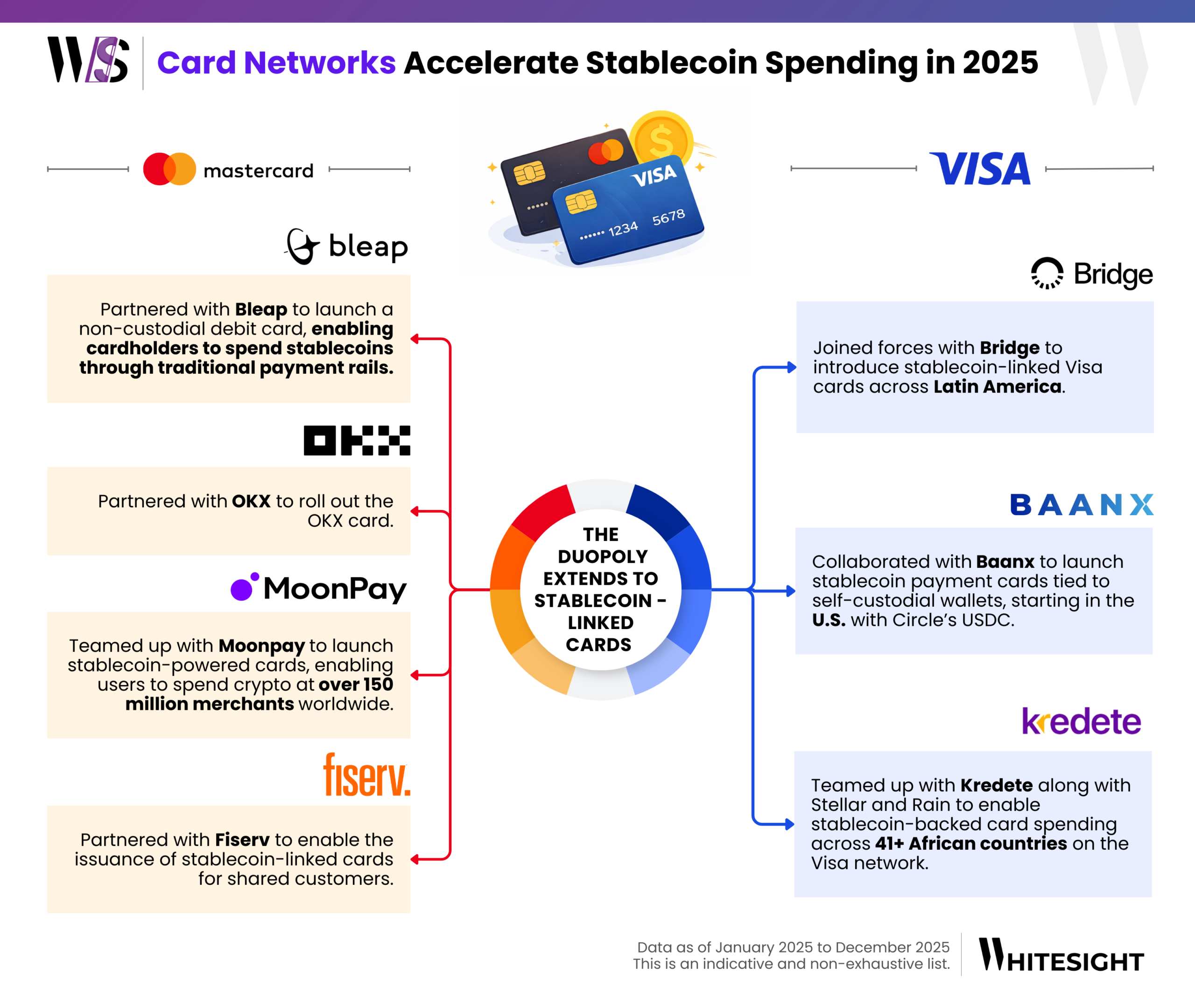

Mastercard vs Visa: The Duopoly Extended to Stablecoin-Linked Cards in 2025

Accelerating stablecoin spending within regulated rails

Visa and Mastercard are rapidly normalizing stablecoin spending by anchoring it to familiar card experiences while outsourcing most of the crypto complexity to specialist partners. The pattern across these 2025 moves skewed towards the networks protecting the reliability and trust of card rails, while enabling stablecoins to function as a faster settlement and funding layer underneath everyday payments.

- Market Expansion and Distribution: Visa is using region-focused partners such as Bridge to introduce stablecoin-linked Visa cards across Latin America, and Kredete, alongside Stellar and Rain, to enable stablecoin-backed card spending across more than forty African countries. Mastercard is pursuing scaled distribution through platforms that already aggregate users, partnering with MoonPay to launch stablecoin-powered cards with broad merchant acceptance and with OKX to roll out the OKX card.

- Wallet Integration and Custody Options: Visa is collaborating with Baanx to launch stablecoin payment cards tied to self-custodial wallets, starting in the U.S. with Circle’s USDC. Mastercard is working with Bleap to support a non-custodial debit card experience that still interoperates with traditional payment rails, lowering friction for everyday use.

- Issuance and Program Industrialization: Mastercard’s partnership with Fiserv signals a push to make stablecoin-linked card issuance repeatable for shared customers. Visa’s partner mix similarly indicates a playbook built around specialist enablement partners that can accelerate compliant issuance and local execution across priority regions..

Collectively, these moves formalize stablecoins as a mainstream funding and settlement primitive inside regulated card architectures, while reinforcing the traditional rail duopoly rather than weakening it. By routing stablecoin balances through Visa and Mastercard’s acceptance, risk, dispute, and issuer frameworks, stablecoins gain everyday usability without forcing merchants or consumers to change behavior.

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn and subscribe to our Future of Fintech Newsletter to be the first to know about the Next Big Fintech Strategies.

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts