2023 Roundup: Top 20 Milestones in Open Banking

- Sanjeev Kumar

- 10 mins read

- Insights, Open Finance

Table of Contents

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked by significant partnerships, technological advancements, and regulatory milestones. Here’s a look at the Top 20 events that shaped the open banking landscape last year. 1. Apple Launches ‘Connected Cards’ Using Open Banking in the UK Event OverviewApple introduced ‘Connected Cards’ in the UK, integrating open banking to streamline financial management and transactions on Apple devices. The Wallet app will now display account balances (including credit cards) and transaction history for UK users, supporting major banks, including Barclays. Potential ImpactThis integration is expected to significantly enhance the user experience by providing users with the ability to access balances and transactions for multiple cards and accounts seamlessly through Wallet, improving financial visibility and budgeting control. Apple’s involvement could normalise open banking, encouraging wider adoption and innovation in the financial ecosystem. Payment initiation directly from bank accounts could be the next frontier for Apple to expand into. BeneficiariesPrimarily benefiting consumers by offering them a more integrated and intuitive financial management experience, it also aids financial institutions by potentially increasing engagement and transaction volumes through Apple devices. Fintech’s future on your radar Actionable insights on fintech, […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar and Samridhi Singh

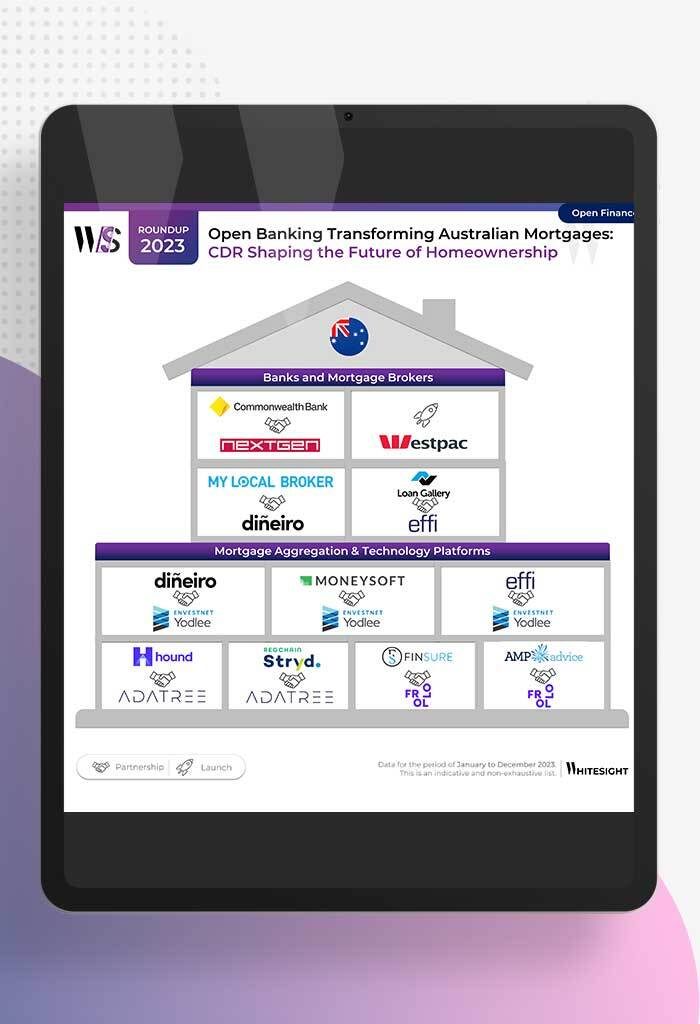

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...