Breaking Down JPMD, JPM Coin, and Stablecoins

The Convergence of Banking and Blockchain

Liquidity flows where confidence sits. And right now, JPMorgan is positioning itself at that intersection – reshaping how digital dollars are built, regulated, and deployed at scale.

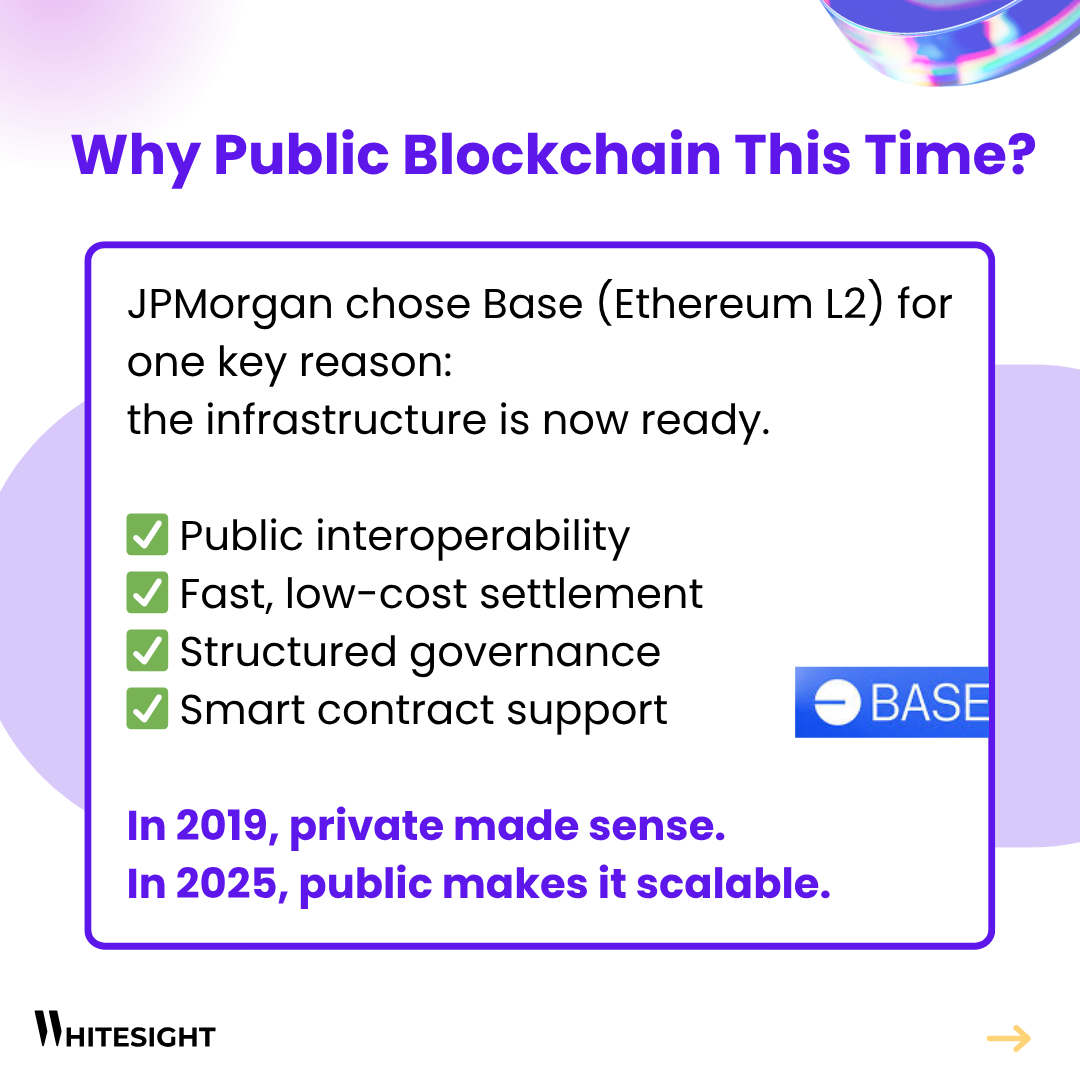

The launch of JPMD, a tokenized bank deposit issued on Base (an Ethereum Layer 2), signals more than an infrastructure upgrade. It marks a strategic shift. For institutions that have watched the crypto world from a cautious distance, this is not a tentative test. It’s a full step into programmable money, done on public rails, under the rules of traditional banking.

Stablecoins are not being sidelined in this story. If anything, they set the tone. JPMD learns from their speed, their flexibility, and their composability. But it doesn’t stop there. It builds in the regulatory muscle, governance logic, and operational guardrails that banks need, not just to experiment, but to transact with intent.

What JPMD is, and why the structure matters

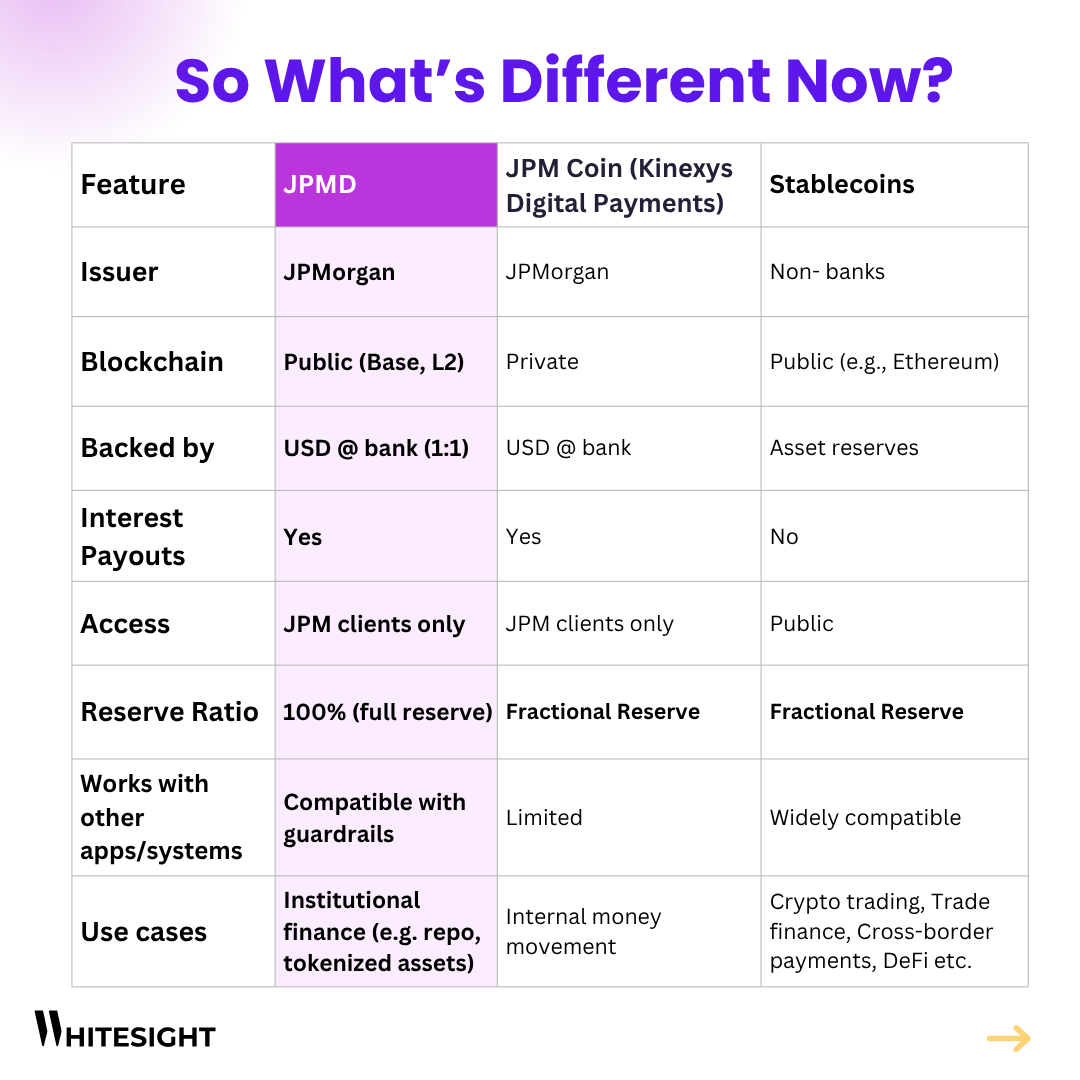

- JPMD is a tokenized version of a real-world bank deposit. It represents US dollars held at JPMorgan, issued to a permissioned group of institutional clients. It lives on Base, which means it can plug into Ethereum-based financial tools and applications. But it remains gated in terms of access and usage.

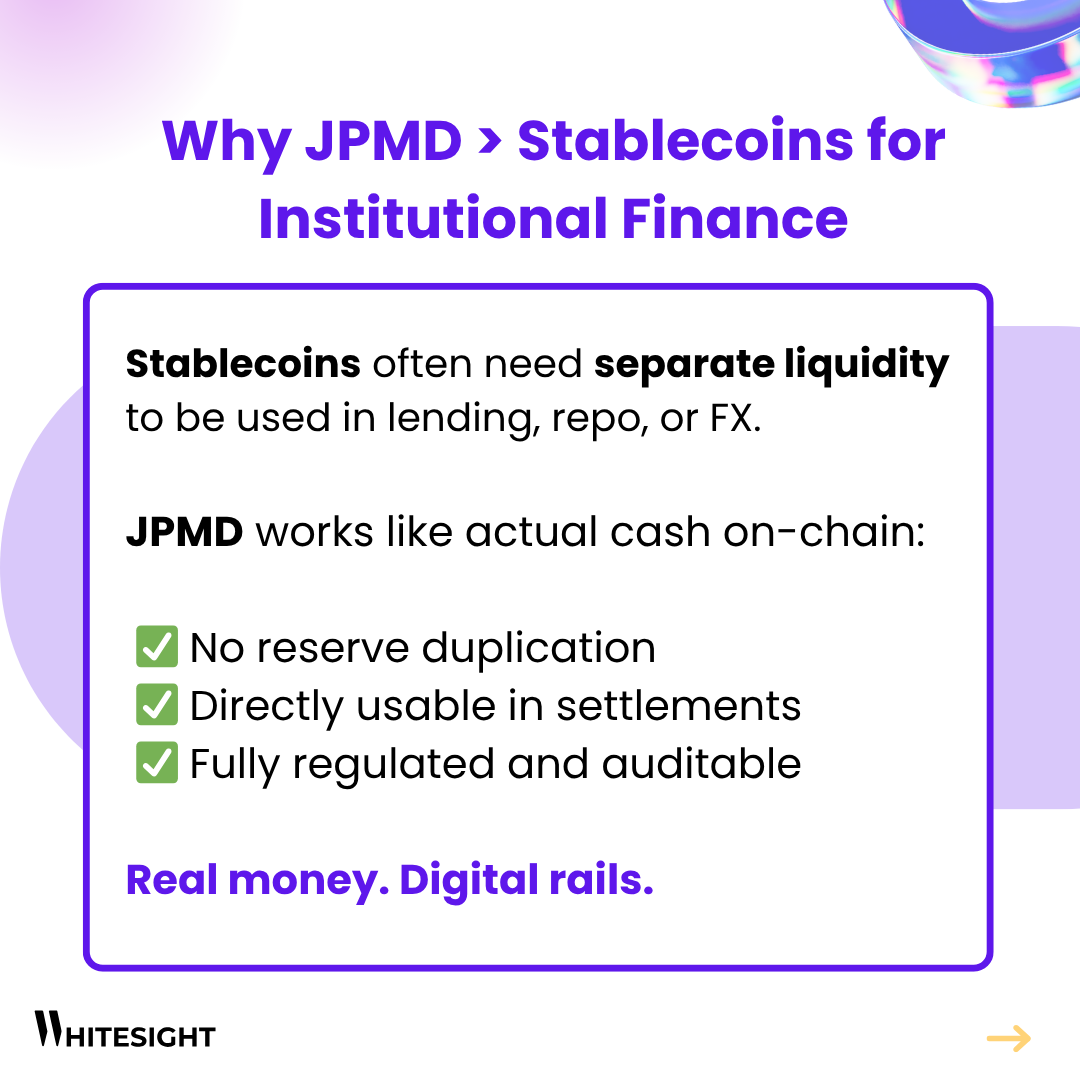

- This setup solves some long-standing frictions. In the case of most stablecoins, capital duplication is still a problem. You often need a separate reserve to make the system liquid, and institutions are forced to layer on legal wrappers to fit those assets into existing operations. With JPMD, there’s no extra reserve. No legal hacks. The dollar on-chain behaves like a dollar in the bank – because that’s exactly what it is.

How private rails set the foundation:

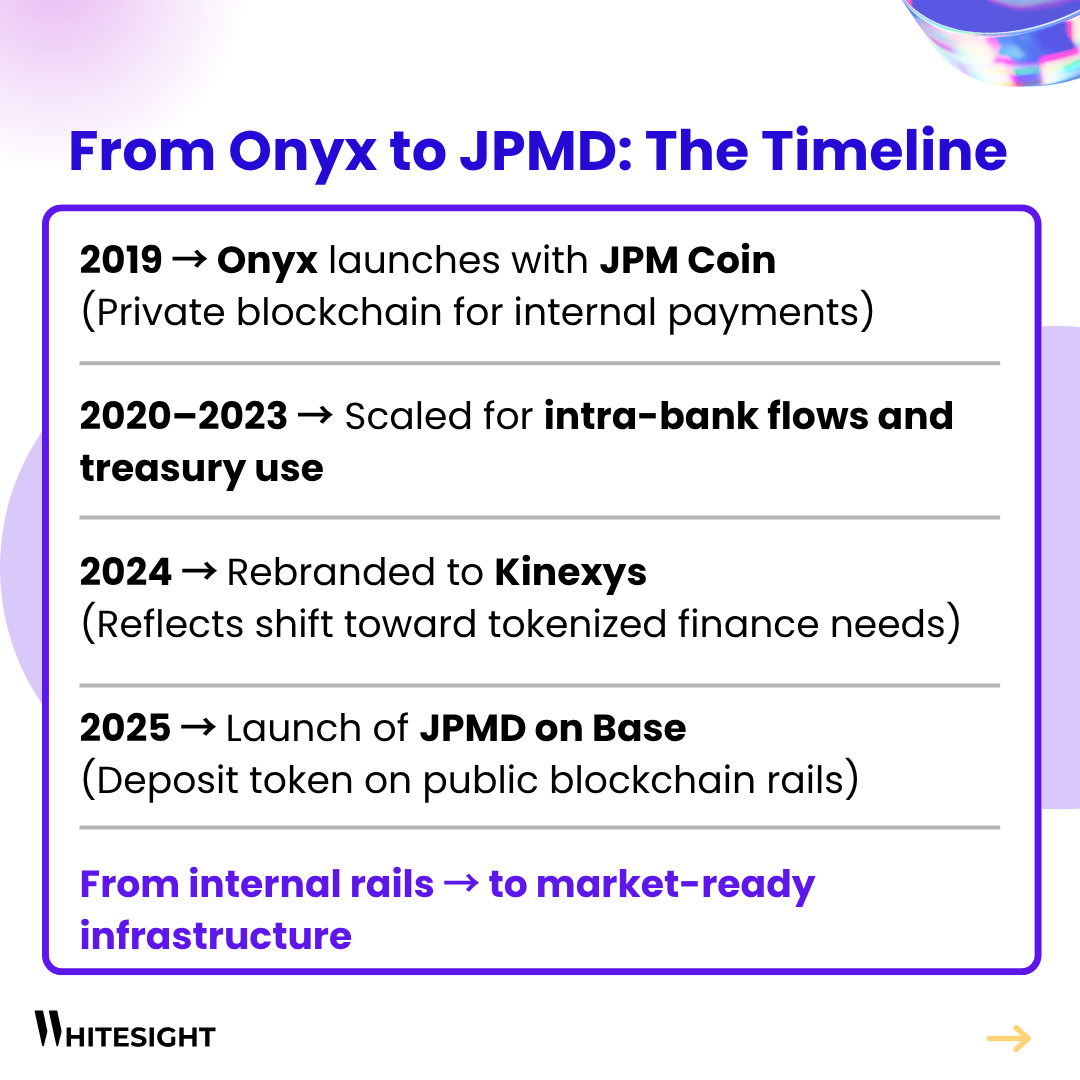

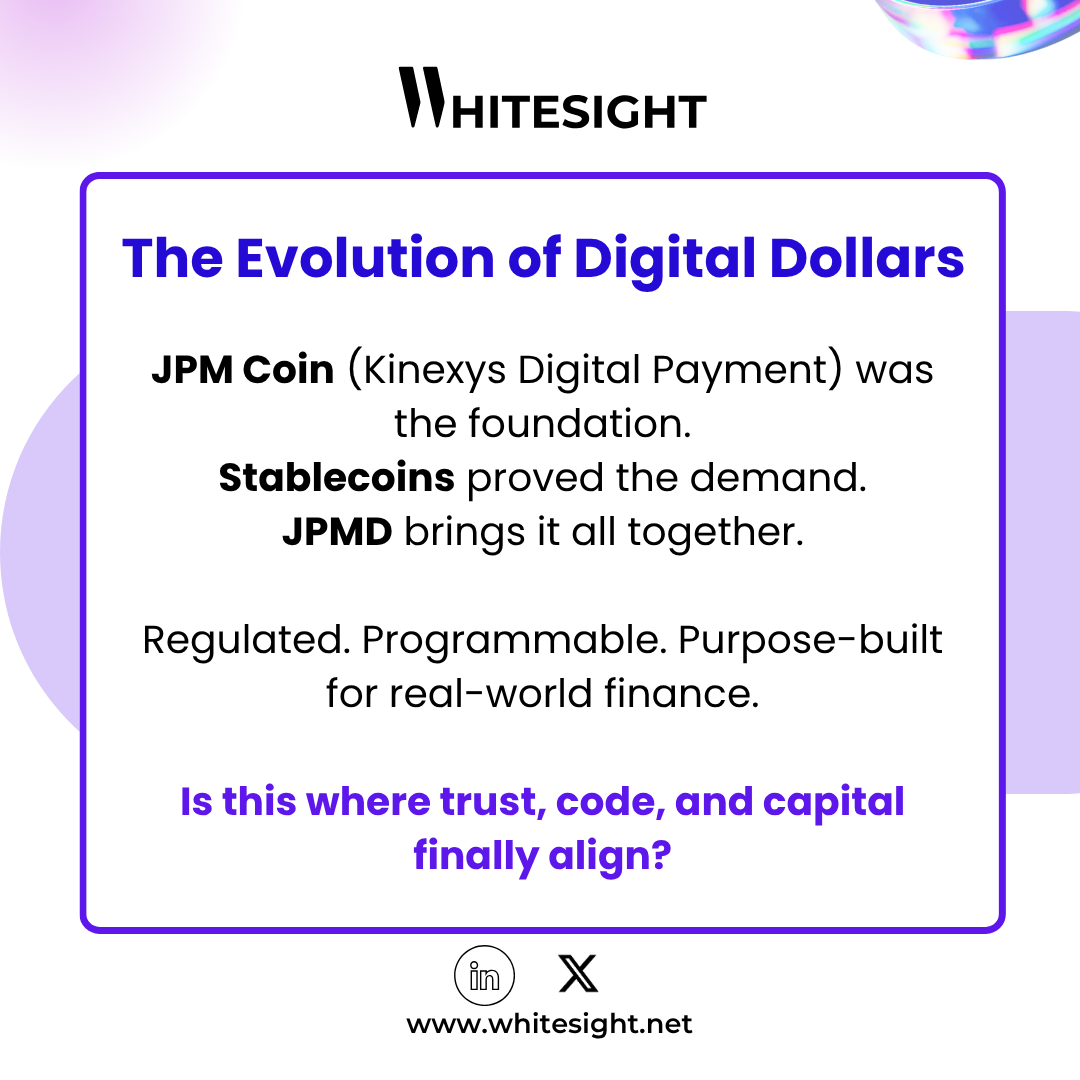

JPMorgan didn’t get here overnight. In 2019, it launched Onyx, a private blockchain designed to support internal operations, including liquidity corridors, treasury flows, and inter-entity settlements. Within that environment, the bank introduced JPM Coin, a digitised deposit token used for moving funds across entities faster than traditional rails allowed.

Onyx proved valuable for closed-loop use cases, but as tokenized assets matured outside its walls – money market funds, repo agreements, FX – the limitations became clear. By 2024, it was time to expand.

That’s when Onyx was rebranded to Kinexys, a move that signalled a shift from controlled networks to market-facing platforms. And JPM Coin itself was repositioned as Kinexys Digital Payments, with a broader mandate to enable asset-backed flows across connected platforms.

JPMD now sits as a separate product – purpose-built to work in public blockchain environments, but with safeguards that align with how institutions operate.

Why Base, and why this matters now:

Base, Coinbase’s Layer 2 network built on Ethereum, offers a balance that makes sense for JPMorgan. It delivers lower fees, faster throughput, and compatibility with Ethereum tooling. More importantly, it supports permissioned environments on top of public infrastructure – a design that mirrors what banks need.

For JPMD, this means it can operate where tokenized assets live, without losing the protections expected by regulators and institutions. This alignment becomes crucial when the intent is not experimentation, but daily settlement, collateral movement, and capital efficiency at scale.

Stablecoins showed demand – JPMD targets structure

Stablecoins deserve credit for proving that people want dollars on-chain. They enabled high-frequency trading, global remittance flows, and basic interoperability between crypto platforms. But they weren’t built for regulatory certainty.

Many are backed by reserves that fluctuate in composition. Others operate under loosely defined legal frameworks, or depend on infrastructure that exists outside the scope of traditional oversight. For institutions, that creates friction. It means lawyers, workarounds, and operational disclaimers.

JPMD answers those frictions. It brings the benefits of tokenized money – speed, programmability, compatibility – into a format that works for institutional workflows. You don’t have to build around it. You can build with it.

What this really signals:

JPM Coin proved that digital cash could work inside the bank. Stablecoins proved that programmable dollars could move across the internet. JPMD brings those ideas together in a format that meets the standards of financial institutions, not as an experiment, but as a tool meant for production.

If more banks follow this path, the real questions won’t be about token design or blockchain compatibility. They’ll be about who defines settlement logic. Who controls the rails? And which infrastructures quietly become default, not because they shouted the loudest, but because they functioned best at scale. JPMorgan is not waiting to find out. It’s building with that future in mind.

Don’t want to miss the next big thing in digital assets? 🪙

Our monthly Digital Assets newsletter unpacks the latest across stablecoins, tokenization, crypto trading, and global regulations, all in one punchy read. Perfect for staying ahead of the curve without the scroll fatigue.

Read the latest issue and subscribe to catch the next drop this week!

Supercharge your Fintech IQ with WhiteSight Radar

Join Radar for exclusive member benefits and access to expert reports, industry trend breakdowns, and insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond.

Be the First to Know About the Next Big Fintech Strategies!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn and subscribe to our Future of Fintech Newsletter to be the first to know about the Next Big Fintech Strategies.

Author

Anjali Singh

Research Analyst- Fintech & Digital Asset

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts