2023 Roundup: Open Banking as the Jackpot for Modern Gambling

- Sanjeev Kumar and Risav Chakraborty

- 4 mins read

- Insights, Open Finance

Table of Contents

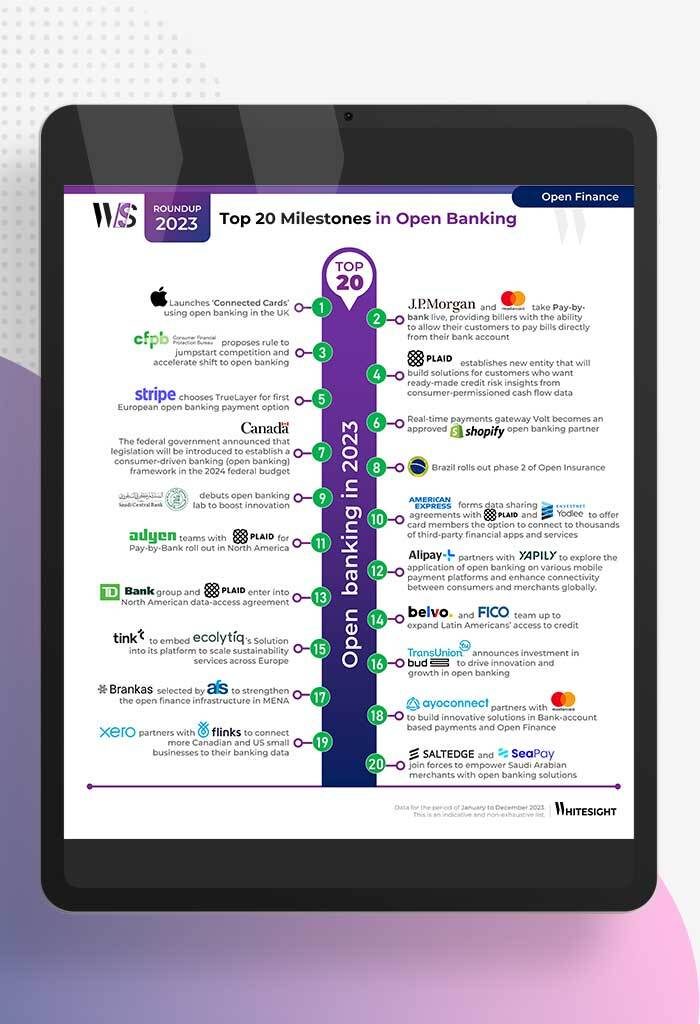

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by 2024, and expected to reach $138.1B by 2028. While this growth brings exciting opportunities, it also raises critical concerns about player safety and responsible gambling practices. Traditional onboarding processes and payment methods often fall short, posing challenges for both players and gambling operators. The industry itself is classified as high-risk, requiring stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) checks, often hindering smooth operations and profitability. Fortunately, a revolutionary technology is stepping up to address some of these concerns: Open Banking.Open banking operates on two key principles: data sharing and payments. With player consent, it allows authorised third-party providers, like gambling platforms, to access real-time financial data directly from bank accounts. It enables gambling operators to seamlessly and securely initiate transactions directly from customer accounts using account-to-account payment methods, offering a streamlined experience for players and a cost-efficient solution for operators. Shuffling the deck with open banking This unlocks a whole new realm of opportunities in the gambling and online gaming scene. And let’s talk about 2023 – what a year it was for Open Banking! We saw an […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Sanjeev Kumar

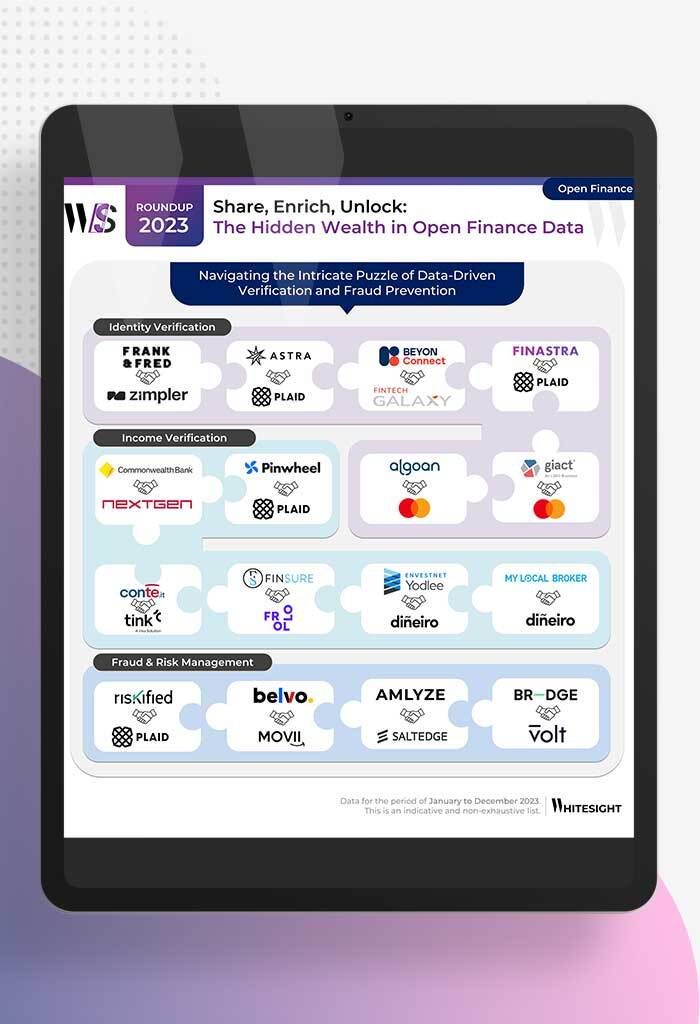

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

- Samridhi Singh and Sanjeev Kumar

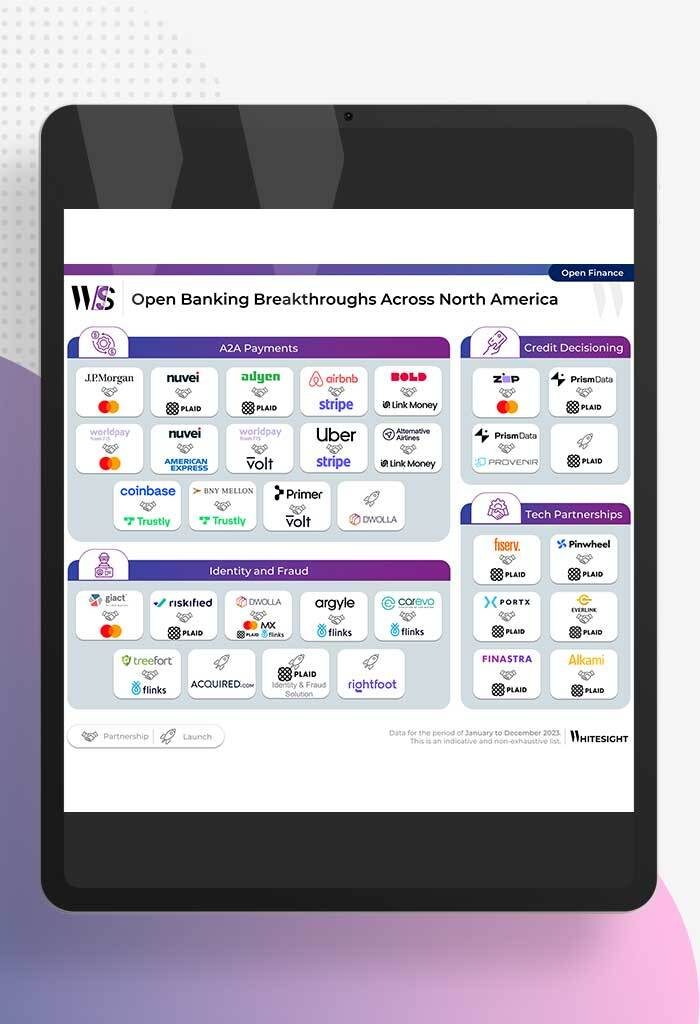

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

- Samridhi Singh and Sanjeev Kumar

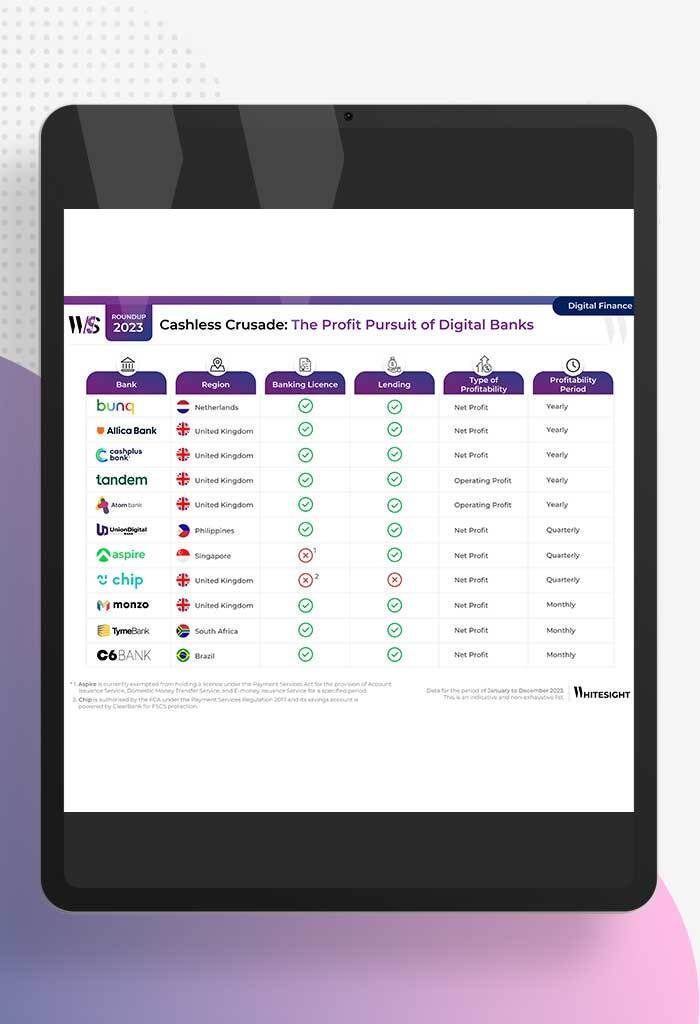

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

- Sanjeev Kumar and Risav Chakraborty

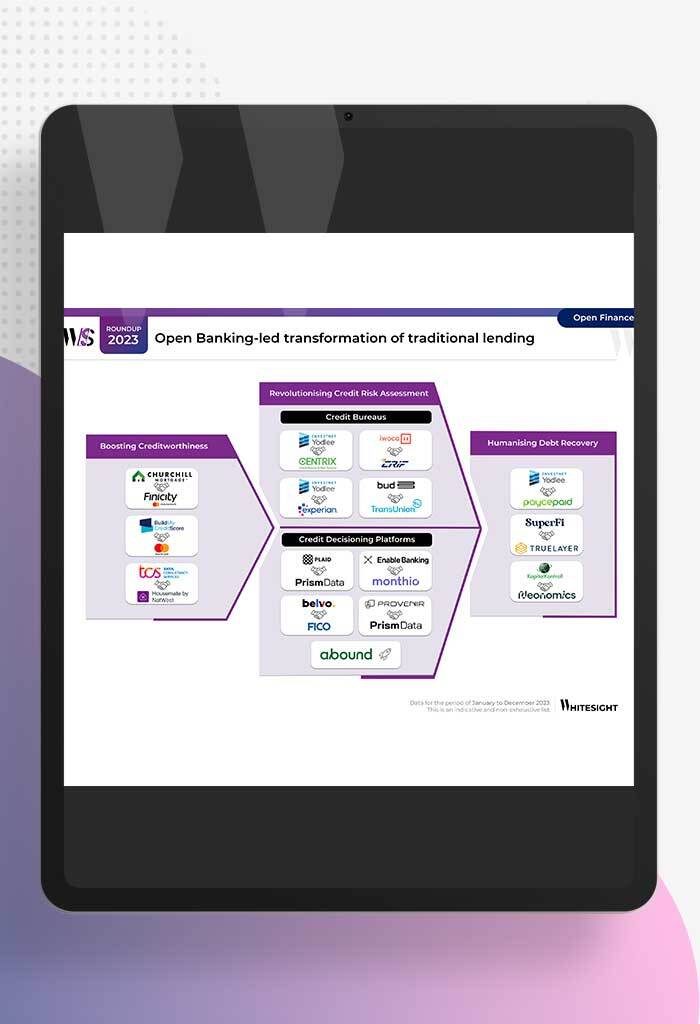

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...

- Sanjeev Kumar and Samridhi Singh

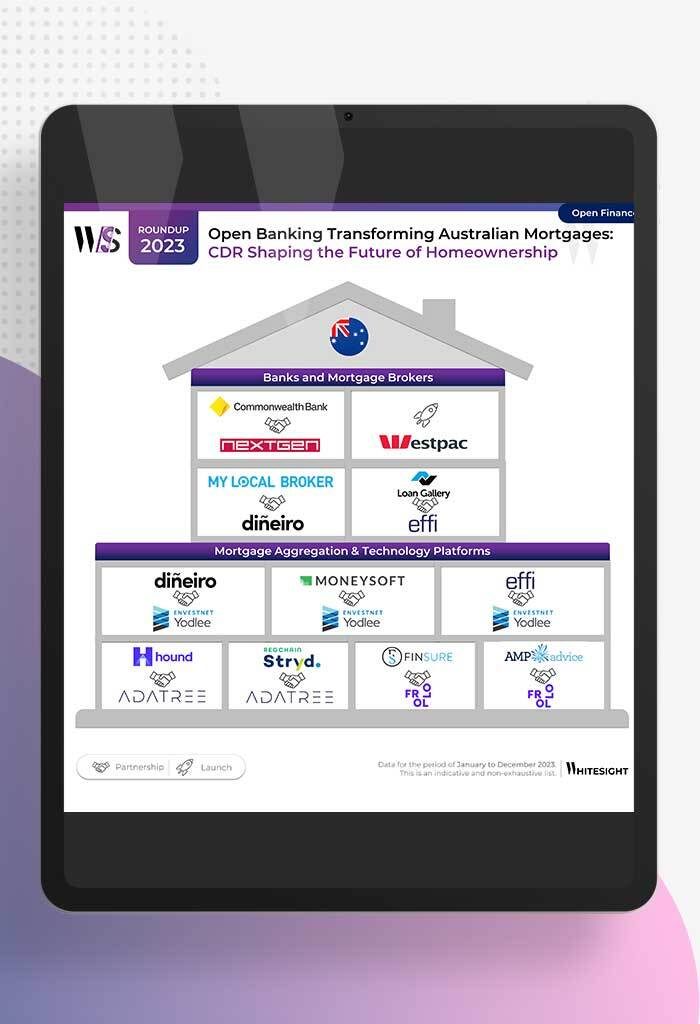

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for...