How Digital Assets are becoming the New Banking Map of Asia

Inside Asia’s Banking Push Into Blockchain and Digital Assets

The spotlight on financial innovation often points West. Yet the East has long rewritten the rules of trade, from caravans along the Silk Road to today’s cross-border capital flows. Now, a new cargo is on the move: digital assets.

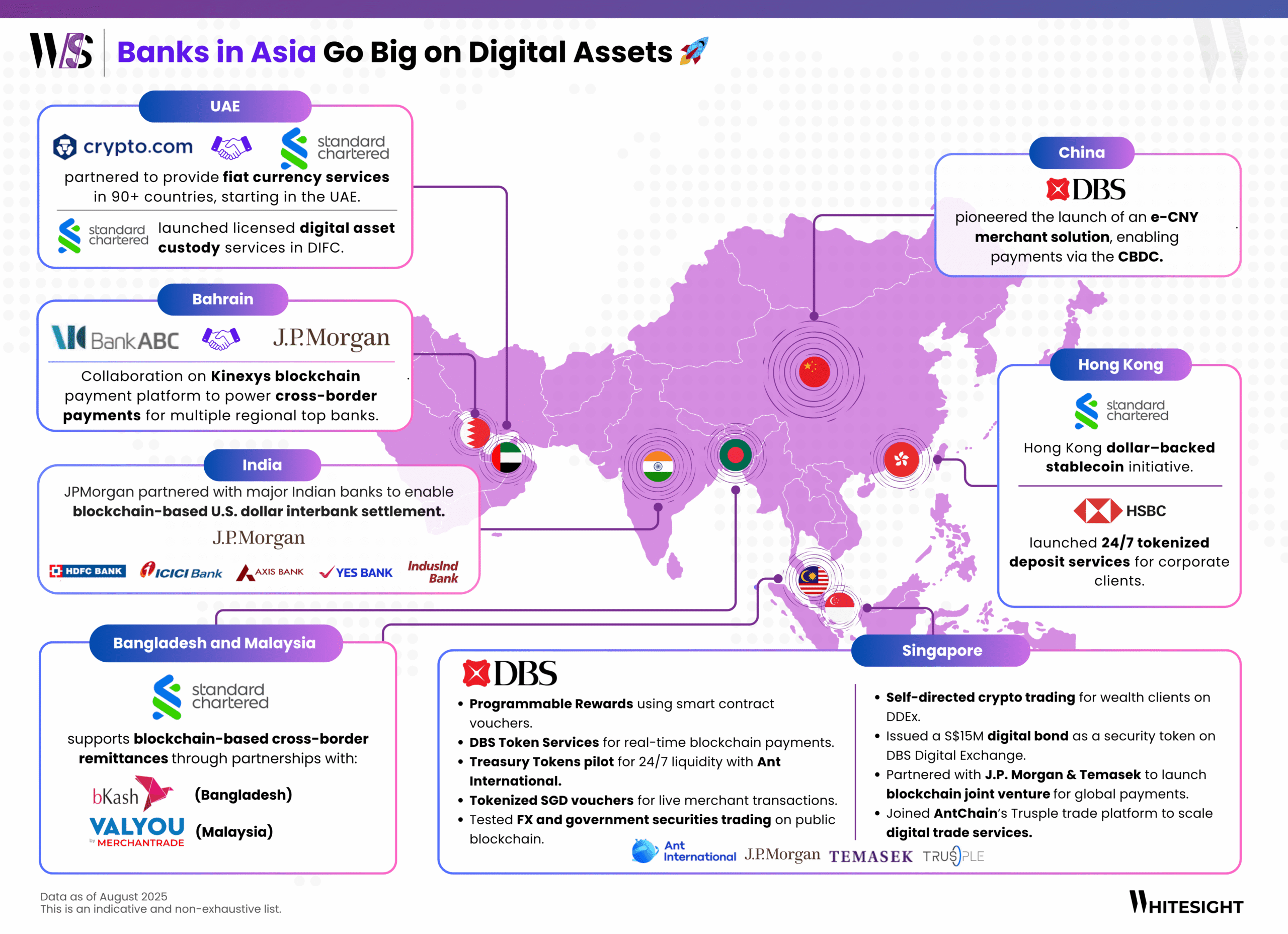

However, “Asia” is not a single story. Gulf banks are channelling oil liquidity into tokenized markets. South Asia’s financial rails are shaped by remittances, where speed and cost matter most. Southeast Asia experiments through sandboxes, with Singapore pushing tokenization into capital markets. And in China and Hong Kong, state-driven pilots, from e-CNY to stablecoin frameworks, set the tone. Fragmented and still in the experimental stages, Asia’s approach defies a single narrative. What unites it is a clear direction: banks are placing deliberate bets on digital infrastructure that could redefine how value moves across the region.

We’ve also mapped the same intersection of digital assets and banking across the US and Europe. Have a look now >>

External and Internal Pressures

The numbers tell the story. APAC’s digital asset ownership has reached 22% in 2024, almost three times the global average of 7.8%. Capital is moving in, regulators are experimenting, and institutions are no longer on the sidelines.

In the more advanced pockets of the region, momentum is clear. Regulatory clarity in Singapore, Hong Kong, and the UAE has given banks confidence to roll out tokenized deposits, stablecoin pilots, and new settlement platforms. Institutions like DBS, Standard Chartered, and HSBC are pushing experiments from programmable payments to tokenized bonds, turning financial hubs into laboratories for scaling digital asset infrastructure. These markets are no longer testing the waters — they are positioning themselves as standard-setters in the global race.

Elsewhere, progress is slower and more uneven. Licensing frameworks remain fragmented – what works in Singapore doesn’t translate easily in India or Bangladesh – limiting cross-border scalability. Harmonised standards on eKYC, fraud protection, and data sharing are still missing. Digital inclusion gaps keep retail adoption modest, while banks often concentrate their digital asset offerings on high-net-worth clients rather than the mass market. Infrastructure is being built, but the benefits are not yet equally distributed, creating an adoption bottleneck that will need to be addressed if the region wants to move from pilots to mass usage.

The Activity Map: How Banks Are Building

Payments and Remittances are the sharp edge of adoption. J.P. Morgan’s partnerships in India and Bahrain show how interbank USD settlement is moving onto blockchain rails. Standard Chartered is wiring together remittance corridors between Bangladesh and Malaysia. Its tie-up with Crypto.com in the UAE gives global reach to fiat flows. In economies where remittances are survival tools, blockchain is not a speculative experiment but a direct cost and efficiency fix.

Stablecoins are emerging as instruments of liquidity. Standard Chartered, HKT, and Animoca Brands launched a HKD-backed stablecoin to modernise Hong Kong payments. HSBC has introduced tokenized deposits for corporates in HKD and USD, offering 24/7 liquidity. In Singapore, DBS custodies reserves for Paxos’s USDG, while Standard Chartered supports stablecoin custody and cash management. These moves aim to make corporate cash and settlement more efficient.

Custody and wealth management remain central. Standard Chartered DIFC in Dubai is anchoring licensed custody for institutions, while DBS has launched trust solutions for private clients. This tilt toward the wealthy is deliberate; banks know institutional and high-net-worth money moves first. But the infrastructure being built will eventually shape how broader retail markets access digital assets under regulated guardrails.

Tokenization and capital markets are being tested at scale in Singapore. DBS has issued digital bonds, experimented with programmable rewards, tested FX and government securities on blockchain, and piloted 24/7 treasury solutions with Ant International. These experiments target core market instruments, positioning tokenization as a tool for efficiency and liquidity – not just novelty.

Infrastructure and Trade Finance are perhaps the region’s most distinctive focus. DBS, J.P. Morgan, and Temasek’s Partior aim to rewire interbank payments. DBS has joined AntChain’s Trusple platform to digitise trade services for SMEs. In supply-chain heavy economies, digitising trade finance is not optional, it is a competitive necessity.

What Banks Are Really Solving

- Standard Chartered → remittance corridors, stablecoin-backed cash management, institutional custody.

- J.P. Morgan → interbank USD settlement, corporate cross-border payments.

- DBS→ tokenized capital markets, programmable money, trade finance rails.

- HSBC → tokenized deposits for corporates and liquidity management.

Asia and the Middle East’s Distinct Path

The Gulf is anchoring global liquidity and custody hubs. South Asia is focused on low-cost remittances. Southeast Asia, led by Singapore, is turning tokenization into a capital markets story. Hong Kong and China are testing hybrids of private innovation and state-backed rails. Diversity is the region’s challenge, but also its strength: while fragmented, it allows multiple models to be tested in parallel.

The lesson here is not that APAC is behind, but that it is solving a different problem. Where the West is debating investor access and regulatory compliance, the East is building transaction rails that could carry the world’s trade for the next century, just as it did once before with the Silk Road.

The West may scale faster, but the East is testing deeper. Asia and the Middle East are turning digital assets into laboratories for real-world finance – and what works here will eventually set the standards everywhere else.

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts