Visa vs Mastercard: Decoding the Battle for Digital Assets

Building the Rails for a Tokenized Future

When disruption knocks, Visa and Mastercard don’t flinch; they fling open the door, roll out a red carpet, and invite it to stay. That instinct is being tested yet again. This time with digital assets.

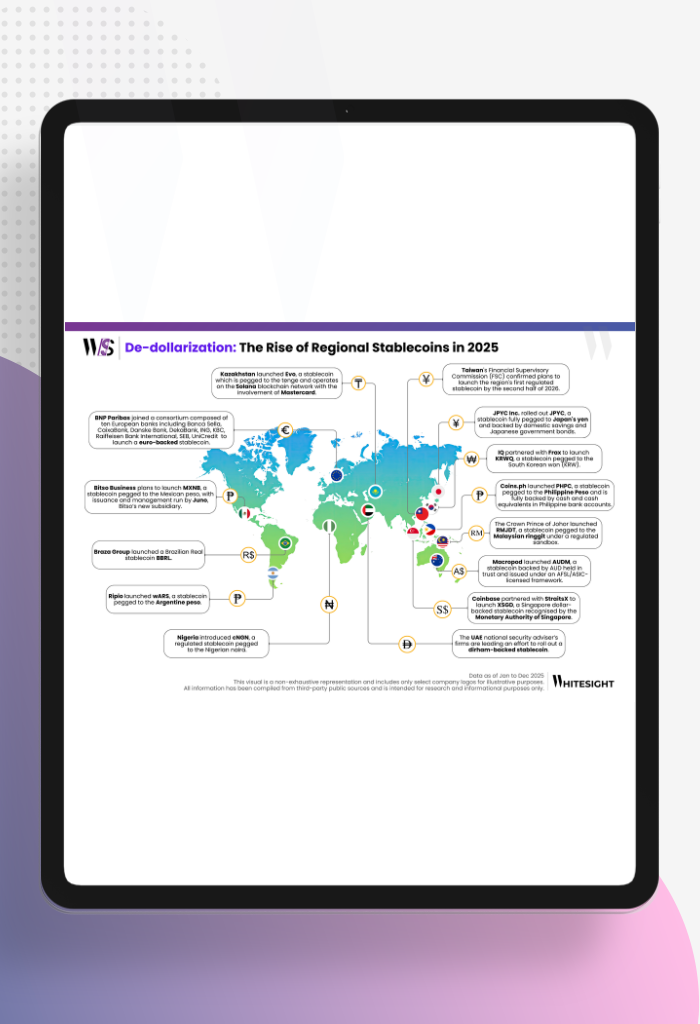

A regulatory and retail reset is brewing around stablecoins. One that threatens the very foundation of card-based payments. The Genius Act, a bill proposing a formal regulatory framework for stablecoins, has just cleared a procedural vote in the House of Representatives. This could usher in regulated, non-bank payment rails that bypass traditional card networks by using bank and non-bank-issued stablecoins.

Retail giants have taken notice. According to The Wall Street Journal, Walmart and Amazon have begun exploring stablecoin payment systems as a way to cut down or entirely avoid fees paid to Visa, Mastercard, and other card processors. Markets responded with alarm: Visa’s stock fell over 5%, and Mastercard dropped by 4.6% in the wake of the news.

This wasn’t just a reaction to policy; it was a disruption alert. If merchants embrace stablecoins and regulators approve rails to support them, it directly threatens the core of Visa and Mastercard’s business: interchange and transaction fees on card payments.

So how are the two payment titans responding?

So how are the two payment titans responding?

Stats That Tell the Story

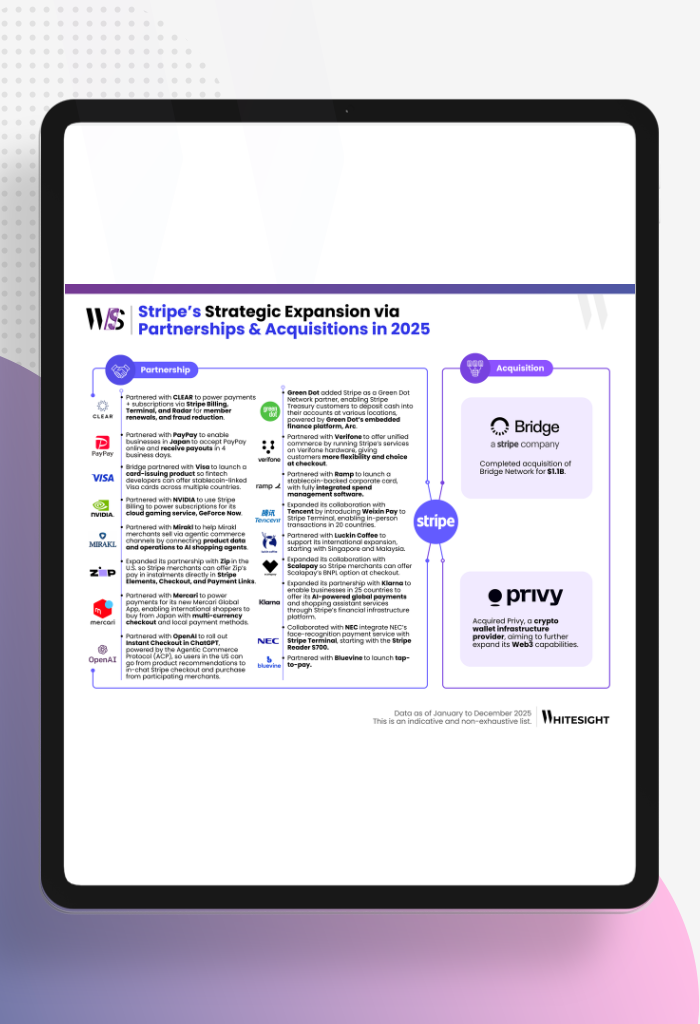

Digital assets, i.e. stablecoins, crypto wallets, tokenized deposits, are going mainstream. Visa and Mastercard, long synonymous with card payments, are making bold plays to remain the rails beneath whatever money looks like next. Here’s how Mastercard and Visa are making digital assets a part of daily life:

- Mastercard now enables crypto and stablecoin payments at over 150 million merchants worldwide, with more than 100 crypto-focused card programs launched.

- Visa has facilitated over $100 billion in crypto purchases and more than $25 billion in spending directly via Visa crypto cards, showing that real money is moving through these new rails.

Whether it’s at checkout, through partnerships, or in the design of entirely new payment rails, both companies are turning digital assets from a niche offering into something you can actually use in everyday life.

Who Does What? Two Titans, Two Playbooks

Visa and Mastercard may seem neck and neck, but the way they’re chasing digital asset leadership comes down to different mixes of building and partnering.

Visa: Making Crypto Feel Like Card Payments

Visa is out to make paying with digital assets as simple as using your card at the corner shop, by weaving building, partnering, and investment into its approach:

- Seamless stablecoin payments (Build): Visa develops its own stablecoin-enabled products, like USDC-backed Visa cards, now live across Europe, Africa, and Latin America, letting people spend stablecoins just like any local currency.

- Expanding options everywhere (Partner): Visa teamed up with Rain, Yellow Card, Baanx, and others to offer micro-credit, cross-border pay, and stablecoin-linked spending, helping Visa bring digital assets into day-to-day life at scale.

- Tokenization moves: Visa is working with BBVA to explore the potential of tokenized money through its new Tokenized Asset Platform. This initiative is designed to bring blockchain-native, programmable assets into the Visa ecosystem, opening the door for new types of tokenized money and value flows.

- Strategic investment: Visa has further doubled down on digital asset innovation with its investment in BVNK, a blockchain payments firm focused on bringing stablecoins and on-chain infrastructure to financial institutions and enterprises.

Mastercard: Building Trust and Industry Standards

Mastercard is focused on building robust foundations and setting industry standards for digital asset payments through building and partnering:

- Future-proof infrastructure (Build): Mastercard has built tools like the Multi-Token Network (MTN) and end-to-end stablecoin capabilities, making it easy for banks and fintechs to create blockchain-based products. This setup lets partners use both traditional money and digital currencies, offering things like programmable payments and cross-network transfers- all while keeping everything secure and compliant.

- Compliance up front (Build): Services like Crypto Credential make sending and receiving digital assets seamless and regulatory-safe across Europe and Latin America, ensuring compliance is embedded in every flow.

- Connecting digital assets to daily life (Partner): Over 100 crypto-focused card programs with partners including Kraken, MoonPay, imToken, Chainlink, Fiserv, Bleap, and OKX bring crypto and stablecoins into mainstream payments, making them usable for online shopping and everyday transactions.

- Tokenization advances: Ondo Finance is set to become the first provider to bring real-world assets (RWAs) to Mastercard’s MTN, marking a step forward in integrating tokenized bonds, funds, and more into global payment networks.

- Tokenized deposits: Mastercard has executed its first tokenized deposit transactions in partnership with StanChart subsidiaries, testing how tokenized bank deposits can move across programmable blockchains for secure and regulated payment flows.

Why This Battle Matters

Visa’s strategy makes digital assets almost invisible – users can pay and get paid like always, including in places where banking remains a challenge. That reach means millions can now use stablecoins or crypto just as easily as local currency.

Mastercard, meanwhile, is focused on trust, safety, and future-forward rails. Its approach is about enabling banks, fintechs, and merchants to use digital assets with confidence, while ensuring they’re ready for whatever form money takes next.

What’s Shaping the Next Wave?

Both companies are moving fast to meet new demands:

- Merchants want faster, cheaper payments and solutions that keep up with shifting buying habits.

- Central banks are piloting digital currencies and require secure, scalable digital payment systems.

- Regulators seek innovation that balances opportunity with trust and safety.

- Customers and businesses expect a world where money moves freely, instantly, and without borders.

Soon, it may not matter whether you’re using a “card” or “crypto” – the real question will be: which network gives you more ways to control, spend, or save your money, wherever you are? Visa and Mastercard are not only ‘rivalling’ dominance – they’re creating new choices, stronger safety, and more freedom for everyone who moves money.

At Whitesight, we’ll keep tracking these shifts as new digital rails open the world of money to more people and fresh possibilities.

Supercharge your Fintech IQ with WhiteSight Radar

Join Radar for exclusive member benefits and access to expert reports, industry trend breakdowns, and insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond.

Be the First to Know About the Next Big Fintech Strategies!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn and subscribe to our Future of Fintech Newsletter to be the first to know about the Next Big Fintech Strategies.

Author

Anjali Singh

Research Analyst- Fintech & Digital Asset

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts