Asset Tokenisation: The Next Frontier for Partnerships in Banking

- Sanjeev Kumar and Animesh Kaushik

- 3 mins read

- Digital Assets, Insights

Table of Contents

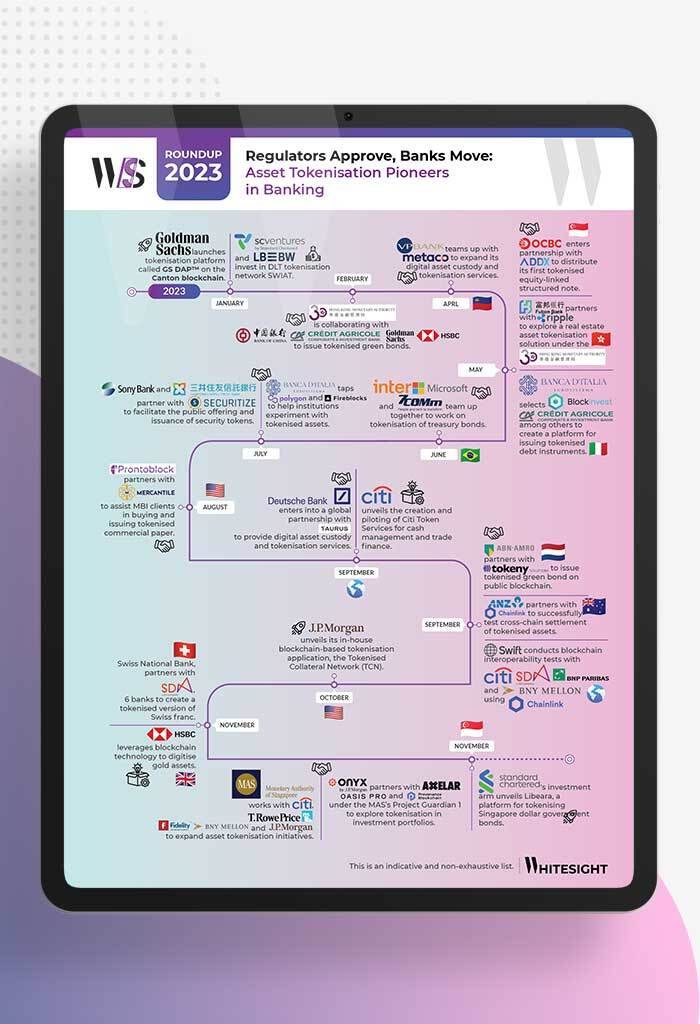

The blockchain and crypto industries have been weathering the difficult ‘crypto winter’, with decreased activity and market value presenting barriers for companies when it comes to continuing operations. While the use of blockchain and distributed ledger technologies (DLT) is still in its early stages, the industry has been exploring various use cases and tapping into investment opportunities.One trend that is attracting industry attention is the tokenisation of assets, enabling the creation of digital tokens on a blockchain that represents ownership of real-world assets. By unlocking the potential for fractional ownership of tangible and intangible assets, asset tokenisation is allowing investors to access a diversified range of asset choices for their portfolios.According to a BCG report, the total size of illiquid asset tokenisation alone would be $16T globally by 2030. Considering the huge market potential, many banks and financial institutions are dipping their toes in the asset tokenisation domain in different ways, with engagement in strategic partnerships becoming ever so crucial for adopting promising tokenisation solutions. In this blog, we take a look at how the banking ecosystem is leveraging collaborative tokenisation capabilities to trigger more transparency, cost advantages, and enhanced liquidity.To foray into this ambitious market, many banks have partnered […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...

- Risav Chakraborty and Kshitija Kaur

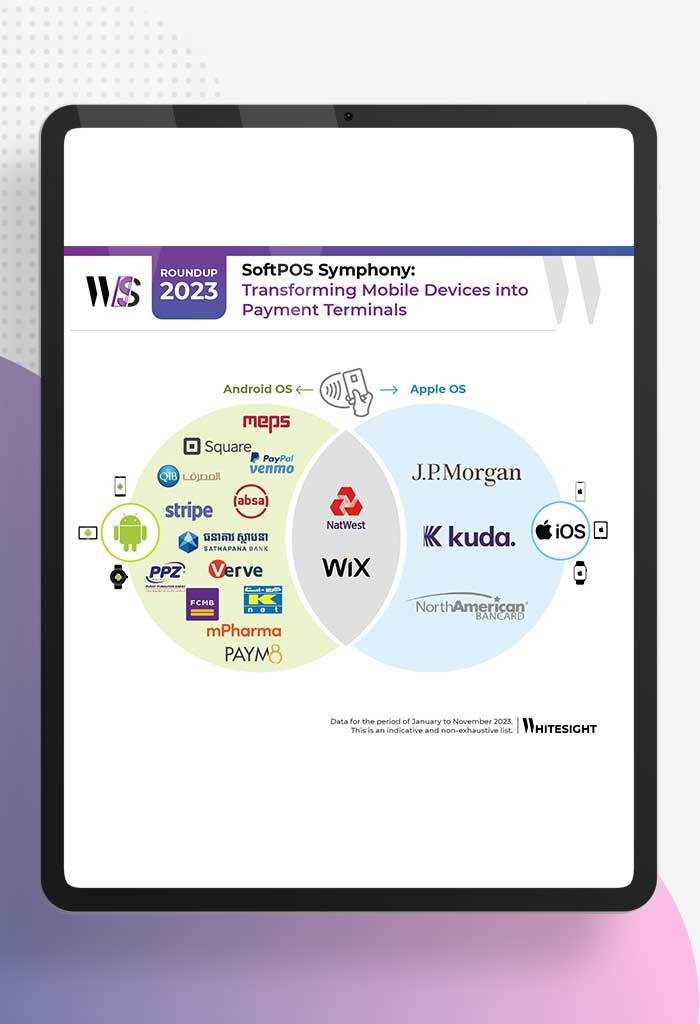

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

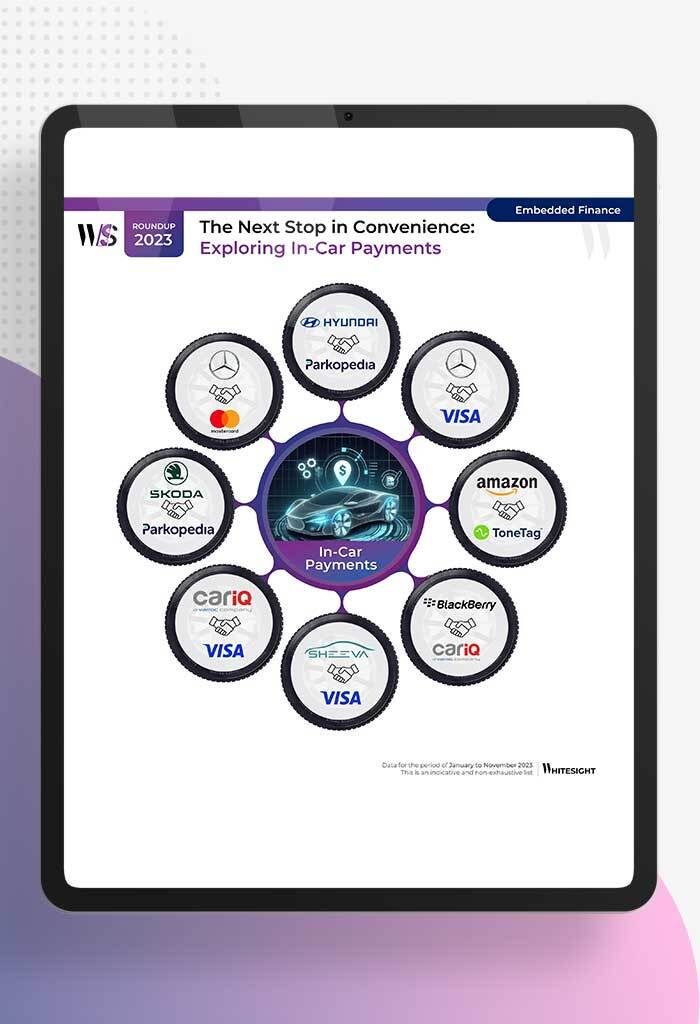

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

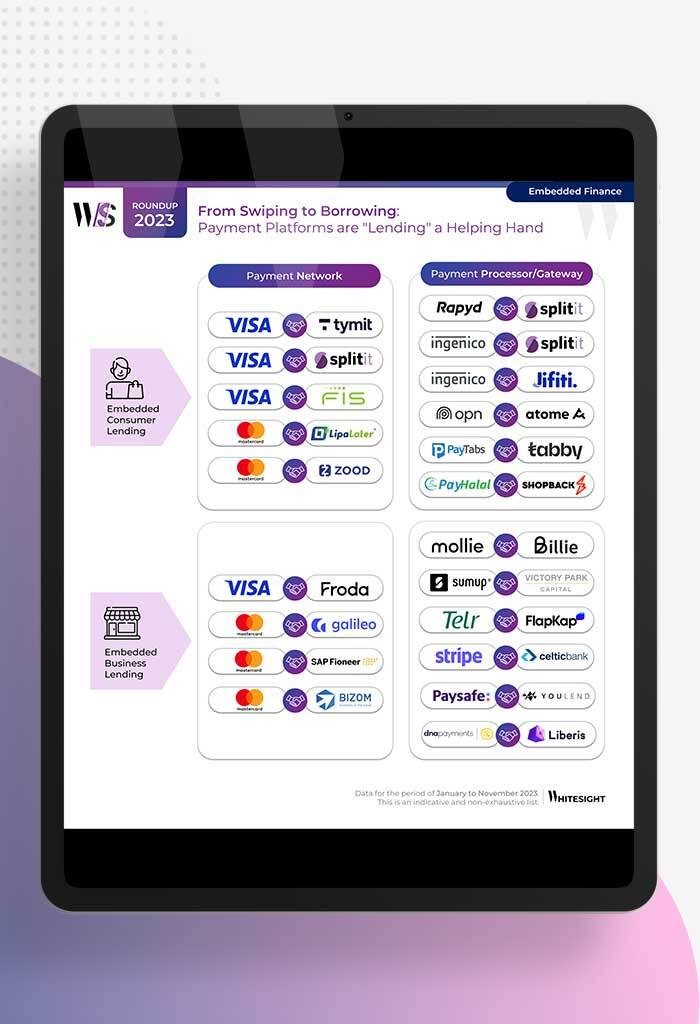

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

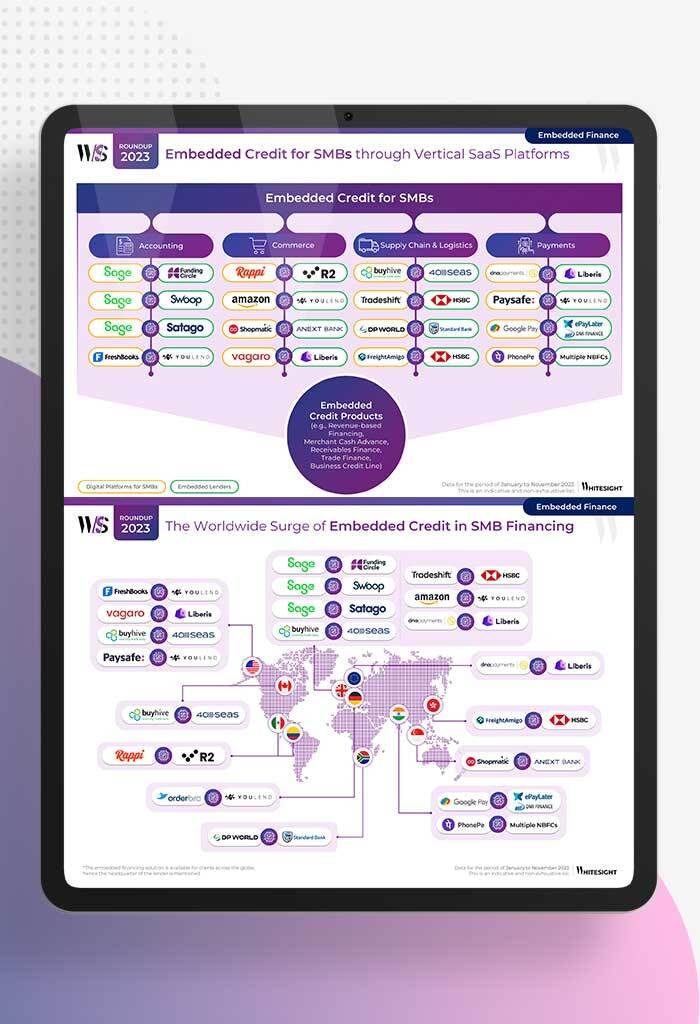

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...