Bump Up the BaaS: Banking-as-a-Service Roundup 2022

- Kshitija Kaur and Risav Chakraborty

- 6 mins read

- Embedded Finance, Insights

Table of Contents

The banking universe has been all about the BaaS – with platforms of all genres needling their way to providing tailored offerings. Integrating financial services directly into regulated financial infrastructures has become the new norm thanks to the adoption of embedded finance, as it caters to the appeal of ease of use by businesses and consumers.From payments to lending and even bank accounts and cards, Banking-as-a-Service (BaaS) is neatly unfolding novel revenue models for industry players, where diverse value chain configurations between licensed financial institutions, BaaS Tech enablers, and front-end FinTechs and non-banks underplay to create contextualised customer experiences. A wide variety of financial services are delivered to consumers via APIs and modern digital tech stacks, making it easier than ever for any ecosystem participant to offer banking and financial propositions to customers and, in the process, deliver superior financial inclusion and wellness experiences to customers and unlock new revenue streams for themselves.Having previously implored on the many themes of embedded finance – such as BNPL’s Transition Phase, Neobanks’ Tryst with BNPL, Super App Strategies, and even deep diving into the Banking-as-a-Service wave in the US – in this post, we are extending our magnifying glass to do a quick […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

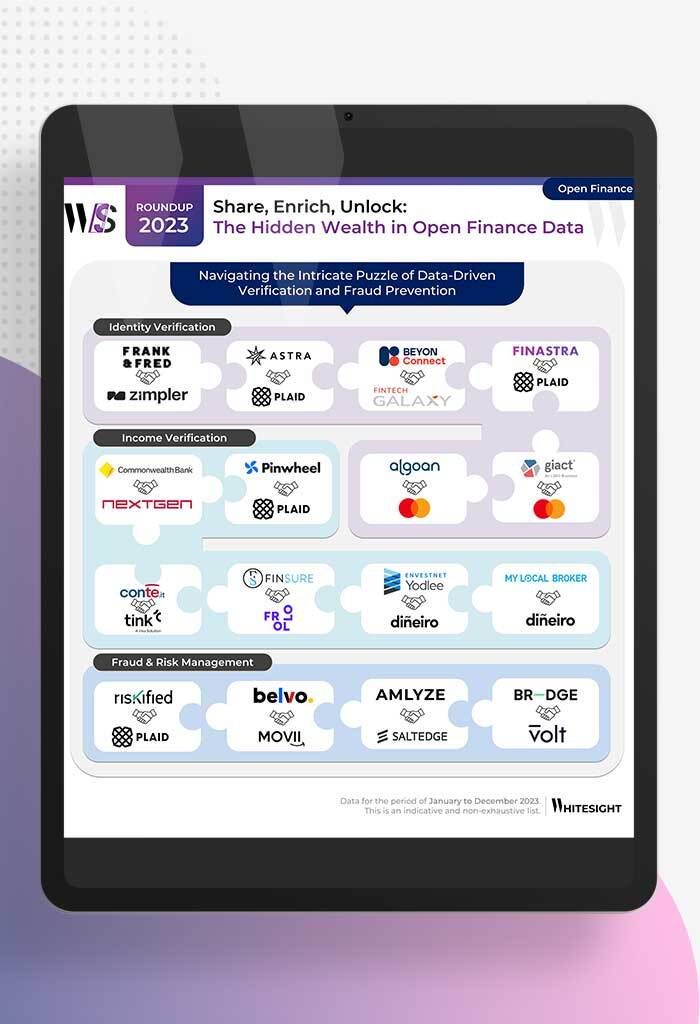

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

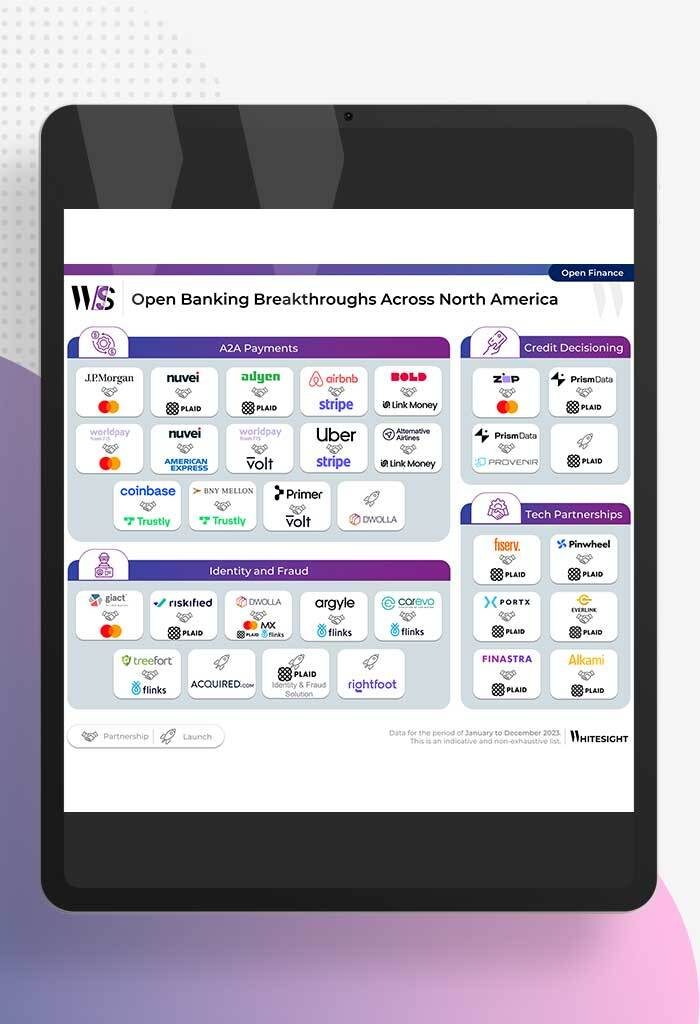

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

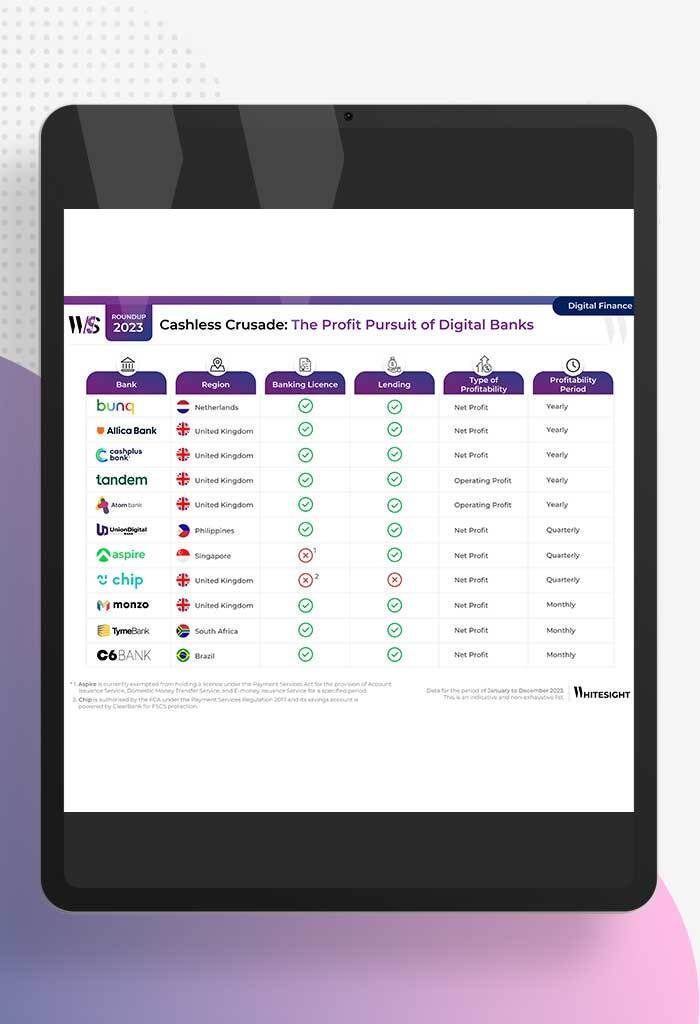

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

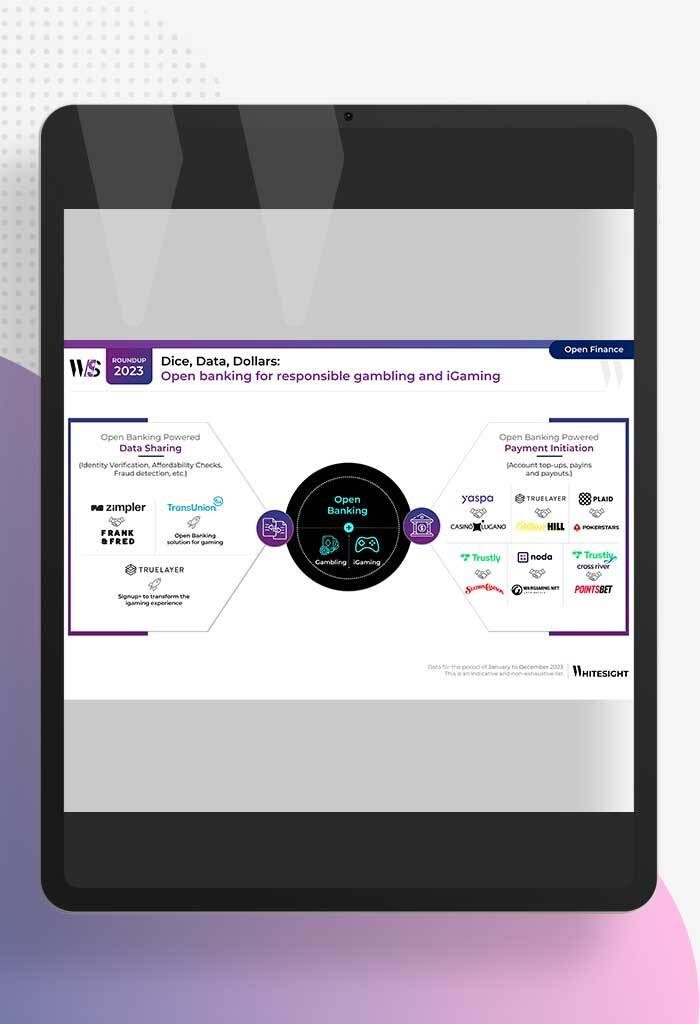

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

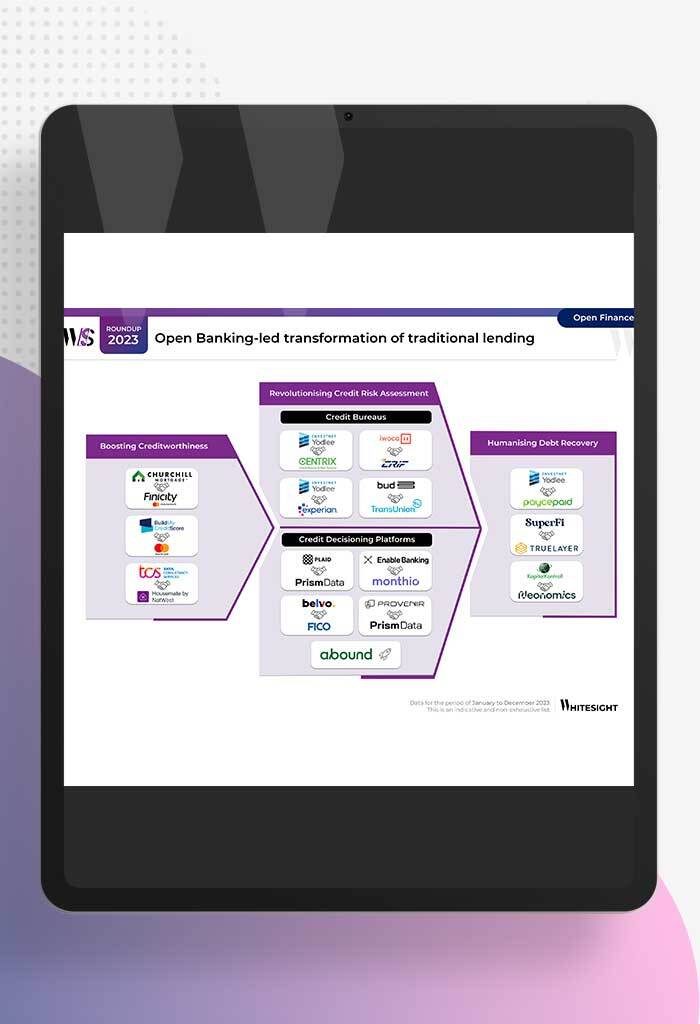

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

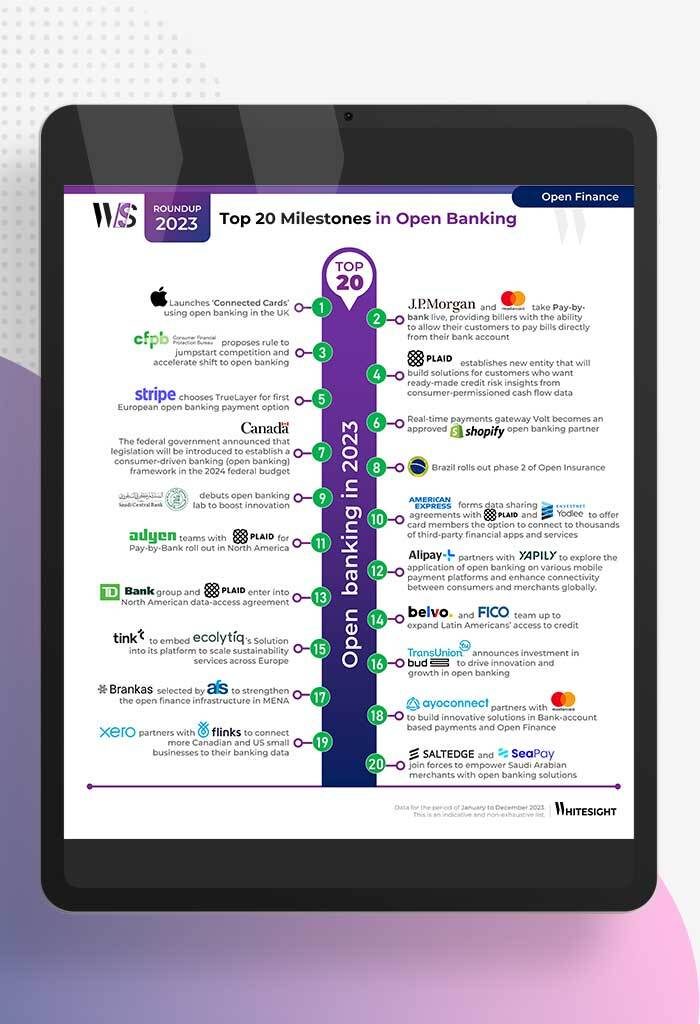

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...