2023 Roundup: From Vision to Victory in the Race of Profitability

- Samridhi Singh and Sanjeev Kumar

- 4 mins read

- Digital Finance, Insights

Table of Contents

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive financial innovation. Where once innovation was synonymous with towering skyscrapers housing corporate headquarters, it now resides in lines of code and algorithms powering mobile applications. It’s like the financial industry traded in its power suits for hoodies and traded floor plans for virtual spaces. Amidst the evolving landscape, digital banks have faced a wild array of challenges. This varied from securing essential licences to outshining traditional banks in the realm of face-to-face service or even having enough money to keep going until they become profitable. Our previous blog explored the tumultuous journey of failures and setbacks experienced by digital banks worldwide, leading to closures, market exits, license application withdrawals, or business pivots. We also penned a detailed blog highlighting digital banks that have cracked the profitability code amidst the chaos and what factors led to their growth. In 2023, fueled by our annual reflections and roundups, we witnessed numerous digital banks proudly announcing the achievement of their profitability milestones. While a few were highlighted in our previous blog, this marks a new chapter for them and others as they forge their journey. […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...

- Sanjeev Kumar and Samridhi Singh

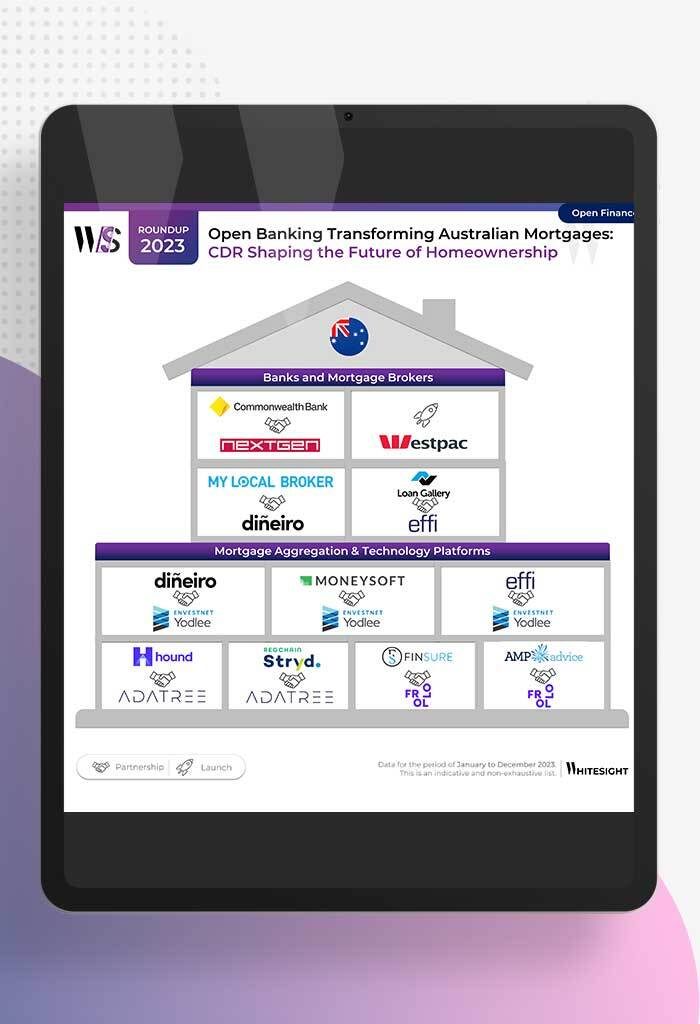

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...