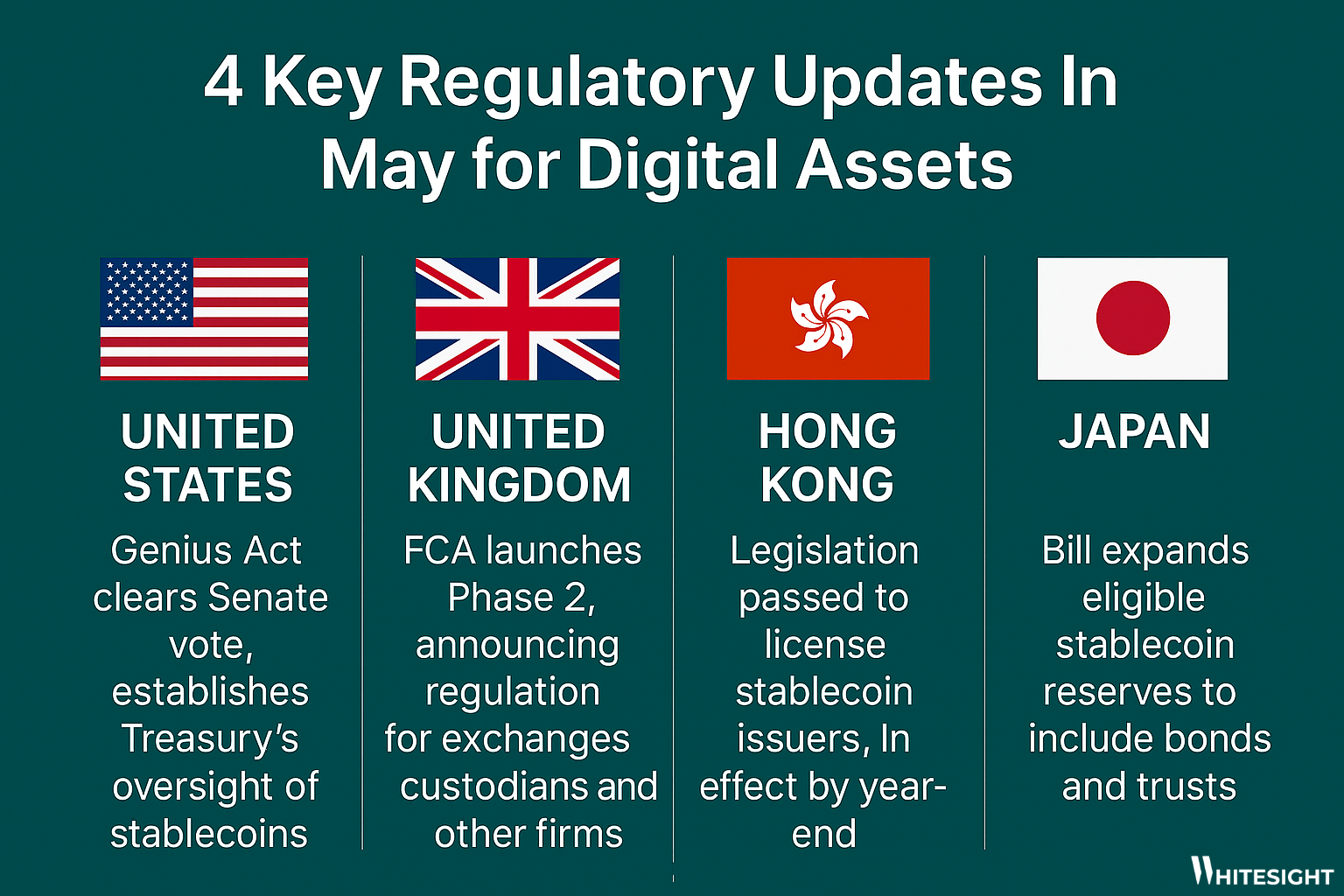

4 Regulatory Updates in May for Digital Assets

Four Economies Are Laying the Ground for Stablecoin Legitimacy

May brought a wave of pivotal developments in the regulatory frameworks for digital assets, spotlighting a notable convergence: heightened scrutiny and formalization of stablecoin oversight across jurisdictions.

- In the United States, the Genius Act’s Senate clearance is a landmark move, granting the Treasury a central role in supervising stablecoins, signaling a shift toward federal-level policy coherence amid fragmented state approaches. This paves the way for institutional entry by reducing ambiguity around permissible stablecoin issuers and structures.

- The UK’s FCA, by entering Phase 2 of its digital asset regime, is reinforcing its ambition to make the country a competitive yet safe crypto hub. The move to regulate custodians and exchanges expands the perimeter of oversight beyond token issuance to critical infrastructure providers, elevating compliance expectations and fostering institutional trust.

- Hong Kong’s legislation mandating licensing for stablecoin issuers (effective year-end) is another calculated step in reclaiming fintech leadership in Asia. The regime promotes accountability while signaling openness to regulated Web3 innovation.

- Japan‘s expanded definition of eligible stablecoin reserves to include bonds and trusts is a prominent development in enabling traditional finance integration. This evolution supports new stablecoin constructs backed by diversified, yield-generating assets—critical for fintechs eyeing compliant, capital-efficient models.

Together, these developments suggest a maturing digital asset environment where regulatory clarity becomes a competitive advantage.

Don’t want to miss the next big thing in digital assets?

Our monthly Digital Assets newsletter unpacks the latest across stablecoins, tokenization, crypto trading, and global regulations—all in one punchy read. Perfect for staying ahead of the curve without the scroll fatigue.

Read the latest issue and subscribe to catch the next drop this week!

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts