Earth Day 2021: Green is the New Black in FinTech

- Team WhiteSight

- 5 mins read

- Insights, Sustainable Finance

Table of Contents

In 1970, Senator Gaylord Nelson in the United States created Earth Day as a way to force this issue onto the national agenda. This year, on April 22, 2021, Earth Day marks the 51st anniversary of the modern environmental movement.Given the current pandemic situation, Earth day celebrations may be subdued, but the COVID-19 crisis should rather implore the innovators and entrepreneurs around the globe, about the real threats and challenges before our planet and its residents.Early this year Sir David Attenborough, an English broadcaster and natural historian, ,made an impassioned plea to the members of the security council reminding them of their prime responsibility of holding the key to preventing a global catastrophe. Along with national leaders, innovators and entrepreneurs from the startup ecosystem also have a significant responsibility to ensure sustainable development and eco-friendly growth.This article aims to highlight some of these climate-conscious initiatives that fintech startups are focusing on to deliver immediate and impactful results and drive transformative change for people and the planet.FinTech Segments Driving the Green Agenda In recent times various banks such as JP Morgan Chase, Citi, Bank of America, Morgan Stanley etc. have unveiled their trillion-dollar commitments towards the planet with a sustainable finance […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

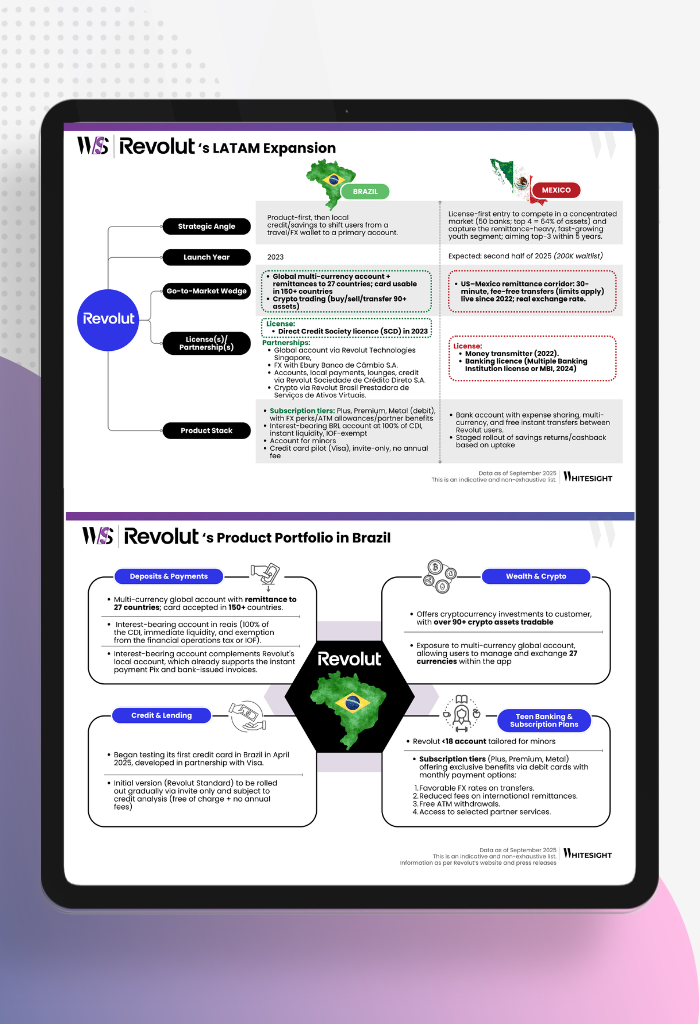

LATAM’s Digital Banking Boom Becomes the Next Battleground for Revolut For decades, Latin America’s financial landscape was a study in...

- Sanjeev Kumar and Risav Chakraborty

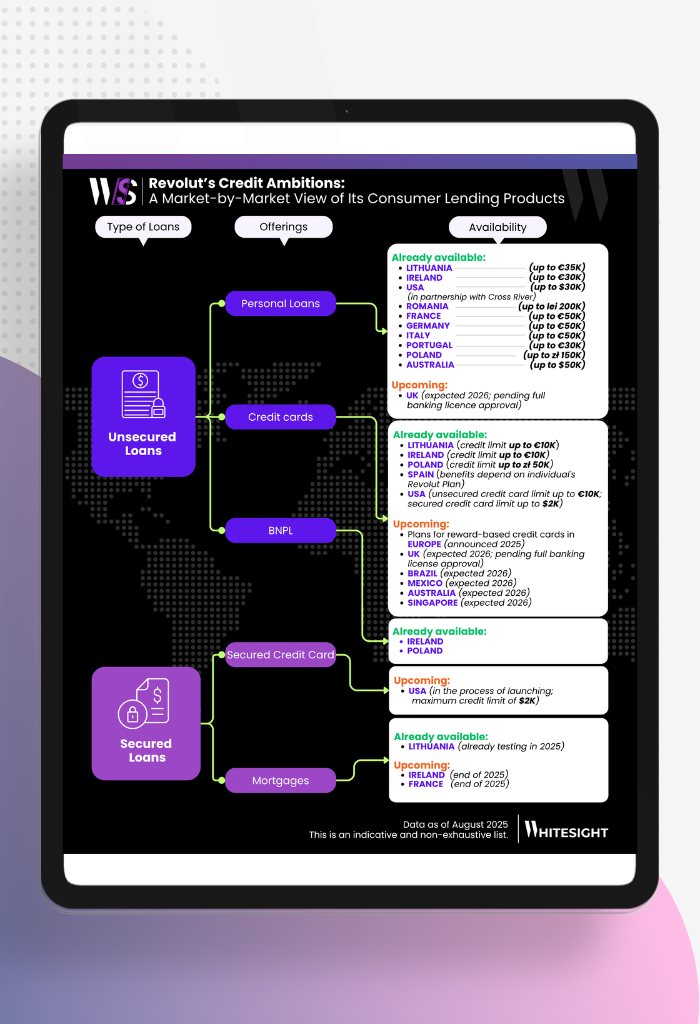

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...

- Kshitija Kaur and Sanjeev Kumar

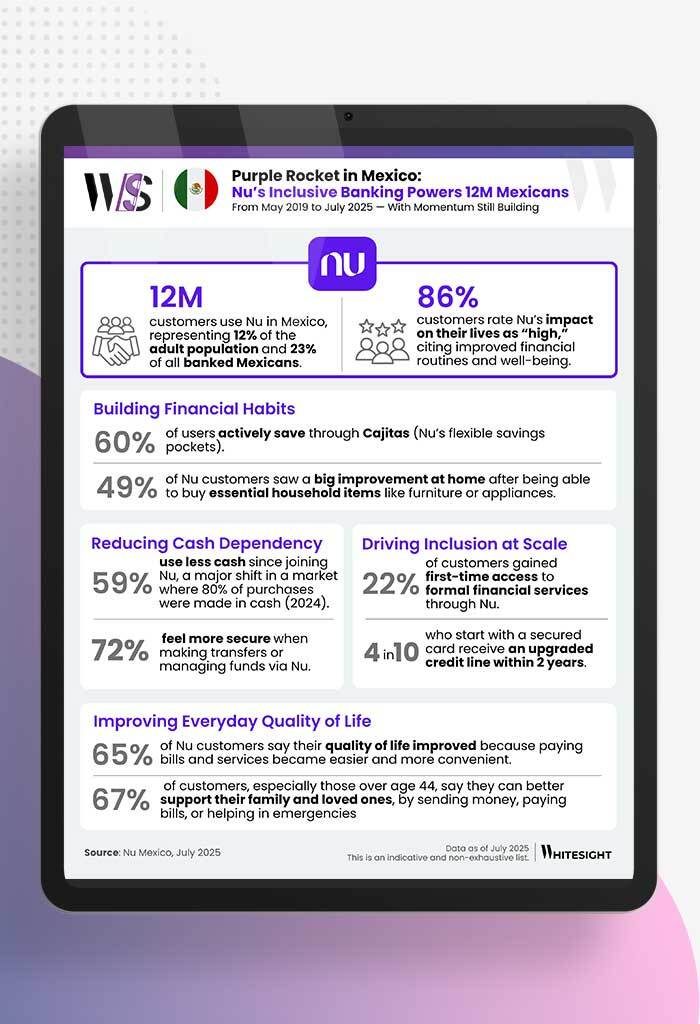

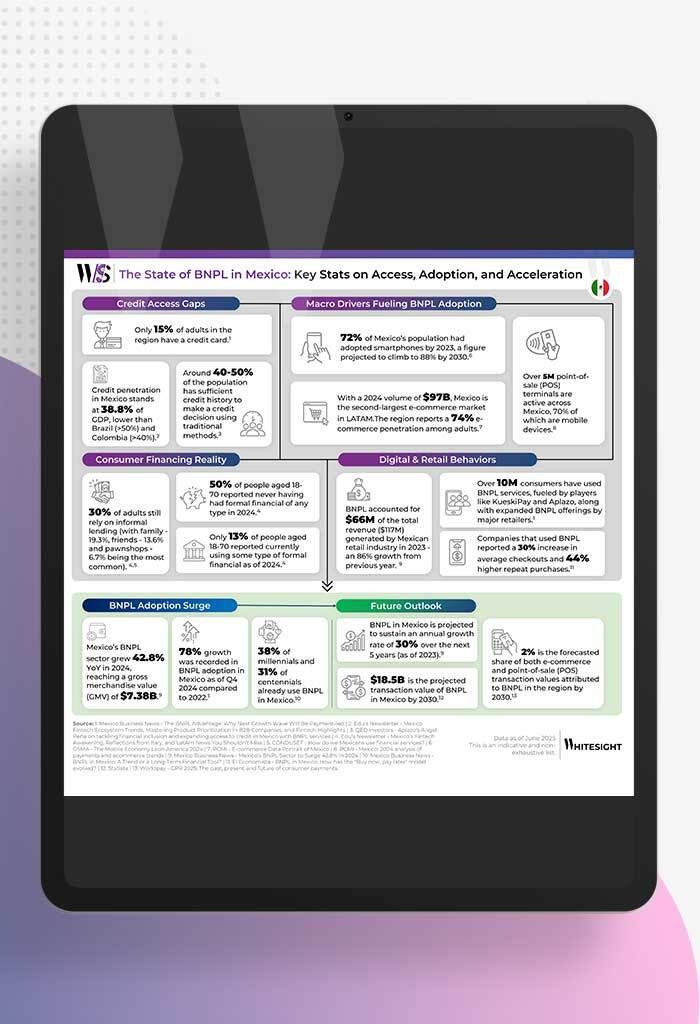

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar