2023 Roundup: Mortgage Makeover with Open Banking

- Sanjeev Kumar and Samridhi Singh

- 4 mins read

- Insights, Open Finance

Table of Contents

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for your dream home. Open banking, Down Under’s version called the Consumer Data Right (CDR), which was launched in 2020, is shaking up the mortgage industry in Australia. Open banking is no longer nibbling at the edges with budgeting apps and account aggregation. This is a full-blown transformation, going straight to the heart of mortgages and flipping the script on the entire industry value chain. Picture this: Australia’s A$2T ($1.4T) mortgage industry (that’s right, trillion with a T!) finally embracing the power of open banking. Banks, non-bank lenders, savvy mortgage aggregators, even your friendly neighbourhood broker – everyone’s jumping on the open banking bandwagon. They’re not just passengers, though – they’re actively driving a revolution that’s changing the way Australians think about and manage their mortgages. The Big CDR Push in the Mortgage Industry What are Digital Mortgage Platforms? Digital Mortgage Platforms are online systems set up by banks to make getting a mortgage quicker and easier. You can apply for a mortgage, upload documents, and even get approval, all online. These platforms use technology (Open Banking, Data Analytics, AI, etc.) to […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Risav Chakraborty and Sanjeev Kumar

The Meteoric Rise of BaaS Models in the Modern Financial Landscape In 2011, Marc Andreessen penned an influential essay claiming,...

- Kshitija Kaur and Sanjeev Kumar

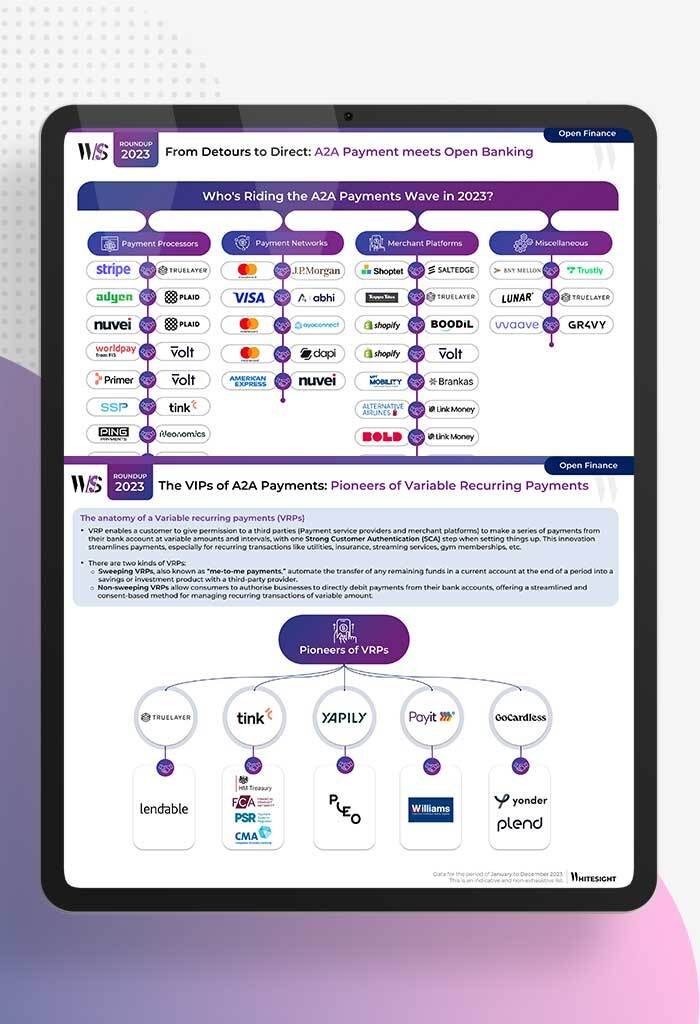

No More Hoops: A2A Payments Unleashed with Open Banking “Hi, you’ve reached our customer service, please wait while we connect...

- Afshan Dadan and Sanjeev Kumar

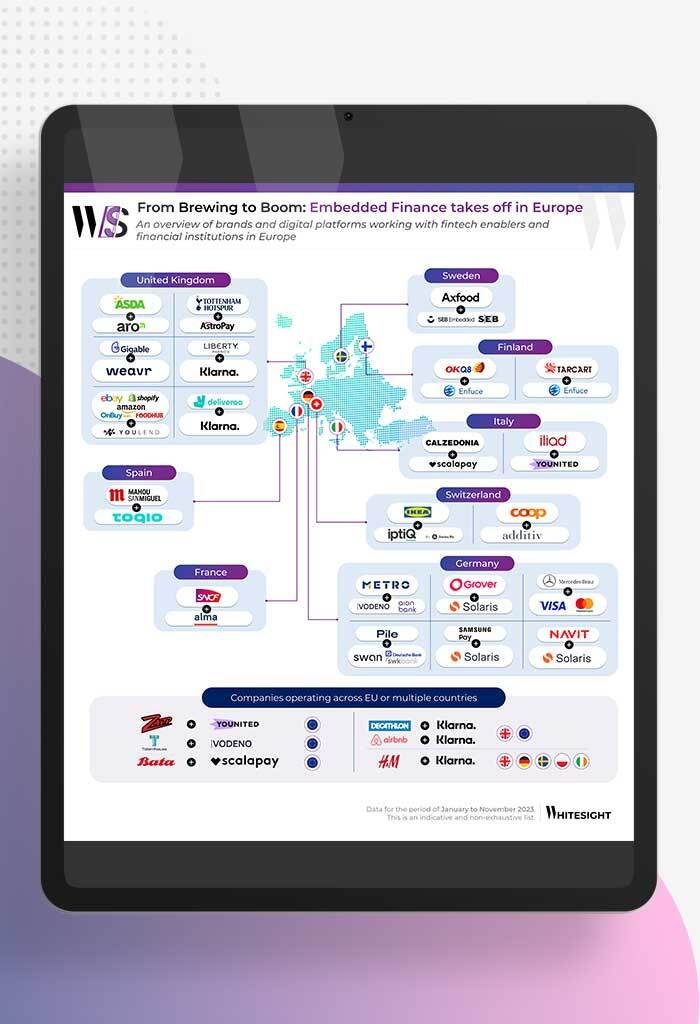

From Groceries to Policies: Europe’s Embedded Endeavours Brands and digital platforms across Europe are integrating financial products, refining user experience...

- Sanjeev Kumar and Samridhi Singh

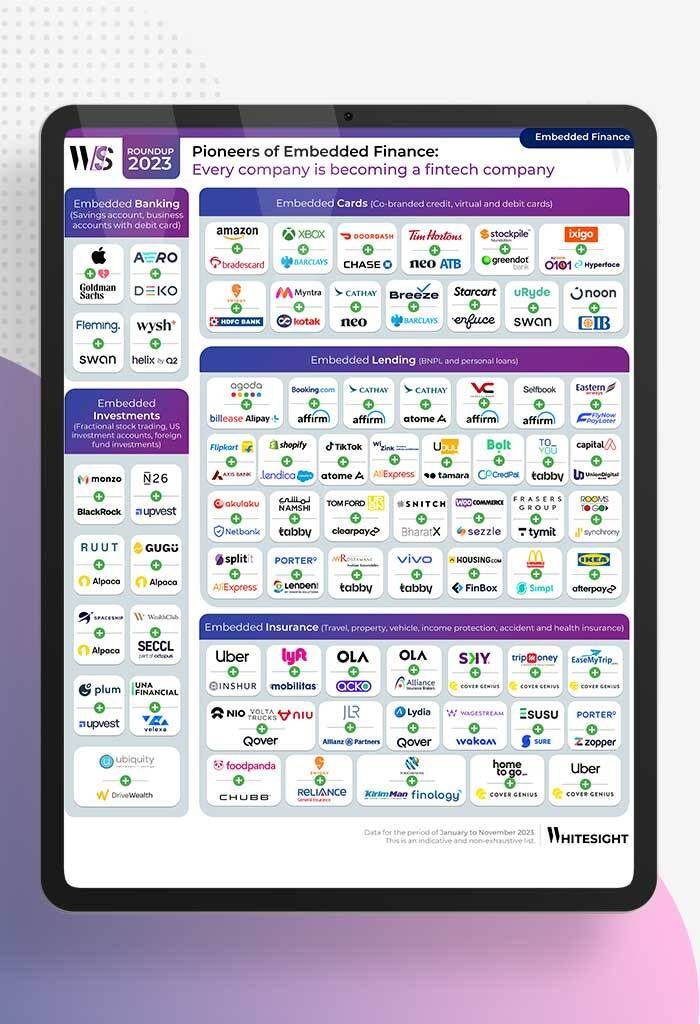

Shop, Ride, Bank: Your Favorite Apps Now Double as Financial Hubs! If finance ever had a wardrobe change—Embedded Finance would...

- Risav Chakraborty and Sanjeev Kumar

The Chronicles of Cardnia: PSPs Reshape Card Issuance in 2023 Ever tried getting a customised card from a traditional bank?...

- Kshitija Kaur and Risav Chakraborty

Symbiosis in Action: Saudi Arabia’s Open Banking Renaissance In the quest to build vibrant, diversified economies beyond the oil horizon,...