Table of Contents

Disclaimer: The content of this webpage is not investment advice and does not constitute any offer or solicitation to recommend any investment product. It is for general education and information purposes only.Kudos to Apple for acquiring Credit Kudos in the UK!Apple has reportedly shelled out $150M for Credit Kudos, an open banking technology firm. Let’s go down the rabbit hole of the resultant phenomenon that has emerged at the intersection of BigTech and Open Banking.Apple says hello to the Open Banking world. But wait, there’s more to Credit Kudos than just Open Banking.What Does Credit Kudos Bring To The Table?In addition to holding an AISP (Account Information Service Provider) license, they are also an FCA-regulated credit reference agency. And that gives them access to both open banking data and the credit data from banks that other traditional credit bureaus have access to. Being an AISP, Credit Kudos is also authorized to access an individual’s or SME’s bank account data from their financial institutions with their explicit consent. Credit Kudos is also registered with the Information Commissioner’s Office as a Data Controller and is compliant with the UK’s Data Protection Act and the EU’s General Data Protection Regulation. In addition to […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

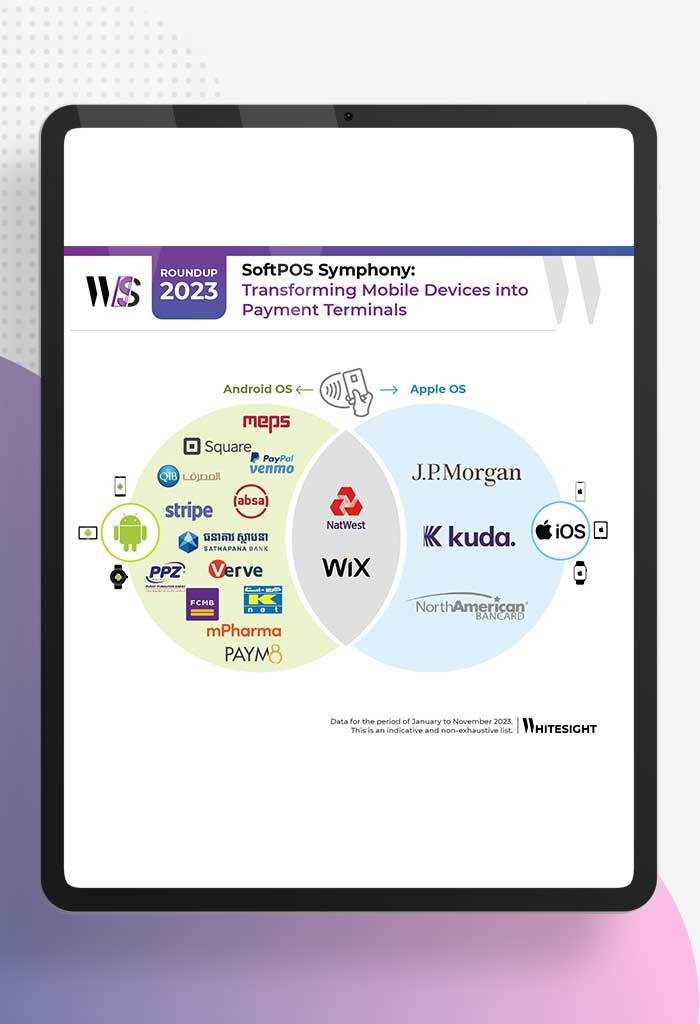

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

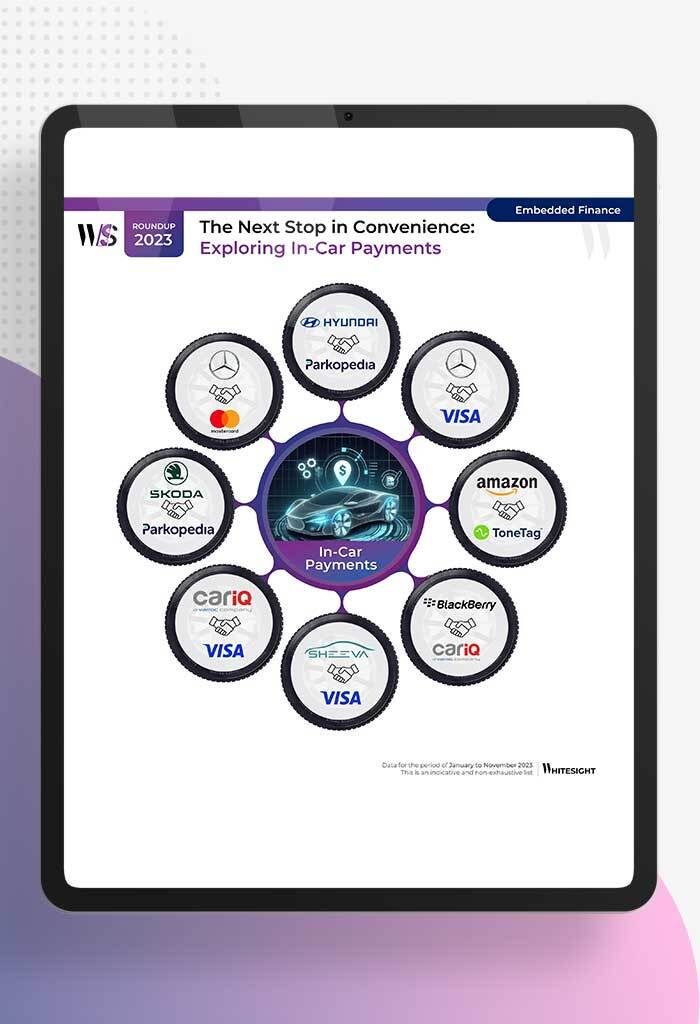

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

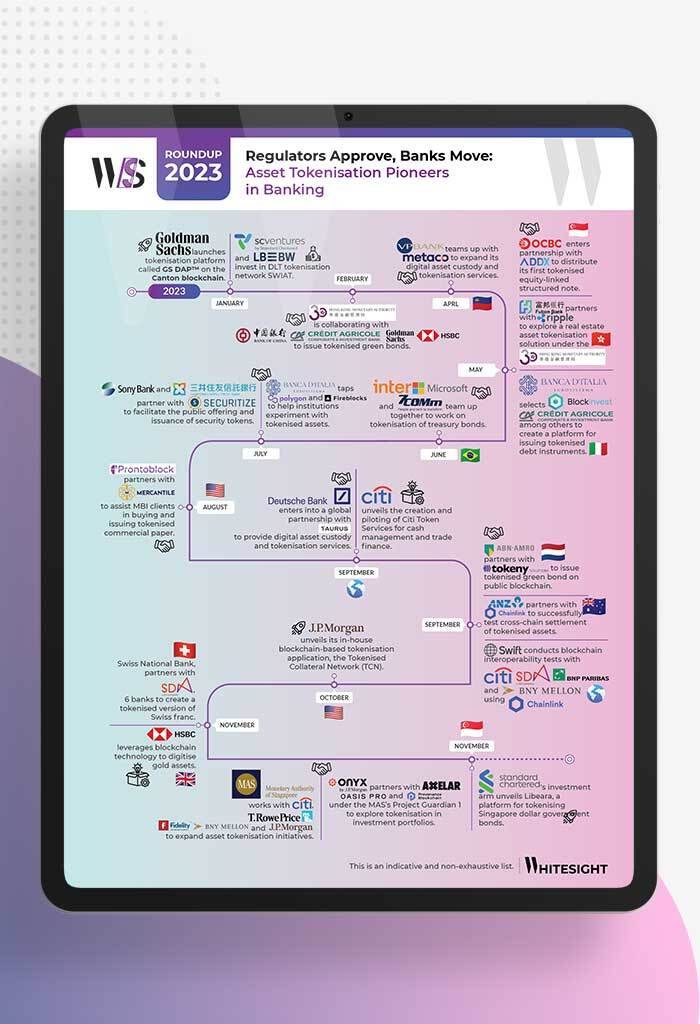

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

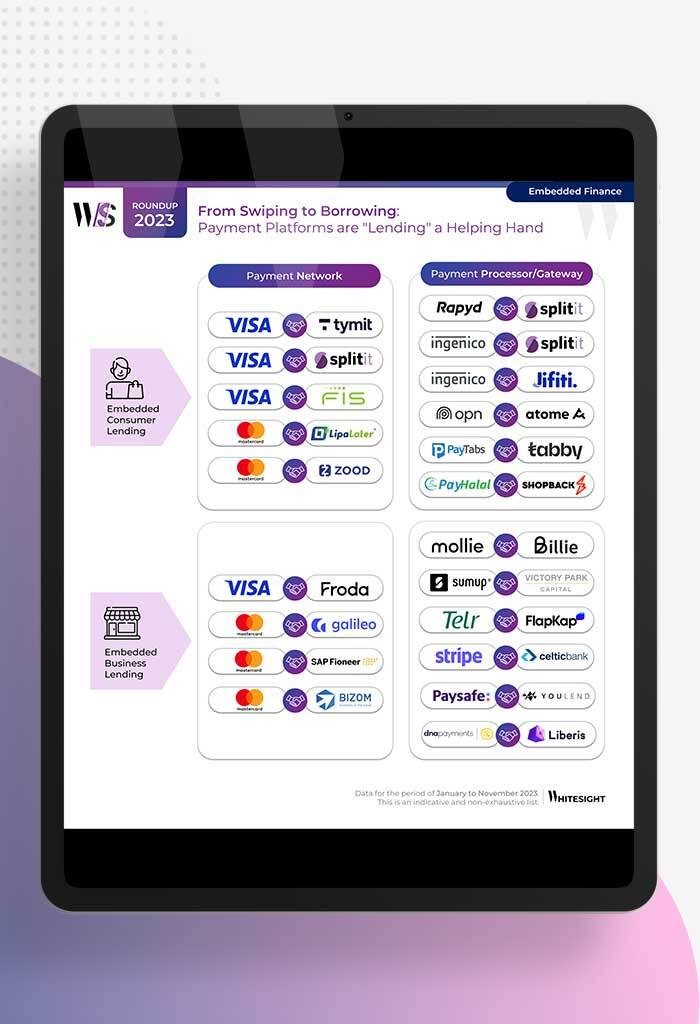

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

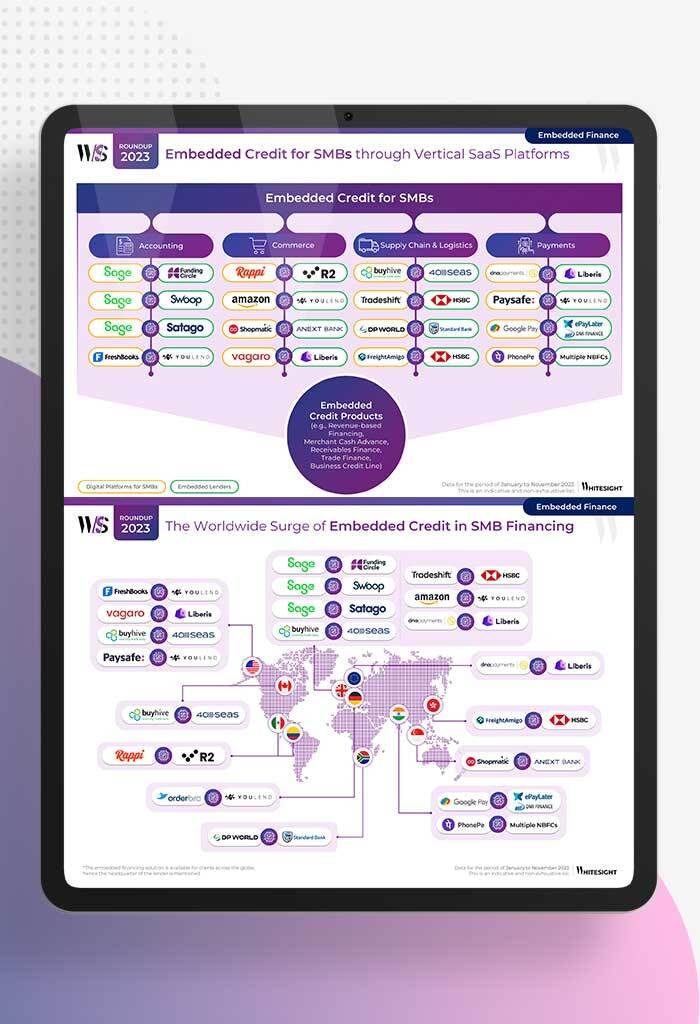

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...