Bump Up the BaaS: Banking-as-a-Service Roundup 2022

- Kshitija Kaur and Risav Chakraborty

- 6 mins read

- Embedded Finance, Insights

Table of Contents

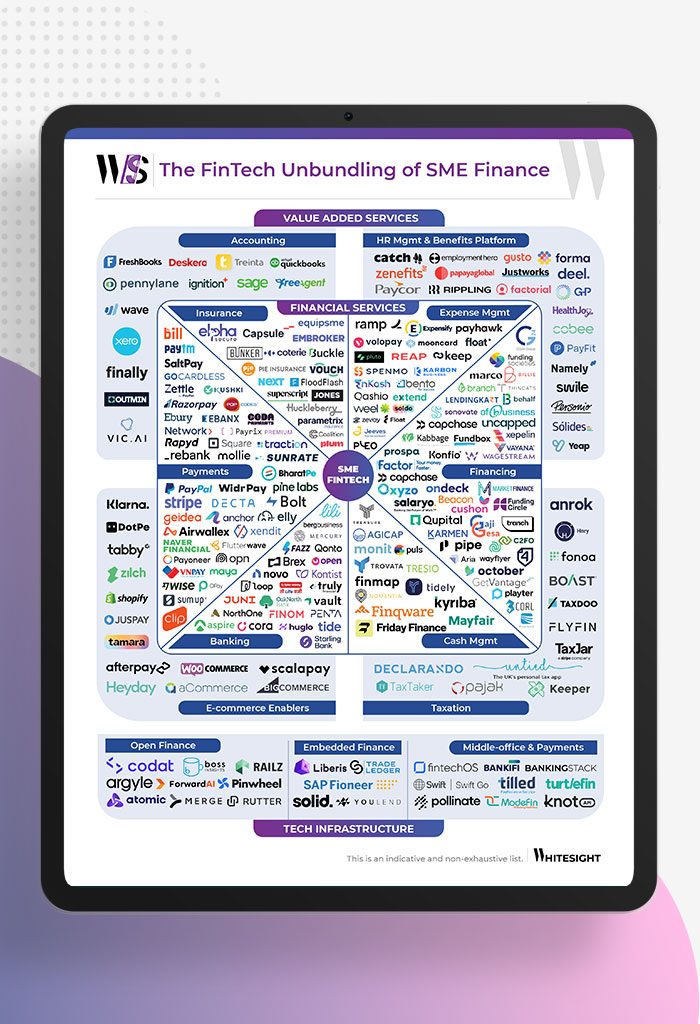

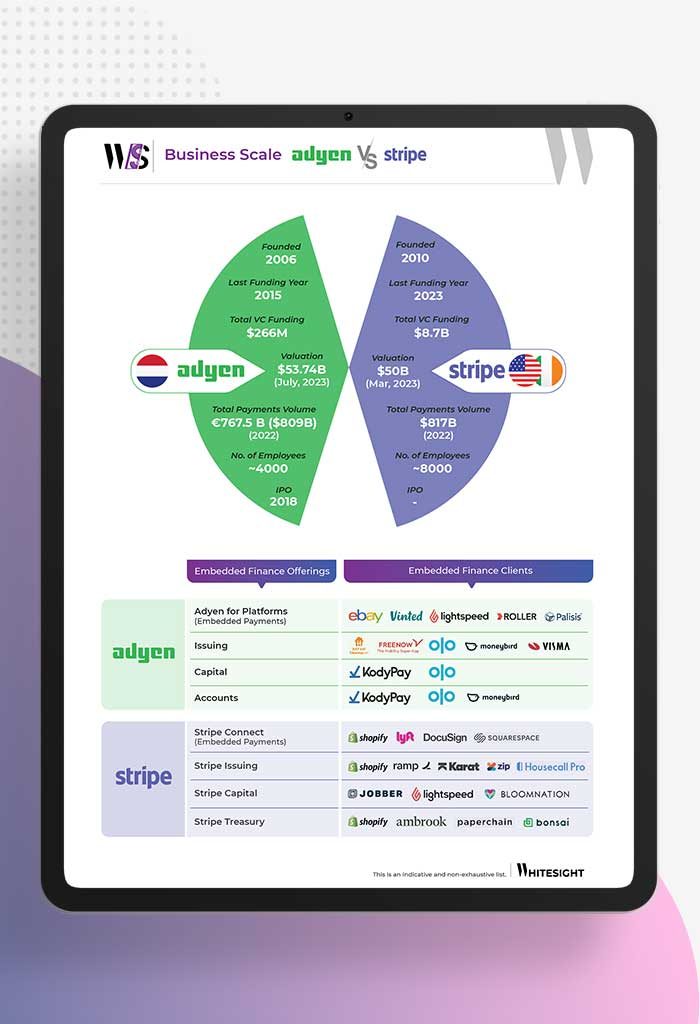

The banking universe has been all about the BaaS – with platforms of all genres needling their way to providing tailored offerings. Integrating financial services directly into regulated financial infrastructures has become the new norm thanks to the adoption of embedded finance, as it caters to the appeal of ease of use by businesses and consumers.From payments to lending and even bank accounts and cards, Banking-as-a-Service (BaaS) is neatly unfolding novel revenue models for industry players, where diverse value chain configurations between licensed financial institutions, BaaS Tech enablers, and front-end FinTechs and non-banks underplay to create contextualised customer experiences. A wide variety of financial services are delivered to consumers via APIs and modern digital tech stacks, making it easier than ever for any ecosystem participant to offer banking and financial propositions to customers and, in the process, deliver superior financial inclusion and wellness experiences to customers and unlock new revenue streams for themselves.Having previously implored on the many themes of embedded finance – such as BNPL’s Transition Phase, Neobanks’ Tryst with BNPL, Super App Strategies, and even deep diving into the Banking-as-a-Service wave in the US – in this post, we are extending our magnifying glass to do a quick […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Samridhi Singh and Kshitija Kaur

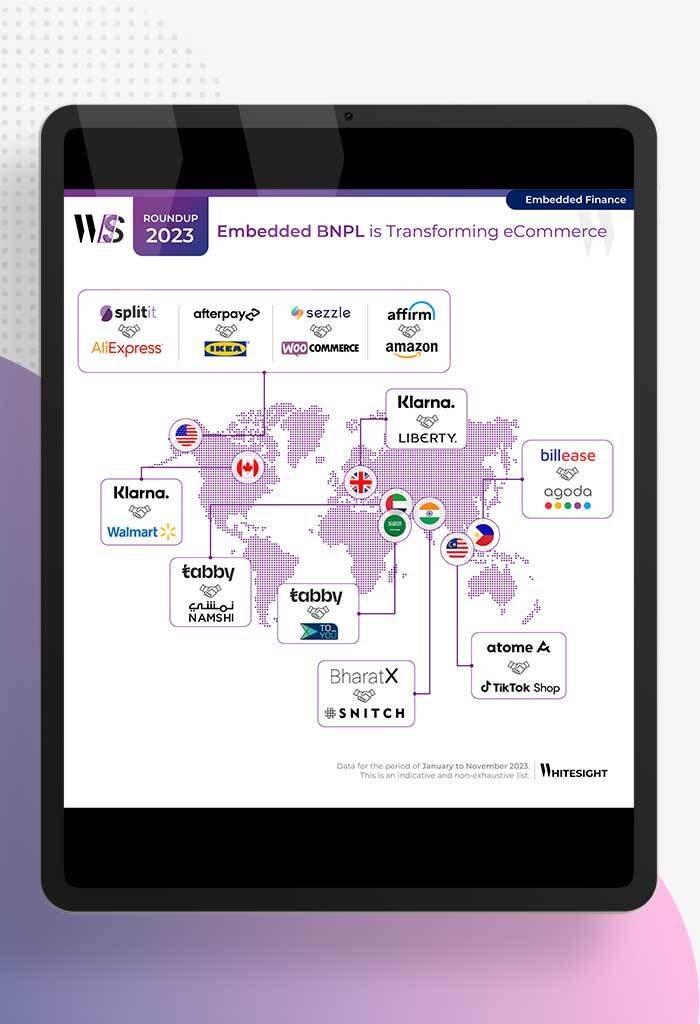

Swipe, Splurge, Savor: E-comm’s New Norm! What’s more fun than a Sunday shopping spree, right? Picture this: you on your...

- Risav Chakraborty and Kshitija Kaur

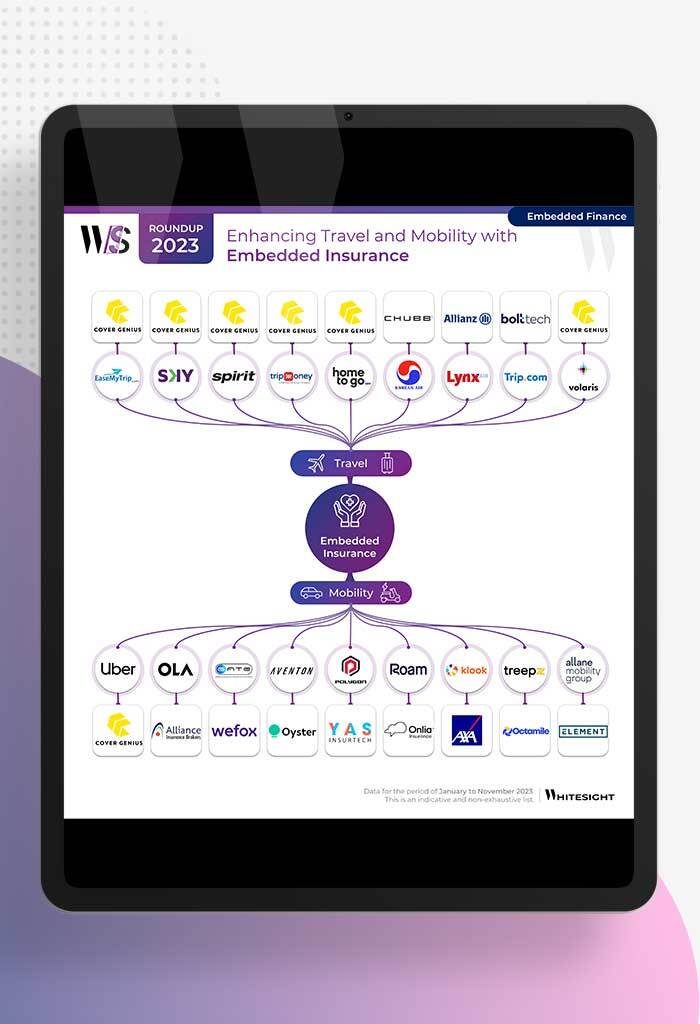

Drive Safe, Fly Secure: Embedded Insurance Escapade The travel and mobility sectors are roaring back to life now that the...

- Kshitija Kaur and Risav Chakraborty

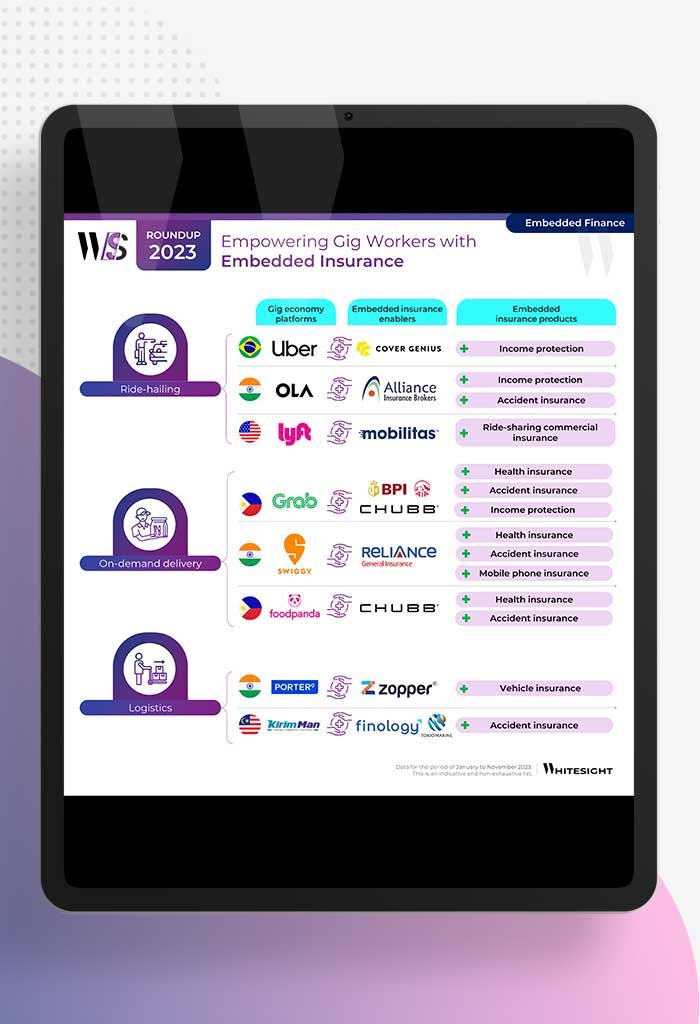

Insurtechs: The New Guardians of the Gigaxy? Life in the gig lane is a rollercoaster, isn’t it? You’ve got the...

- Afshan Dadan and Sanjeev Kumar

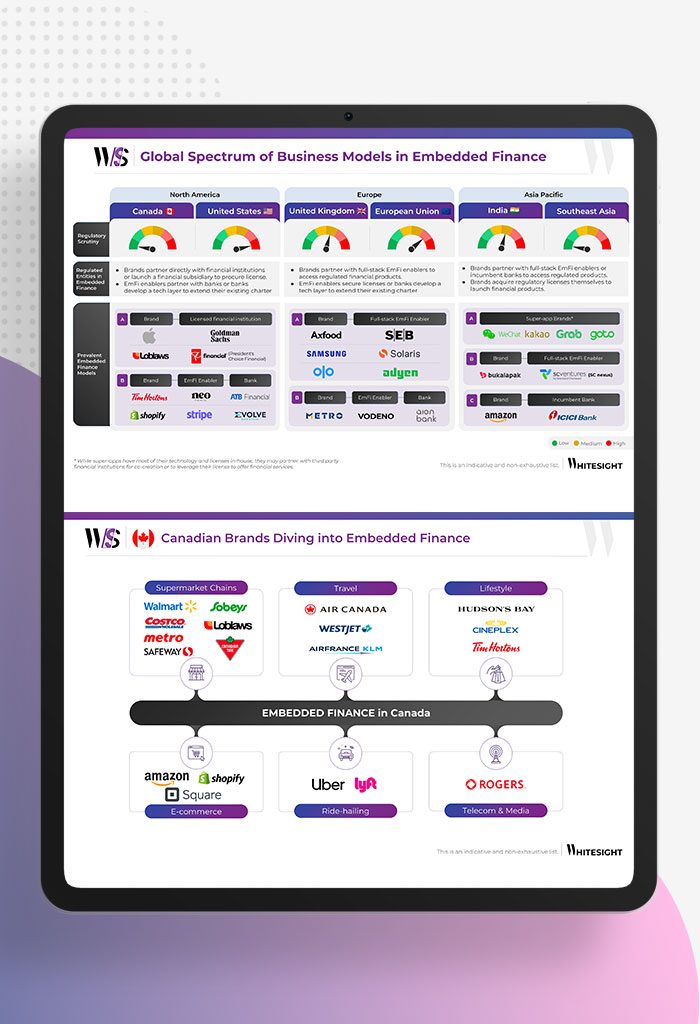

We’re going to go ahead and say it – 2023 is the year for embedded finance. This not-so-sneaky little trend...

- Sanjeev Kumar and Afshan Dadan

In the ever-evolving world of finance, fintech has emerged as a game-changer, particularly for small and medium enterprises (SMEs). As...

- Kshitija Kaur and Sanjeev Kumar

Payment processors had an incredible run during the pandemic, riding the wave of increased adoption of digital payments among merchants...