The Stablecoin Playbook: How Finance Giants Are Shaping the Future of Money

The shift from stablecoin experiments to everyday financial infrastructure

The stablecoin frontier is no longer a speculative sandbox, it’s becoming a foundational layer in modern financial infrastructure. From programmable money to real-time settlement and identity-linked wallets, stablecoins are being industrialized by some of the world’s most powerful fintech and payments firms.

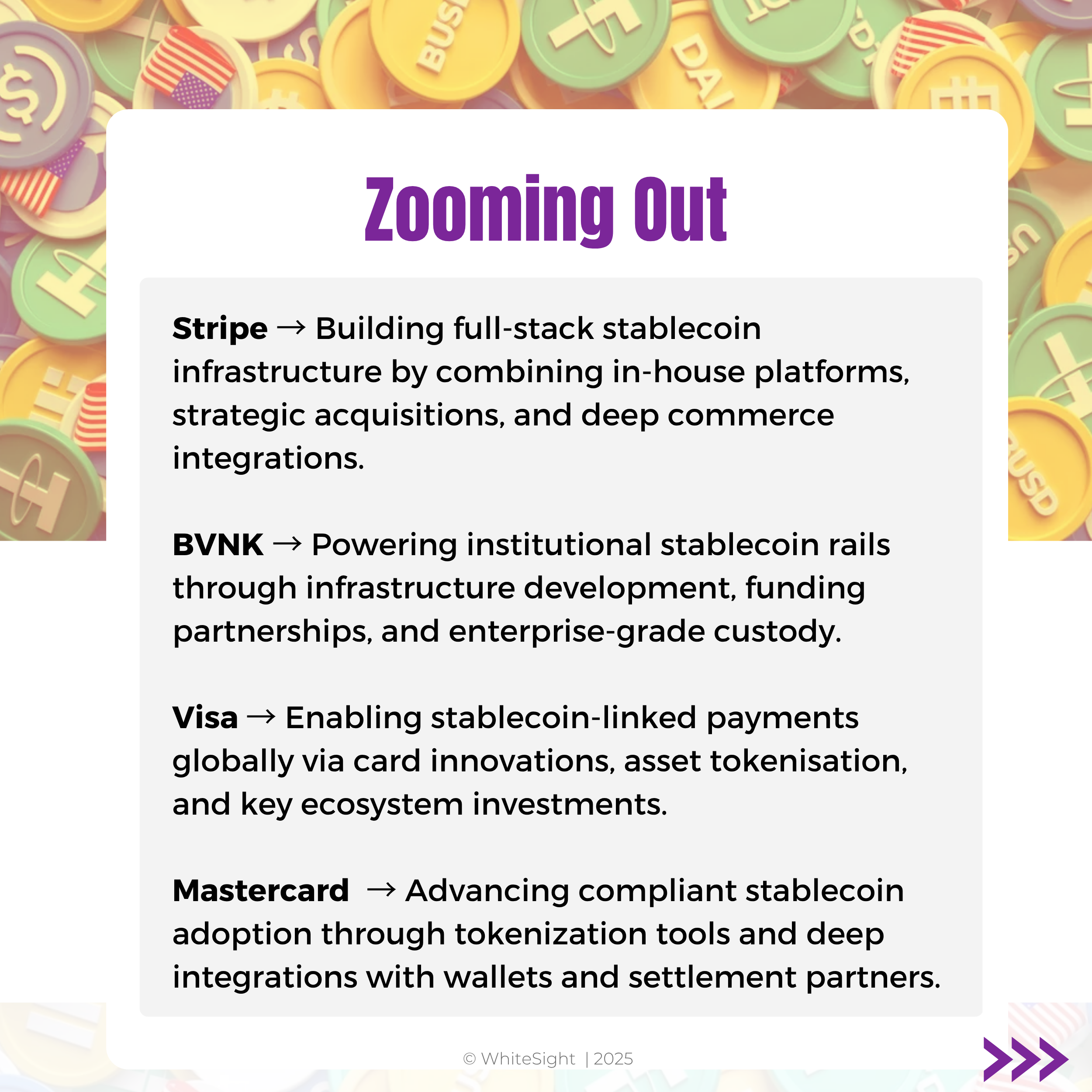

Here’s how Stripe, BVNK, Visa, and Mastercard are tactically wielding stablecoins across build, investment, and partnership lenses to architect the future of digital value exchange.

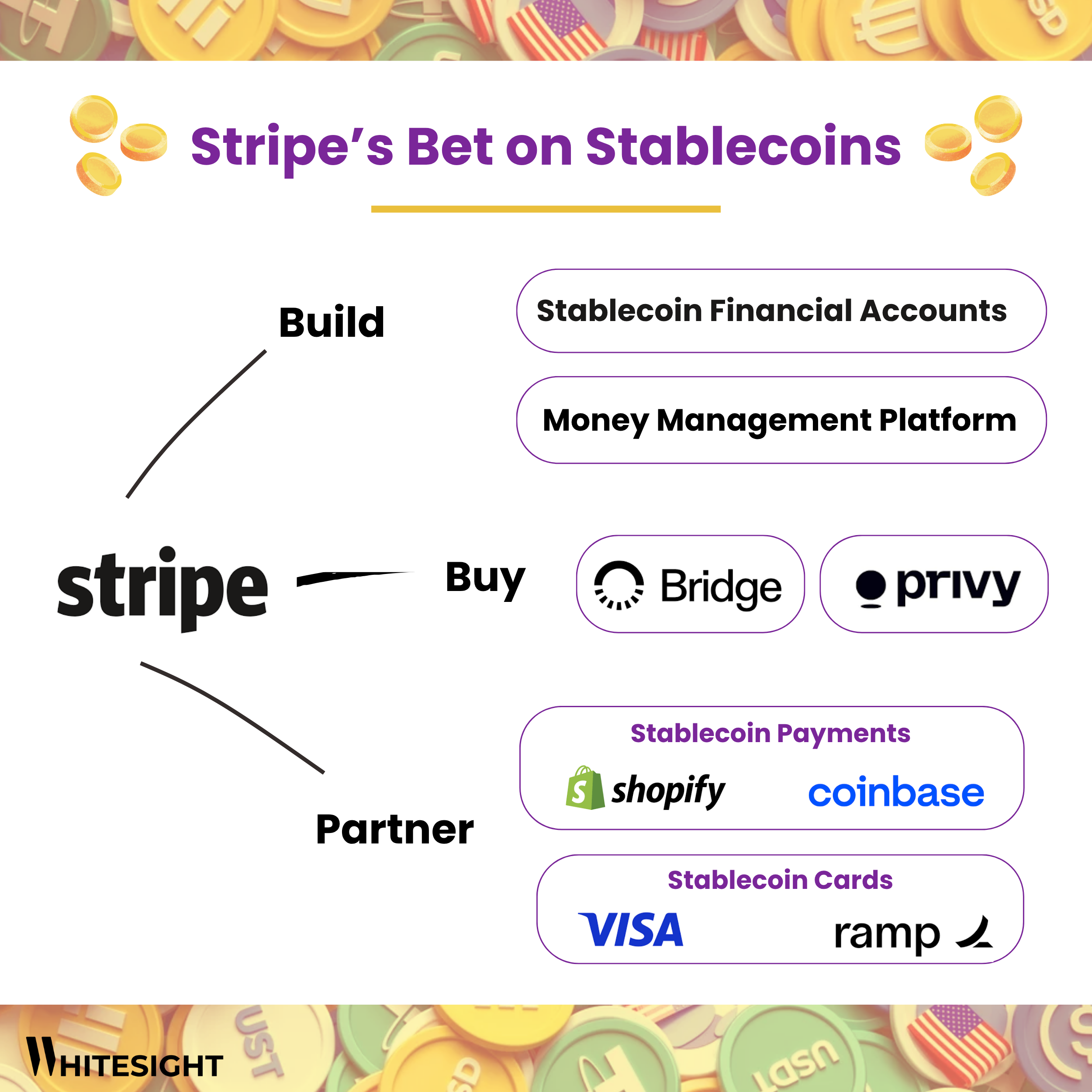

Stripe: Embedding Stablecoins into Digital Commerce DNA

- Stripe is building toward a full-stack stablecoin-native experience. With new launches like Stablecoin Financial Accounts and a Money Management Platform, Stripe is enabling businesses across 100+ countries to hold, send, and receive stablecoins like USDC and USDB directly from their dashboard. These accounts integrate Stripe’s fraud protection and payout stack, turning them into programmable cash management rails that operate 24/7.

- This build strategy is reinforced by acquisitions like Privy (privacy-preserving user identity infra) and Bridge (wallet architecture for on/off-chain asset movement), which together enable Stripe to offer regulated, composable rails for identity, custody, and liquidity. By partnering with Shopify and Coinbase on payments and with Visa and Ramp on stablecoin cards, Stripe is positioning stablecoins not as an add-on, but as native commerce infrastructure.

- This signals a Stripe that wants to abstract the blockchain away, making stablecoins an invisible but indispensable backend for payouts, merchant liquidity, and global money movement.

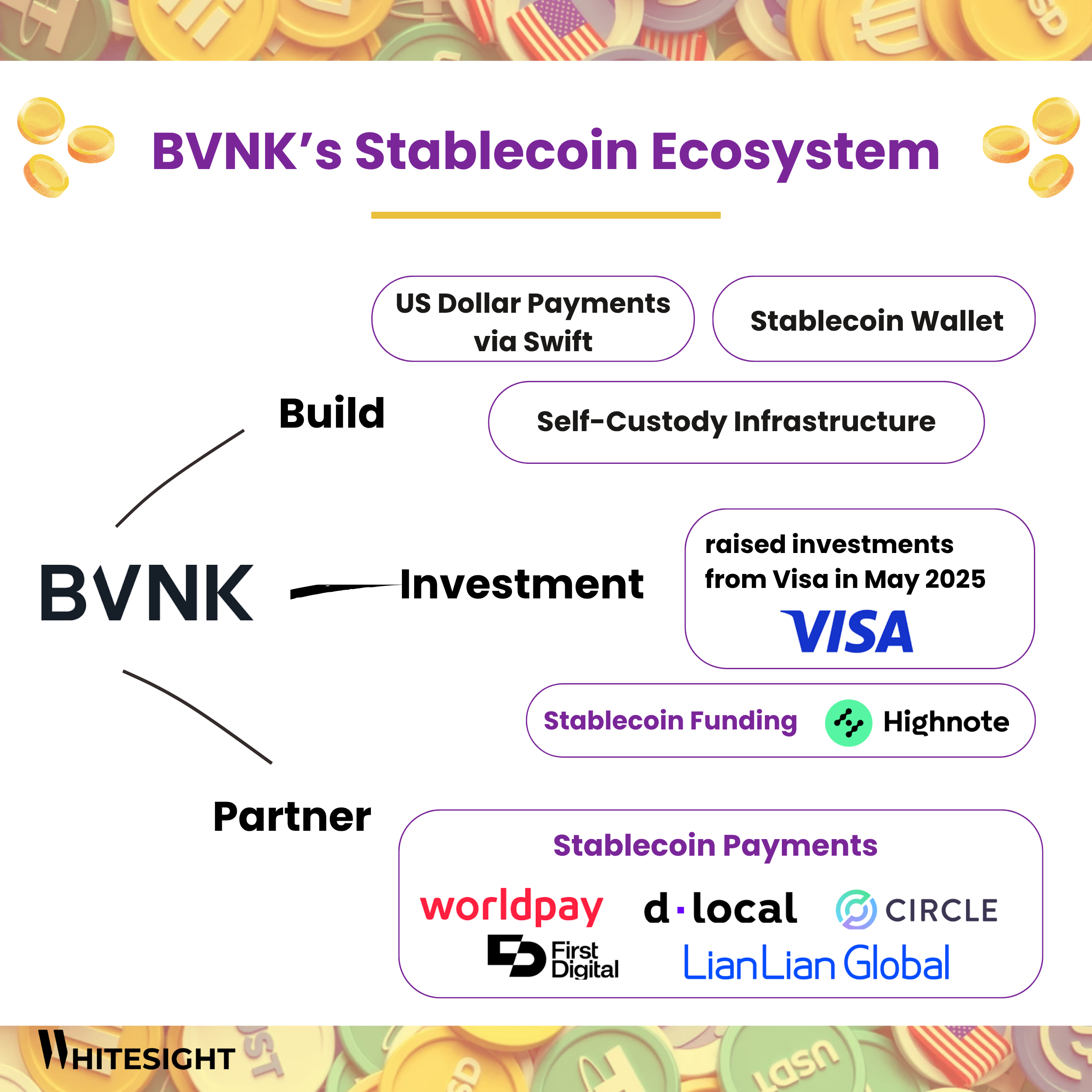

BVNK: Engineering Stablecoin Infrastructure for Institutions - BVNK is establishing itself as a foundational platform for enterprise-grade stablecoin enablement. Its embedded wallet framework integrates both fiat systems (Swift, SEPA, ACH) and stablecoin blockchains, allowing for seamless, round-the-clock settlement across networks. With a strong emphasis on compliance and automation, its Layer 1 orchestration suite provides capabilities like automated wallet provisioning, multi-asset support, and real-time reconciliation crucial for regulated institutions aiming to adopt digital currencies at scale.

- The addition of Swift-compatible USD rails makes BVNK a viable connector between traditional banking infrastructure and programmable money. Its ecosystem strategy is gaining traction, backed by Visa’s investment and partnerships with Highnote, Circle, Worldpay, and First Digital. BVNK’s infrastructure is designed to be modular and interoperable, enabling fintechs, PSPs, and banks to deploy stablecoin solutions without needing to build the rails themselves.

This model aligns closely with rising institutional demand for integrated digital asset frameworks that don’t compromise on security or scalability.

Visa: Creating Global Rails for Stablecoin Payments

- Visa has transitioned from early experimentation to full-scale productization of stablecoin use cases. It introduced stablecoin-linked debit cards across six Latin American countries, enabling users to spend USDC balances at any Visa-accepting merchant.

- On the infrastructure front, Visa has developed the Tokenized Asset Platform (VTAP), which is tailored for institutional settlement, custody, and token issuance. This platform is designed to support cross-border value movement, helping financial institutions integrate stablecoins into their existing treasury and clearing operations.

- Visa’s capital support for BVNK, along with technical partnerships with Worldpay, Nuvei, Yellow Card, and BAANX, points to a wider strategy of embedding stablecoins into both consumer and institutional payment environments. The company is building a layered architecture that integrates compliance, liquidity, and tokenized settlement across multiple jurisdictions.

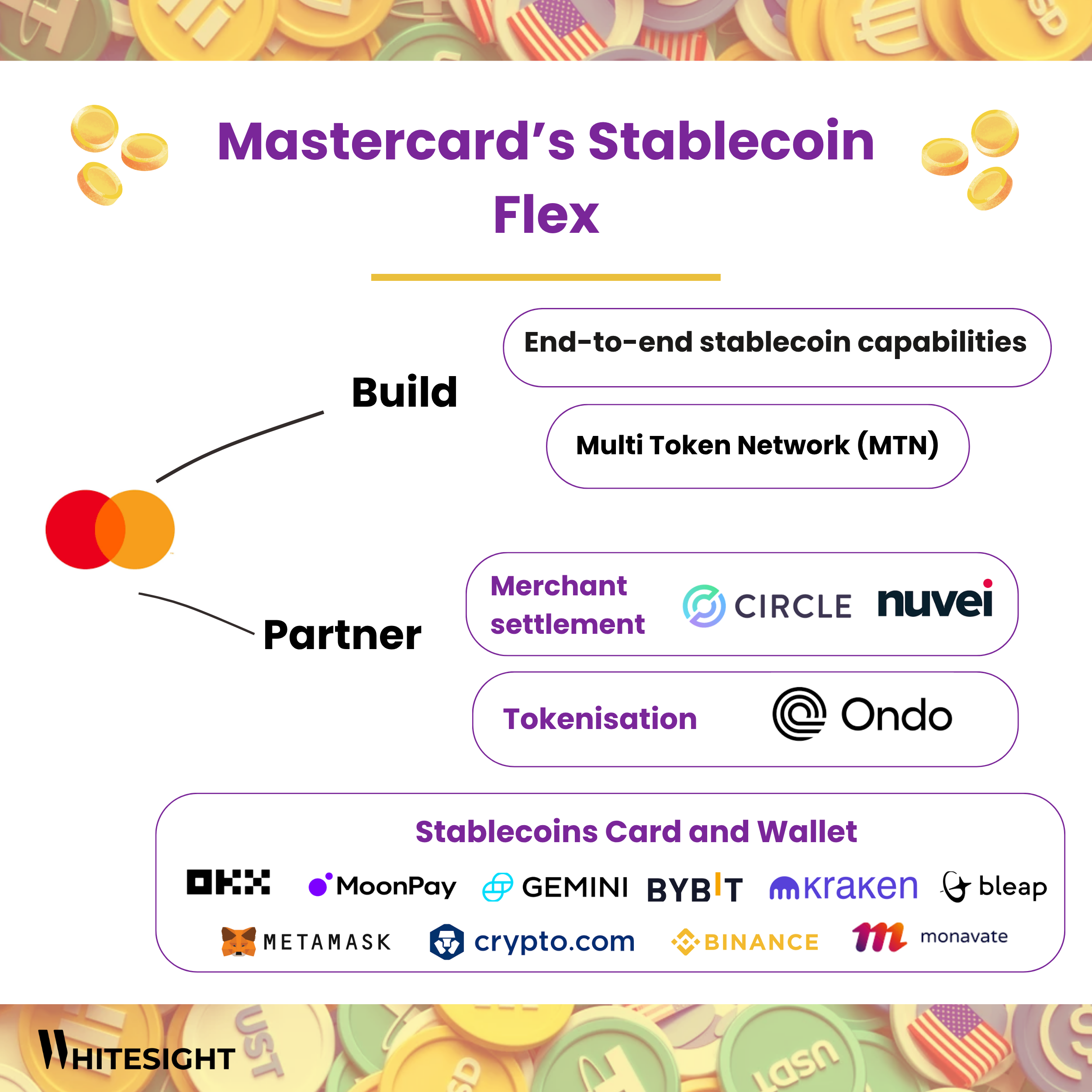

Mastercard: Driving Compliance-Centric Tokenization and Ecosystem Play - Mastercard is focused on enabling secure and compliant stablecoin transactions through a full-stack infrastructure approach. The Multi Token Network (MTN) supports issuance, transfers, and acceptance of stablecoins across wallets and merchant systems.

- Its newly launched end-to-end stablecoin capabilities span wallet integration, transaction routing, and regulatory tooling—enabling businesses to onboard users, manage funds, and complete stablecoin payments with operational clarity and regulatory alignment.

- Through integrations with Circle, Nuvei, Ondo, MetaMask, Binance, and MoonPay, Mastercard is creating a stablecoin network that aligns with institutional and retail needs. Rather than focusing on issuance, the company is enabling scale by standardizing the rails through which stablecoins can move securely and compliantly within existing financial systems.

Together, these players are shaping the long-term foundation for stablecoins as a core utility in digital finance, not as standalone instruments, but as embedded components of a re-architected value network.

Don’t want to miss the next big thing in digital assets? 🪙

Our monthly Digital Assets newsletter unpacks the latest across stablecoins, tokenization, crypto trading, and global regulations, all in one punchy read. Perfect for staying ahead of the curve without the scroll fatigue.

Read the latest issue and subscribe to catch the next drop this week!

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts