2023 Roundup: Open banking flips the traditional lending game

- Sanjeev Kumar and Risav Chakraborty

- 4 mins read

- Insights, Open Finance

Table of Contents

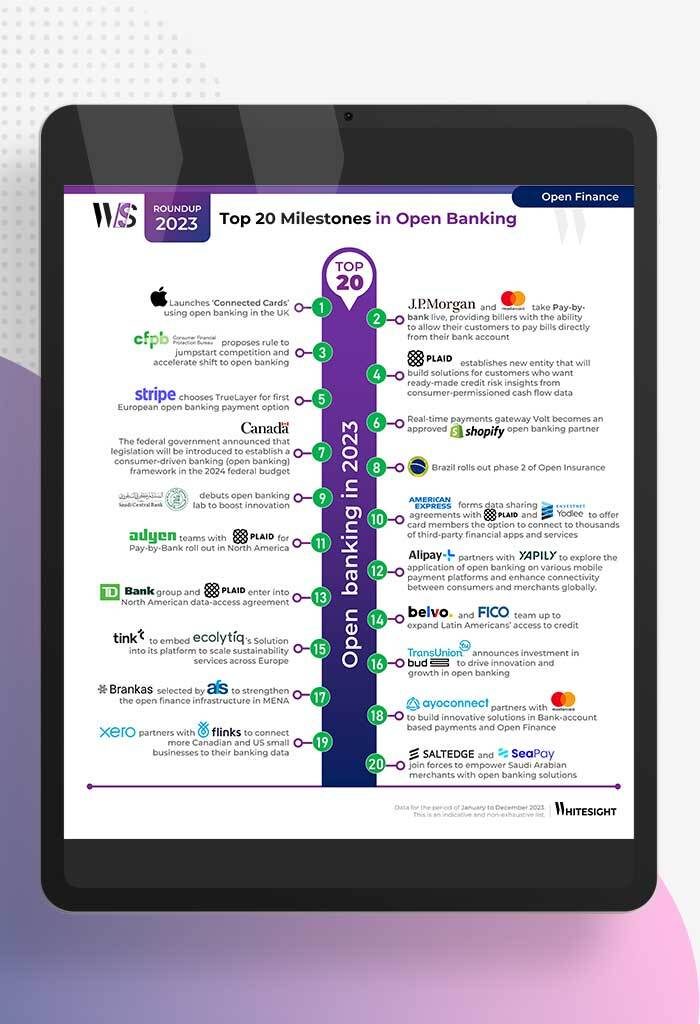

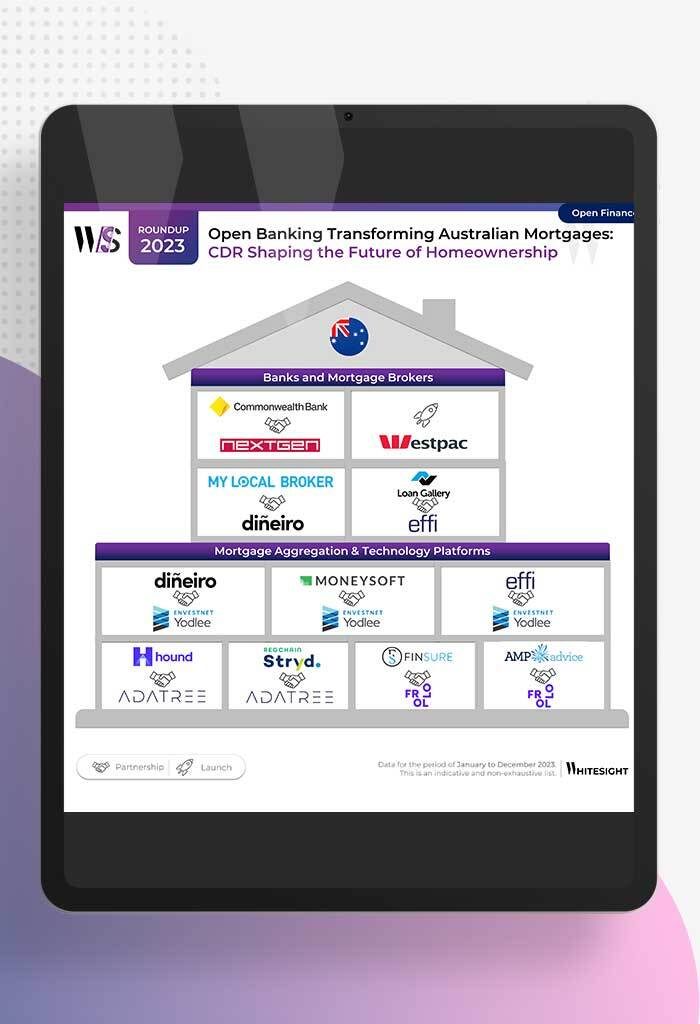

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several key players in Open Banking taking a stab at reimagining how traditional lending works. Before exploring Open Banking’s role in transforming lending, let’s recap our journey. Previous blogs covered the Top 20 Big Moments in Open Banking, showcasing key developments, the revolution in A2A payments enhancing payment efficiency and security, and Open Banking’s role in reinventing mortgage processes.So, what’s up with lending lately? Gone are the days when your chance at a loan rested solely on a credit score that seemed more like a magic number than a real reflection of your financial life. You know the drill – traditional lenders pull up that score, and if it’s not up to snuff because of past mistakes, limited history, or it just doesn’t capture your true financial health, you’re out of luck—no loan for you, or at least not one with favourable terms.But here’s how Open Banking transforms the lending game. It’s like that friend who actually takes the time to get to know you rather than just judging you based on your past. With Open Banking, lenders can take a deep dive […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

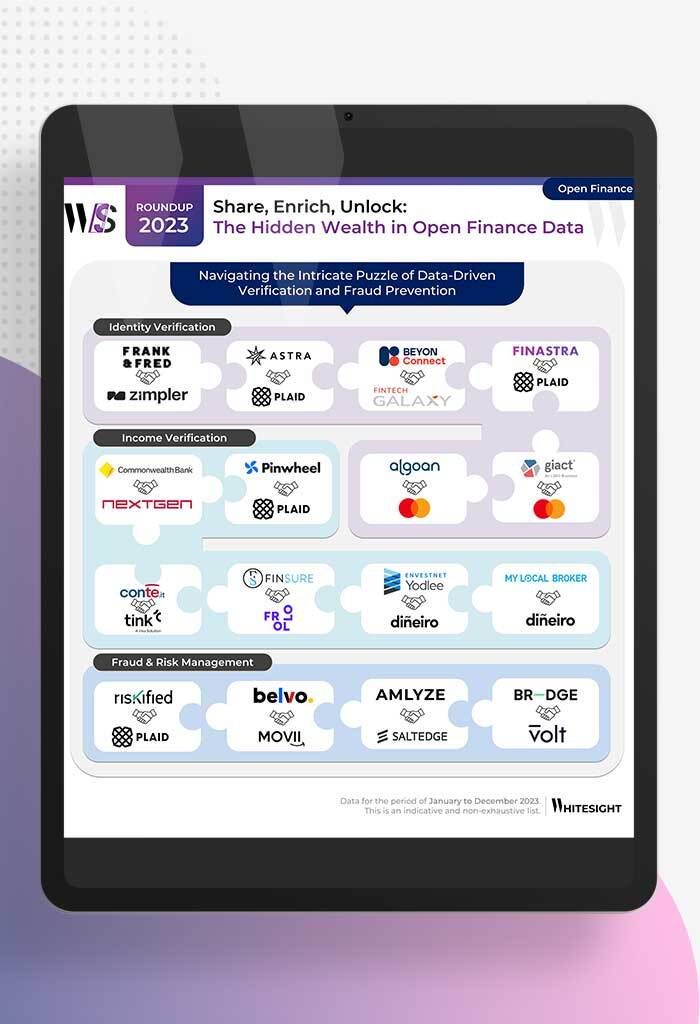

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

- Samridhi Singh and Sanjeev Kumar

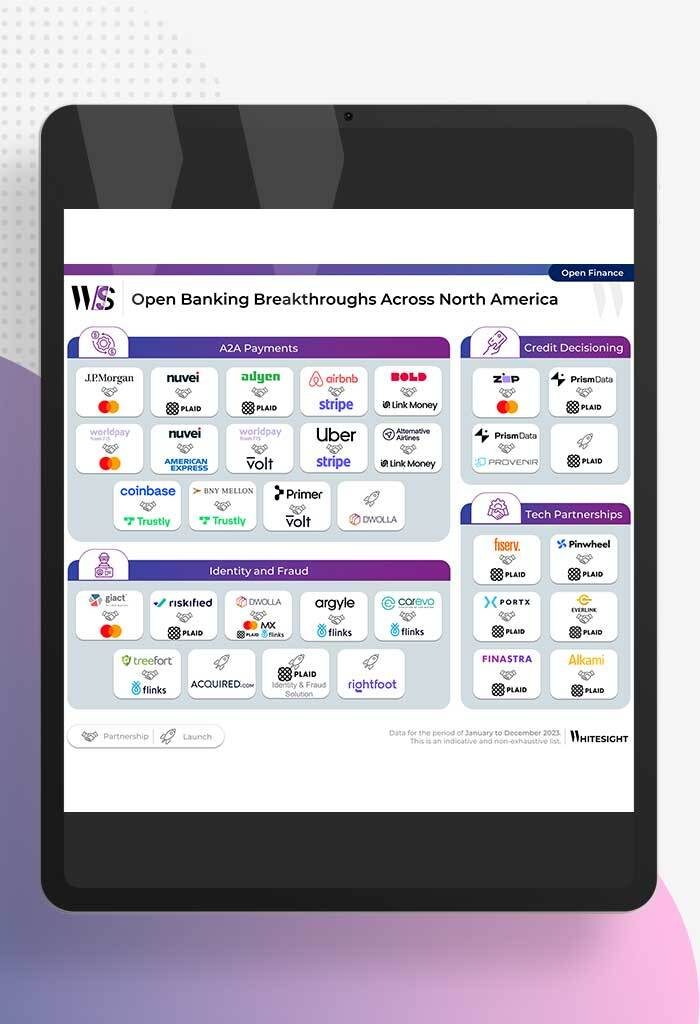

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

- Samridhi Singh and Sanjeev Kumar

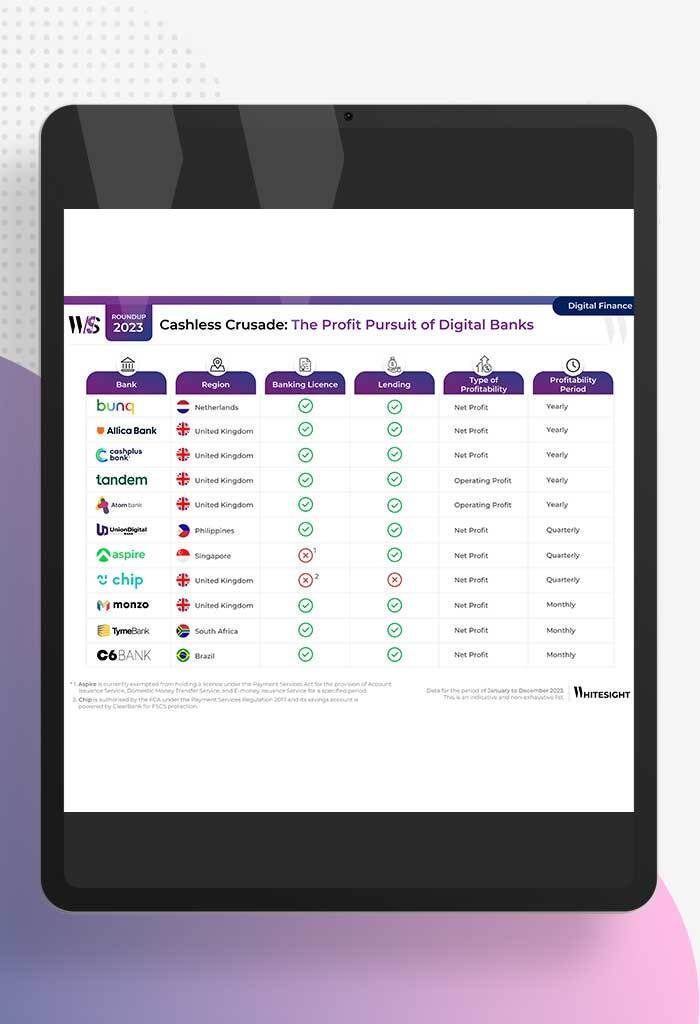

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

- Sanjeev Kumar and Risav Chakraborty

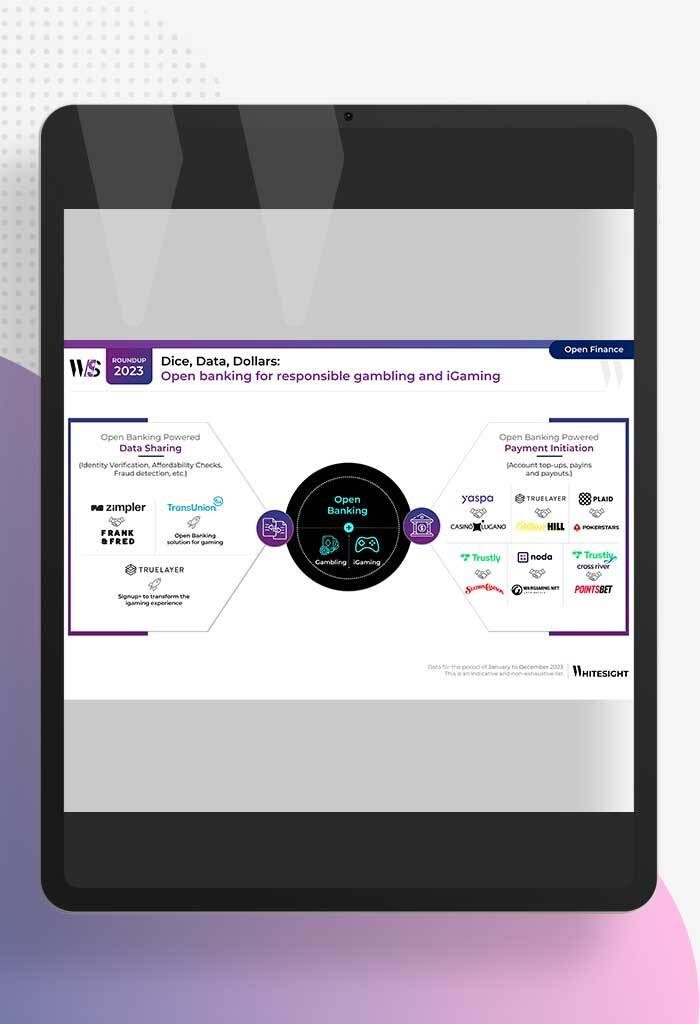

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...

- Sanjeev Kumar and Samridhi Singh

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...