2023 Roundup: Open Banking as the Jackpot for Modern Gambling

- Sanjeev Kumar and Risav Chakraborty

- 4 mins read

- Insights, Open Finance

Table of Contents

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by 2024, and expected to reach $138.1B by 2028. While this growth brings exciting opportunities, it also raises critical concerns about player safety and responsible gambling practices. Traditional onboarding processes and payment methods often fall short, posing challenges for both players and gambling operators. The industry itself is classified as high-risk, requiring stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) checks, often hindering smooth operations and profitability. Fortunately, a revolutionary technology is stepping up to address some of these concerns: Open Banking.Open banking operates on two key principles: data sharing and payments. With player consent, it allows authorised third-party providers, like gambling platforms, to access real-time financial data directly from bank accounts. It enables gambling operators to seamlessly and securely initiate transactions directly from customer accounts using account-to-account payment methods, offering a streamlined experience for players and a cost-efficient solution for operators. Shuffling the deck with open banking This unlocks a whole new realm of opportunities in the gambling and online gaming scene. And let’s talk about 2023 – what a year it was for Open Banking! We saw an […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Risav Chakraborty and Kshitija Kaur

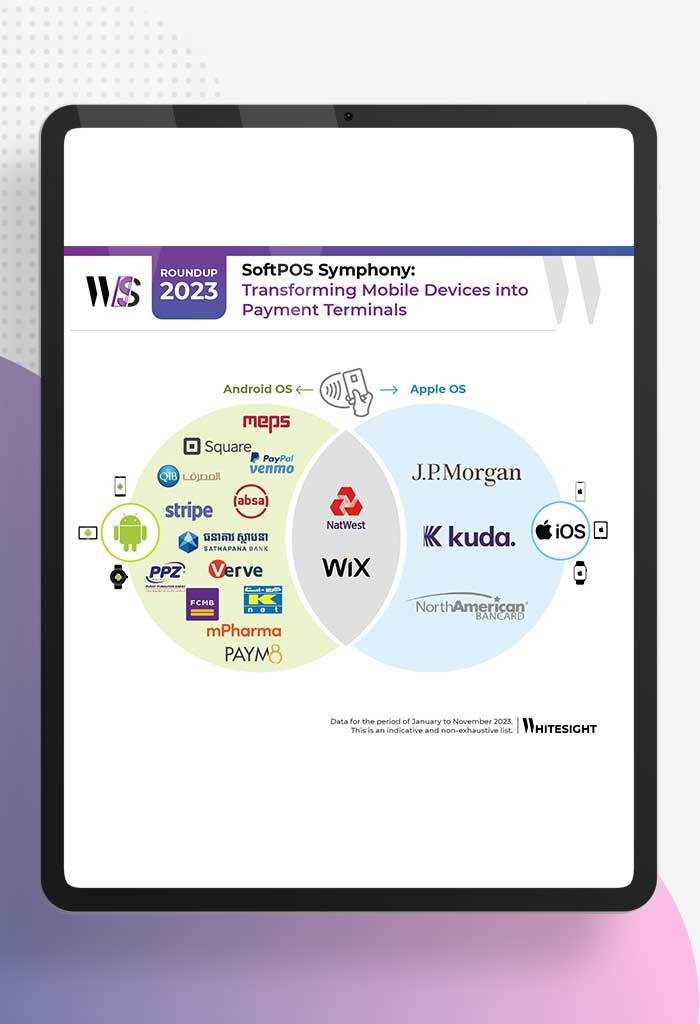

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

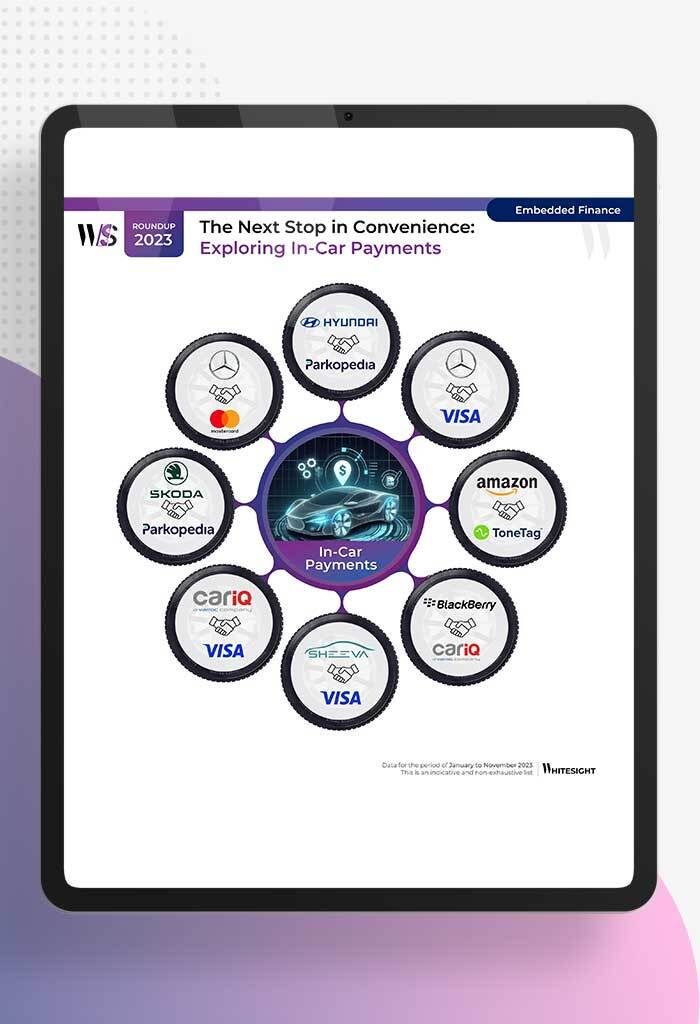

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

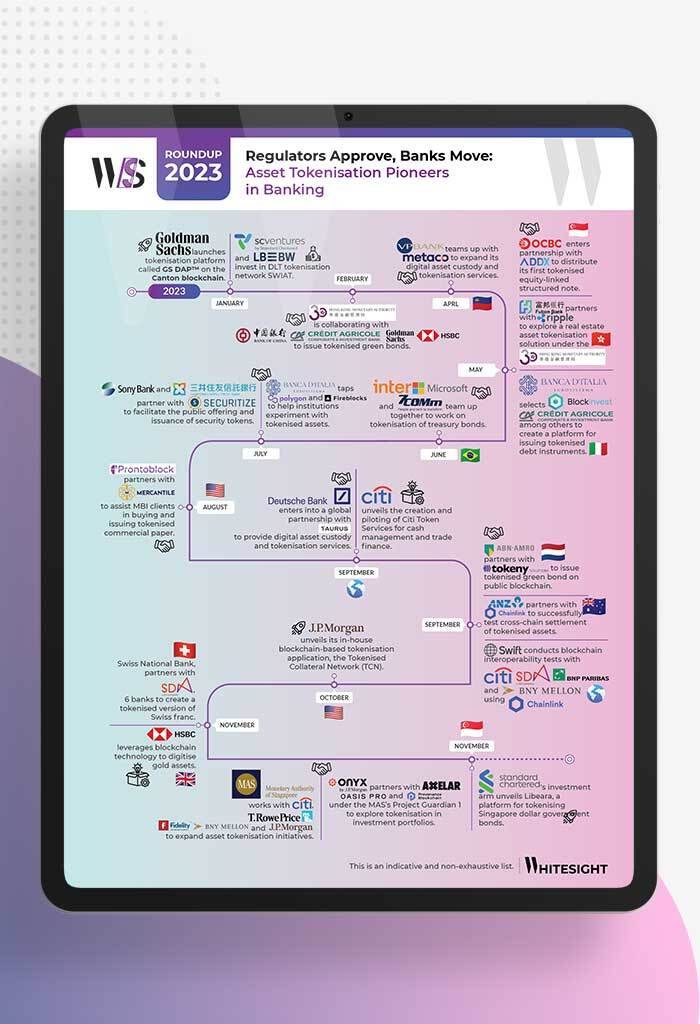

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

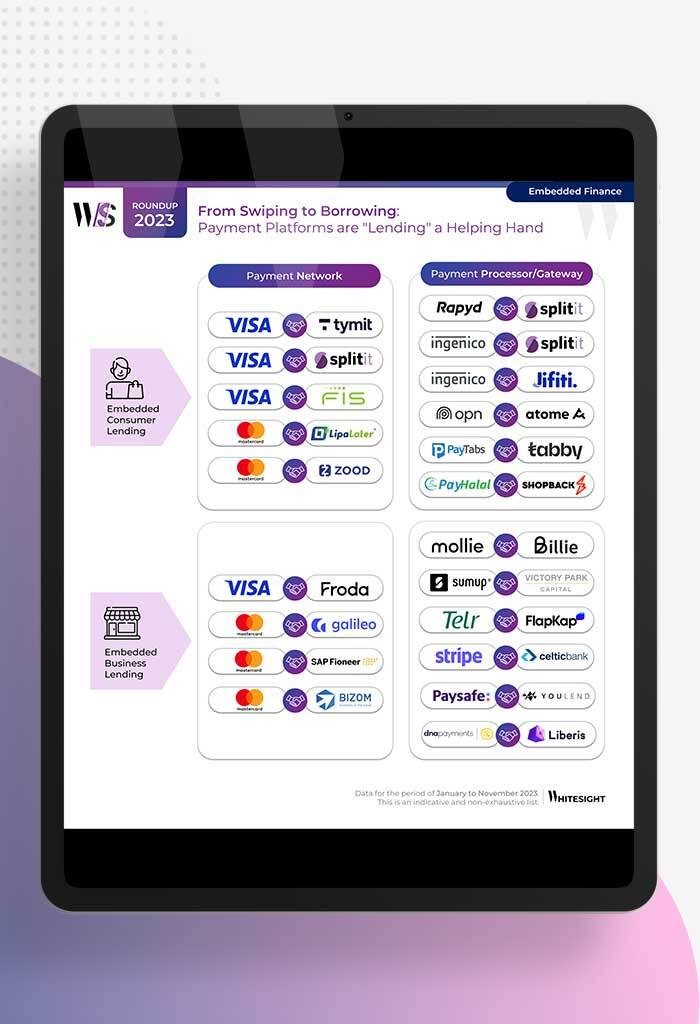

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

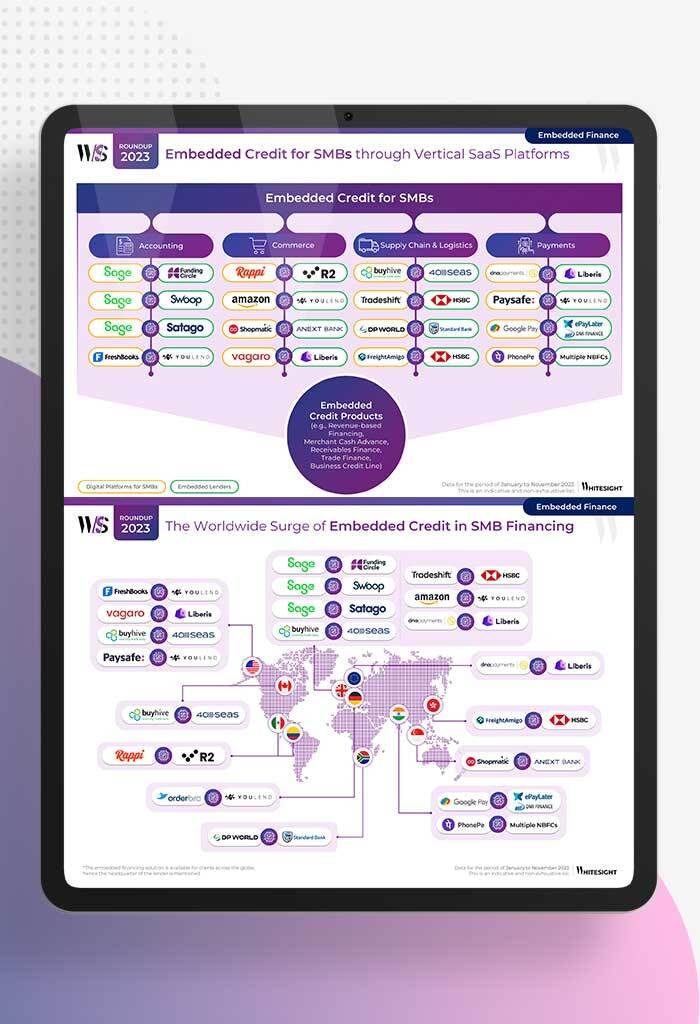

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...

- Samridhi Singh and Kshitija Kaur

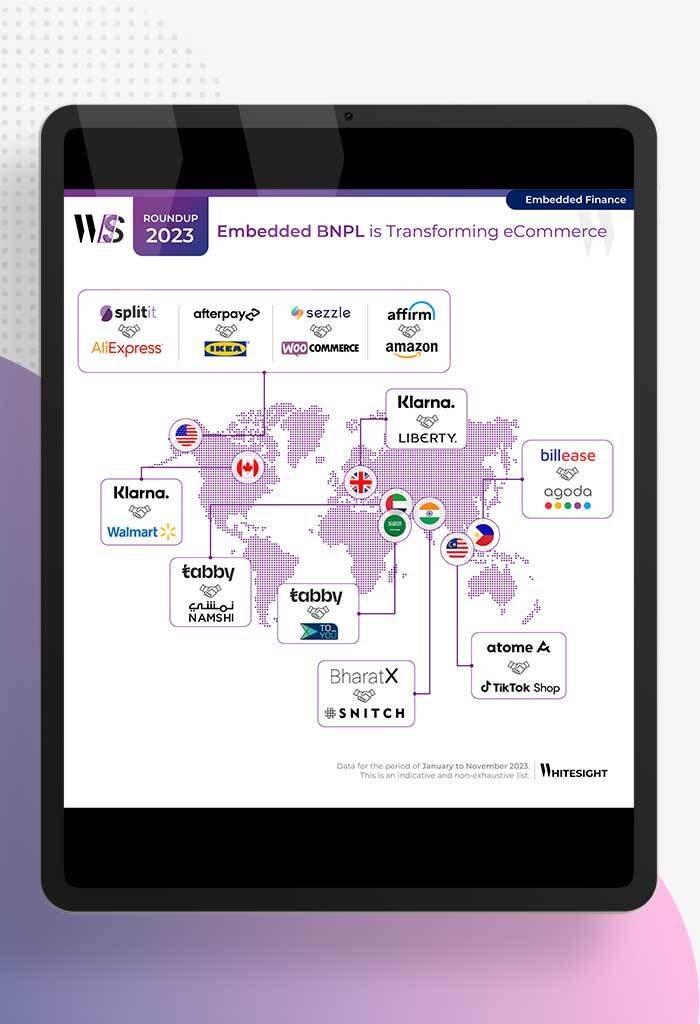

Swipe, Splurge, Savor: E-comm’s New Norm! What’s more fun than a Sunday shopping spree, right? Picture this: you on your...