Future of Fintech: Payments Pule (10 Payment Trends)

From Stablecoins to Subscriptions: The Key Payment Trends Driving Transformation

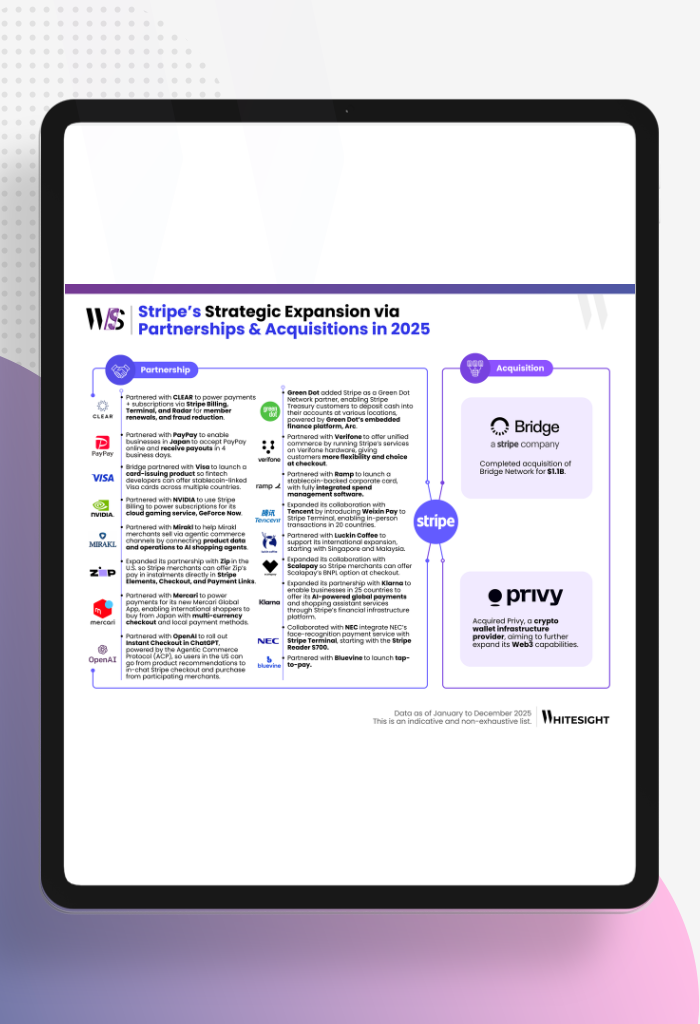

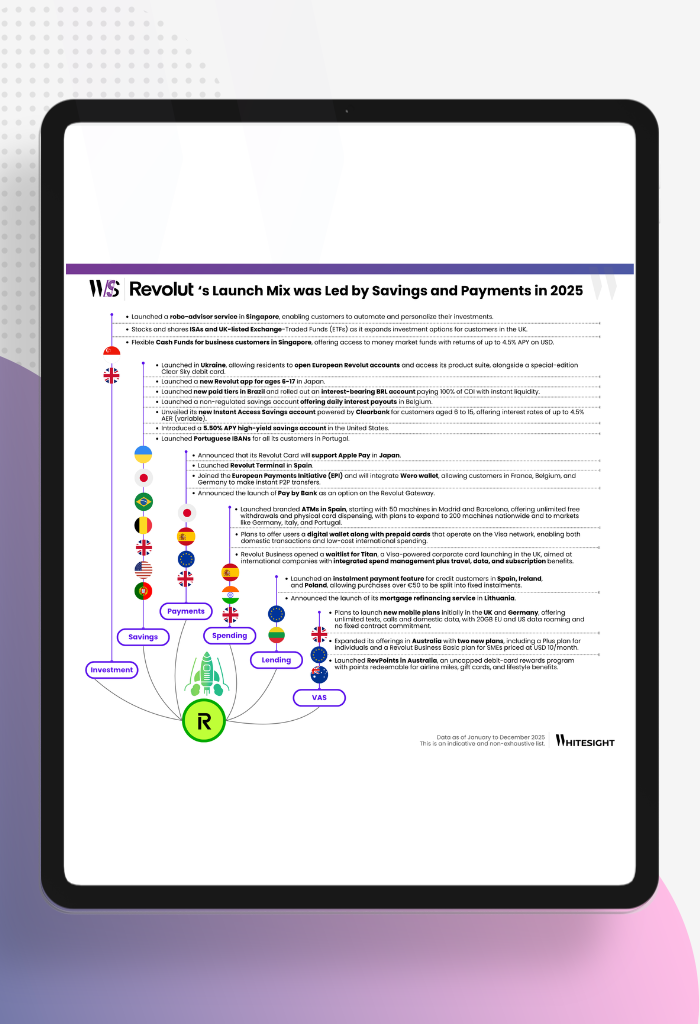

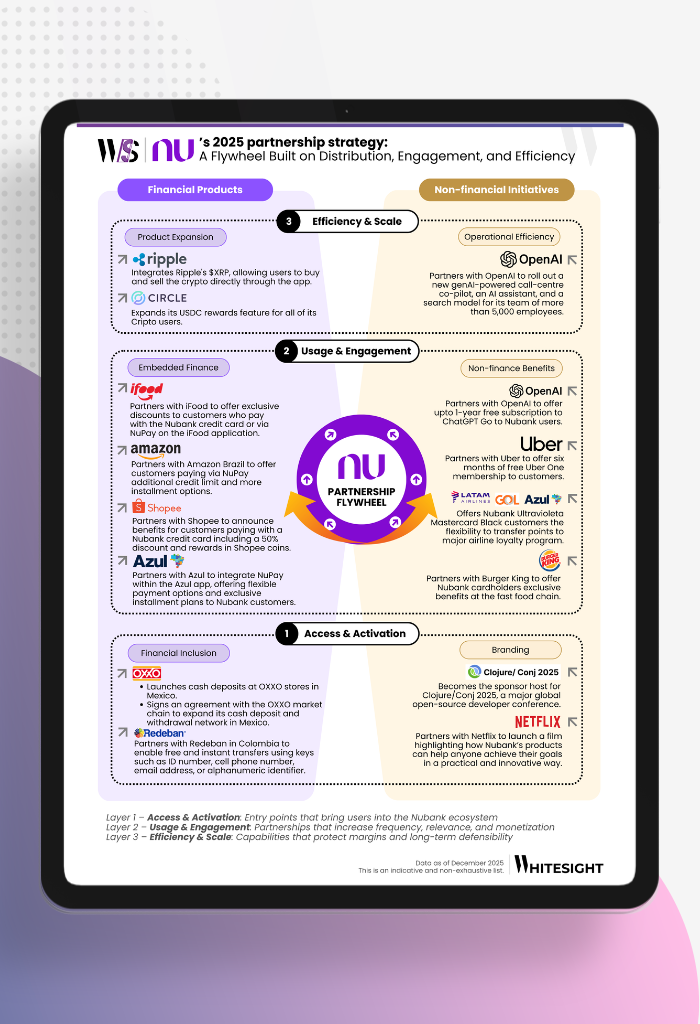

The latest wave of payment innovations marks a shift toward flexibility, interoperability, and future-proofing through strategic collaborations. This evolution signals a future where financial infrastructure becomes invisible yet ubiquitous, enabling seamless transactions across multiple platforms, currencies, and markets.

Key trends include:

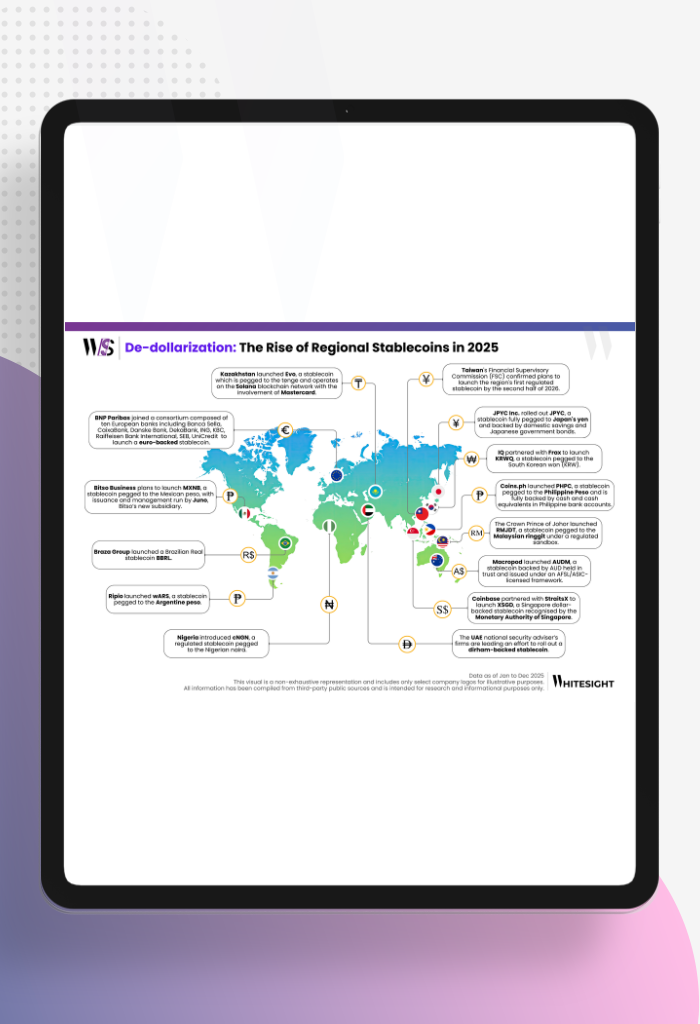

- Stablecoins Lead the Currency Transformation: The growing adoption of stablecoins by players like PayPal (via PYUSD) and BBVA highlights how digital currencies are moving beyond hype into real-world use cases. These companies are embedding stablecoins into existing systems, from SAP’s currency hubs to Visa’s VTAP platform, signaling the next phase of financial stability through programmable money.

- Embedded Payments & Regional Expansions are Redefining User Convenience: Whether it’s FOMO Pay enabling Visa cardholders to scan QR codes seamlessly, TRAY enhancing its POS systems for regional enterprises, or Western Union easing Chilean bank transfers via Khipu, the trend is clear: tailored embedded solutions at the intersection of payments and local needs are the future. Players adopting this model will gain significant user loyalty through hyper-personalized, contextual payment experiences.

- Subscription Economy Gets Smarter with Tech-Backed Payment Innovations: Mastercard’s acquisition of Minna Technologies and Venmo’s push into recurring payments underscore a key theme—streamlining user experience around subscriptions and payments management. This points toward an increasingly service-centric future, where businesses that simplify recurring transactions will dominate the space by reducing friction for consumers.

Subscribe yourself to interrupted fintech intel with WhiteSight Radar. 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies that propels your business to the forefront of fintech.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Fintech's future on your radar 🚀

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

The future of payments lies in collaboration, interoperability, and consumer-centric innovation. As financial services embed deeper into everyday experiences and regional preferences, industry players need to rethink how they integrate payments into their service offerings – restructuring how businesses, consumers, and financial institutions will interact in the years to come.

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts