2023 Roundup: Mortgage Makeover with Open Banking

- Sanjeev Kumar and Samridhi Singh

- 4 mins read

- Insights, Open Finance

Table of Contents

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for your dream home. Open banking, Down Under’s version called the Consumer Data Right (CDR), which was launched in 2020, is shaking up the mortgage industry in Australia. Open banking is no longer nibbling at the edges with budgeting apps and account aggregation. This is a full-blown transformation, going straight to the heart of mortgages and flipping the script on the entire industry value chain. Picture this: Australia’s A$2T ($1.4T) mortgage industry (that’s right, trillion with a T!) finally embracing the power of open banking. Banks, non-bank lenders, savvy mortgage aggregators, even your friendly neighbourhood broker – everyone’s jumping on the open banking bandwagon. They’re not just passengers, though – they’re actively driving a revolution that’s changing the way Australians think about and manage their mortgages. The Big CDR Push in the Mortgage Industry What are Digital Mortgage Platforms? Digital Mortgage Platforms are online systems set up by banks to make getting a mortgage quicker and easier. You can apply for a mortgage, upload documents, and even get approval, all online. These platforms use technology (Open Banking, Data Analytics, AI, etc.) to […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

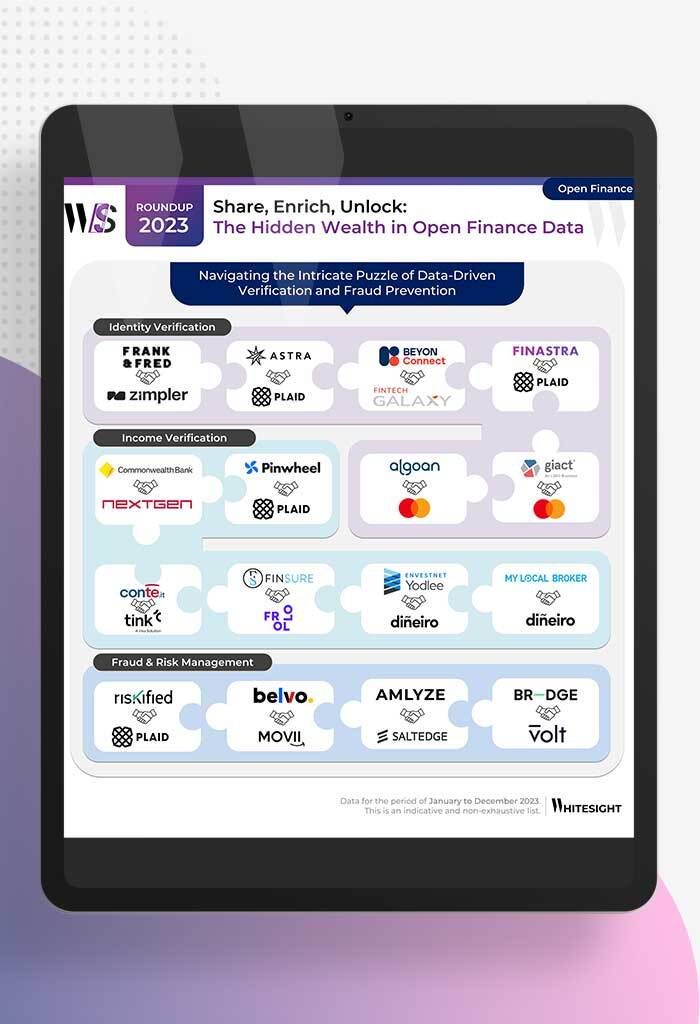

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

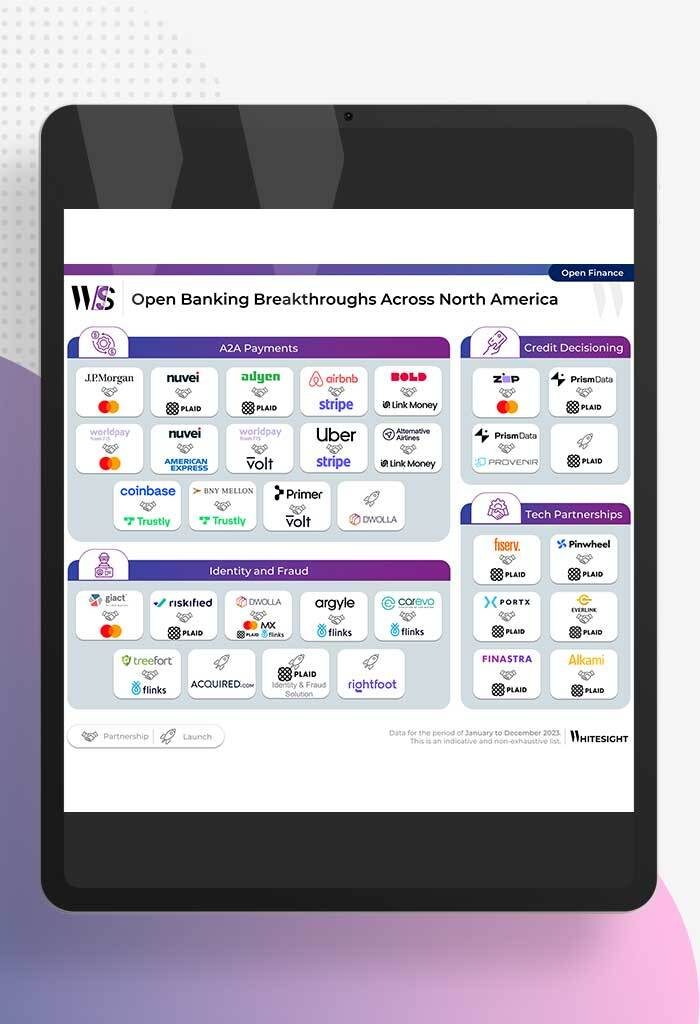

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

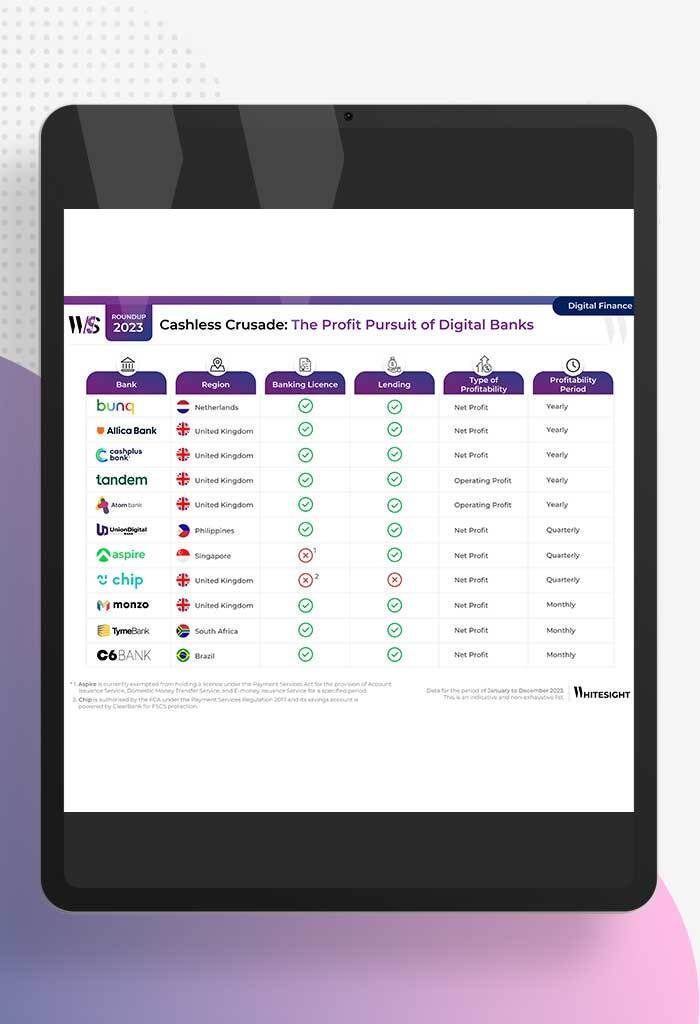

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

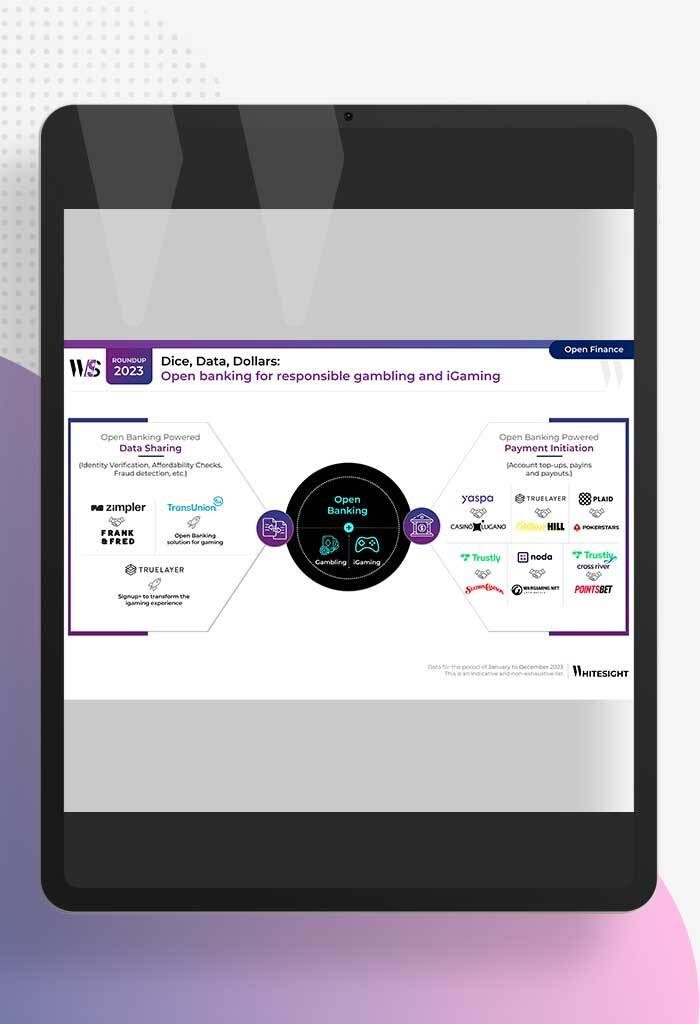

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

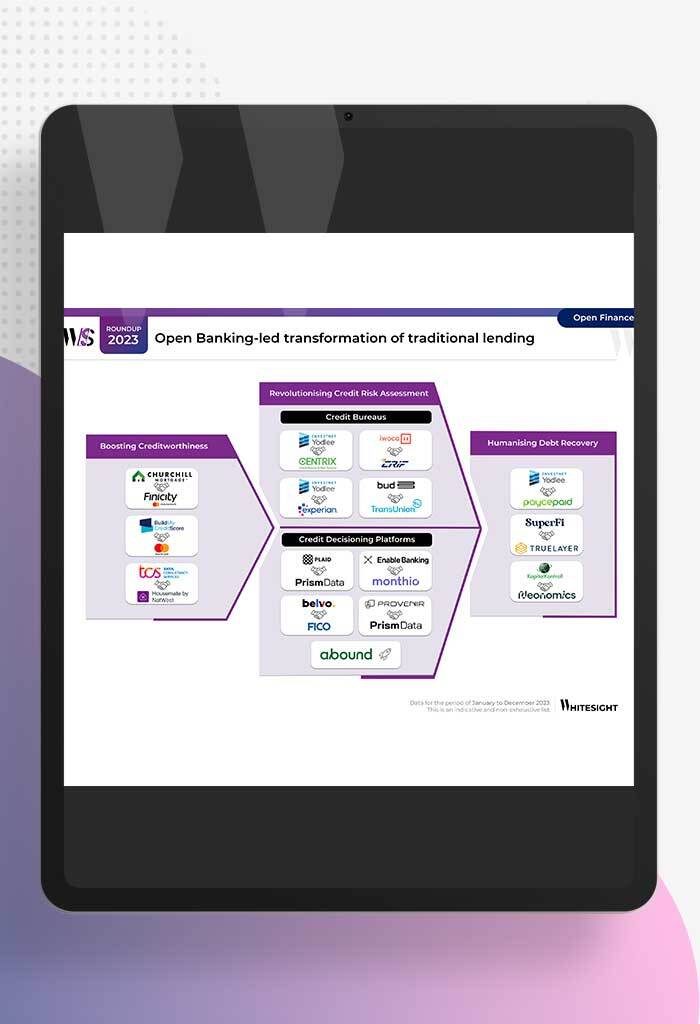

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

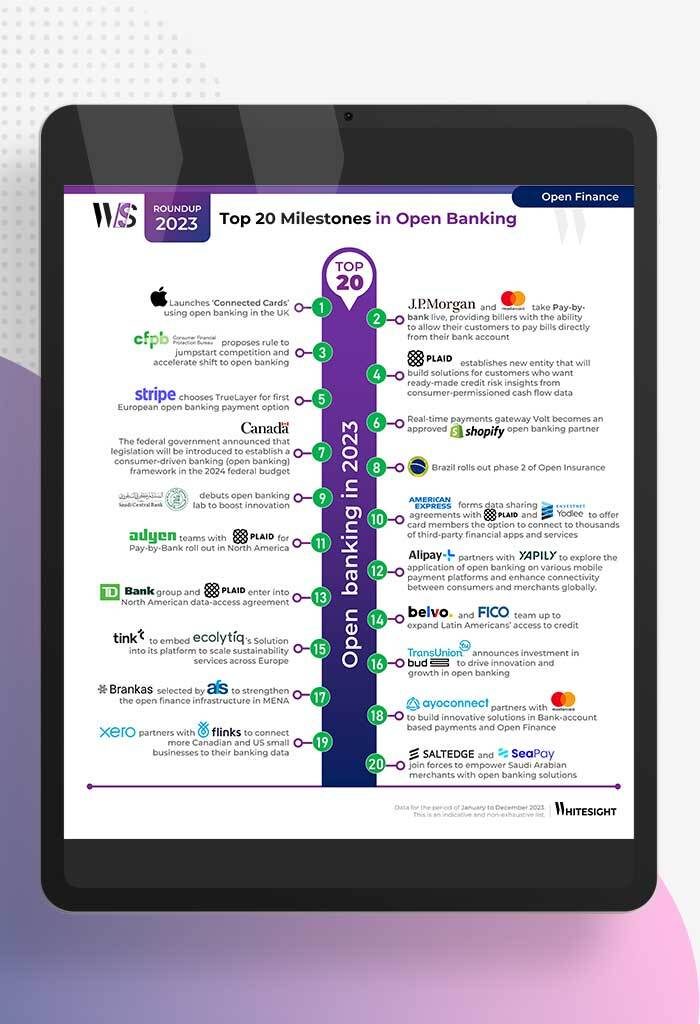

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...