Stripe vs. Adyen: The Operating System for SMB Embedded Finance

Shaping the Future of SMB Money Flows

Adyen and Stripe, long celebrated for reshaping digital payments, are building something bigger beneath the surface. These are no longer just payment processors. They are becoming embedded finance powerhouses, rewiring how platforms and marketplaces offer credit, accounts, and cards to SMBs.

Platforms, Marketplaces, and B2B Embedded Finance

Platforms and marketplaces serving small and medium-sized businesses (SMBs) are undergoing a structural shift. Traditionally, these entities acted as software providers or intermediaries facilitating commerce. Today, they are becoming financial enablers, embedding credit, accounts, and card solutions directly into the workflows of the SMBs they serve.

- Software Platforms (Vertical SaaS): Companies delivering either industry-specific (vertical) or cross-industry (horizontal) SaaS solutions that integrate financial services into core workflows.

- Vertical examples include construction SaaS (Procore), restaurant management tools (Toast), and salon/spa software (Mindbody).

- Horizontal examples include accounting platforms (QuickBooks, Xero), invoicing solutions (FreshBooks, Zoho Invoice), and ERP suites (NetSuite, SAP, Zoho).

- Marketplaces: Digital ecosystems connecting buyers and sellers, often managing multi-party payments and delivery needs. Examples include e-commerce marketplaces (Amazon, Etsy), food delivery networks (DoorDash, Deliveroo), and quick commerce providers (Gorillas, Getir).

- SMBs: The end users leveraging these platforms and marketplaces to run their businesses, increasingly expect working capital, faster payouts, and spend controls integrated into their existing tools.

This triad, i.e. Payment Processors, Platforms/Marketplaces, and SMBs, forms the backbone of the embedded finance ecosystem. Payment processors like Adyen and Stripe are moving beyond payment rails into full-stack financial infrastructure. Platforms and marketplaces are embedding these capabilities to create new revenue streams and deepen user engagement. SMBs benefit from improved liquidity, operational efficiency, and simplified financial management.

Value Exchange Across the Embedded Finance Chain

Embedded Finance Becomes the Core Stack

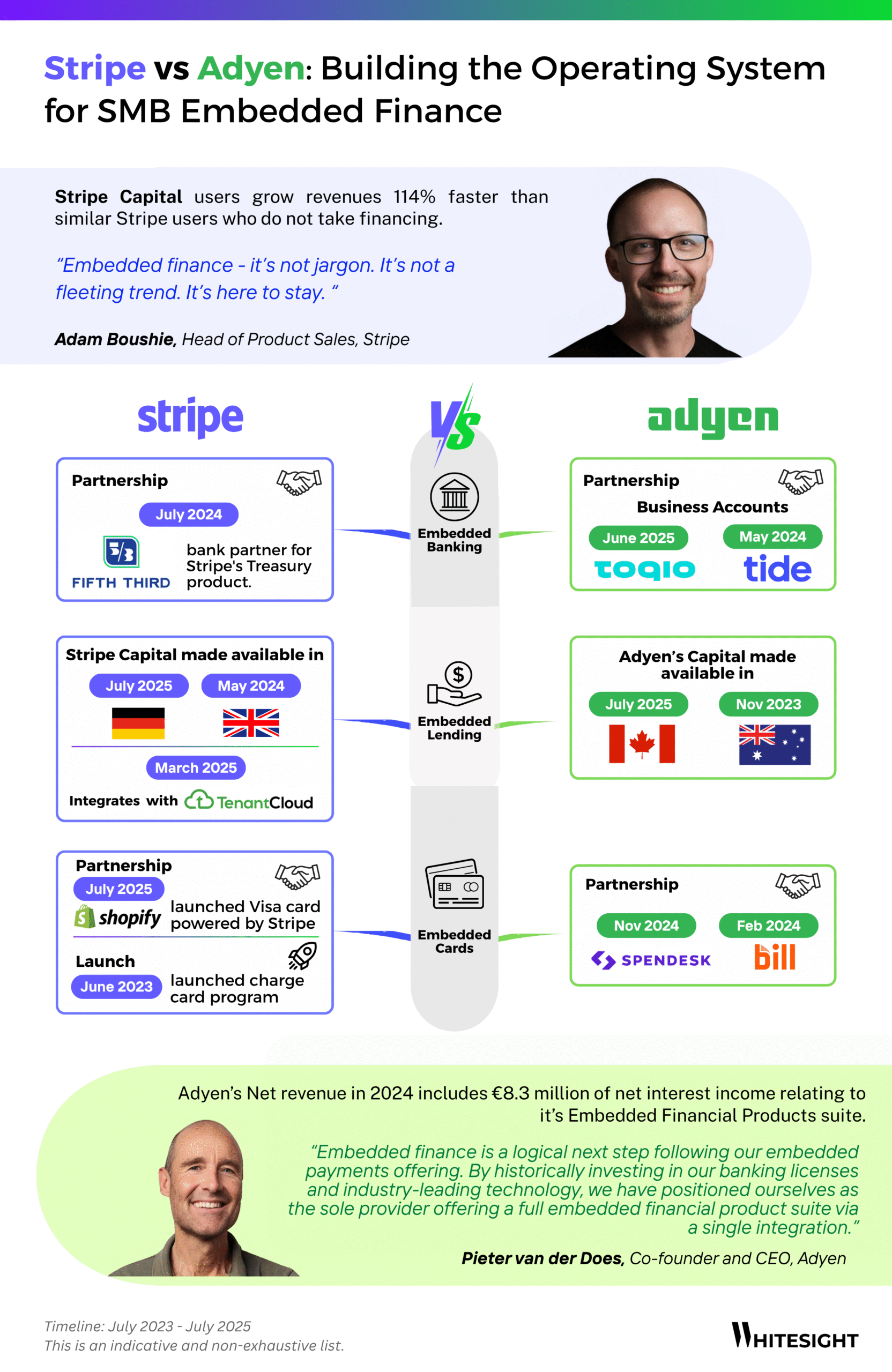

Stripe Capital users grow revenues 114% faster than similar Stripe users who do not take financing. Adyen’s Platforms’ net revenue grew 63% YoY, reaching €55.5 million, reflecting strong momentum in the SaaS segment and the increasing appeal of its embedded financial products offering. Why now?

Because the old platform model – collect fees, process payments – is no longer enough.

Today’s platforms are stepping deeper into the financial lives of their users, i.e. merchants and sellers. They are offering credit linked with payouts. Issuing cards to manage spending. Powering embedded accounts for faster access to funds. Managing treasury flows natively, without sending businesses elsewhere.

Embedded finance is helping platforms unlock new revenue, increase user retention, and extend their influence into core money movement. For Stripe, this shift means more surface area for product expansion. For Adyen, it strengthens the value of its all-in-one stack. In both cases, embedded finance is reshaping how platforms grow, what they monetise, and how they compete.

Stripe: Infrastructure Built for Platforms

Stripe’s embedded finance approach focuses on modular systems that let platforms build quickly and expand flexibly.

Stripe Capital is gaining ground across geographies. After rolling out in the UK during mid-2024, the offering reached German SMBs by 2025. Partner platforms like TenantCloud enabled credit access right where users operate, without additional friction or lift.

Card issuance follows a similar pattern. Shopify introduced Visa business cards in 2023 through Stripe. Shortly after, a global charge card product entered the market. Stripe operated the full stack – risk, compliance, and distribution – while platforms controlled the experience.

Banking capabilities advanced with Fifth Third Bank joining Stripe’s network in 2024. This allowed embedded accounts, payouts, and money management within US platforms. Stripe delivered the rails, while platforms stayed in control of user-facing experiences.

The product structure allows platforms to adopt individual components – capital, cards, accounts – based on need. By letting platforms pick the features they need and roll them out independently, Stripe is positioning itself as the plug-and-play financial layer for software businesses globally.

Adyen: Full Control Through One Stack

Adyen’s strategy focuses on integration depth and control. The entire stack – issuing, lending, banking – is built in-house and delivered through a single platform.

Adyen Capital expanded to Australia in 2023 and reached Canada by mid-2025. These launches used real-time transaction data for underwriting, removing reliance on third-party inputs. In February 2025, Adyen introduced a low-code SDK that lets platforms offer cash advances with limited development work.

Card products followed suit. Spendesk and BILL leveraged Adyen’s infrastructure to launch and manage corporate card programs. Expense controls, real-time data, and compliance all ran through Adyen’s systems.

In the banking segment, partners like Toqio and Tide rolled out embedded treasury and business account features. With Adyen powering account creation, transfers, and business credit, platforms expanded their offerings without additional vendor layers.

By managing every part of the infrastructure, Adyen is delivering consistency, fewer dependencies, and stronger operational alignment. This gives clients one contract, one system, and complete coverage.

Market Forces Driving the Shift

Several external forces are reinforcing this move to embedded finance.

Efficiency Becomes Strategy

SaaS platforms are moving away from burn-driven growth. They are building margin by embedding financial features into existing workflows – turning credit, card spend, and fund movement into revenue drivers.

SMBs Expect Financial Flexibility

Small businesses are expecting speed, simplicity, and tighter control. Platforms that are offering embedded lending, faster payouts, and spend tools are creating stronger user relationships and better monetisation pathways.

Geographic Expansion Picks Up Pace

Both Stripe and Adyen are launching embedded finance products across regions at a faster pace than legacy players. With licenses, regulatory clarity, and payment infrastructure already in place, they are widening their lead in international distribution.

Execution Strategy: Contrast and Clarity

While both companies target the same space, their execution styles remain distinct.

Adyen is integrating everything in one motion. Clients like Tide and Spendesk are adopting lending, cards, and accounts through a single build. This creates tighter relationships and operational simplicity.

Stripe is letting clients go step-by-step. A platform might start with issuing, test lending later, and expand into banking once the use case is mature. That modularity is opening Stripe to developer-led teams, marketplaces, and global SaaS players looking for flexibility.

Both companies are deepening their grip, but they are choosing different lanes. Stripe is winning where speed and optionality matter. Adyen is gaining share where control and consolidation drive the decision.

What Comes Next

For platforms and marketplaces, embedded finance is becoming a core strategic lever for margin expansion and customer retention. Payment processors will compete not on payment fees but on how well they power end-to-end financial ecosystems. SMBs will increasingly choose platforms not just for software utility but for the financial lifeline embedded within them.

The winners will be those who treat embedded finance not as a product suite, but as the operating system for SMB economic activity.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts