Banks in Europe Go Big on Digital Assets

How Banks Are Embracing Crypto & Tokenization

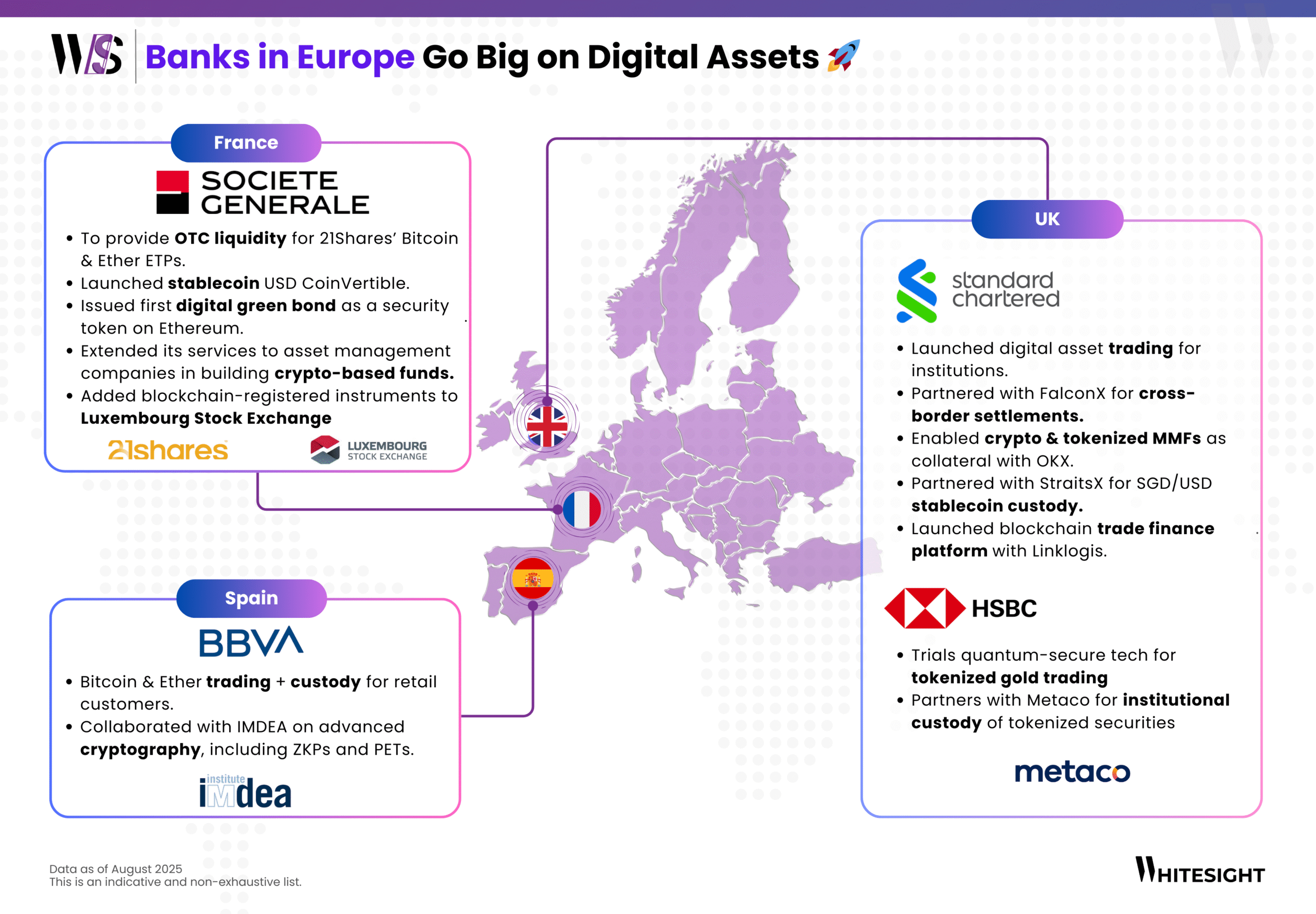

A new phase of European banking is unfolding in digital assets. Europe’s leading banks are moving beyond traditional balance sheets, making bold strides into the world of digital assets.

The US is racing ahead with stablecoins, Asia is testing blockchain for bonds and settlement, and Europe is often dismissed as the region that regulates too tightly and moves too slowly. That perception has become hard to ignore, and it is pushing banks to show they can keep up.

Inside Europe’s banks, the pressure is just as real. Traditional revenues are thinning, costs from old settlement and reconciliation systems remain heavy, and clients expect more speed and safety than legacy processes can offer. In tracing recent developments, what stands out is that tokenized bonds, custody, and settlement are not headline-chasing moves. They are early signs of how Europe is testing whether it can adapt to digital assets without losing its reputation for stability.

Why now?

Two forces are pushing Europe forward. Externally, global rivals are locking in strategies that leave little room for neutrality. Washington is betting on private stablecoins. Beijing has outlawed crypto markets in favour of its state-led e-CNY. Europe has chosen a harder path: building both a digital euro and a regulated framework for private issuers. That duality may look slow, but it creates optionality in a system where no single model has yet proven durable.

Internally, the calculation is strategic. By anchoring custody inside banks, experimenting with tokenized issuance, and testing faster settlement, Europe is stress-testing whether its banks can still shape financial infrastructure in a world where alternatives are multiplying.

How banks are moving

Trading and Market Access

Trading is the entry point. Spain’s BBVA opened retail trading and custody for Bitcoin and Ether, offering customers a regulated alternative to offshore exchanges. In the UK, Standard Chartered is building institutional access by partnering with FalconX and OKX to handle block trades and liquidity. The contrast shows two ends of the spectrum: retail adoption in Spain and institutional scale in the UK. Both approaches converge on the same objective – reclaiming trading flows that had drifted outside the banking system and bring them back under regulated oversight.

Custody as the Foundation

Custody is emerging as the anchor service. HSBC is working with Metaco on institutional custody of tokenized securities, while Standard Chartered has added stablecoin custody with StraitsX. BBVA bundled custody into its retail crypto offering. Custody matters because it restores trust after years of exchange collapses and counterparty risk. Banks also have a natural edge here: strong capital requirements, established compliance systems, and long-standing client trust. Whoever secures custody is positioned not just to hold assets but to become the primary channel for flows into other digital products.

Tokenization of Assets

France’s Societe Generale issued a digital green bond on Ethereum and worked with Luxembourg Stock Exchange to test blockchain-registered instruments. HSBC piloted tokenized gold trading for its institutional clients. These are early examples, but they point to a larger shift. Tokenization allows faster issuance, real-time tracking, and wider distribution. For Europe, where markets are fragmented across countries, tokenization is not only about efficiency but also about creating shared rails that reduce friction in cross-border issuance.

Settlement and Infrastructure

Standard Chartered has been building blockchain-based settlement solutions for trade finance and capital markets. By replacing T+2 norms with near-instant settlement, the bank aims to reduce reconciliation costs and free up trapped liquidity. These initiatives target the hidden cost layers of finance. Corporates gain faster access to working capital, while banks reduce operational drag and credit risk. Europe’s settlement experiments may not draw headlines, but they could position the region as an infrastructure hub if execution scales successfully.

Cryptography and Research

BBVA is backing research with IMDEA into zero-knowledge proofs and privacy-preserving technologies. This is not about immediate customer products but about preparing for a regulatory environment where compliance and privacy will both be demanded. By investing early, banks buy a stake in the future of secure and scalable digital identity, positioning themselves for the next wave of requirements.

The Emerging Pattern

- Trading pulls client activity back into regulated channels.

- Custody restores trust and positions banks as gateways.

- Tokenization accelerates issuance and creates new liquidity.

- Settlement addresses inefficiency in the financial plumbing.

- Cryptography builds readiness for future compliance demands.

Each initiative ties directly to a weakness in current banking systems rather than chasing speculative narratives.

The beneficiaries differ by layer. Retail clients gain safer access through banks like BBVA. Institutional investors gain trusted custody and liquidity from players like Standard Chartered and HSBC. Issuers gain faster, cheaper issuance through tokenization pilots in France. Corporates gain efficiency from settlement tools in London. Regulators gain visibility and control across the system.

Europe is not trying to mimic the US or Asia. The US has turned digital assets into mainstream investment products. Asia is using tokenization to accelerate bond markets and settlement systems. The region is focusing on infrastructure and regulation-led adoption. Its banks are not adopting digital assets to compete with crypto, but to replace broken processes inside their own systems.

That is the distinct path Europe is carving. The bigger story is how Europe is using digital assets to stress-test its own banking model. Every initiative is less about chasing new revenue and more about proving that banks can still be the architects of financial infrastructure in an age where alternatives are multiplying. If this path holds, Europe will show that digital assets can be absorbed into banking without breaking the system.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts