Open Banking Beyond Open Pipes

- Kshitija Kaur and Sanjeev Kumar

- 3 mins read

- Insights, Open Finance

Table of Contents

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was often questionable. While it enabled basic needs for water usage, its lack of treatment limited its potential for advanced uses such as cooking and drinking. That’s precisely where Open Banking stood just a while back. It opened the floodgates of financial data, connecting institutions and innovators. This raw data can be related to untreated water. It was often murky, incomplete, and challenging to utilise by both banks and fintechs to orchestrate modern experiences for customers.But just as filtration and purification transformed water into a life-giving resource, open banking underwent (and is expected to gain further momentum this year as well) a significant metamorphosis in 2023 and embraced the power of data enrichment. Think of it as building a sophisticated water treatment plant for financial data. By leveraging diverse sources and advanced analytics, and maybe even a few sprinkles of Gen AI, open banking is transforming raw data into a crystal-clear, enriched stream, unlocking previously unimagined possibilities.This metamorphosis has paved the way for groundbreaking applications in identity verification, fraud detection, and risk management. This has unleashed unprecedented opportunities for innovation and […]

This post is only available to members.

Already a subscriber? Log in to Access

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...

- Sanjeev Kumar and Samridhi Singh

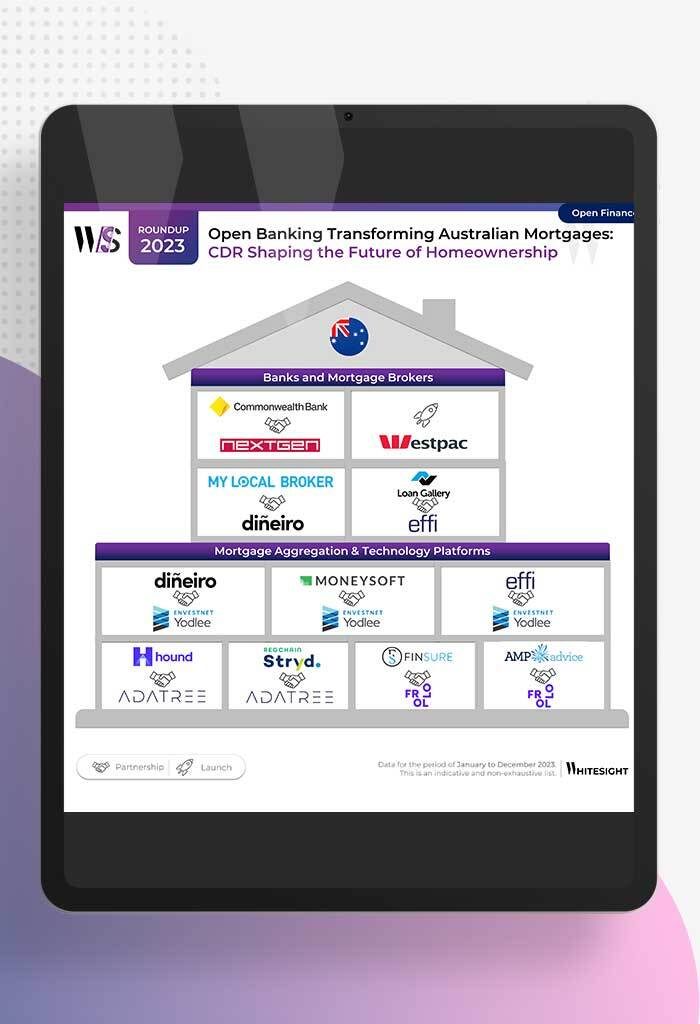

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...