Stripe’s Launches in 2025: Preparing the Stack for Agent-Led Transactions

The change from accepting funds to managing merchant liquidity

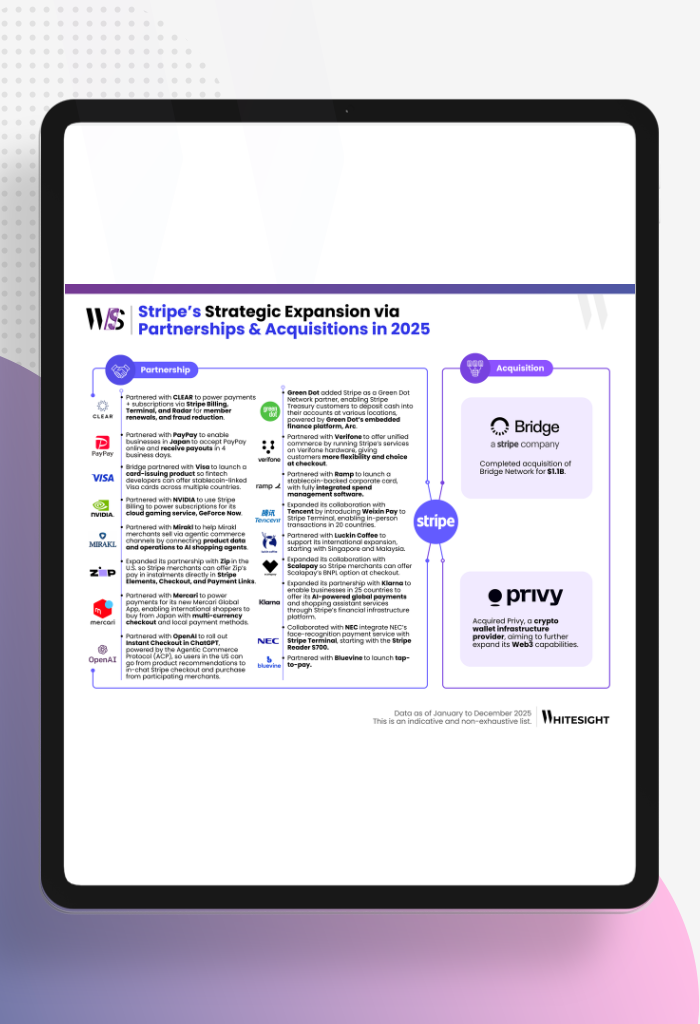

Stripe’s 2025 launches read less like feature drops and more like a coordinated stack shift that highlight expansion beyond cards into bank and local rails, attaching capital and money management to payment flows, and making payments agent-ready with secure credential primitives.

- Rail diversity is now a core lever for conversion and margin:

Instalments help merchants convert higher-value carts without sacrificing approval rates. At the same time, Pay by Bank and the broader rollout of local payment methods give Stripe more control over routing, so each transaction can be directed to the rail that delivers the strongest combination of acceptance, lower cost, and lower dispute and fraud risk. The emphasis on SEPA fraud protection reinforces the European lesson: expanding beyond cards works only when alternative rails are paired with local, method-specific risk controls that keep losses predictable as volume grows - Money management being built into the payments engine:

Multi-currency money management, global payouts, and localisation tools for tax and pricing push Stripe closer to becoming the operating account merchants run day-to-day. Stablecoin financial accounts extend that reach by making it easier to hold and move value across borders, while the expansion of Stripe Capital brings financing into the same workflow. Together, these launches let Stripe monetise FX and balances, and meet working-capital needs directly through routine settlement activity rather than separate banking relationships. - Agentic commerce is the next interface layer:

The Agentic Commerce Suite and shared payment tokens point to delegated purchasing where software agents can pay within clear limits. Stripe’s fraud focused foundation model reinforces the shift to real time, intent aware trust, supported across both online payments and in person acceptance through Terminal expansion.Stripe’s 2025 launches show payments becoming a single system that manages how money moves, where it sits, and how risk is handled. The key signal is Stripe pairing new rails and new token formats with strong, method-specific fraud controls so scale does not increase losses.

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn and subscribe to our Future of Fintech Newsletter to be the first to know about the Next Big Fintech Strategies.

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts