A Decade of Digital Banking: Revolut vs Monzo

A Look at the Core Financial Metrics and Monetisation Levers

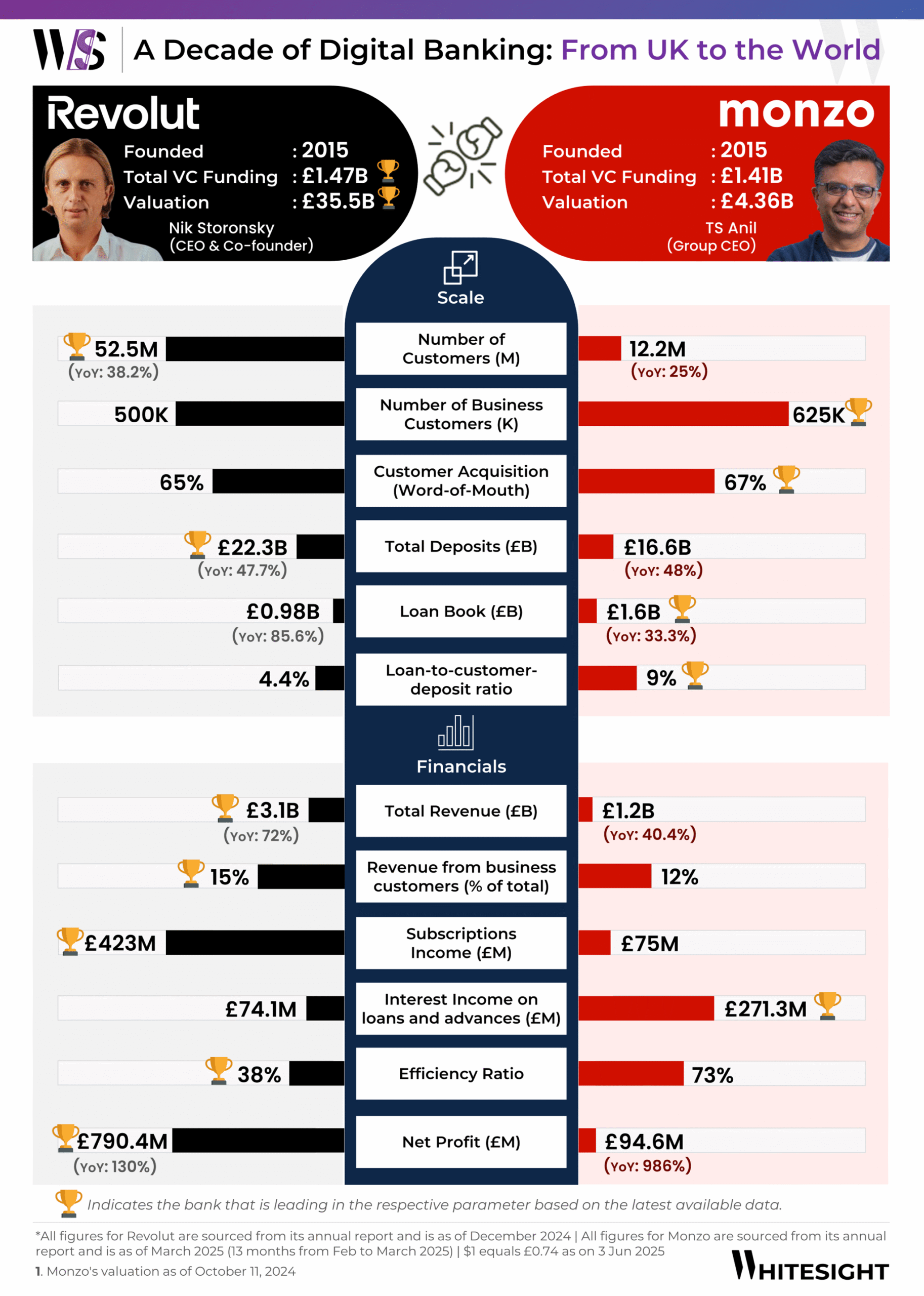

A decade since their founding, Revolut and Monzo have shaped two distinct arcs in digital banking. While one scaled globally through product breadth, the other deepened domestically with focused execution. Together, they now reflect how digital banks are maturing into full-stack, revenue-driven financial platforms.

Both players have spent the decade scaling, and the results now reflect deliberate strategic direction.

- Revolut continues to scale horizontally, now with 52.5M users and operations spanning dozens of markets. Its focus on product breadth, from crypto, stock trading, and subscription plans, has enabled layered monetisation, reflected in a substantial £3.1B revenue and £790M profit. The company’s expansion mirrors a shift from a single-purpose digital bank to a global financial superapp.

- Monzo, on the other hand, has deepened vertically within the UK, focusing on lending (loan book: £1.6B), strong unit economics, and a UX-centric consumer model. Now actively entering the EU and US markets, it’s building on high customer affinity and a strong word-of-mouth loop (67%).

Both players are now converging on business banking, lending income, and subscriptions, marking a turning point where neobanks evolve from disruptors to diversified digital finance platforms. The playbooks may differ, but the signals point to growing operational depth and ambition on both sides.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts