Beyond Single Verticals: Mexico’s Digital Banks Expand Their Horizons

Converging toward full-stack and multi-product ecosystems

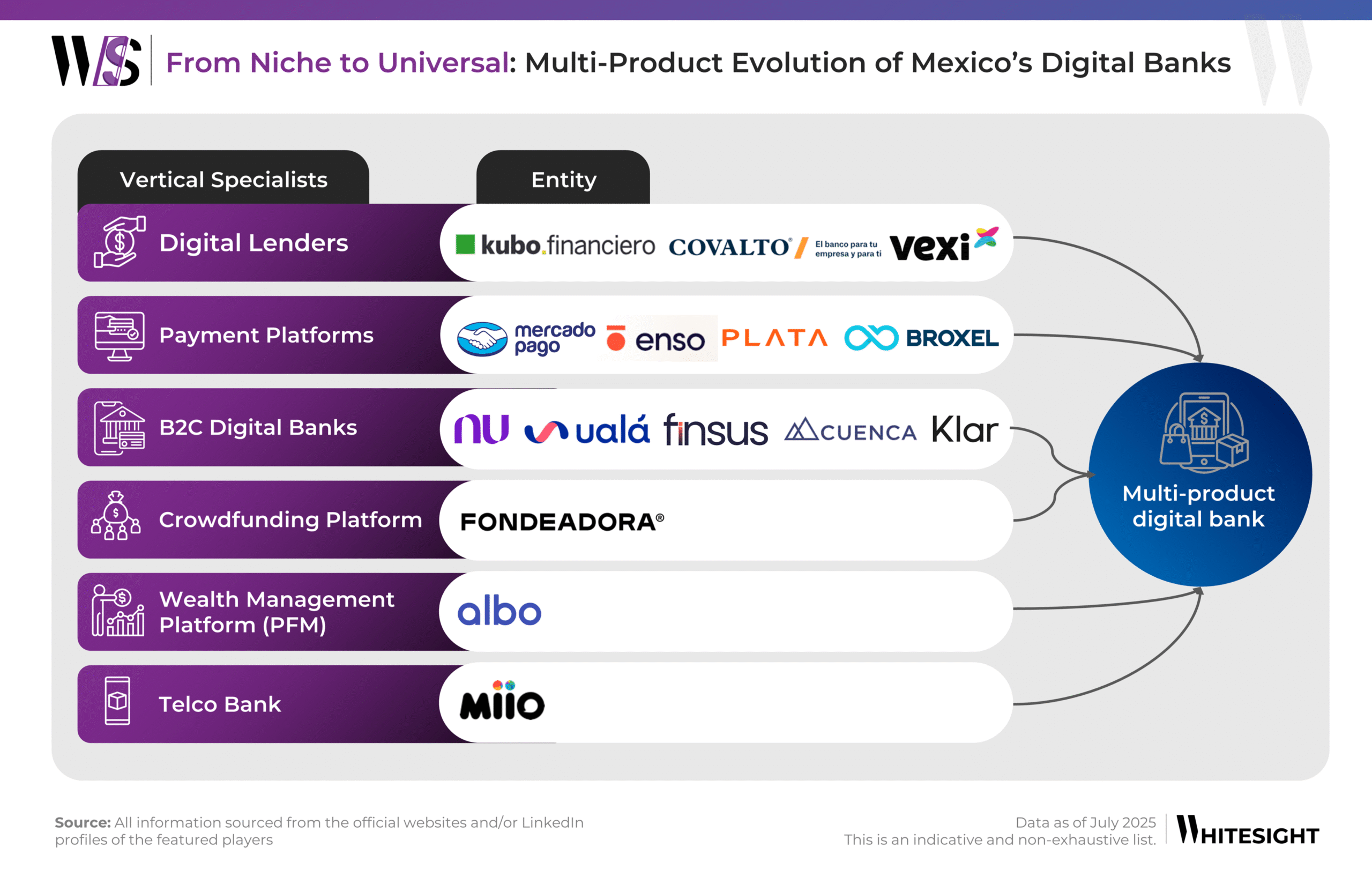

Mexico’s digital banking sector is entering a new phase where once-vertical fintech specialists are evolving into holistic, multi-product digital banks. This shift marks a deliberate move to build full-stack platforms that can serve as comprehensive financial ecosystems, responding to user demand for integrated, financial management and aiming to compete head-on with entrenched incumbents.

- Convergence of verticals into full-stack models: Mercado Pago and Broxel are expanding beyond payment processing into wallet-based banking and credit services, while Kubo Financiero and Vexi are layering savings and payment functionalities onto their lending core. Fondeadora, which began as a crowdfunding platform, has transitioned into offering full checking accounts and debit products. Together, these moves signal a clear trajectory: vertical specialists are consolidating into universal digital banks to serve broader financial needs under one roof.

- A user-driven product expansion strategy: Nu Mexico, Ualá, and Klar are building out end-to-end financial experiences that combine credit, savings, and payments, responding to user demand for integrated management in a fragmented market. By embedding multiple services within a single platform, these players are increasing customer stickiness and creating powerful cross-sell engines that align with Mexico’s underbanked dynamics.

- Competitive dynamics reshaping market structure: The race is intensifying as Plata, Enso, and Cuenca push into new product categories, while incumbents like Albo and Miio accelerate their roadmaps to stay relevant. This shift toward universal banking models is driving a wave of licensing upgrades; players such as Klar are seeking full banking charters to unlock broader capabilities, signaling that regulatory flexibility is becoming as critical as product innovation in shaping market dominance.

For stakeholders, this trend signals more than just product diversification; it reflects the emergence of platform-driven financial ecosystems built to capture lifetime value. As digital banks shift from serving single-use cases to orchestrating comprehensive financial journeys, they are positioning themselves not only as service providers but as primary financial hubs in a country where trust and convenience drive adoption.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts