2023 Roundup: Payment Titans Go All-In on the Embedded Lending Revolution

- Kshitija Kaur and Risav Chakraborty

- 4 mins read

- Embedded Finance, Insights

Table of Contents

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic?Well, as the pandemic subsided, the sky-high growth rates in digital payments that payment firms enjoyed have also tapered off. To compensate for this slowdown, numerous payment companies are now turning their focus to the burgeoning field of embedded finance.Why payments, you ask? Well, it’s the ideal gateway for platforms to sneak into financial services. A payments association builds data, trust, and inevitably leads to more banking needs (we’ve got a detailed account of Adyen capturing that journey). It’s like the foundation for payment platforms to offer an entire buffet of embedded finance goodies, levelling up their revenue, user experience, and customer retention game.So, what’s the fresh buzz that has our attention entangled? It’s all about payment processors and payment networks going all-in on embedded lending in 2023. (Ah yes, the embedded web that keeps weaving).Think of it like this: existing payment players are expanding their repertoire to provide lending options that go beyond the norm. Today, your favourite payment buddies aren’t just processing; they’re lending a helping hand (quite literally) to both consumers and businesses. As payment firms seamlessly integrate the payment flow, […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

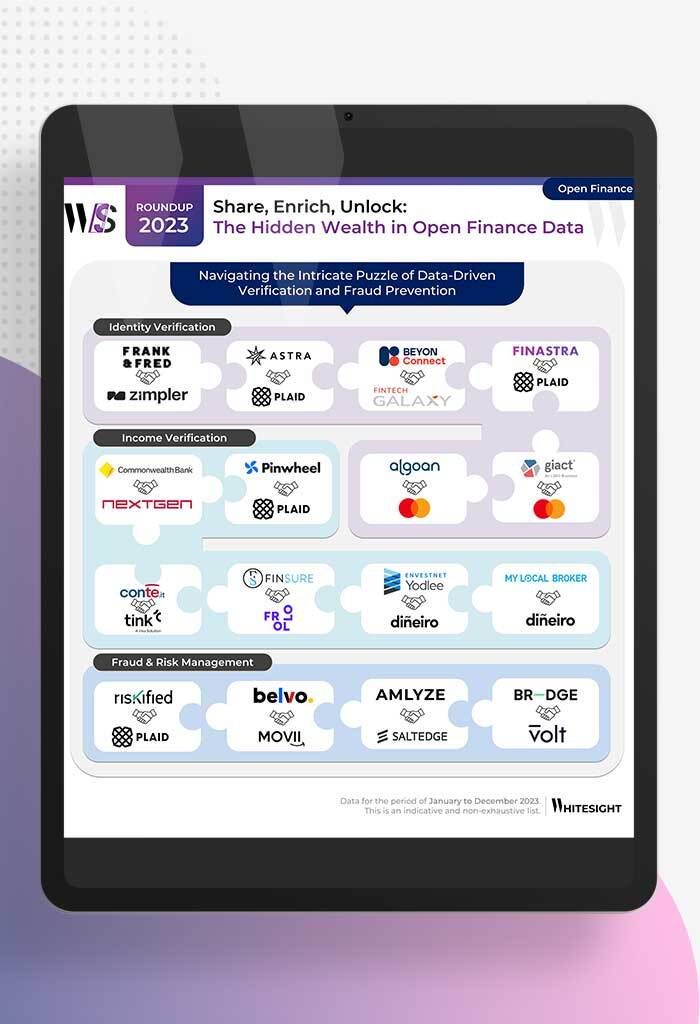

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

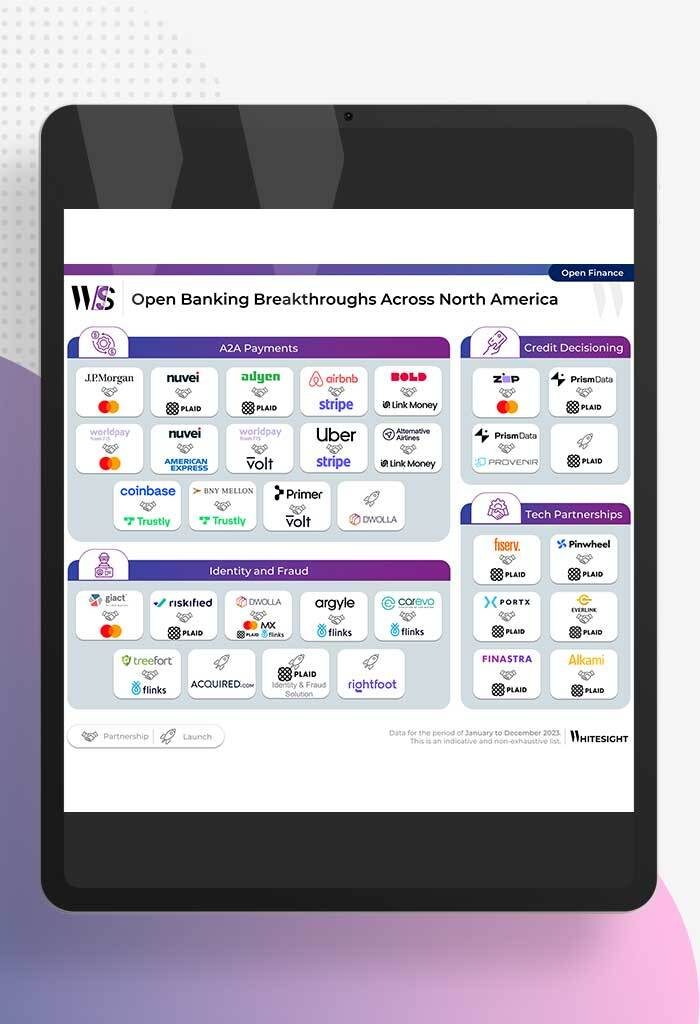

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

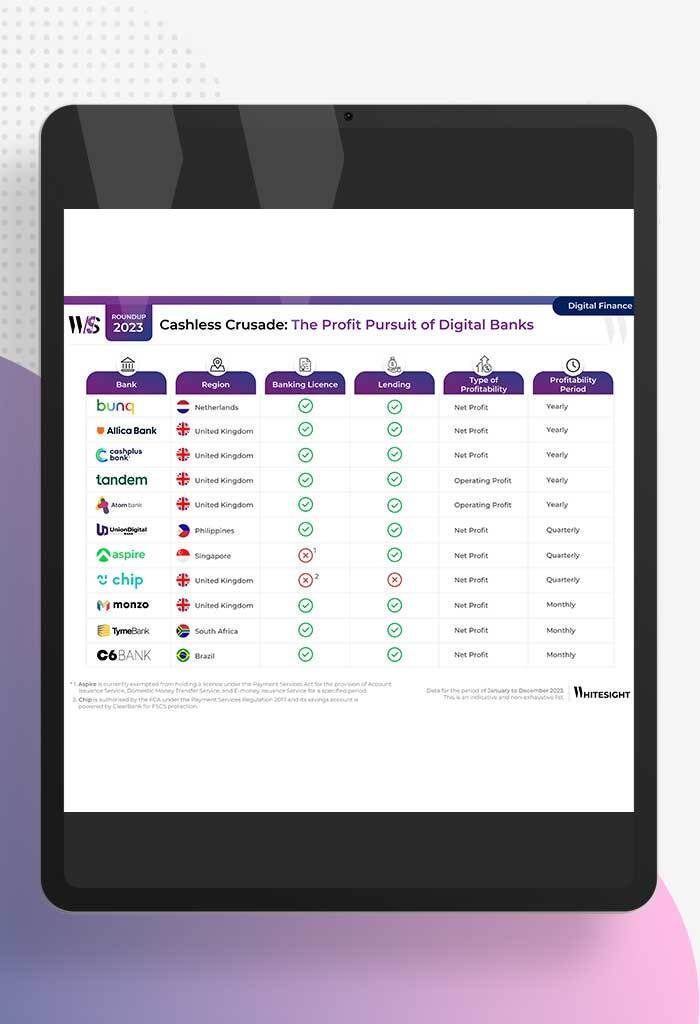

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

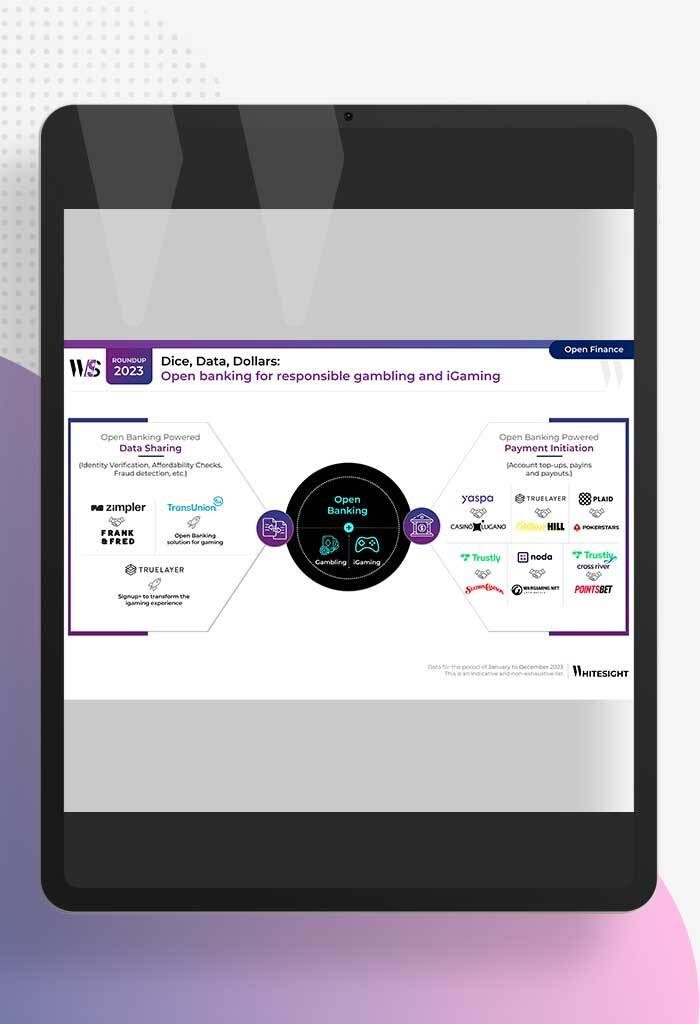

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

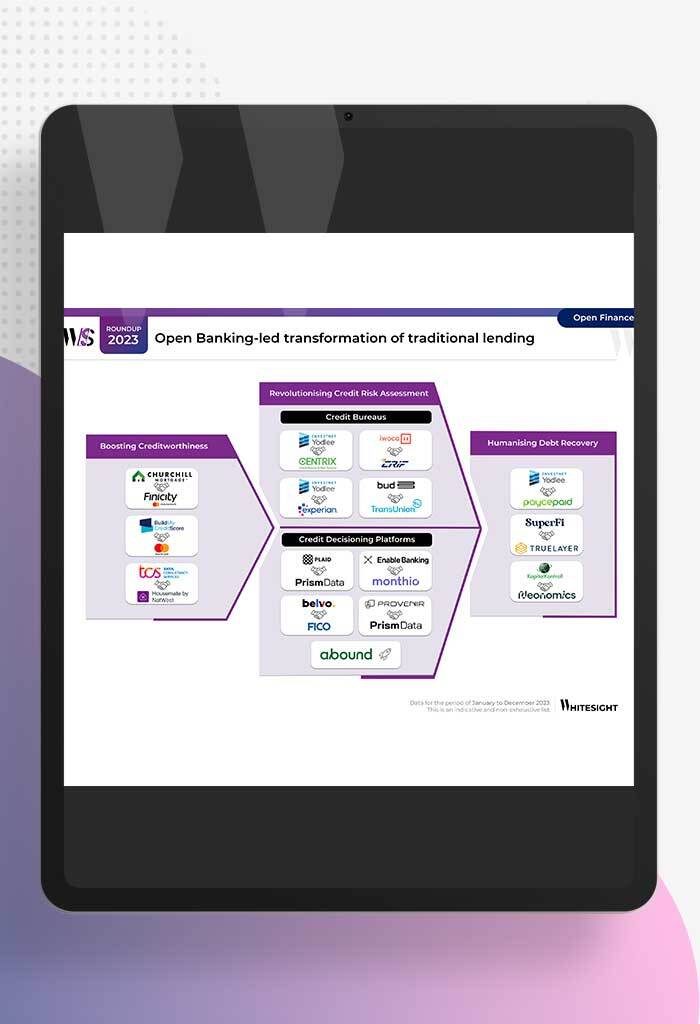

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

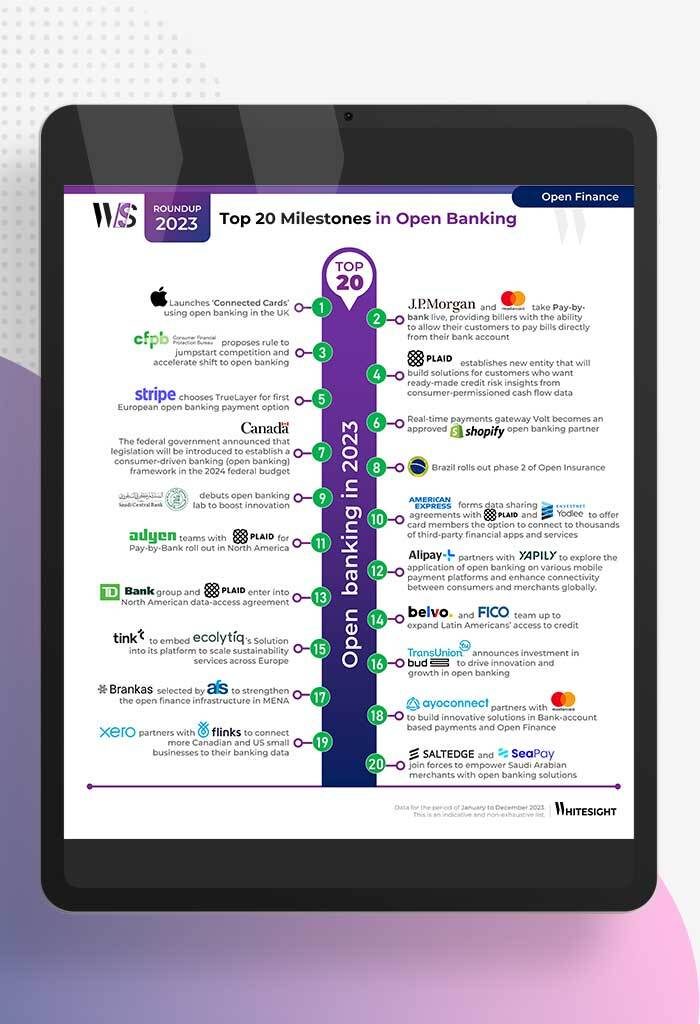

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...