Beyond Barriers: Embedded Lending Helps SMEs Thrive

- Ananya Shetty and Kshitija Kaur

- 5 mins read

- Embedded Finance, Insights

Table of Contents

Cash Flow Lifeline: Embedded Finance for SMEs Imagine a burgeoning entrepreneur, their independent bookstore teeming with life. The latest bestsellers are disappearing faster than they can be restocked, yet a crucial cash injection is needed to secure the next shipment. Traditional banks, however, resemble a labyrinth – an endless maze of paperwork, demoralising delays, and the ever-present shadow of rejection. Here’s the startling truth: a staggering 40% of Small and Medium-sized Enterprises (SMEs) globally grapple with unmet financial needs, despite being the very lifeblood of our economic ecosystem representing 90% of all businesses and 50% of GDP worldwide.Access to capital and efficient cash flow management are critical for SMEs’ growth and sustainability. Embedded lending solutions are transforming how businesses access capital, manage cash flow, and fuel growth, offering a lifeline to businesses by seamlessly integrating lending capabilities within existing platforms. Interestingly, SMEs are increasingly receptive to these offerings, with 47% in high-income countries willing to pay a premium for embedded finance compared to traditional banks.In this blog post, we will delve into the critical role of embedded finance in addressing the capital and cash flow management challenges faced by SMBs. We will explore various industry-specific use cases, demonstrating how embedded […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Sanjeev Kumar

- Risav Chakraborty, Kshitija Kaur, Samridhi Singh and Chinmayee Kadam

- Kshitija Kaur and Chinmayee Kadam

How the UAE is Unlocking the Potential of Crypto In recent years, the United Arab Emirates (UAE) has emerged as...

- Kshitija Kaur and Sanjeev Kumar

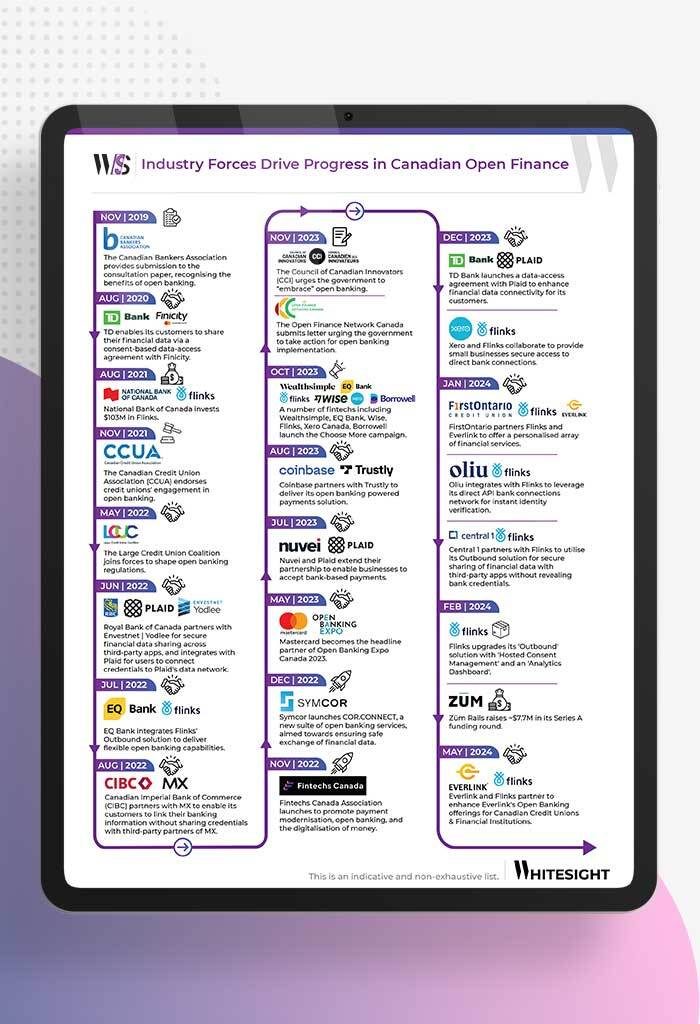

Canada Open Banking: Glacial Pace or Strategic Patience? Canada, a nation renowned for its politeness and measured approach, has finally...

- Sanjeev Kumar

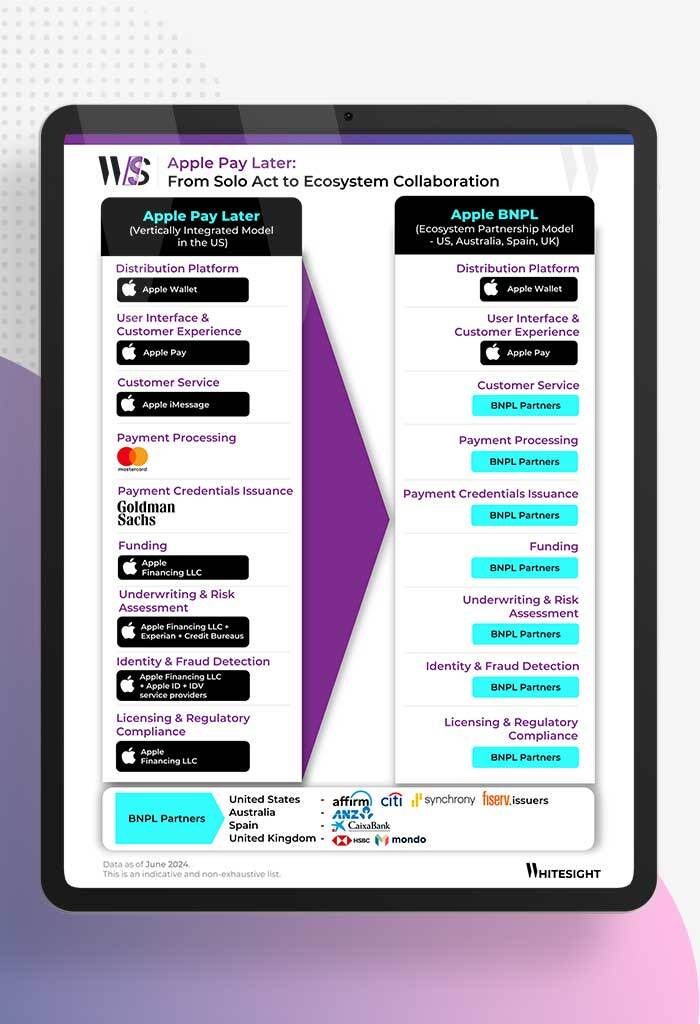

Apple’s Strategic Shift in BNPL This is a quick look at Apple’s strategic shift from building its own BNPL solution...

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...