Revolut’s Launches in 2025: Powered by Savings and Payments

Launches extending ecosystem depth across lending, wealth, and plans

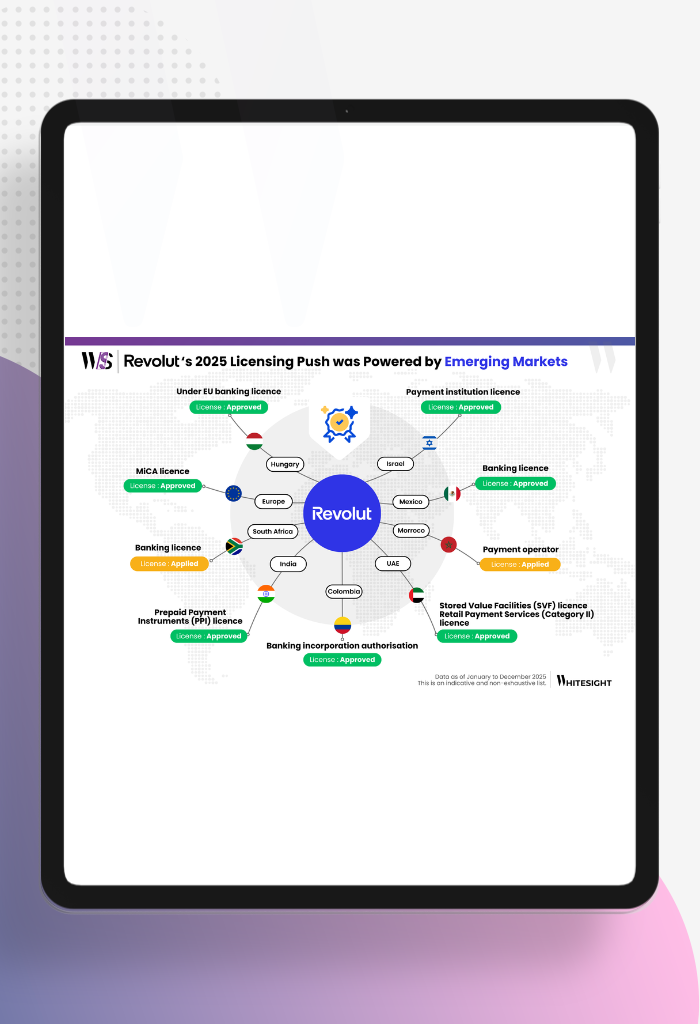

Revolut’s 2025 launches show a disciplined expansion formula, to win the primary account through locally compliant access, pull balances in with savings-led value, then increase take-rate by owning more of the payment journey. The result is a product mix that compounds economics through higher retention, lower unit costs, and faster cross-sell into wealth, lending, and business tooling.

Revolut's Deep Dive Report 📔

Revolut’s journey to 60 million customers hasn’t been just about fast growth. It’s also about how it adapted its model in each market, tweaking product features, go-to-market strategies, and regulatory plays depending on local norms and gaps.

From the UK’s broad product suite to the EU’s carefully localized banking expansion, the Revolut model reveals tested moves for scaling and monetizing fintech.

So how exactly did it pull this off, without breaking unit economics, losing brand consistency, or stretching itself too thin?

WhiteSight’s latest report explores the licences, product bets, and revenue levers that powered Revolut’s transformation from a UK challenger into a truly global digital bank.

Report

Savings as a high-frequency engagement and funding moat:

Revolut is using daily payouts, instant access structures, and segment-specific propositions such as teen savings and business cash funds to make balances feel productive at all times. This improves deposit stickiness, lowers reliance on expensive acquisition, and creates a cleaner funding base to price credit and wealth products more aggressively while protecting margins.

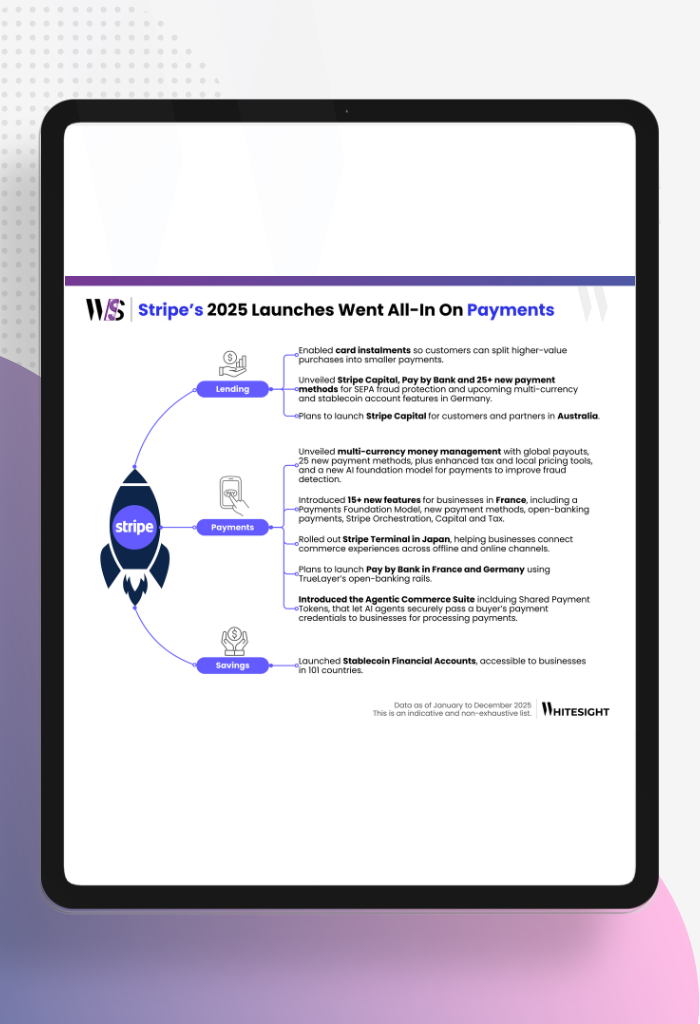

Payments as a routing layer that optimizes cost, risk, and reach:

EPI and Wero connectivity, Pay by Bank enablement, Terminal rollout, and branded ATMs point to a strategy of expanding rail optionality and controlling more endpoints. That control strengthens bargaining power, improves authorization performance, and enables dynamic routing decisions that defend economics as interchange and scheme rules evolve.

Localized rails first, monetization layers second:

Portuguese IBAN rollout, Brazil’s CDI-linked interest account with instant liquidity, and Singapore business cash funds signal a repeatable sequencing. Revolut secures local account primitives and domestic payment access, then layers margin products such as installments, refinancing, rewards, mobile plans, and corporate spend management once a market has the operational and regulatory foundation to scale profitably.

Taken together, these moves position Revolut as a financial operating layer that can be replicated across markets with minimal reinvention. The 2025 launch set shows how a global fintech can turn product breadth into compounding advantage by tightening the link between local access, everyday usage, and monetization.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

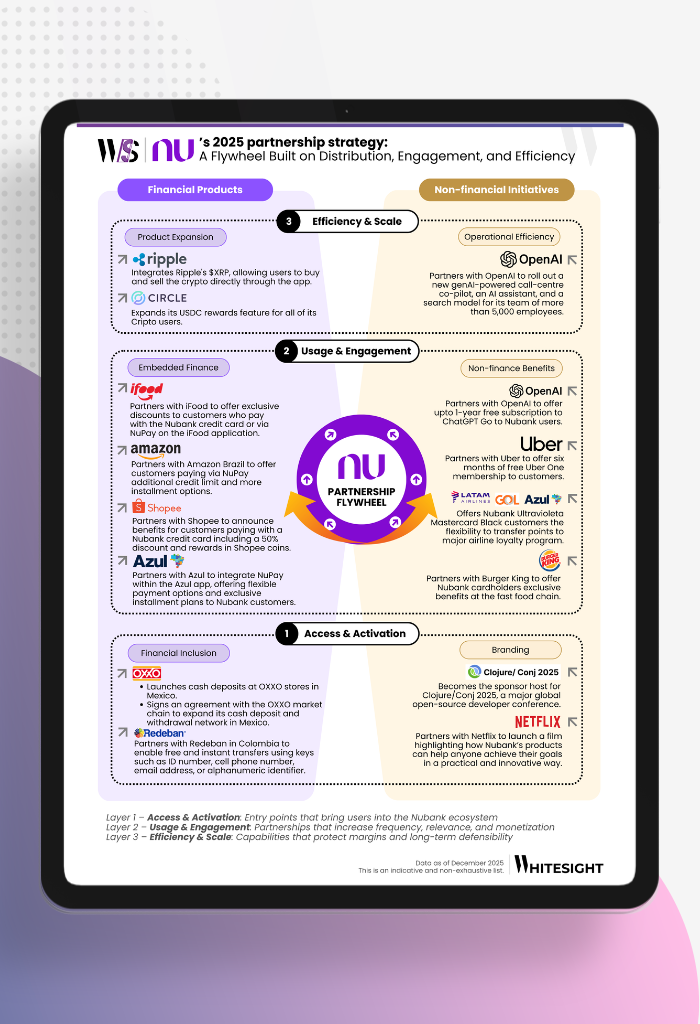

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts