Unlocking Credit: BNPL’s Rise in Mexico’s Digital Economy

Bridging access gaps and improving credit inclusion in Mexico

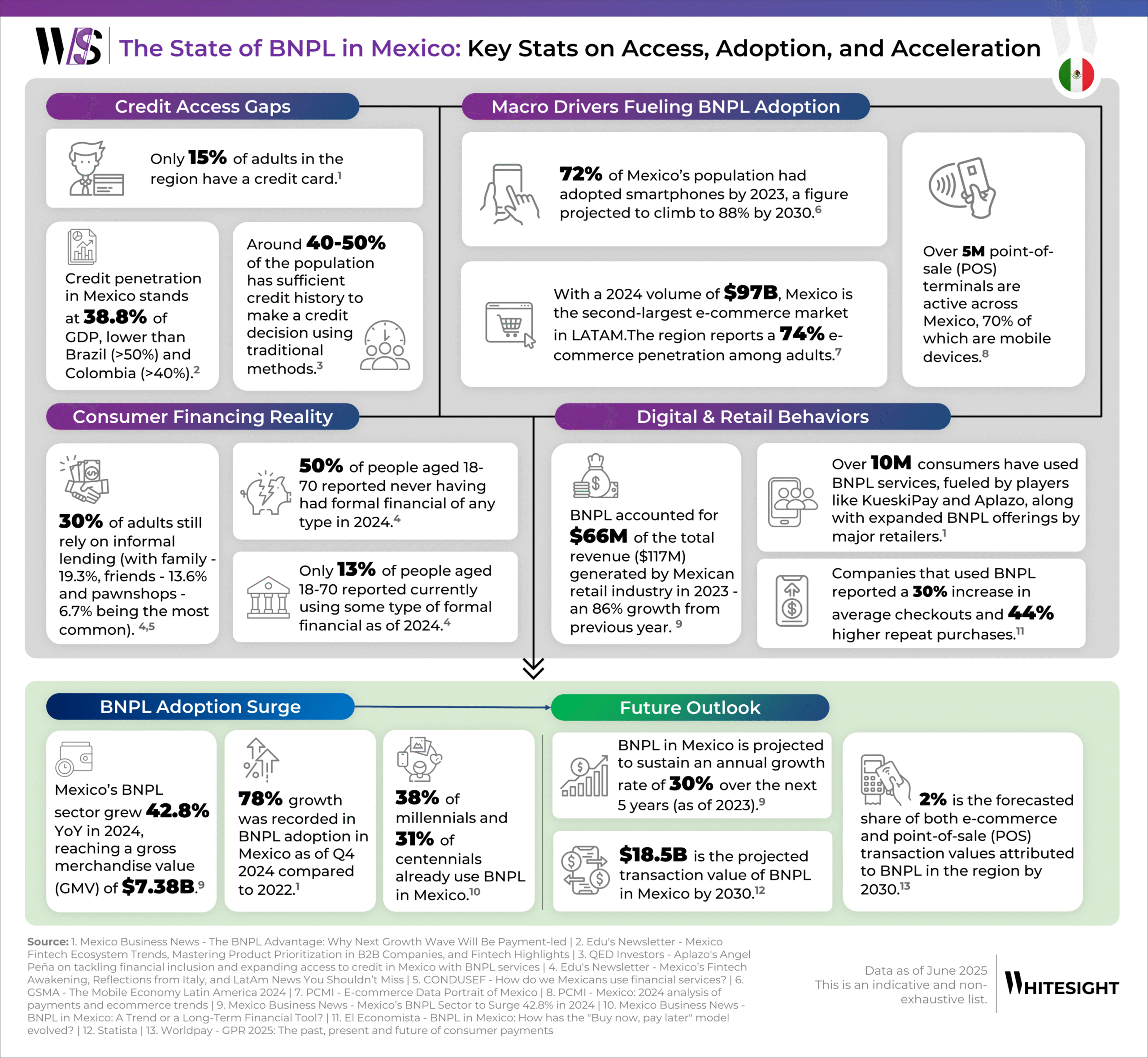

Mexico presents a paradoxical financial landscape: on one hand, only 15% of adults own a credit card, and 30% of adults still rely on informal lending through family, friends, or pawnshops. Credit penetration remains limited at 38.8% of GDP, and nearly 50% of the adult population has never accessed any kind of formal financial service. Traditional banking structures have failed to keep pace with the needs of millions of underbanked individuals, especially the young and digitally native.

Yet, parallel to this credit vacuum is a booming digital ecosystem: 74% of adults are active online shoppers. Mexico has become Latin America’s second-largest e-commerce market, reaching a value of $97B in 2024, and is supported by 5 million POS terminals, 70% of which are mobile-enabled. This digital leap has paved the way for BNPL to thrive, not just as a checkout solution, but as an embedded credit mechanism tailored to the realities of a financially underserved but digitally connected population.

Here’s how BNPL is shaping the country’s financial trajectory:

- Bridging the Gap for the Financially Underserved: In a country where nearly half the adult population has never interacted with formal finance, BNPL has rapidly emerged as a gateway to credit. More than 10 million consumers have already used BNPL services from players like KueskiPay and Aplazo, establishing BNPL as one of the fastest-scaling digital financial tools in the region.

- Accelerating E-Commerce and Retail Engagement: Mexico’s e-commerce market hit $97B in 2024, supported by 72% smartphone penetration and over 5 million POS terminals, 70% of which are mobile. BNPL contributed $66M in GMV to retail in 2023, an 86% YoY growth, with merchants seeing a 30% uplift in average order value and 44% higher repeat purchases, underscoring its commercial impact.

- Building Long-Term Consumer Momentum: Adoption surged 78% YoY by Q4 2024, with millennials (38%) and centennials (31%) forming a strong early adopter base. The model’s traction among digital natives positions it for sustained relevance, with projections indicating a $18.5B transaction volume by 2030 and a 30% annual growth rate.

As millions experience formal credit for the first time through flexible, embedded payment options, BNPL is doing what traditional banking could not: meeting consumers where they already are, on smartphones, in online stores, and at digital points of sale. For businesses, this shift presents a powerful lever to drive conversion, loyalty, and long-term customer value.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts