Cracking the profitability code of successful digital banks

- Sanjeev Kumar and Samridhi Singh

- 8 mins read

- Digital Finance, Insights

Table of Contents

The rise of digital banks has been one of the most significant trends in the financial services industry in recent years. While many digital banks have gained a significant following among digital-savvy consumers, the truth is that profitability remains elusive for most of them. In fact, only a handful of digital banks have been able to register profitability.In today’s environment, profitability is paramount for the continued survival of digital banks. High inflation and interest rates affect the cost of capital and credit, making it challenging for digital banks to operate with low margins. Secondly, venture capital funding for digital banks has decreased, making it challenging for them to sustain growth without generating consistent profits. Finally, regulatory scrutiny on the profitability of digital banks is increasing, with authorities requiring them to demonstrate a sustainable business model.This blog will explore the various factors that contribute to the profitability of digital banks, such as lending, technology monetisation, SME banking, customer base monetisation, and marketplaces, and how they can help digital banks achieve their growth goals.Disclaimer:The scope of this study is limited to digital banks that operate and report their financials as standalone entities, even when they are owned by financial or non-financial organisations. […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

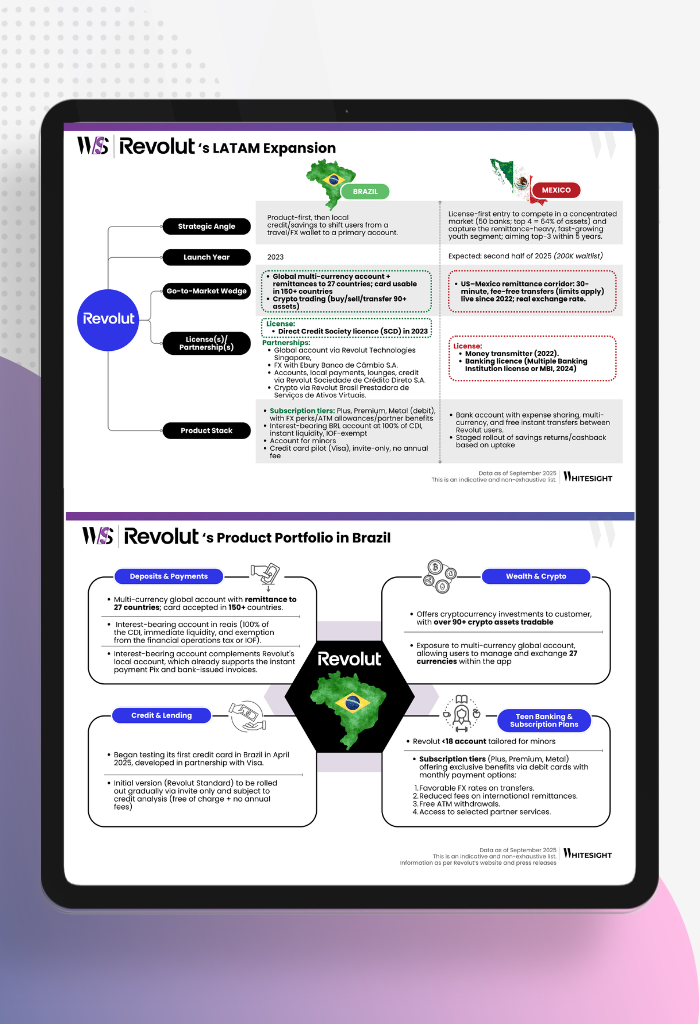

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...

- Sanjeev Kumar and Risav Chakraborty

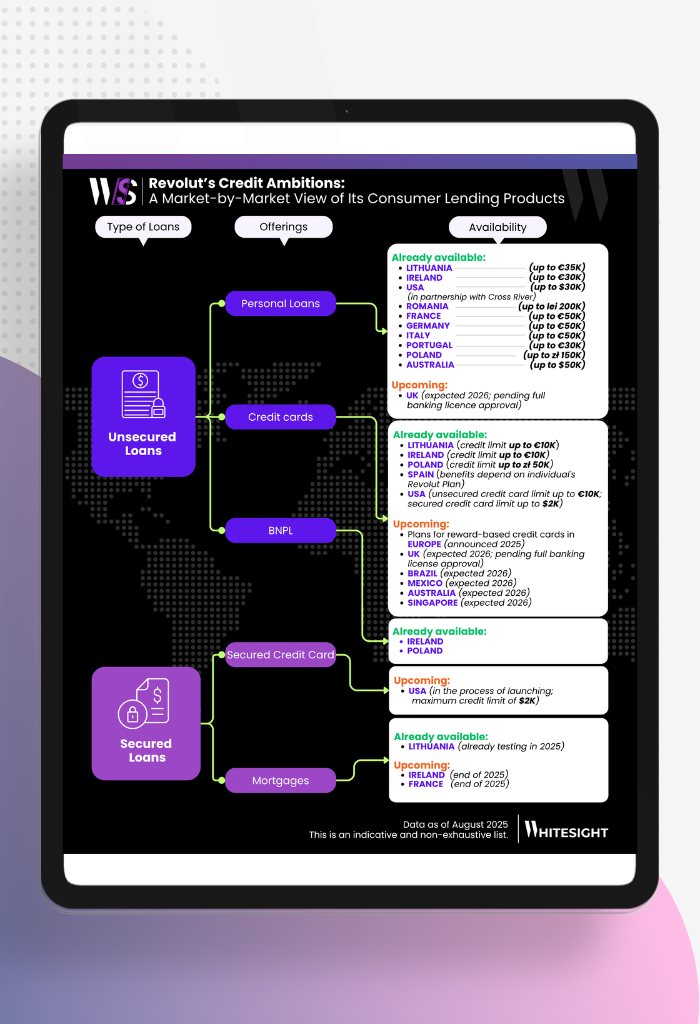

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...

- Kshitija Kaur and Sanjeev Kumar

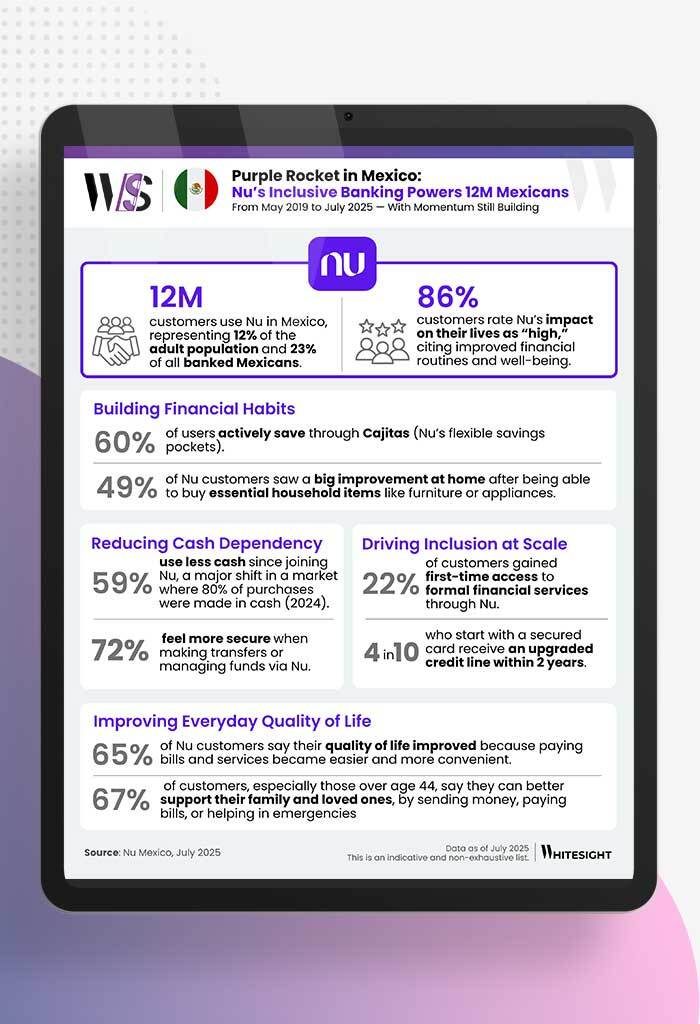

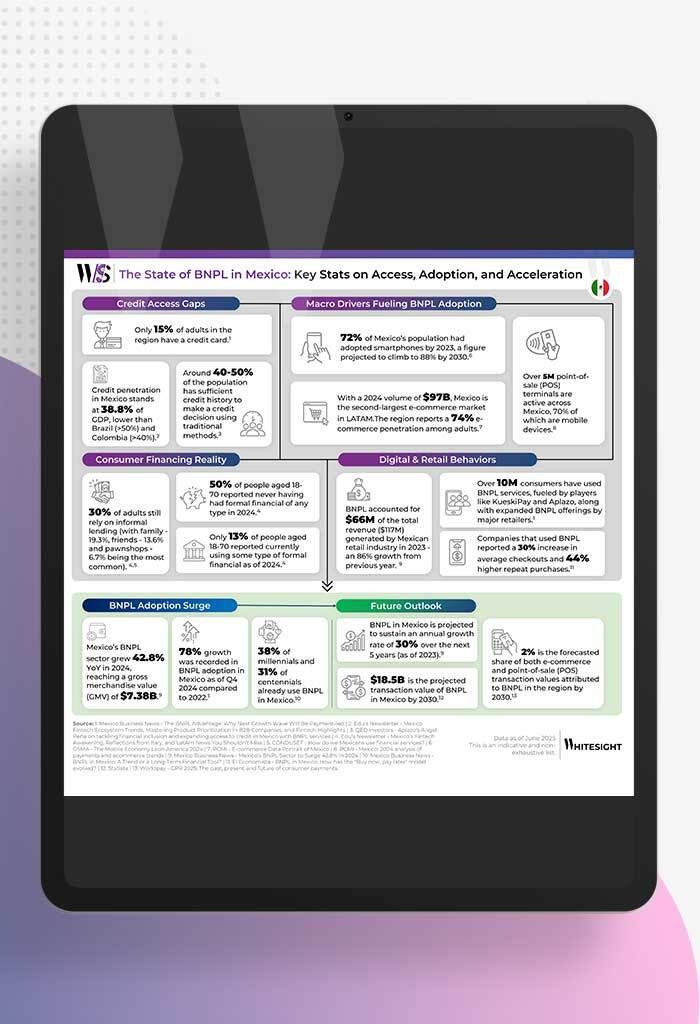

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar