Speed, Strategy, and Local DNA: Behind Revolut’s Path to 60M Customers

Global Scale by Adapting to Local Conditions

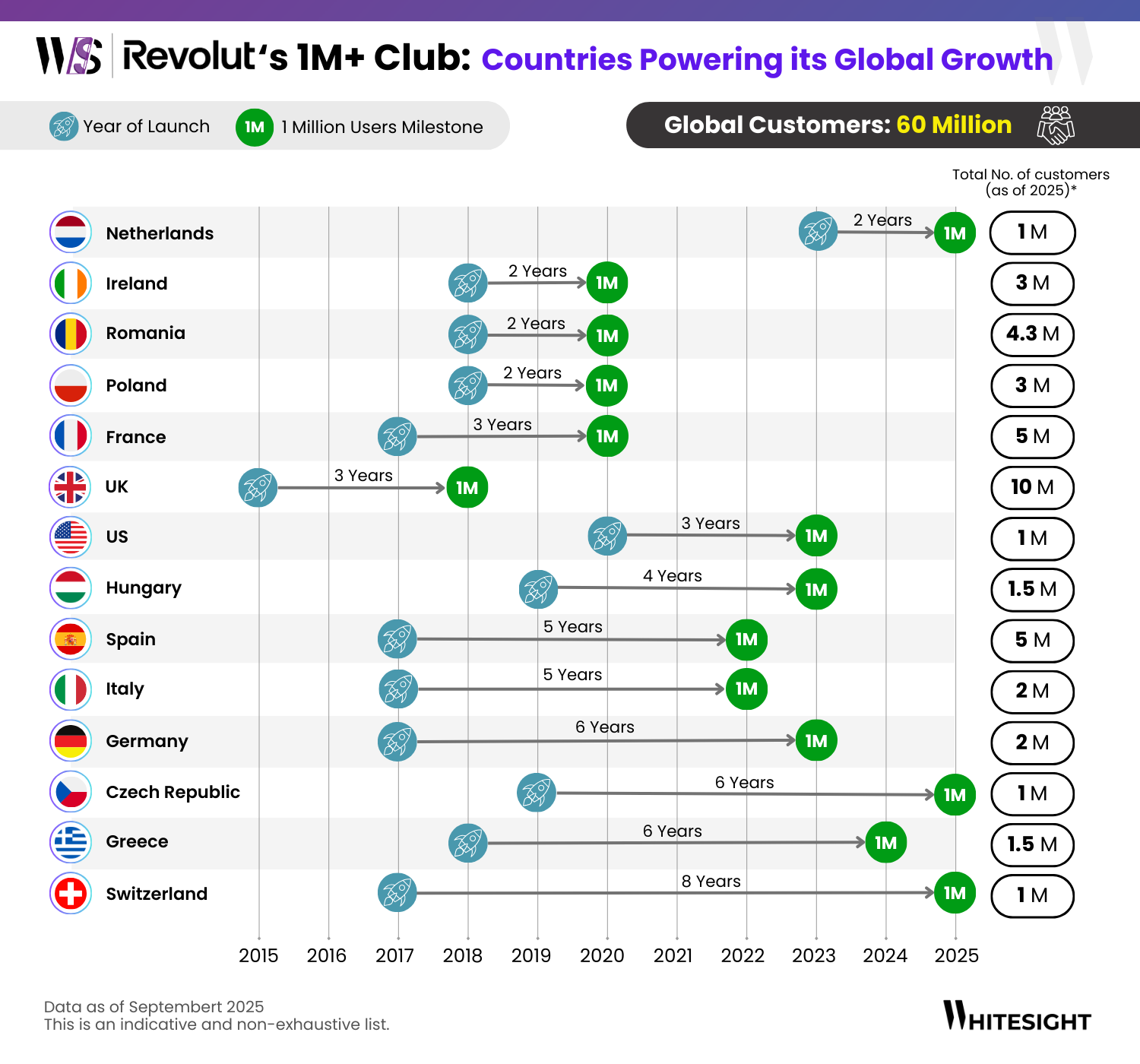

Revolut’s 1M+ milestone map is a window into how the digital bank scales differently across markets.

- In markets like Ireland, the Netherlands, and Romania, Revolut broke through quickly (reaching 1M in 2 years) by filling gaps left by traditional banks, offering lower-cost FX, app-based accounts, and seamless onboarding in markets hungry for digital-first alternatives.

- The UK remains its largest base (10M), not just because it’s home turf but also thanks to product breadth. This includes RevPoints and eSIMs as well as wealth protection, and the anticipation of a full UK banking licence. In France and Spain, growth accelerated as Revolut shifted from a travel-focused financial app. It deepened its product set into savings, investments, and even its upcoming mortgages offering, transforming into an everyday bank.

- By contrast, Switzerland’s slow burn (8 years to 1M) reflects high incumbent trust; growth only took off after Revolut localized with Swiss IBANs, QR payments, and investment products. Add in its push into the US, GCC, and Asia, and the playbook is clear: anchor in Europe, prove unit economics, then replicate globally.

- What ties this together is a strategy built on organic adoption (65% of 2024’s new customers came through referrals), a broadening product set (from youth accounts to joint banking), and localized go-to-market plays. With 60M customers worldwide, Revolut’s “1M+ Club” is less about the milestone itself and more about proving that the company can flex its model to fit very different financial landscapes – a critical test for anyone aiming to build the world’s first truly global digital bank.

Revolut's Deep Dive Report 📔

Revolut’s journey to 60 million customers hasn’t been just about fast growth. It’s also about how it adapted its model in each market, tweaking product features, go-to-market strategies, and regulatory plays depending on local norms and gaps.

From the UK’s broad product suite to the EU’s carefully localized banking expansion, the Revolut model reveals tested moves for scaling and monetizing fintech.

So how exactly did it pull this off, without breaking unit economics, losing brand consistency, or stretching itself too thin?

WhiteSight’s latest report explores the licences, product bets, and revenue levers that powered Revolut’s transformation from a UK challenger into a truly global digital bank.

Report

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts