The Future Of Financial Services Will Run On Open Rails

- Sanjeev Kumar and Kshitija Kaur

- 6 mins read

- Insights, Open Finance

Table of Contents

2021 was a year of great progress for Open Banking across the EU and UK. The regions witnessed strong growth both in the volume of API calls and the number of third-party providers (TPPs). The sector also got a shot in the arm with the FCA’s removal of the 90-day re-authentication rule and the Competition & Markets Authority (CMA) mandate for Variable Recurring Payments (VRPs).2022 is proving to be the year Open Banking grows in its scope – geographical and functional. As we looked in our Open Banking report earlier this year, 100+ countries have either introduced or are considering Open Banking regulations. This year, we see significant movement in the US, Australia, India, Brazil, Bahrain, Saudi Arabia, the Philippines, and Nigeria. On the functional side, Open Banking seems to have grown much beyond the banking industry, with Open Finance and Open Data Economies coming into the mix. Open Banking has created an innovation engine for next-generation financial and lifestyle experiences. It is also acting as one of the tailwinds to propel embedded finance experiences that allow non-banks to embed financial products with their core offerings.In this post, we open the door to the many activities unfolding under the umbrella […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

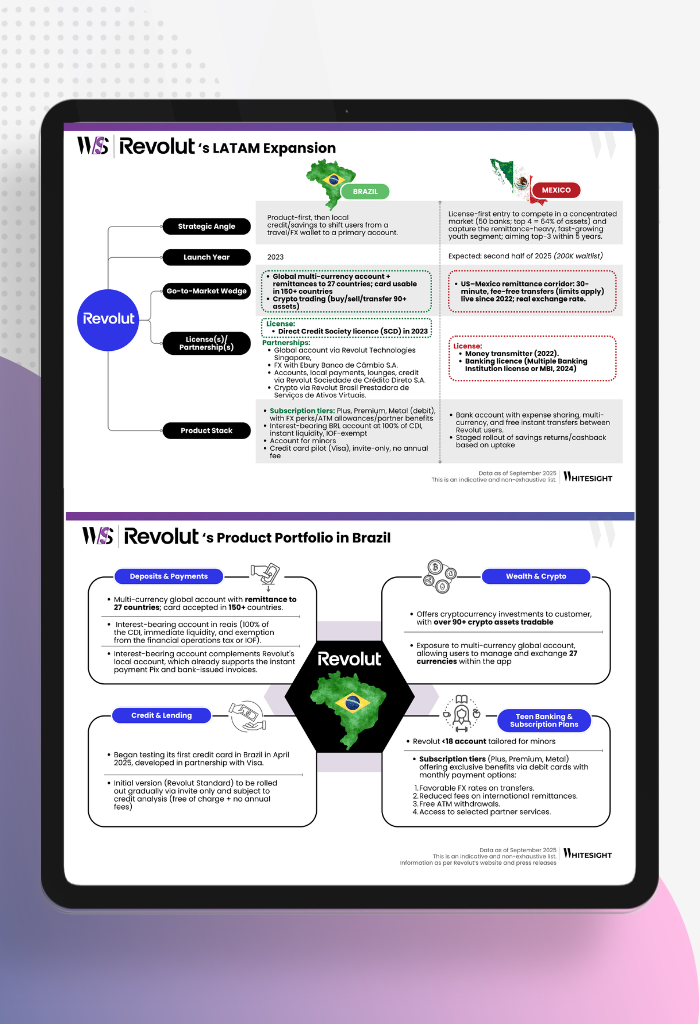

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...

- Sanjeev Kumar and Risav Chakraborty

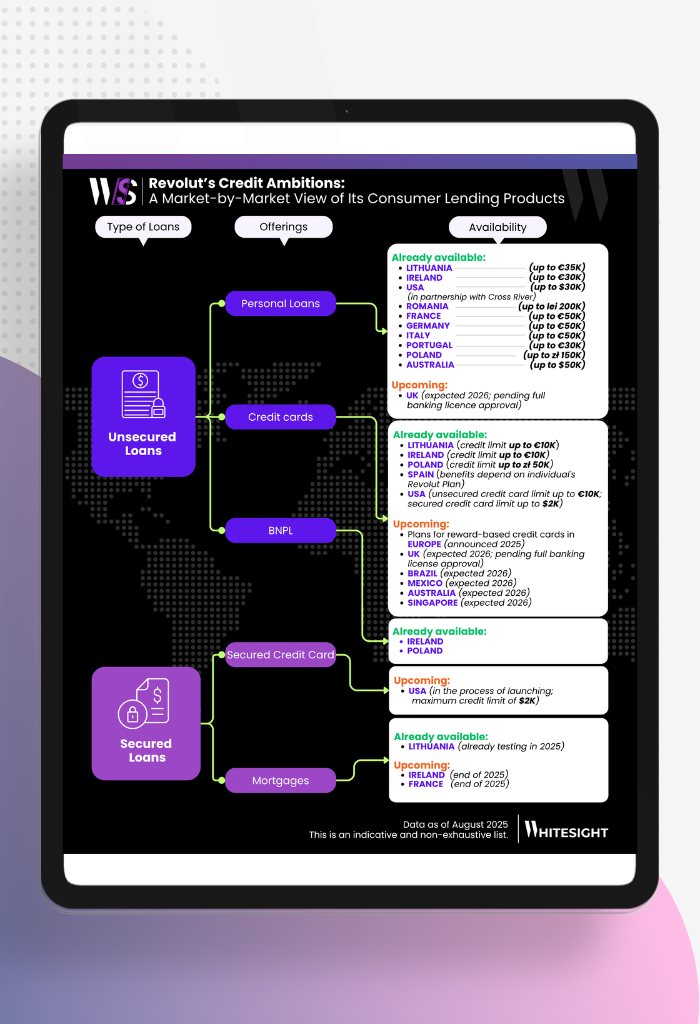

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...

- Kshitija Kaur and Sanjeev Kumar

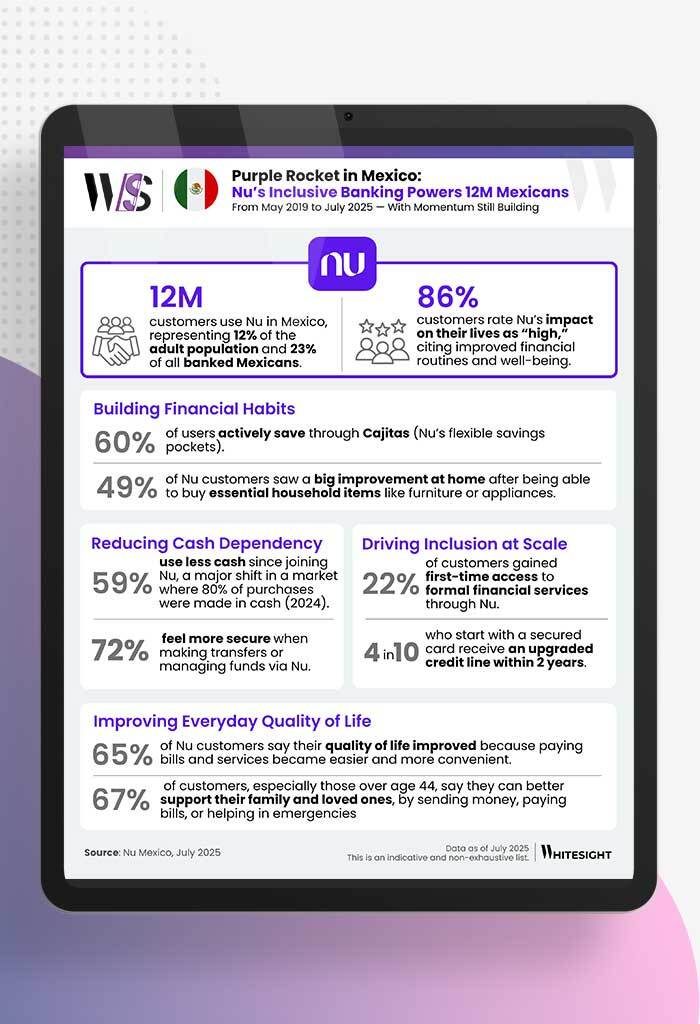

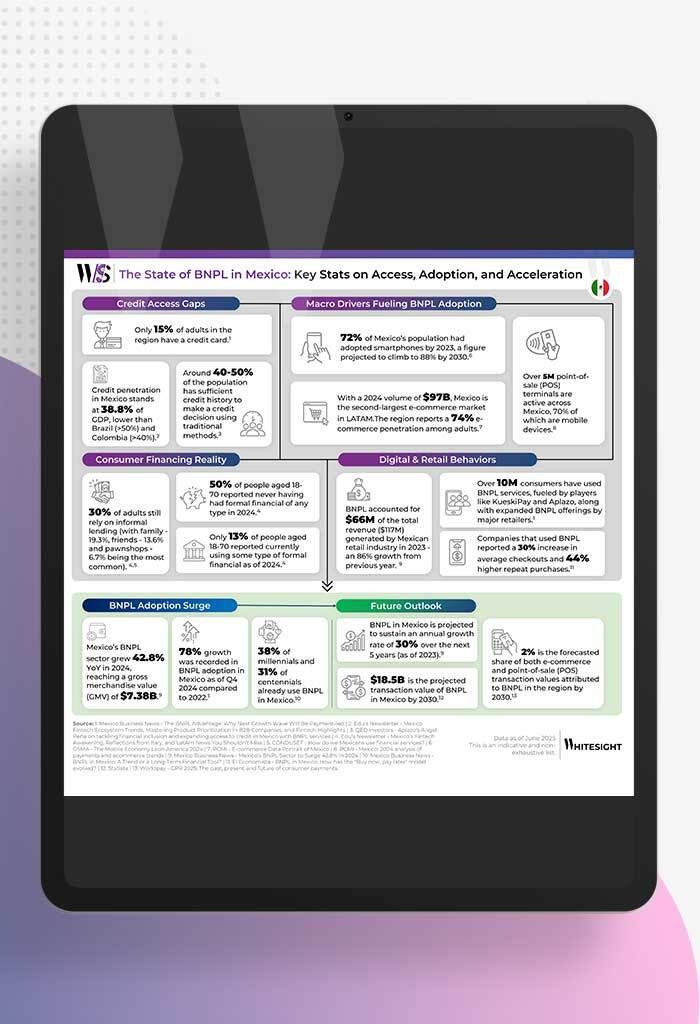

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar