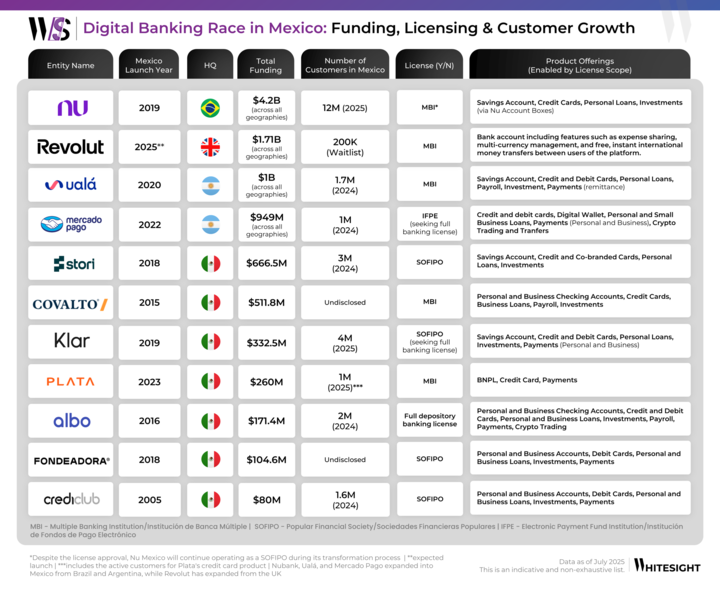

Mexico’s Digital Banking Race: Who’s Funded, Licensed & Scaling

From licensing to ecosystem plays, a look into how digital banks are transforming trust, and credit access in Mexico

Mexico stands at a defining crossroads in its financial evolution. As Latin America’s second-largest economy and home to nearly 130 million people, the country presents a compelling paradox: a highly digital population coexisting with deeply entrenched financial exclusion. Despite decades of banking dominance by a few legacy institutions, over 50% of Mexican adults remain unbanked, and credit penetration lags significantly behind regional peers.

Yet, this very imbalance has created fertile ground for a new generation of digital banks to build systems designed not to extend traditional banking, but to replace it altogether.

- Licensing Has Become a Strategic Differentiator: Mexico’s regulatory tiering: MBI, SOFIPO, IFPE, is now a roadmap for phased ambition. Nu and Revolut, both operating with MBI licenses, are pursuing high-trust, high-functionality growth through full-stack offerings spanning credit, investments, and cross-border transfers. Klar and Stori, SOFIPO-licensed and now license-seeking, exemplify a lean-first, expand-later model, proving that regulatory optionality can support capital-efficient scaling. The license you hold increasingly defines your monetization ceiling

- Growth Favors Local Relevance: Nu’s 12M customer base, built in under six years, isn’t just a product of capital ($4.2B raised), but of surgical localization: cash-out rails via 40,000+ retail partners, micro-savings tools (Cajitas), and simplified credit ladders. Revolut’s playbook, while rooted in global infrastructure, is being reconfigured for the Mexican remittance corridor and spending behavior. Players who fail to localize UX, distribution, and trust signals will struggle to convert their global templates into local traction.

- From Fintech Apps to Full-Service Ecosystems: What began as credit cards, savings, and BNPL is rapidly evolving into full financial operating systems. Klar is layering business accounts and payroll; Mercado Pago and Ualá are progressing toward banking licenses; and early-stage entrants like Plata are launching with embedded commerce and credit bundles from day one. The winners won’t be the fastest to launch, but those architecting infrastructure-rich, modular ecosystems responsive to Mexico’s unique socioeconomic contours.

The digital banking evolution underway in Mexico is poised to have long-term structural implications for the country’s financial landscape. As domestic and international players accelerate their efforts to gain market share, the focus is shifting from user acquisition to building systems of trust, credit accessibility, and embedded utility. With over 50% of the population still unbanked and formal credit access lagging, digital banks are uniquely positioned to redefine financial participation.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts