Fintech Evolution: From Hustlers to License Holders

- Team WhiteSight

- 4 mins read

- Bank-Fintech Collaboration, Partnerships

Table of Contents

The Rise of Licensed, Scaled, and Regulated Fintechs

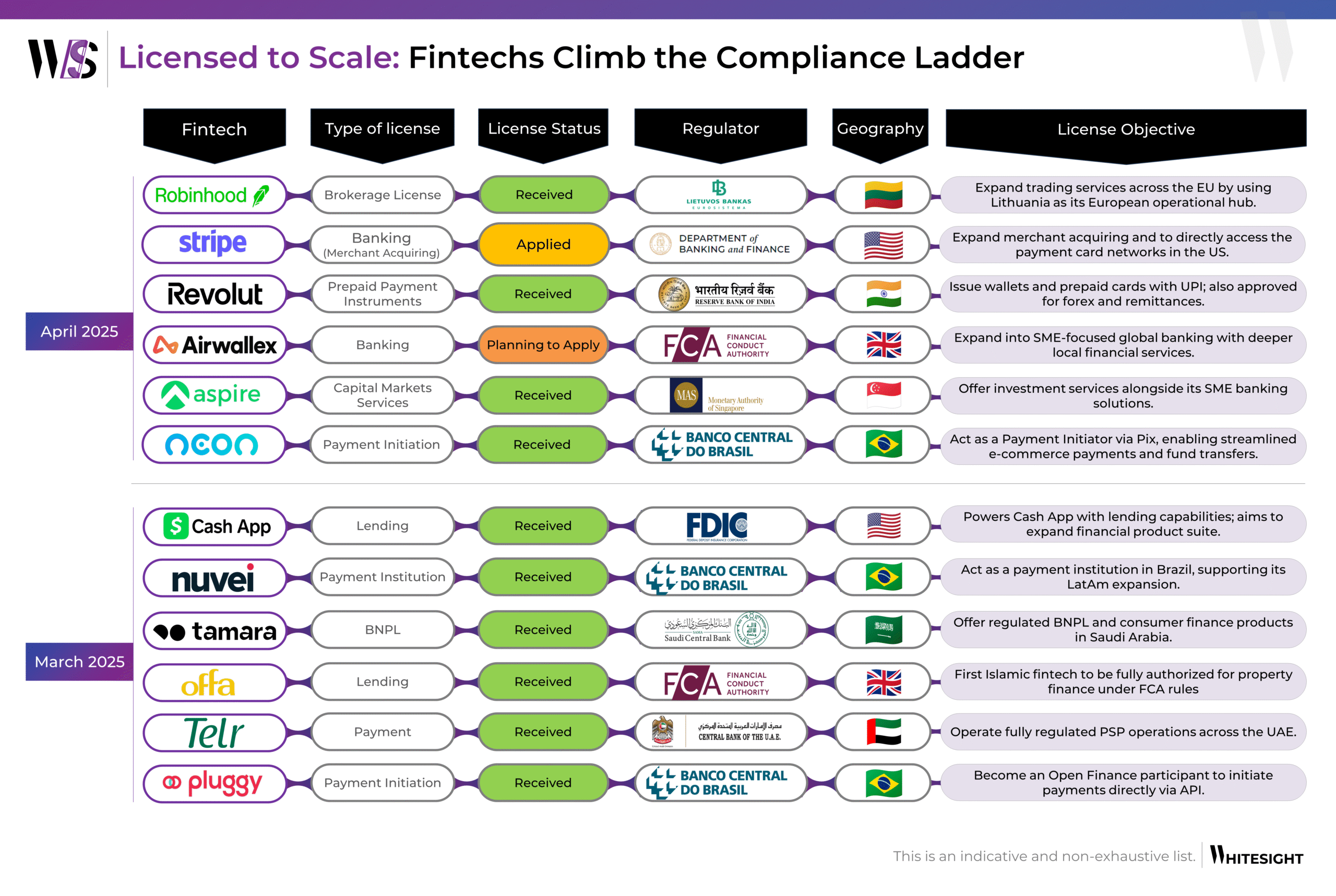

The global fintech industry is maturing, and its next phase of growth is being powered not just by tech innovation, but by regulatory ambition. In the race to become full-stack fintech powerhouses, more and more players are climbing what we at WhiteSight like to call “the compliance ladder.” But getting licensed is more than just ticking a regulatory checkbox; it’s a calculated move that often reveals the strategic DNA of the fintech itself.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

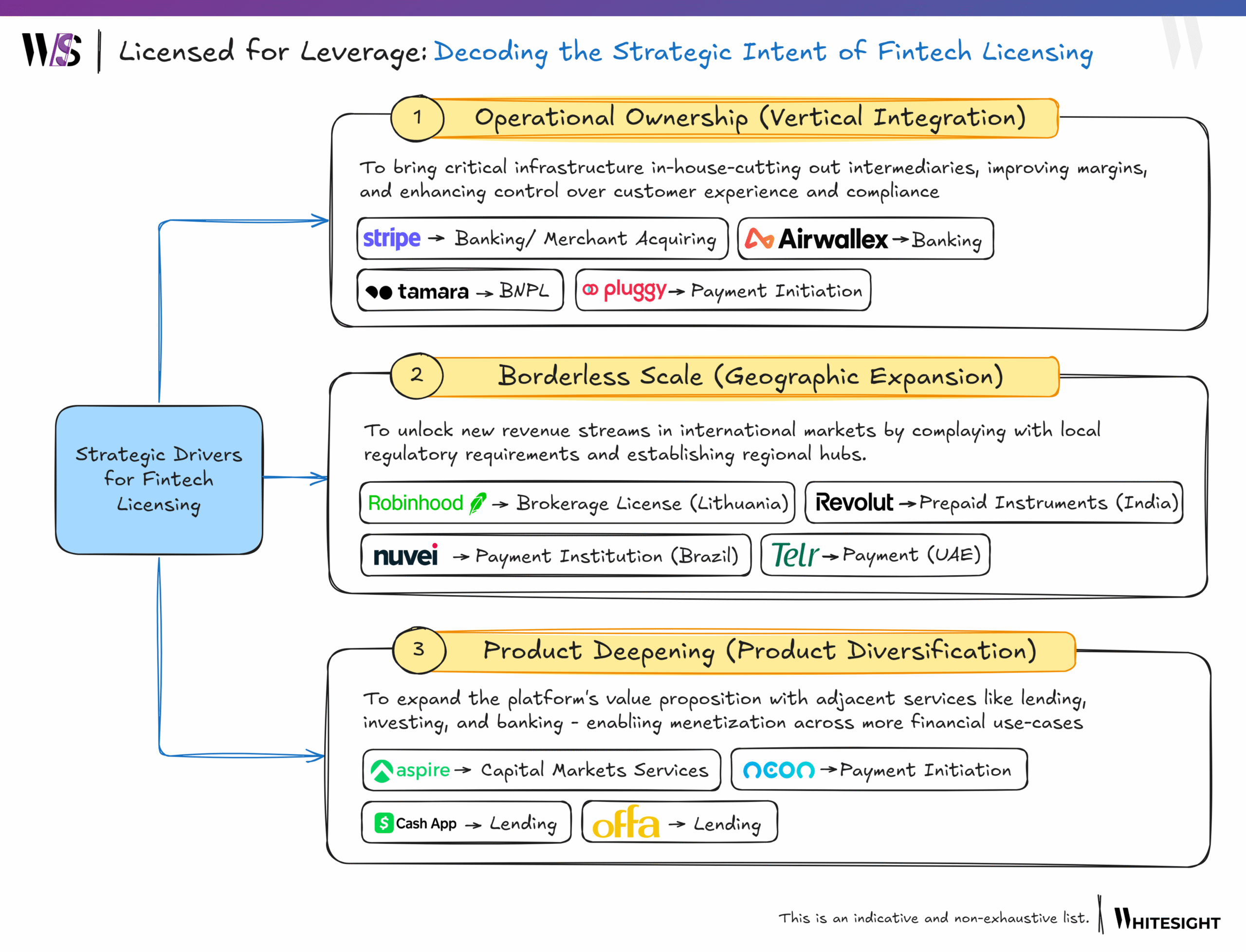

Licenses are not only legal tools – they’re leverage. Whether it’s controlling infrastructure, going global, or unlocking new product categories, fintechs are increasingly viewing licenses as strategic assets. We mapped recent moves into three core licensing strategies that fintechs are pursuing. Here’s how they break down:

Operational Ownership (Vertical Integration): Aiming for Control

For fintechs like Stripe, Airwallex, Tamara, and Pluggy, licensing unlocks ownership of the rails. It’s how they move from playing on the field to owning part of it. By cutting out intermediaries, these companies gain direct control over the customer experience, improve their margins, and enhance compliance. Whether it’s Stripe’s banking and merchant acquiring license or Airwallex’s banking license, these companies are focused on building their capabilities internally to streamline operations and boost profitability. These companies prioritize getting licenses first, setting the stage for deepening their services.

👉 Outcome: Greater control over operations, faster product launches, improved unit economics.

Borderless Scale (Geographic Expansion): Going Global

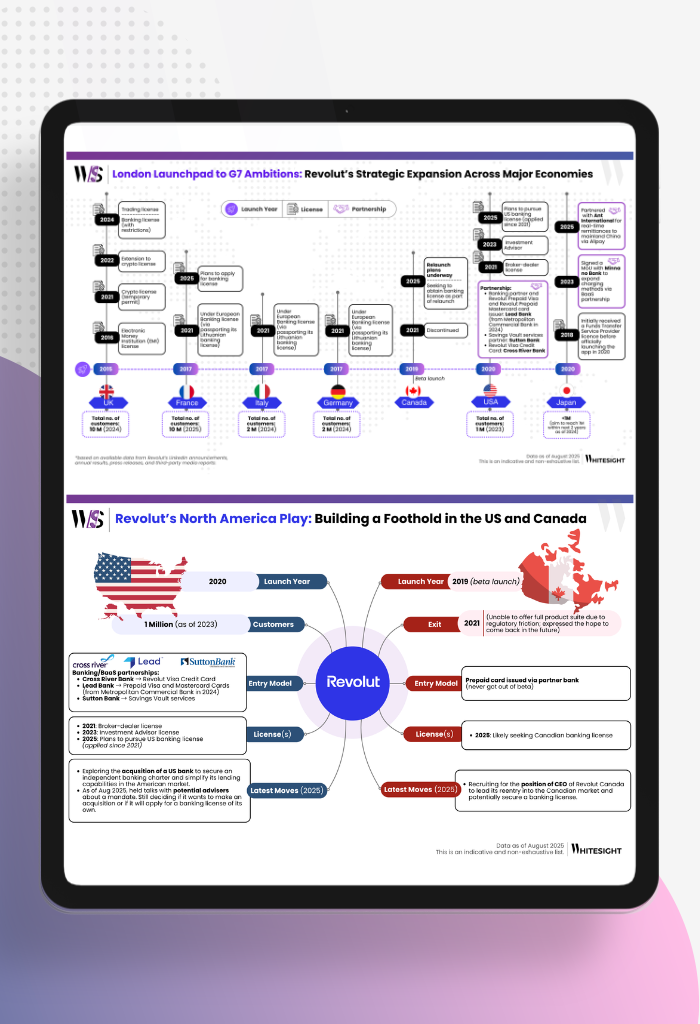

The next group of fintechs—Robinhood, Revolut, Nuvei, and Telr—seeks licensing as a gateway to expanding their geographic footprint. Robinhood, for instance, plans to use its Brokerage License in Lithuania as a launchpad for trading services across the European Union. Similarly, Revolut’s Prepaid Payment Instruments License in India is a crucial step towards scaling its global banking services, while Nuvei targets Latin American markets with its Payment Institution License in Brazil. This group demonstrates how licensing can open new international revenue streams while ensuring compliance with local regulations.

👉 Outcome: Market expansion, regulatory resilience, cross-border product growth

Product Deepening (Product Diversification): Expanding the Value Proposition

For fintechs like Aspire, Neon, Cash App, and Offa, the focus is on product diversification. These companies use licenses to deepen their offerings by adding new financial products – such as lending, investing, or payment initiation. Aspire, for example, has obtained a Capital Markets Services License to offer investment services alongside its SME banking solutions, while Cash App aims to add new lending capabilities with its Lending License. This category highlights how fintechs are leveraging licenses not just for operational scale, but for broadening their customer-facing product portfolios.

👉 Outcome: Full-suite product offerings, increased lifetime value, and ecosystem moat.

Why This Matters: Regulation Is the New Rail

Fintechs have flipped the script – regulation is now part of the blueprint, not the barrier. A blueprint of trust, control, scale, and product innovation. Whether it’s Stripe insourcing banking licenses, Robinhood setting up shop in Europe via Lithuania, or Neon doubling down on payments infrastructure in Brazil, one thing is clear: Licenses look like compliance. They act like weapons.

Just as fintech startups evolved from monoline niche products to multi-product platforms, expect them to license-stack across jurisdictions and sectors—payments in one market, lending in another, banking in a third. We’re entering an era where the fastest-growing fintechs would most likely be the most licensed ones.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

Authors

Curious minds uncovering valuable insights, united by their love for fintech. | hello@whitesight.net

Curious minds uncovering valuable insights, united by their love for fintech.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty