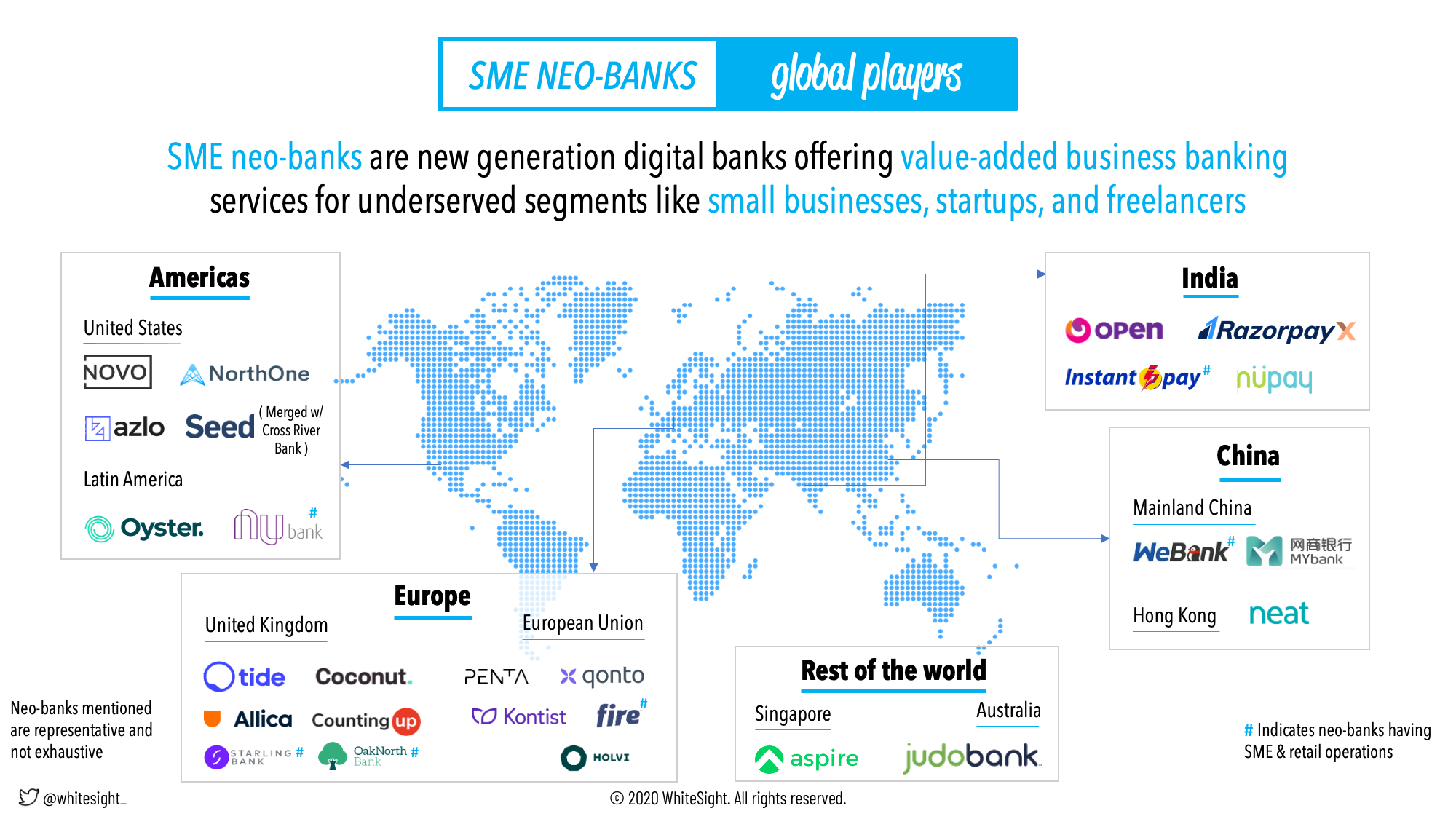

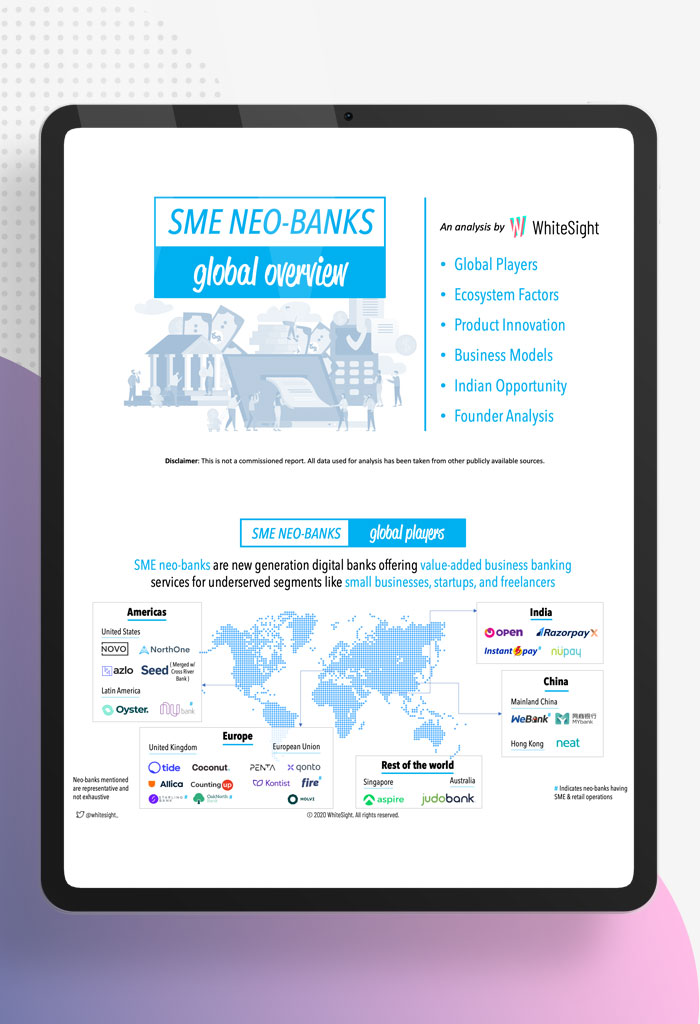

SME Neo-Banks | Global Overview

August 2, 2020

SME Neo-Banks | Global Overview

Neo-banks, especially the ones focused on SME sector, has emerged as #AntiFragiles in #FinTech with massive digitalisation sweeping across the SME sector in the time of pandemic.

Complimentary Research

Description

Whats #Neo in SME Banking?

Neo-banks, especially the ones focused on SME sector, has emerged as #AntiFragiles in #FinTech with massive digitalisation sweeping across the SME sector in the time of pandemic.

Key trends across the globe in the SME Neo-Banking space:

- Creative-destruction needs a fresh perspective is well established with 66% of Neo-banks’ founders being outsiders.

- #Chinese SME Neo-banks are unique in their ownership (owned by the #TechFins) with a unique business model which is intertwined with their parents’ business model. This helps them embed banking in the core-product offerings and enables them to acquire millions of customers super-efficiently.

- #Europe being the breeding ground for Neo-Banks, maintains a lead in terms of Number of Neo-banks with #Banking-as-a-Service, #OpenBanking and #MarketPlace Banking as key operating models.

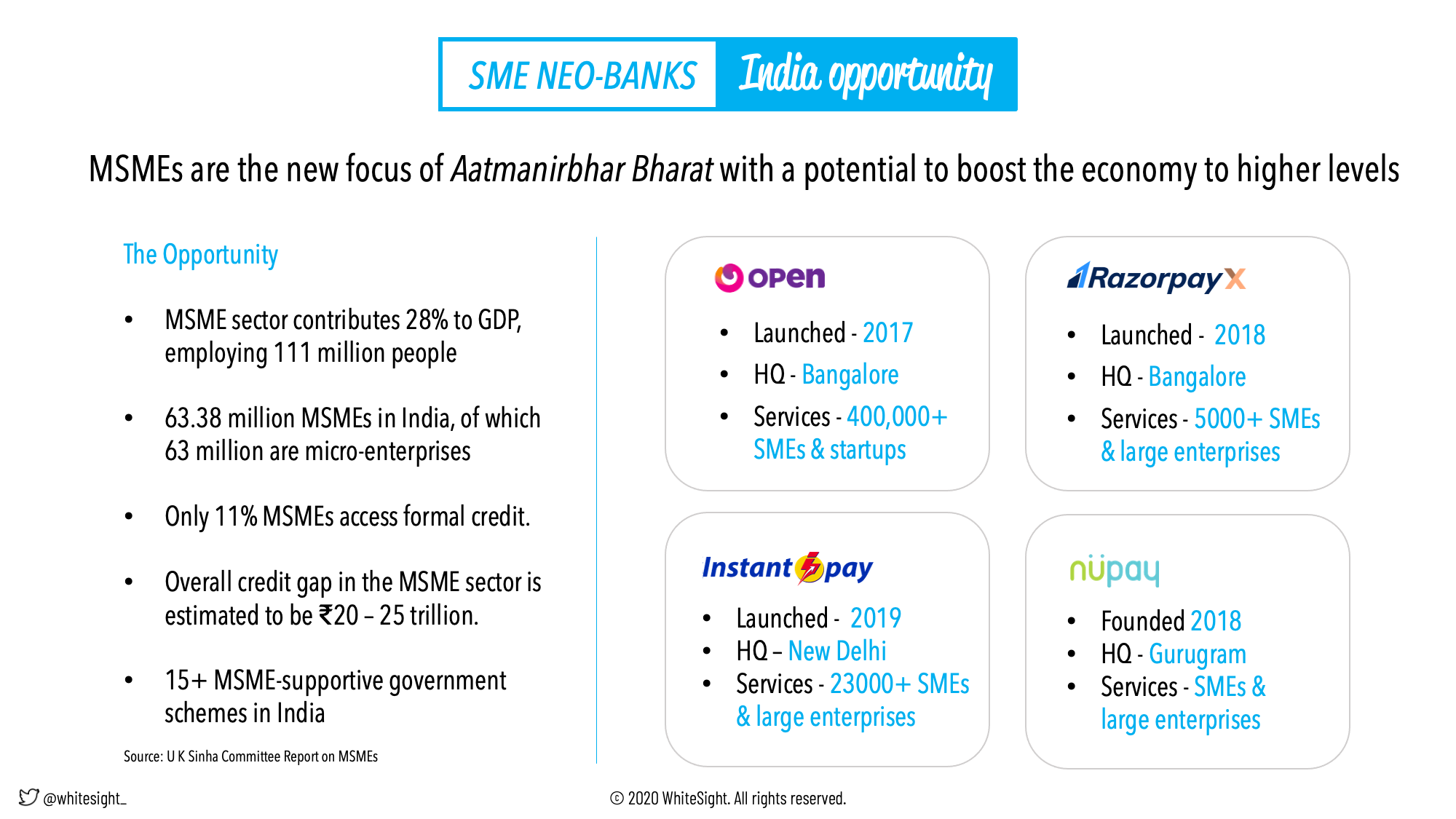

- In #India, the sustained creation of digital public infrastructure (#OCEN being the latest one), along with the govt. focus to revive the MSME sector and players who are digitalising the SME value-chains, presents a unique opportunity for SME Neo Banks.

Already a subscriber? Log in to Access

Radar Subscription Plan

Radar Subscription PlanYour perfect fintech research companion – select a package that aligns with your aspiration

Not Ready to Subscribe?

Begin your fintech adventure free of charge-set forth with our complimentary offering.

Related Reports

Toast is revolutionising the restaurant sector by integrating financial services seamlessly into its restaurant management and Point of…

Dive into how Open Banking is shaking things up in the MENA region’s financial scene. It’s all about sparking collaboration…

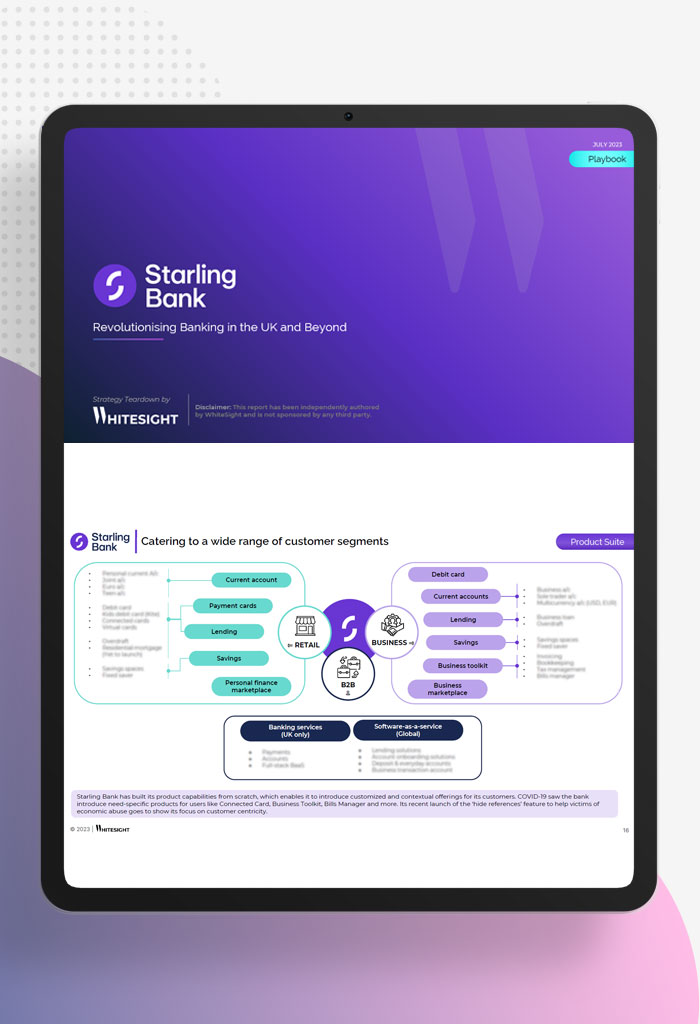

Explore the journey of Starling Bank, a digital disruptor in the UK banking industry. With over 3.6 million…

Stripe is leading the fintech revolution, empowering a diverse range of businesses globally. Discover the tactics fueling Stripe’s…

Explore Revolut’s extraordinary growth, its journey towards obtaining a banking licence in the UK, the challenges encountered, and…

WhiteSight delves into the dynamic world of digital finance, bringing you an update from January to April 2023. We examine…

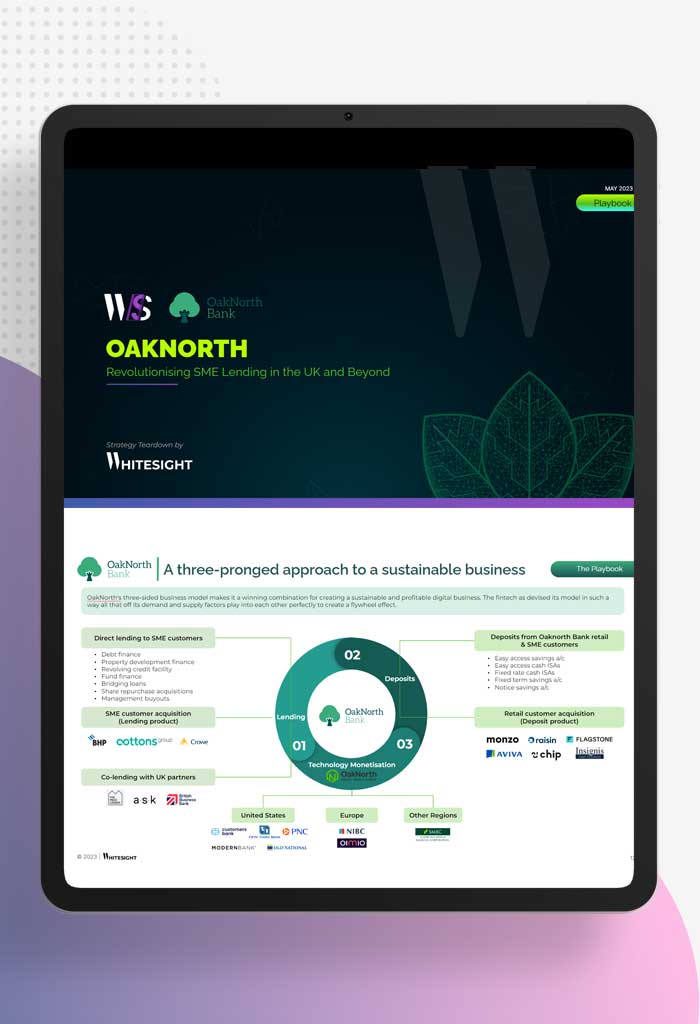

Explore OakNorth’s blueprint for building a tech-first bank that caters to the SME powerhouses of the UK. The…

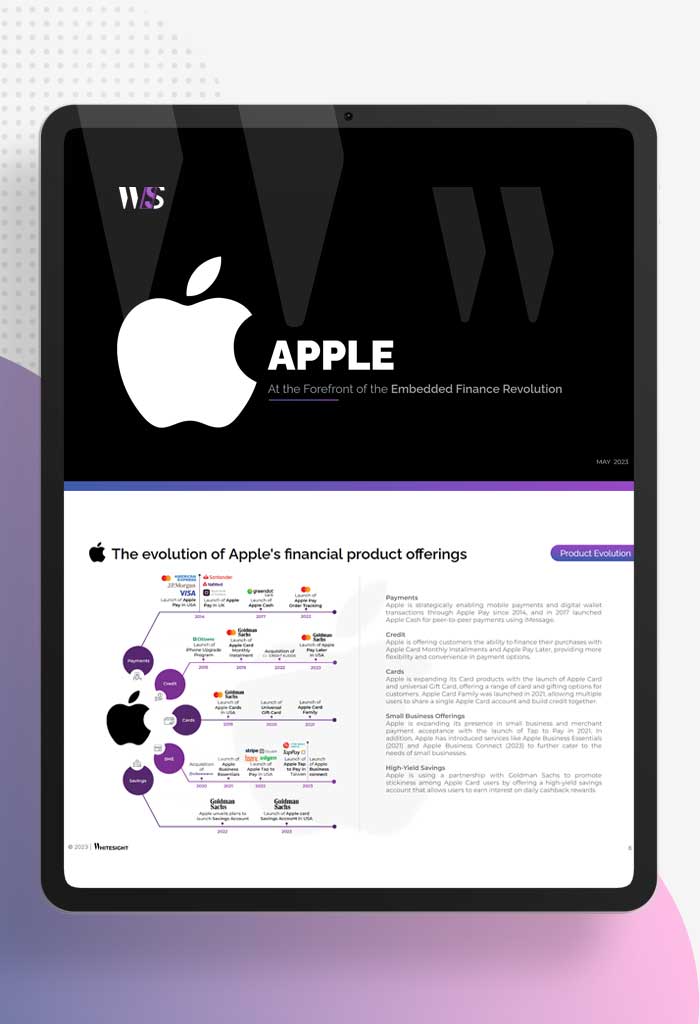

Since the inception of Apple Pay in 2014, Apple has been at the forefront of bigtechs exploring the…

WhiteSight joins forces with Toqio to delve into the heart of the Banking-as-a-Service (BaaS) market in the UK and Europe,…

Embedded finance is experiencing an unprecedented surge in availability across multiple consumer touchpoints, enabling businesses to offer enhanced customer experiences…

With the world rapidly evolving and adopting new trends along the way, customers demand innovative products like never before, while…

The financial industry started the new year with the groundbreaking approach of open finance – an innovative paradigm that has…