From Brewing to Boom: Embedded Finance takes-off in Europe

- Afshan Dadan and Sanjeev Kumar

- 4 mins read

- Embedded Finance, Insights

Table of Contents

From Groceries to Policies: Europe’s Embedded Endeavours Brands and digital platforms across Europe are integrating financial products, refining user experience to the nines. From fashion to logistics, they’re changing the way the world perceives financial services. A personal loan from your go-to grocery store or home insurance from your furniture store – to some it may sound far-fetched and untrustworthy, but the “everything is fintech” mantra is changing this belief.Europe has been at the forefront of several game-changing fintech happenings, and embedded finance is all but one of them. With this blog, we take a look at the innovation in embedded finance across key markets in the UK and European Union. The spotlight is on nonbanks, such as retail brands and digital platforms embedding financial services with the help of fintech enablers and financial institutions that offer their technology and licences.Let’s get to it! Germany and the UK lead embedded finance innovation Progressive regulations and policies in the UK and Europe, such as open banking, PSD2, and fintech licences (electronic money institutions, digital or startup banks, etc.), have led to the creation of an abundant playground for innovation. Non-banks across the UK and EU are experimenting with contextual embedded financial […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

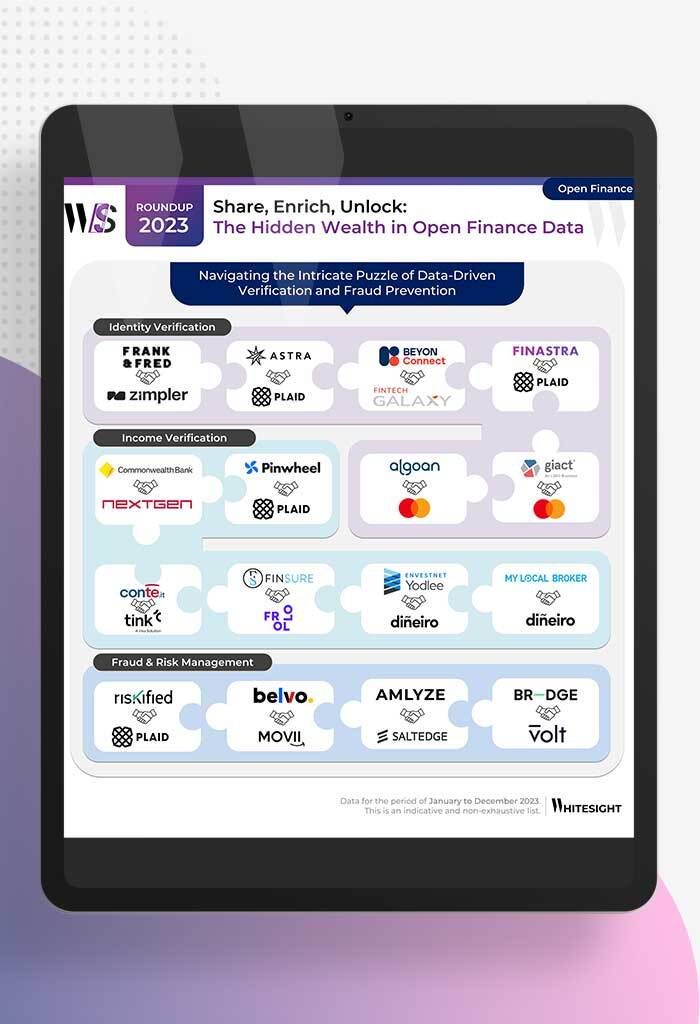

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

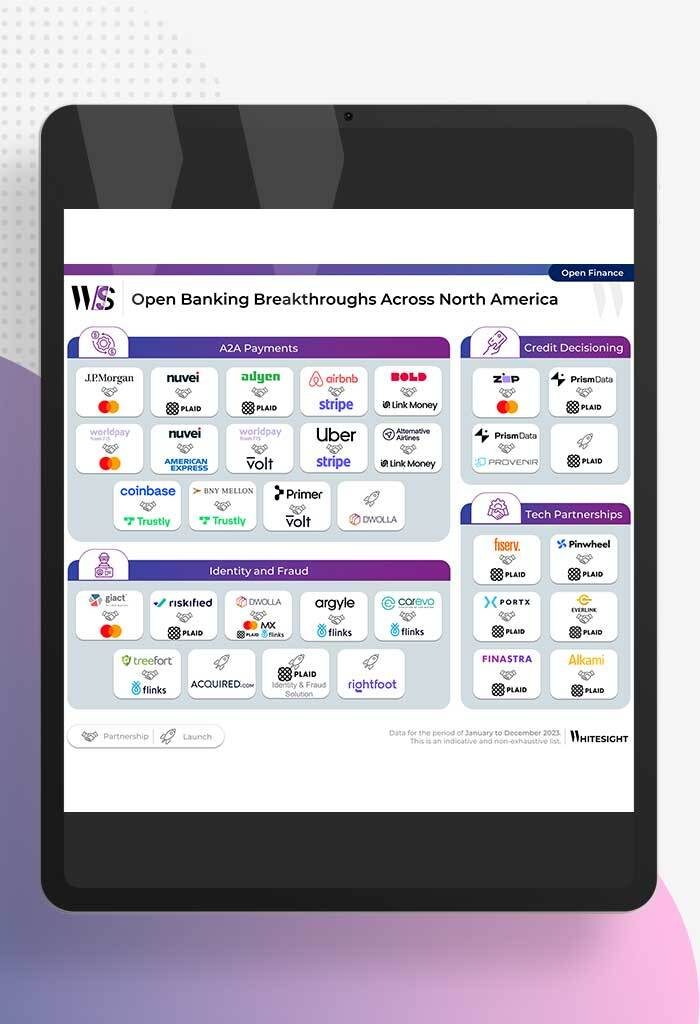

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

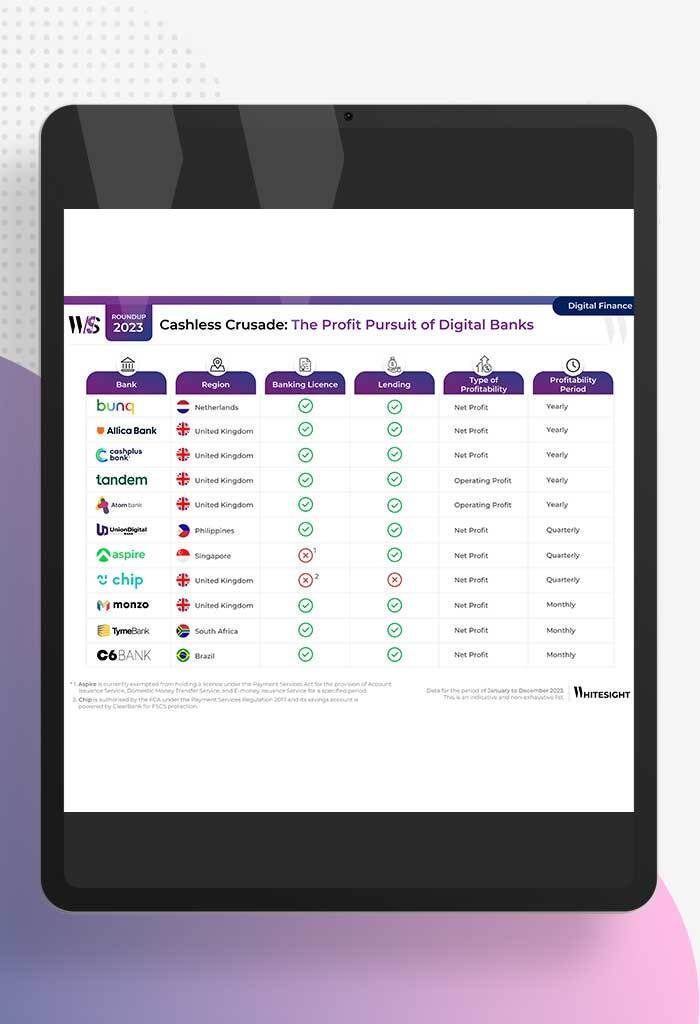

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

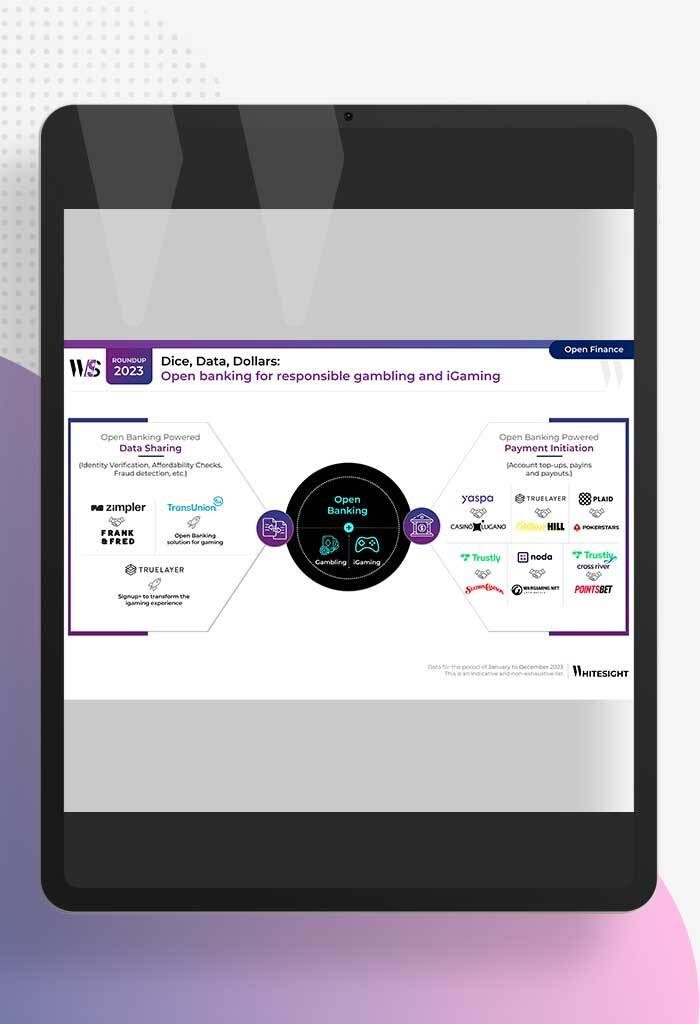

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

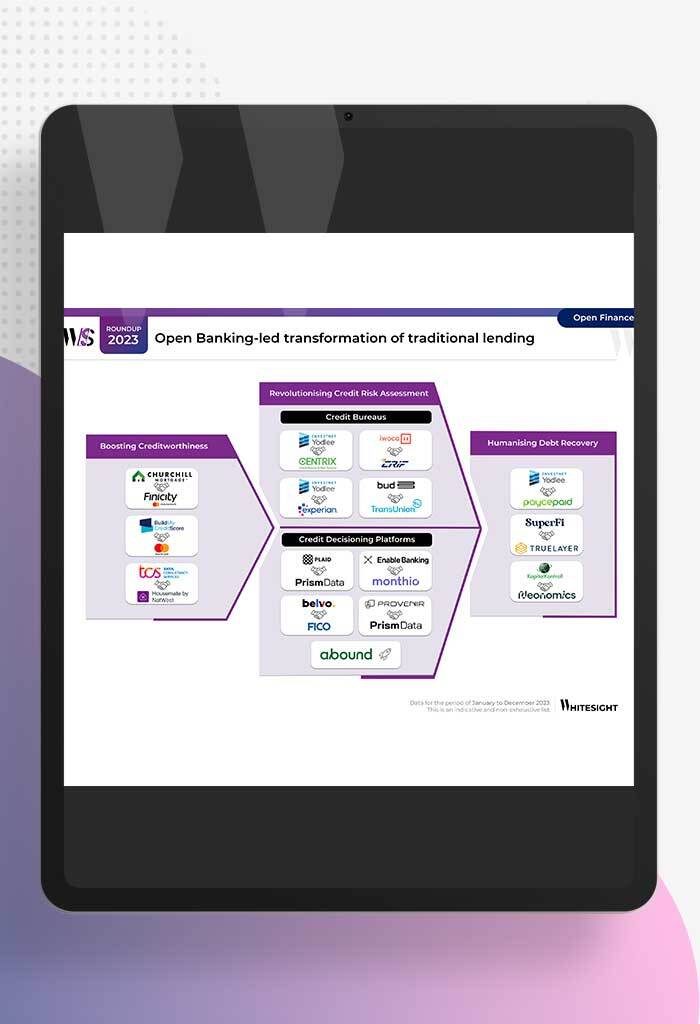

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

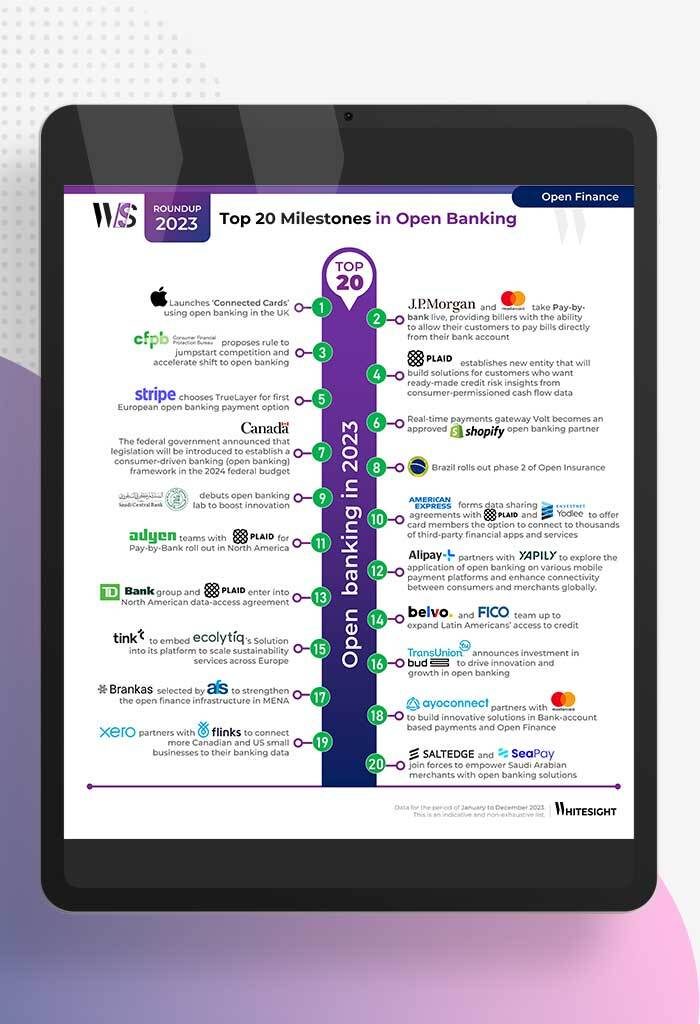

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...