Pre-GENIUS vs Post-GENIUS: The Rise of Regulated Stablecoins

From unclear rules to compliance-ready rails, how banks, fintechs, and crypto platforms are rebuilding their roles in the regulated stablecoin era

The GENIUS Act marks a structural inflection point for financial ecosystems, shaping a regulated stablecoin era where institutional roles are fundamentally changing. The shift from fragmented experimentation to integrated, compliance-ready infrastructure is creating a new operating stack for banks, fintechs, and crypto platforms alike.

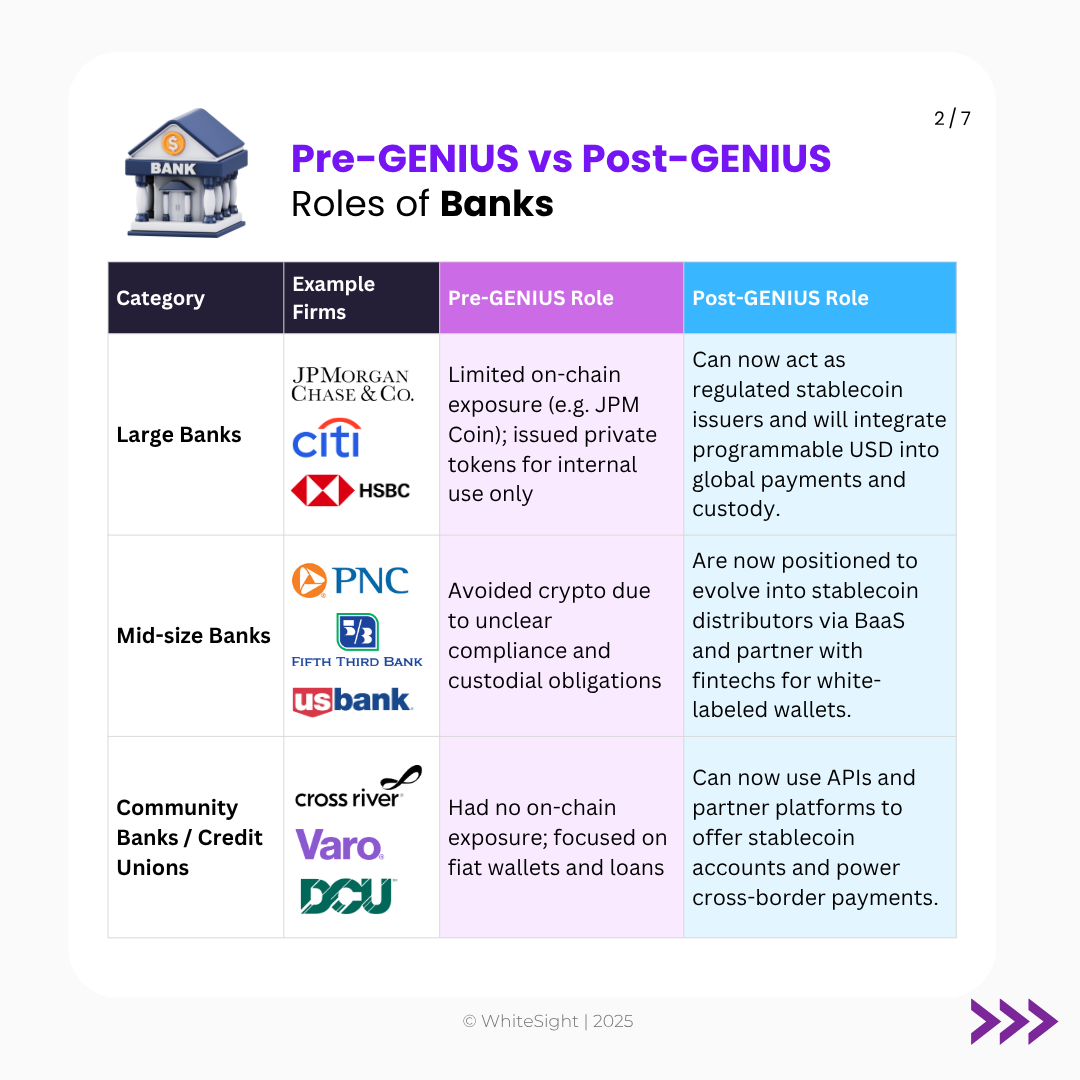

Institutional Scale Meets Programmable Money: Large banks like JPMorgan are evolving from private pilots such as JPM Coin to issuing regulated stablecoins embedded into global payment and custody rails. Mid-tier banks are leveraging BaaS models, partnering with fintechs to distribute assets via white-labeled wallets and cross-border capabilities. Community banks and credit unions are becoming API-powered nodes, offering stablecoin accounts and power cross-border payments.

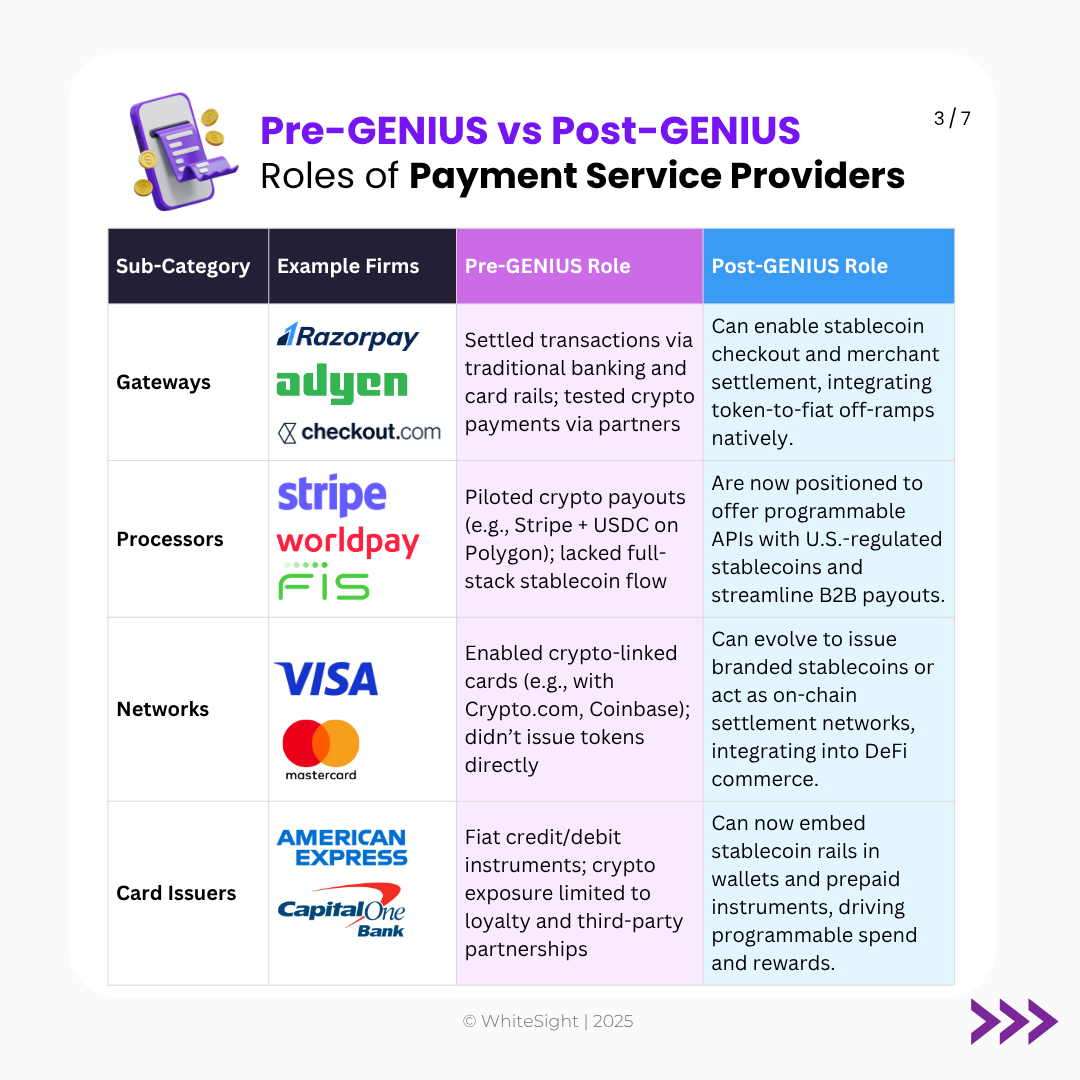

Programmable Payment Infrastructure: Gateways such as Checkout.com and Adyen are moving from card-based settlement into enabling native stablecoin checkout and token-to-fiat merchant flows. Processors like Stripe, which piloted USDC payouts on Polygon, are now positioned to deliver full-stack programmable APIs for regulated B2B payouts. Networks such as Visa and Mastercard are exploring branded stablecoin issuance and on-chain settlement, while card issuers integrate programmable spend into prepaid and credit instruments, bridging traditional rails with programmable money

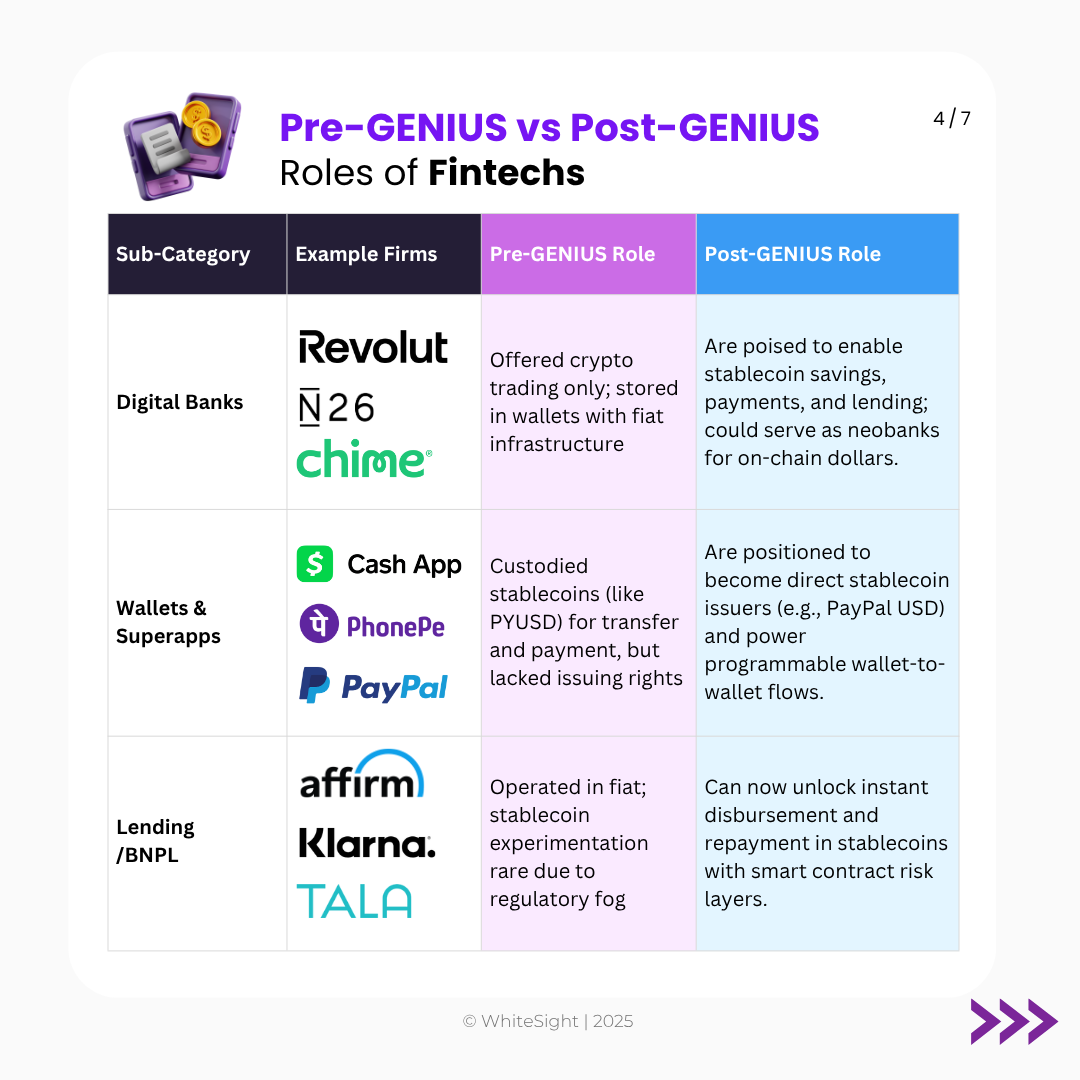

Fintech-Crypto Convergence: Digital banks like Revolut and Monzo are transitioning from offering crypto trading to enabling stablecoin savings, payments, and lending, positioning themselves as neobanks for on-chain dollars. Wallets and superapps such as PayPal (via PYUSD) and Cash App are evolving into direct stablecoin issuers, powering programmable wallet-to-wallet flows. BNPL platforms like Affirm and Klarna are unlocking instant disbursement and repayment in stablecoins with smart contract-based risk layers, collapsing settlement times and enabling real-time credit flows

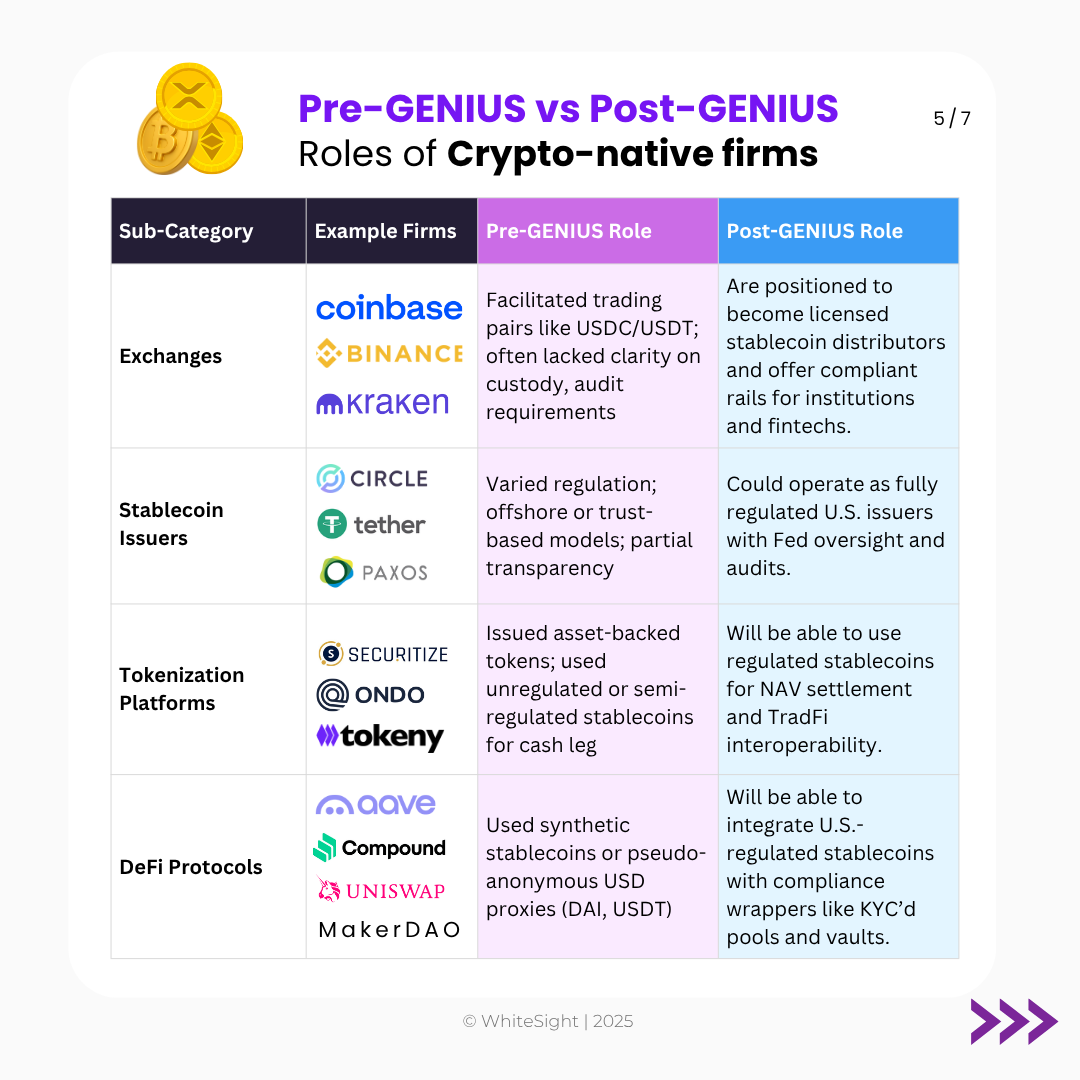

Compliance-First On-Chain Finance: Exchanges such as Coinbase and Kraken are moving from USDC/USDT trading pairs into licensed stablecoin distribution, building compliant institutional rails. Issuers like Circle are transitioning into fully regulated U.S. entities under Fed oversight with transparent reserve audits. Tokenization platforms like Ondo Finance and Securitize can use regulated stablecoins for NAV settlement and TradFi integration. DeFi protocols like MakerDAO and Aave will be able to use U.S.-regulated stablecoins with compliance wrappers like KYC’d pools and vaults.

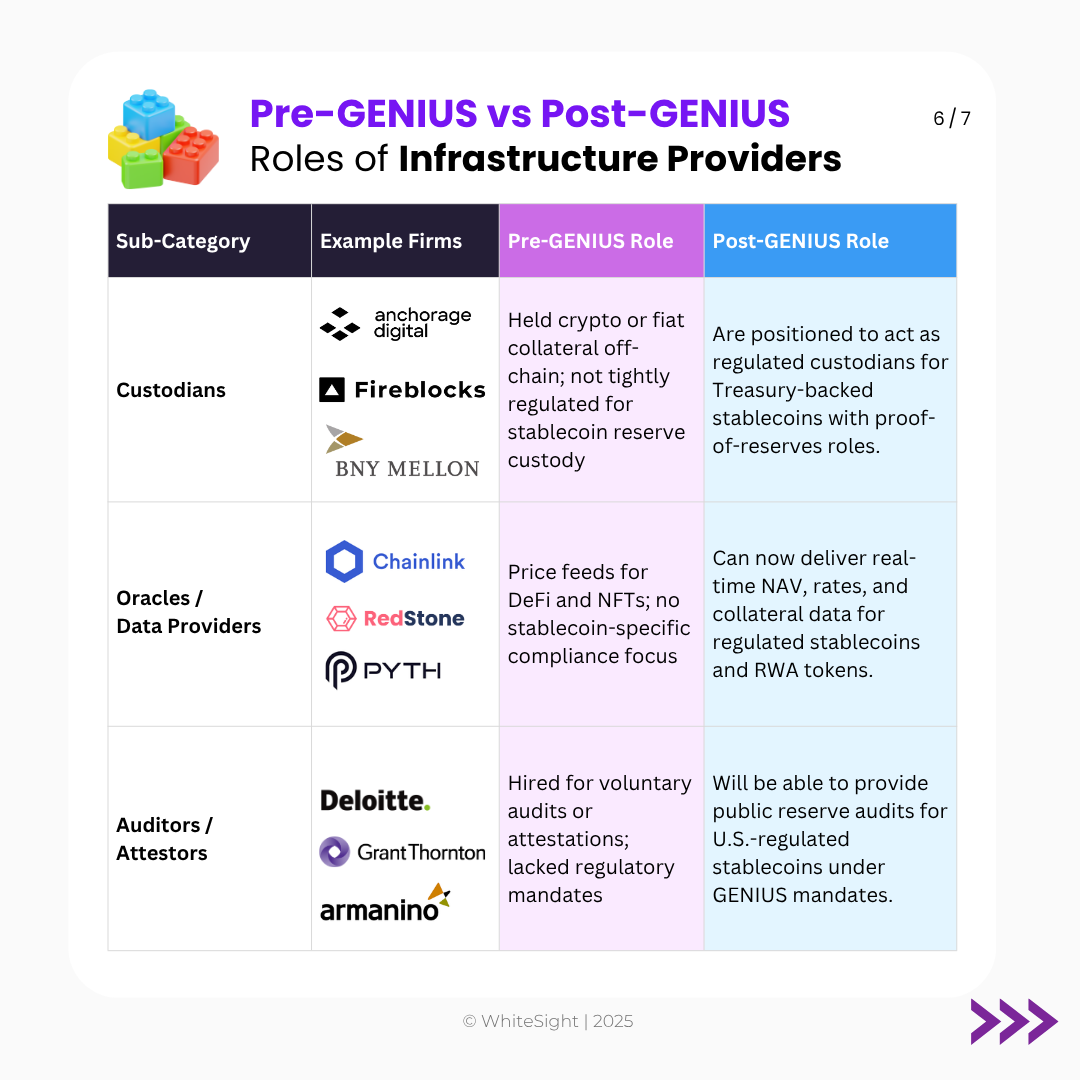

Building the Trust Layer: Custodians like Anchorage Digital and BitGo are becoming regulated reserve holders for treasury-backed stablecoins with verifiable proof-of-reserves frameworks. Oracles such as Chainlink are delivering real-time NAV and collateral data to support tokenized assets and stablecoin compliance. Auditors like Armanino and Grant Thornton are institutionalizing mandated public reserve audits, turning transparency into the cornerstone of the regulated stablecoin economy .

As these shifts take hold, the lines between traditional finance, fintech, and crypto will merge and create a more interconnected system where regulated stablecoins underpin everything from retail payments to institutional settlements.

Don’t want to miss the next big thing in digital assets? 🪙

Our monthly Digital Assets newsletter unpacks the latest across stablecoins, tokenization, crypto trading, and global regulations, all in one punchy read. Perfect for staying ahead of the curve without the scroll fatigue.

Read the latest issue and subscribe to catch the next drop this week!

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts