2023 Roundup: Mortgage Makeover with Open Banking

- Sanjeev Kumar and Samridhi Singh

- 4 mins read

- Insights, Open Finance

Table of Contents

How Open Banking is Altering Australia’s Mortgage Mindset Forget the days of mountains of paperwork and endless phone calls for your dream home. Open banking, Down Under’s version called the Consumer Data Right (CDR), which was launched in 2020, is shaking up the mortgage industry in Australia. Open banking is no longer nibbling at the edges with budgeting apps and account aggregation. This is a full-blown transformation, going straight to the heart of mortgages and flipping the script on the entire industry value chain. Picture this: Australia’s A$2T ($1.4T) mortgage industry (that’s right, trillion with a T!) finally embracing the power of open banking. Banks, non-bank lenders, savvy mortgage aggregators, even your friendly neighbourhood broker – everyone’s jumping on the open banking bandwagon. They’re not just passengers, though – they’re actively driving a revolution that’s changing the way Australians think about and manage their mortgages. The Big CDR Push in the Mortgage Industry What are Digital Mortgage Platforms? Digital Mortgage Platforms are online systems set up by banks to make getting a mortgage quicker and easier. You can apply for a mortgage, upload documents, and even get approval, all online. These platforms use technology (Open Banking, Data Analytics, AI, etc.) to […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Risav Chakraborty and Kshitija Kaur

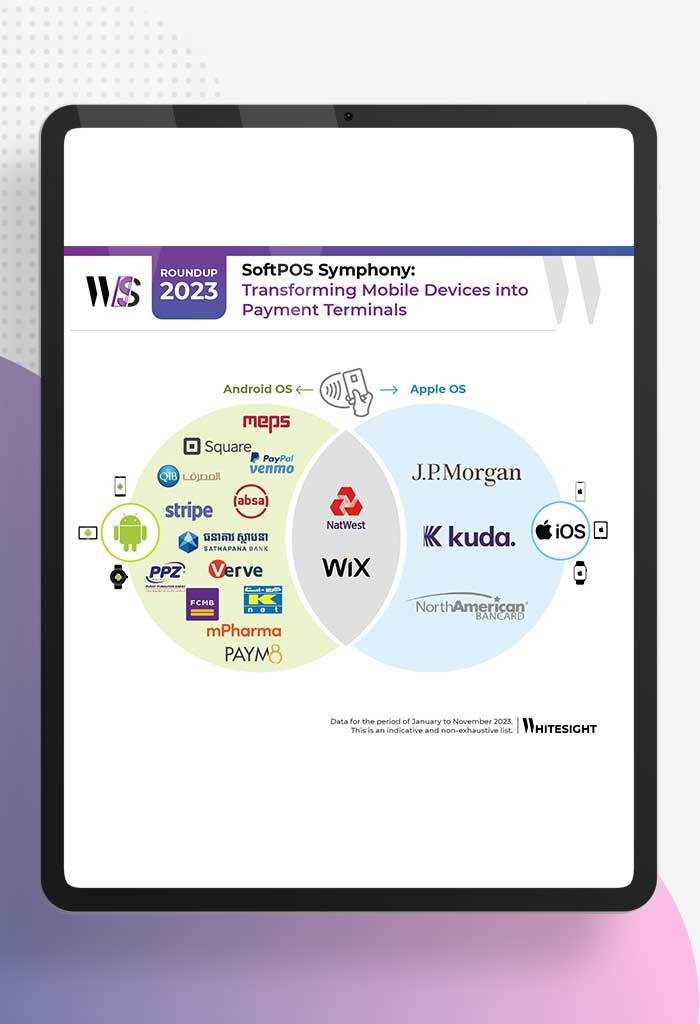

Tap to Pay and SoftPOS: Saving Lunch Breaks in 2023! In a world where our smartphones know our coffee orders...

- Samridhi Singh and Kshitija Kaur

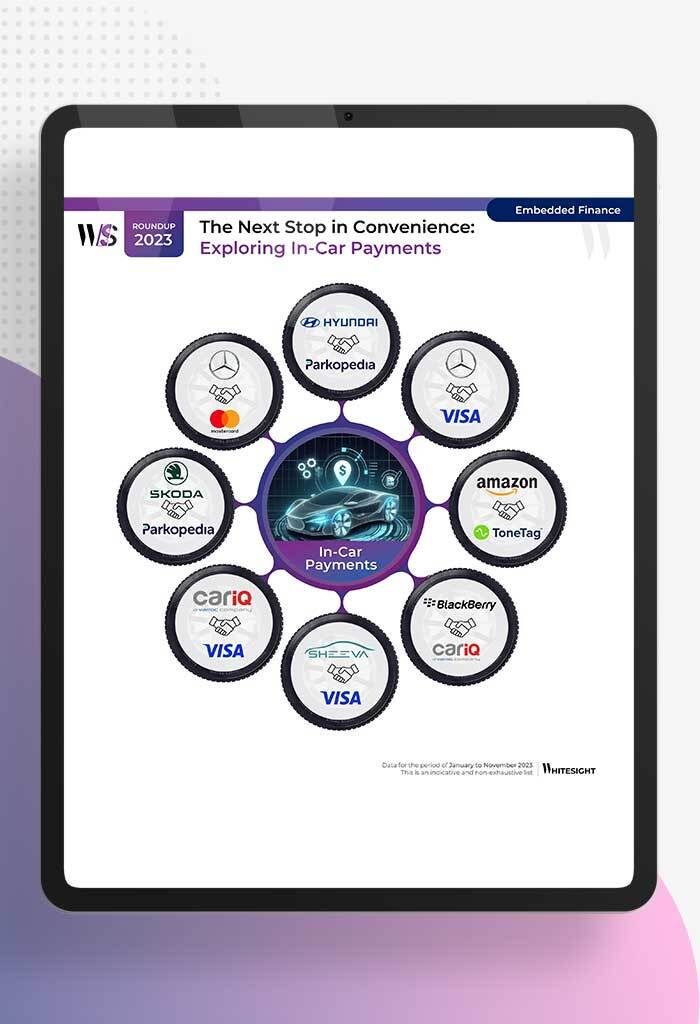

Car-venient Fintech: Buckle Up for In-Vehicle Payments! Ever binge-watched the futuristic Bond or Star Wars movies, marvelling at those high-tech...

- Samridhi Singh and Sanjeev Kumar

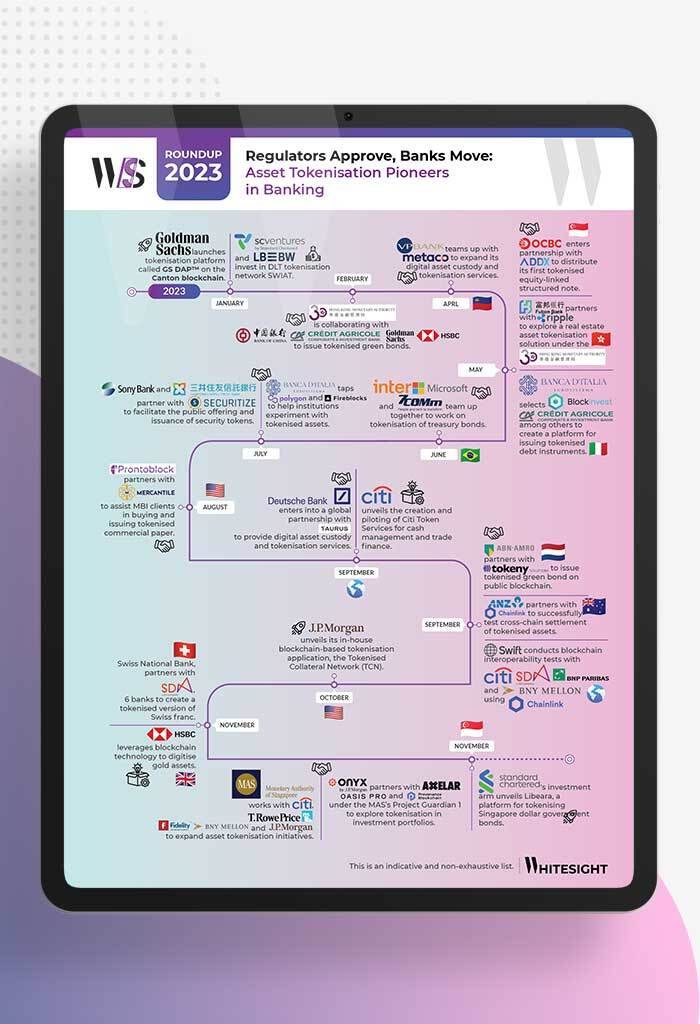

Snazzy Tokens, Real-world Impact: Welcome to Asset Tokenisation! As 2023 dawned, we saw several buzzwords from the crypto universe do...

- Kshitija Kaur and Risav Chakraborty

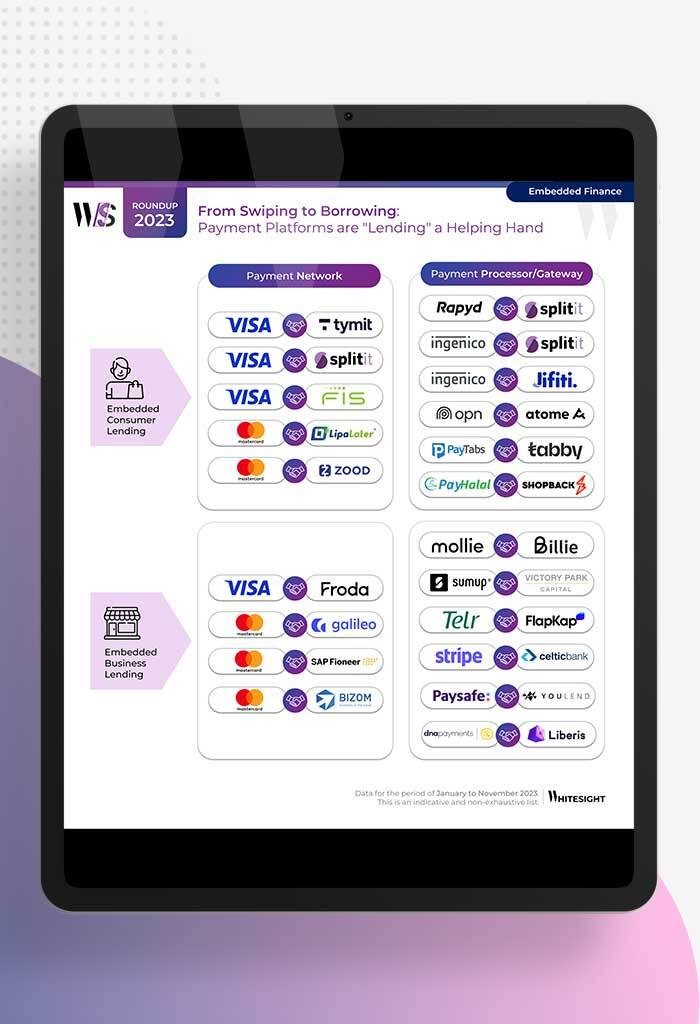

Payment Platforms’ New Side Hustle Remember when payment pros caught the digital payment craze during the pandemic? Well, as the...

- Risav Chakraborty and Sanjeev Kumar

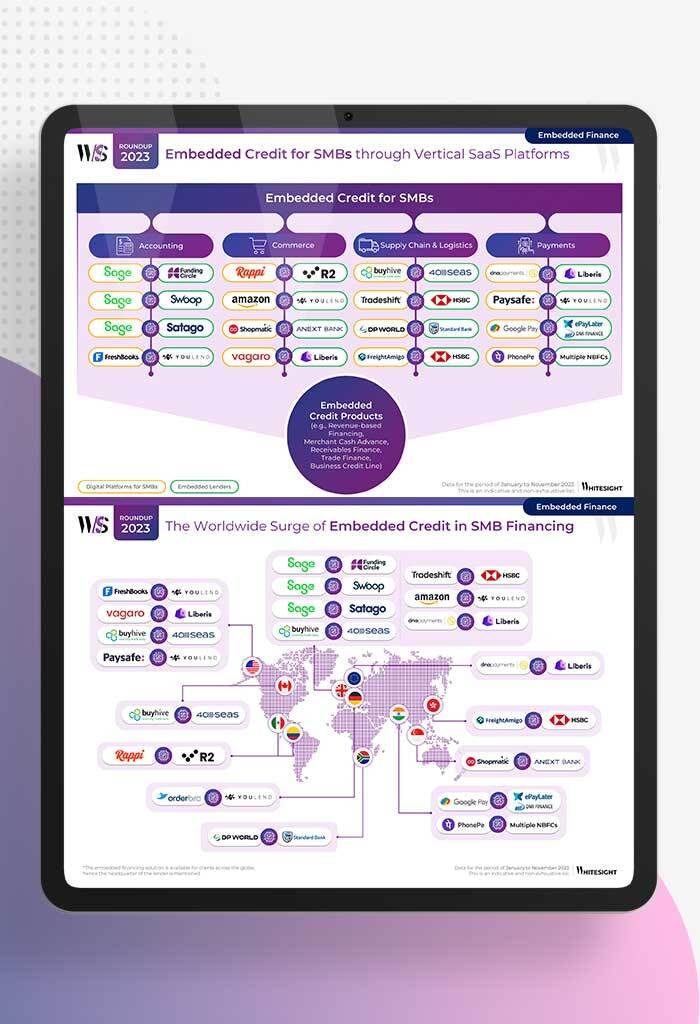

SMB Financing: Cat Bath or Credit Path? For small and midsize businesses (SMBs), trying to get a loan from traditional...

- Samridhi Singh and Kshitija Kaur

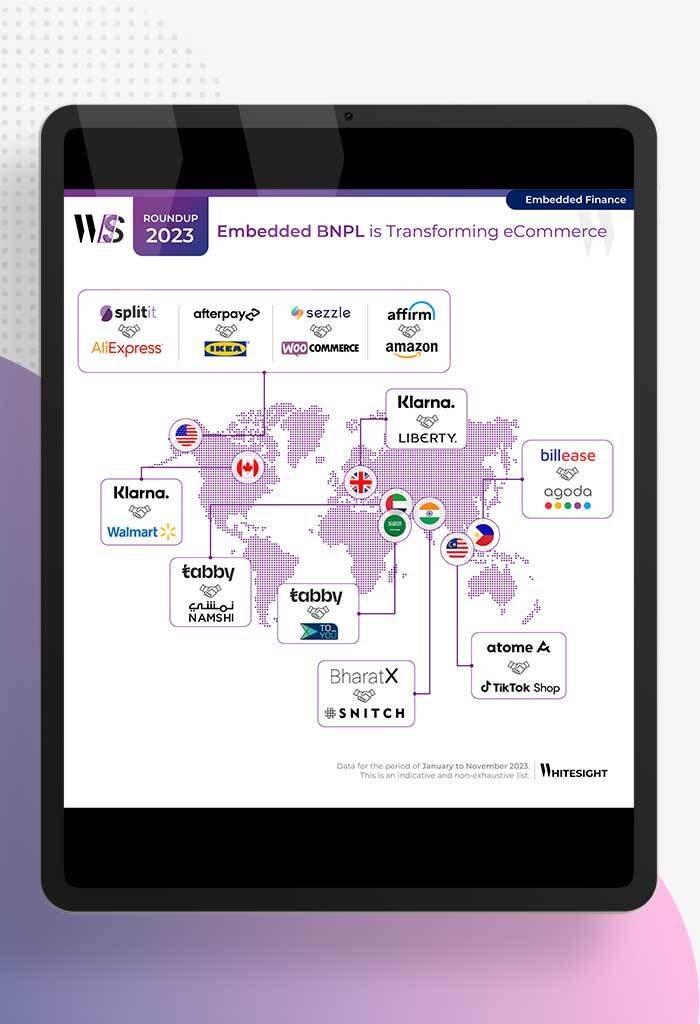

Swipe, Splurge, Savor: E-comm’s New Norm! What’s more fun than a Sunday shopping spree, right? Picture this: you on your...