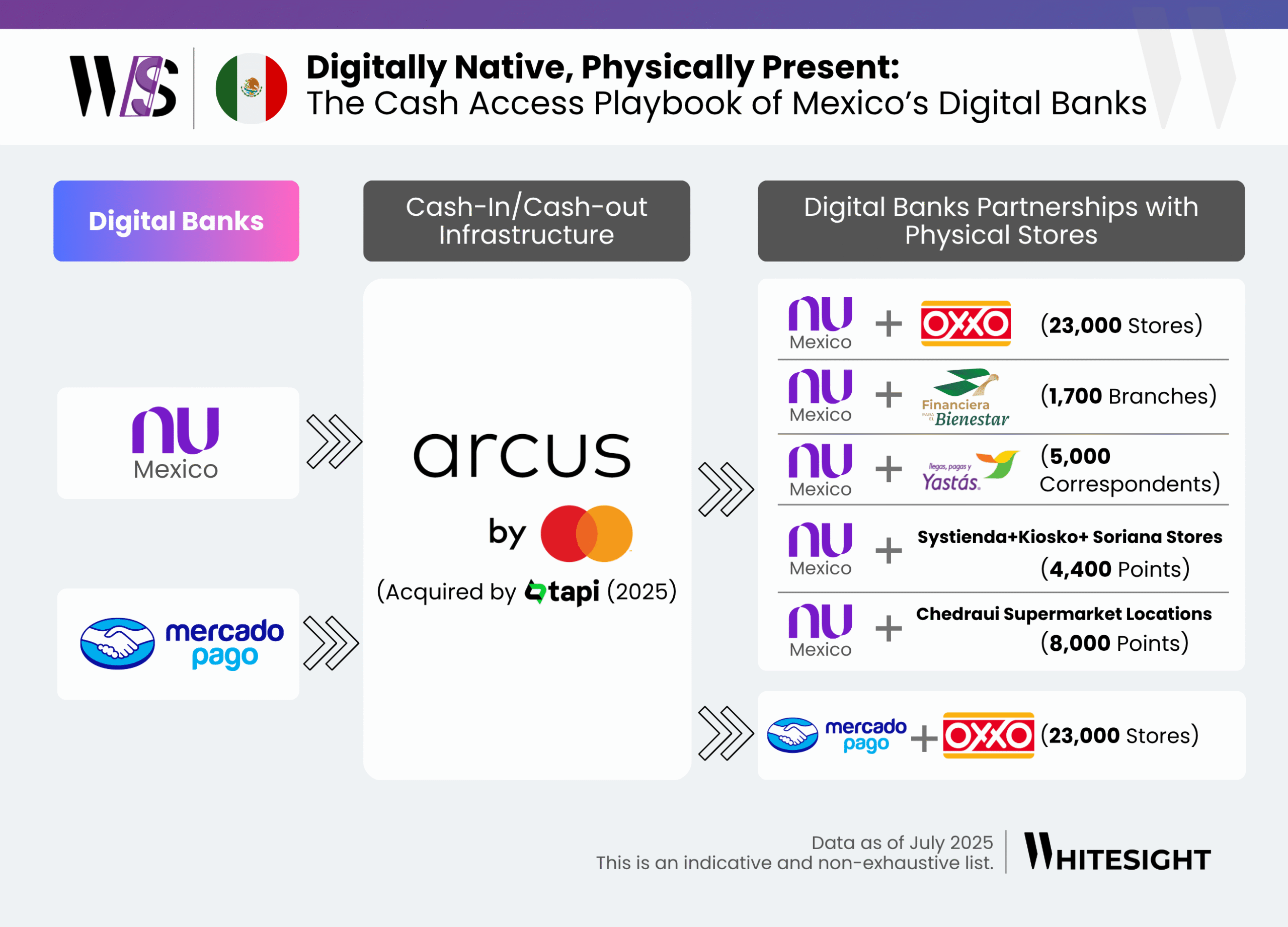

How Mexico’s Digital Banks Are Leveraging Retail Networks

Transforming cash-in/cash-out infrastructure and expanding financial reach

Mexico’s digital banks are developing a distinctive hybrid model where digital-first platforms are combined with an extensive offline presence, expanding cash access in a market that remains significantly dependent on physical currency. This approach reflects a deliberate strategy to position cash-in/cash-out networks as a key competitive advantage and establish a vital link between modern banking infrastructure and everyday consumer touchpoints.

- Scale through strategic store alliances: Nu Mexico’s network surpasses 40,000 access points by aligning with powerhouse retail chains like OXXO (23,000 stores) and Chedraui (8,000 locations). Such partnerships replicate the physical footprint of legacy banks without the overhead of branches, enabling rapid geographic penetration, especially in semi-urban and rural zones where trust is still tied to physical presence. For digital players, this demonstrates that achieving “bank-like” reach doesn’t require branches but rather strategic retail alliances that transform daily errands into financial access moments.

- Shared infrastructure as a competitive lever: The reliance on Arcus by Mastercard, now under Tapi, as the cash-in/cash-out backbone for both Nu Mexico and Mercado Pago signals a maturing infrastructure layer. This common rail not only accelerates interoperability but creates a network effect where new entrants can scale quickly without reinventing distribution. It highlights a shift in power: infrastructure providers are emerging as critical enablers, shaping market dynamics much like card networks did for traditional banking.

- Integrating informal economies into digital rails:By embedding with networks like Yastás (5,000 correspondents) and Financiera para el Bienestar (1,700 branches), digital banks are tapping into Mexico’s vast informal and underbanked segments. These are not just partnerships of convenience; they are strategic moves to convert community-level retail and correspondent networks into gateways for digital finance adoption. It reflects a nuanced understanding that true inclusion in cash-heavy markets requires meeting users where they already transact and building trust via familiar channels.

For fintechs and banks exploring similar models, Mexico’s trajectory underscores that the future of digital banking in emerging markets isn’t purely online. It lies in orchestrating an ecosystem where digital convenience and physical familiarity converge, using retail and infrastructure partnerships to scale trust, access, and liquidity at unprecedented speed and cost efficiency.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts