2023 Roundup: The Asset Tokenisation Boom in the Banking World

- Samridhi Singh and Sanjeev Kumar

- 3 mins read

- Digital Assets, Insights

Table of Contents

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do a Houdini – disappearing right before our eyes. Remember when we thought algorithmic stablecoins were the rocks of Gibraltar? Turns out, they were as stable as a house of cards in a breeze. And DeFi, hailed as the beacon of decentralisation, showed its centralised underbelly. But amidst these vanishing acts, 2023 has been a game-changer, spotlighting two trends that are not just catchphrases but are genuinely reshaping the financial landscape: Central Bank Digital Currencies (CBDCs) and Asset Tokenisation (AT).But what in the world is this whole asset tokenisation shindig, anyway?Asset tokenisation is the process of converting ownership rights to real-world assets into digital tokens on a blockchain. Picture transforming your go-to morning coffee spot’s loyalty points into snazzy digital tokens on a blockchain. Asset tokenisation is like that for real-world valuables. It’s the modern way of making everything digital and tradable—from art and real estate to stocks and sneakers. Each piece gets a unique digital ID, making ownership transparent and divisible. Want to invest in a high-end city apartment? No need to buy the whole thing—just grab a fraction of […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

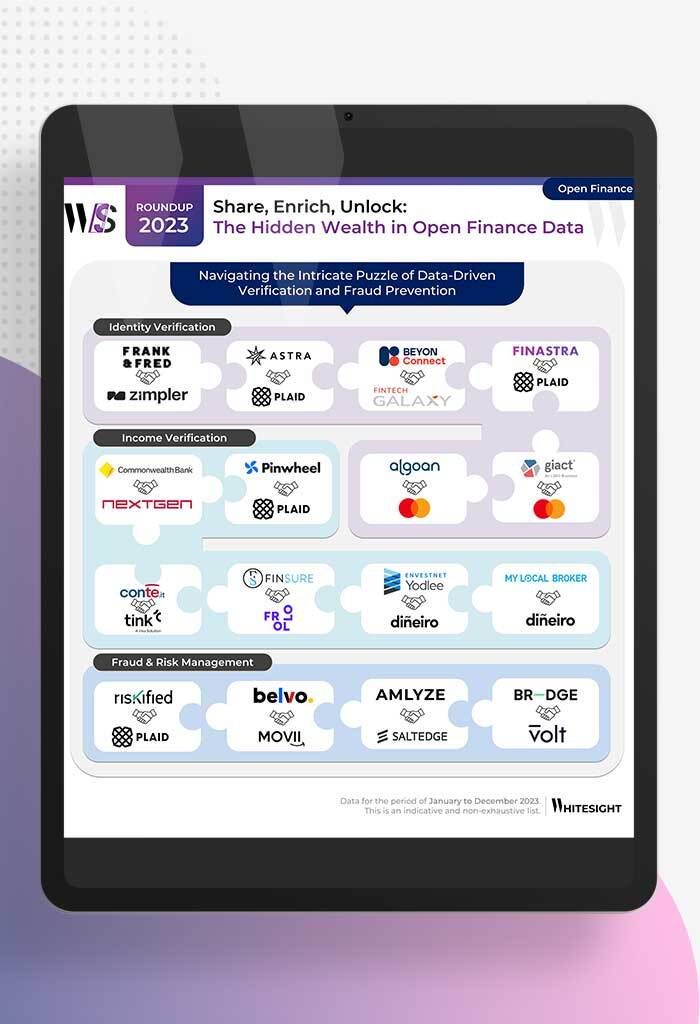

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

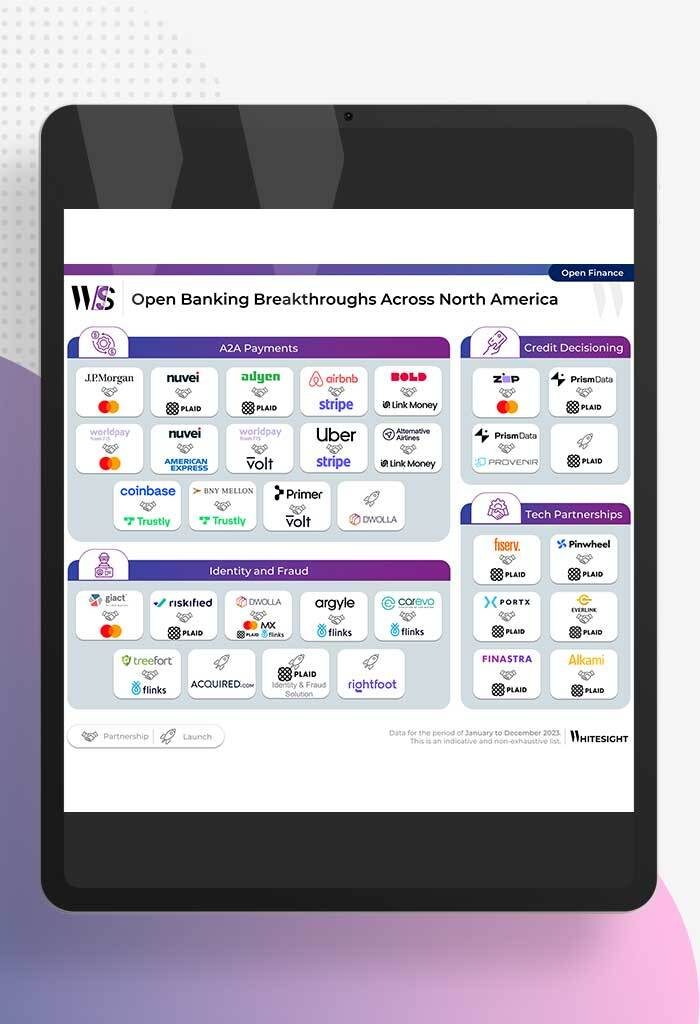

- Samridhi Singh and Sanjeev Kumar

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

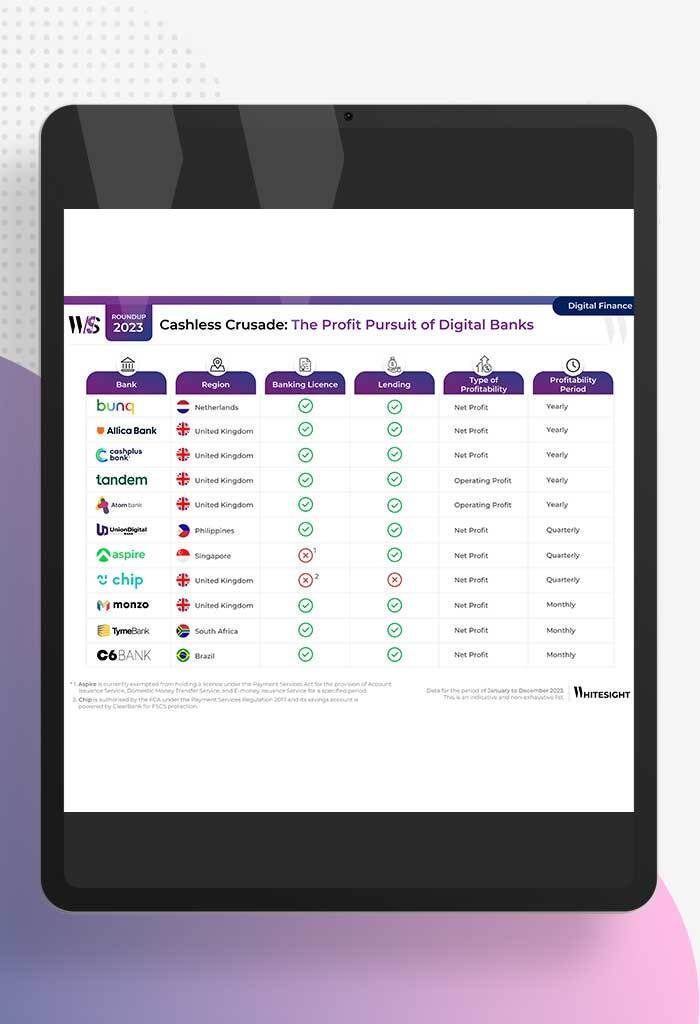

- Samridhi Singh and Sanjeev Kumar

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

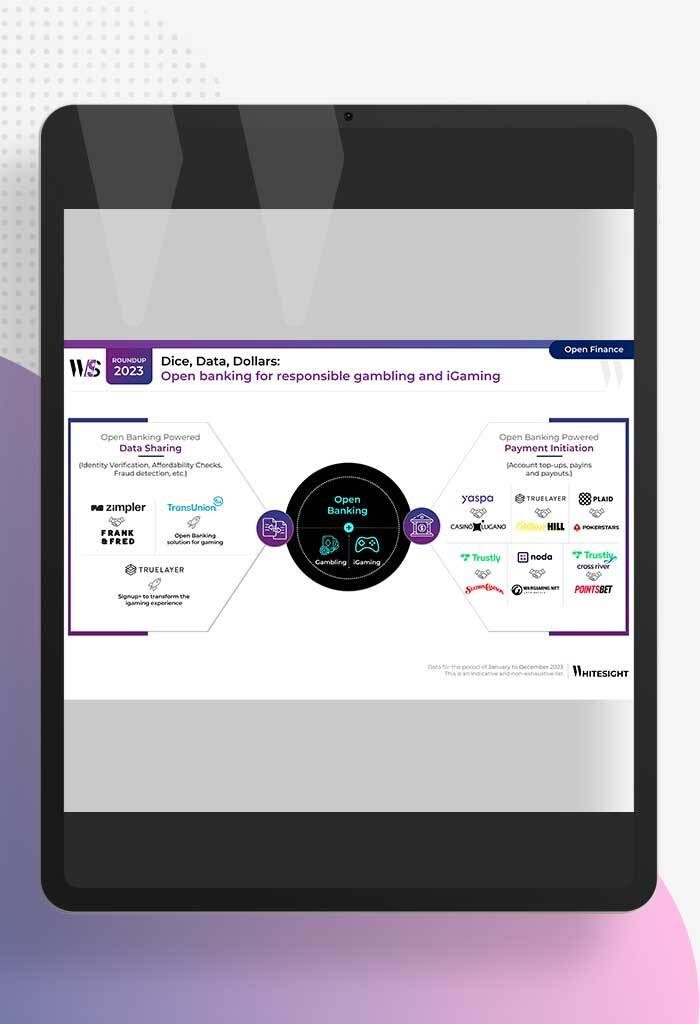

- Sanjeev Kumar and Risav Chakraborty

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

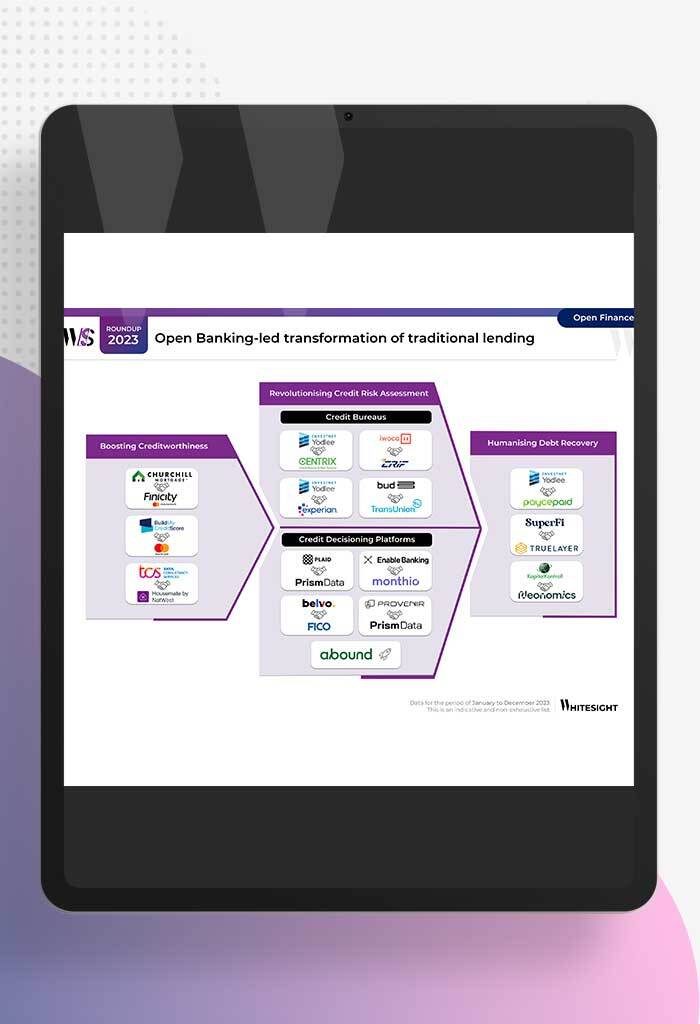

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

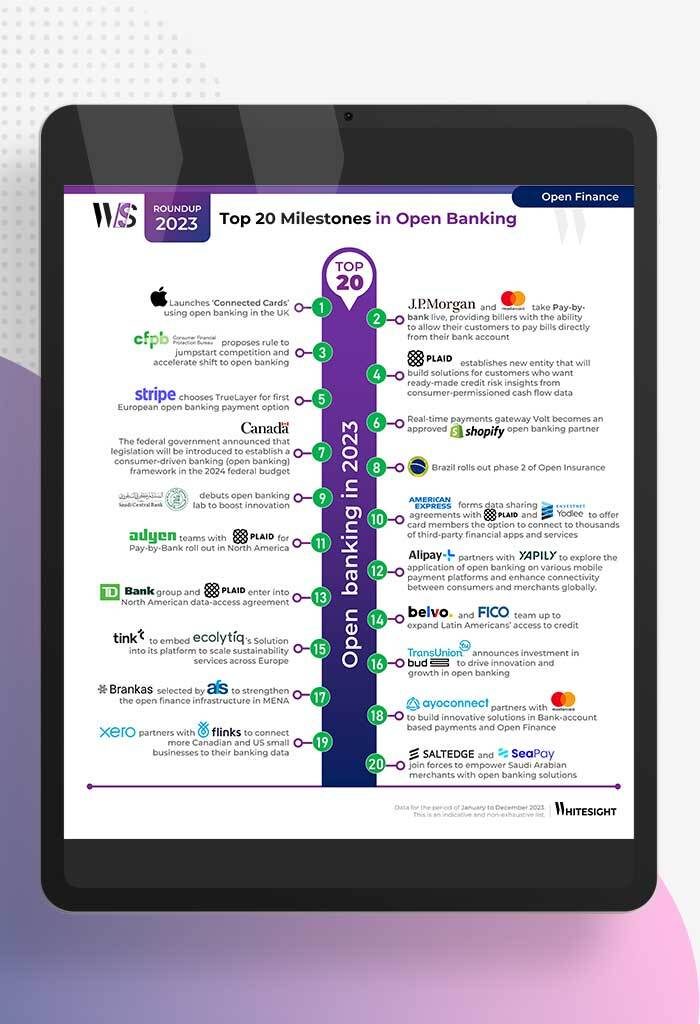

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...