The Rise of Stablecoins in Big Tech’s Payment Strategy

Tech platforms take control of how money flows across their ecosystems

Stablecoins are moving from their crypto-native origins into the core of mainstream finance. What started as a tool for trading is now being reimagined as a foundational payment layer, used by businesses, platforms, and merchants to enhance transactions, reduce costs, and enable instant global settlement.

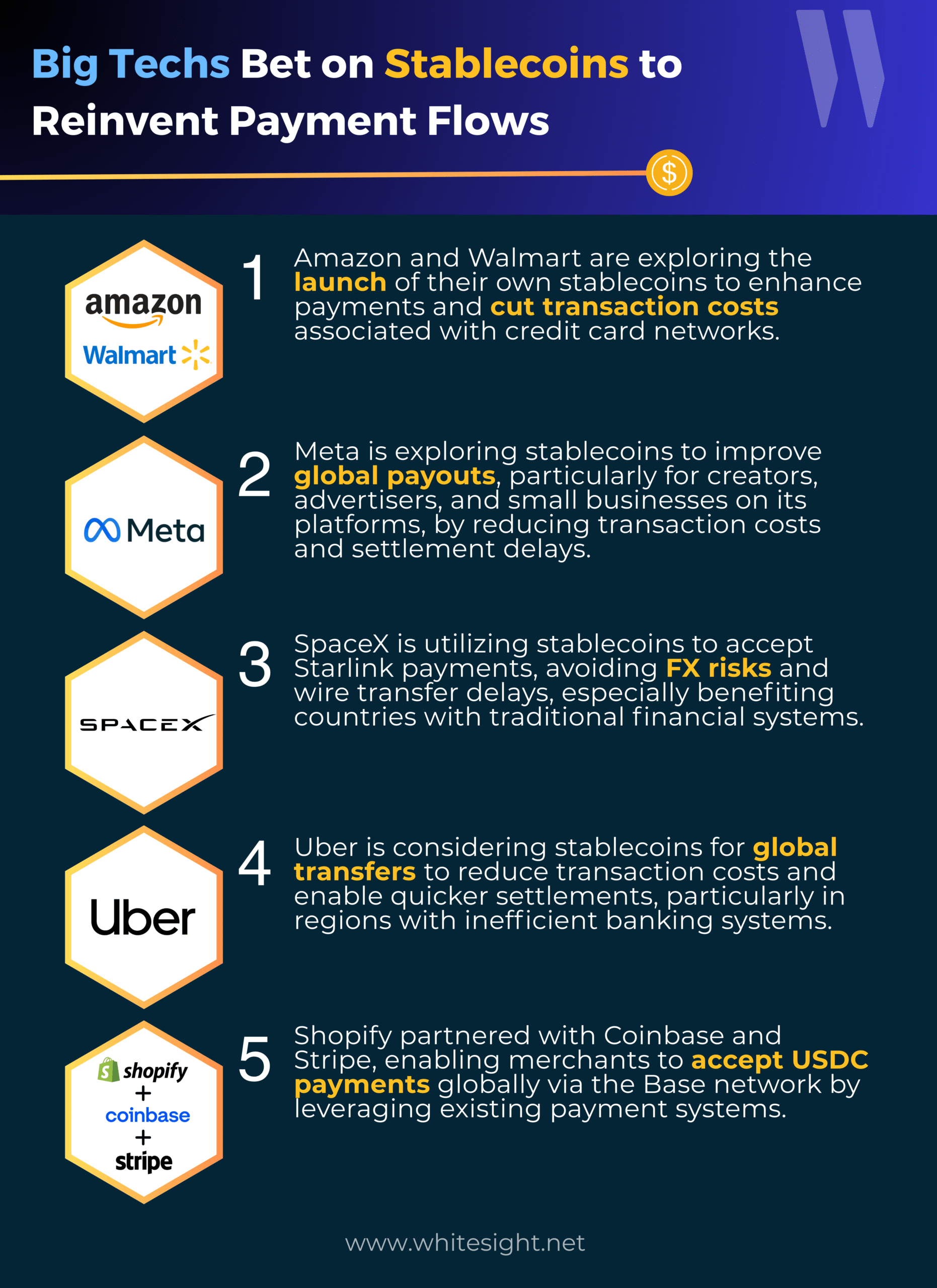

Now, Big Techs are getting in on the action, only they’re not just using stablecoins, they’re helping shape how they work. Whether it’s launching their own tokens, speeding up global payouts, or making it easier for merchants to accept digital dollars, these companies are quietly building the next generation of payment systems. And in doing so, they’re turning stablecoins into a serious part of how money moves at scale. Let’s break down how Big Techs are building around stablecoins:

- From Retail Giants to Payment Rail Builders: Amazon and Walmart are exploring the launch of their stablecoins, aiming to process transactions internally without relying on expensive credit card networks. This lets them cut merchant fees, settle instantly, and potentially create closed-loop ecosystems. For businesses modeling after these retail giants, stablecoin issuance offers a path to control capital float, loyalty mechanisms, and internal circular economies.

- Global Reach Meets Payment Efficiency: Stablecoins are being deployed not for consumer-facing speculation, but to fix structural inefficiencies in how money moves across borders. Global platforms like Meta, Uber, and SpaceX are turning to stablecoins to fix broken cross-border payment rails. For Meta, it’s about enabling instant, low-cost payouts to creators and businesses in-app. Uber, on the other hand, is eyeing stablecoins to simplify earnings for drivers spread across geographies where banking infrastructure is weak or FX volatility eats into margins. SpaceX is already live with stablecoin-based collections for its Starlink service, especially in remote or emerging markets.

- Making Stablecoin Acceptance Plug-and-Play: Shopify is making it easy for merchants to accept stablecoin payments without needing to understand crypto. By integrating with platforms like Coinbase and Stripe, it enables USDC checkouts on the backend. Merchants don’t need new wallets; just integrate and start accepting global payments instantly. This reduces fees, removes borders, and simplifies cross-currency transactions. Shopify is turning stablecoin acceptance into an invisible upgrade for everyday commerce.

Stablecoins are emerging as a serious upgrade to the way money moves: faster and cheaper than legacy systems. Tech giants are laying the groundwork for a new financial stack where control over payments becomes a core capability, not a dependency. For businesses, this signals a shift from adapting to existing rails to owning and shaping their own.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts