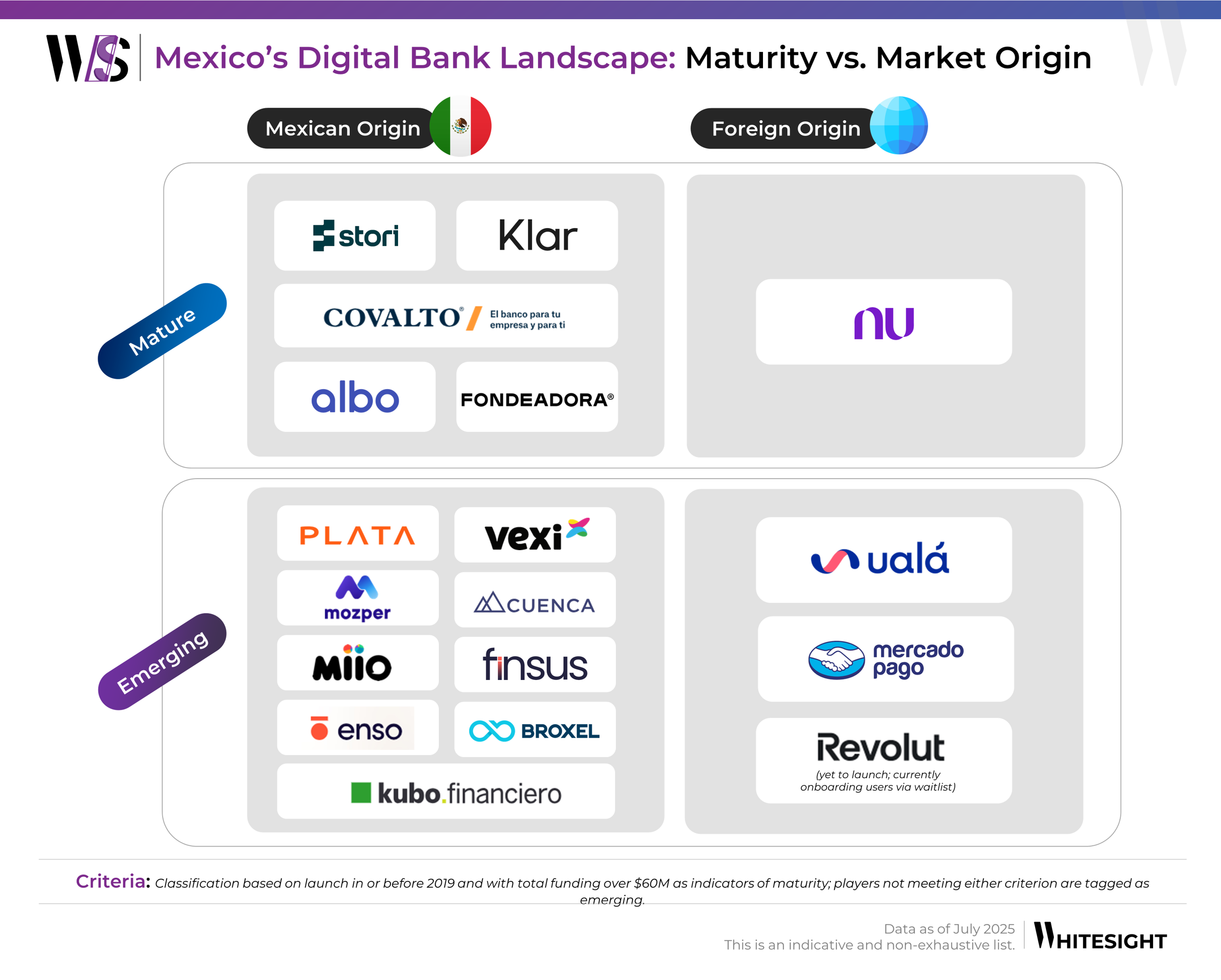

Mapping the Maturity Curve of Digital Banks in Mexico

A dual-lens view of how market origin and operational depth are shaping strategic outcomes

Mexico’s digital banking landscape has entered a phase of structured acceleration. What began as a wave of fintech experimentation is now defined by clearer strategic intent, regulatory pathways, and competitive positioning. Players are increasingly distinguished by two core dimensions: market origin and operational maturity.

This dual lens not only clarifies where each player stands today but also reveals how they are building for long-term scale, resilience, and product depth in a market that remains both underbanked and digitally engaged.

- Local Incumbents Gain Ground Through Embedded Scale and Product Breadth: Mexican-origin digital banks like Stori, Klar, albo, Covalto, and Fondeadora have achieved maturity not through origin advantage alone, but by hitting critical thresholds of funding and product expansion. Klar, for instance, has reached 4M users and is pushing for a full banking license. These players are now evolving into full-stack financial institutions offering lending, payroll, and credit products, riding on pro-fintech regulation and maturing local infrastructure. Their journey reflects how time in the market, not just speed to market, is translating into meaningful user trust and scale.

- Foreign Entrants Leverage Capital and Licensing to Fast-Track Maturity: Nubank stands out as the most dominant foreign-origin digital bank, now representing 12% of Mexico’s adult population and 23% of all banked individuals. Its full MBI license and deep product localization, like Cajitas for savings and secured credit pathways, have allowed it to outperform in inclusion and impact metrics. Ualá and Mercado Pago are following closely, while Revolut, with a six-figure waitlist pre-launch, is a looming competitive force. These global players use their balance sheets and product IP to leapfrog local incumbents, signaling a maturing, yet still open-ended market.

- Emerging Players Reflect a Strategic Fork: The emerging cluster is packed with younger, agile players like Plata (BNPL-led), Cuenca (wallet-first), and Mozper (teen banking) experimenting with focused propositions. Their current regulatory and funding limitations place them below the maturity threshold, yet their vertical focus may serve as beachheads for future full-stack expansion. What’s revealing is that both local and foreign origin banks are present in this tier, signaling that maturity is of deliberate strategy, licensing ambition, and capital depth.

Together, these dynamics outline more than a map of where digital banks stand, they signal where the market is heading and what it will take to lead. In a country where half the population remains unbanked and credit access is limited, the real opportunity lies in building durable, license-backed, and trust-driven financial ecosystems.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts