Nubank’s SME Expansion (4 Key Offerings)

Nubank’s SME Offerings Across Banking, Lending, Payments and Financial Management

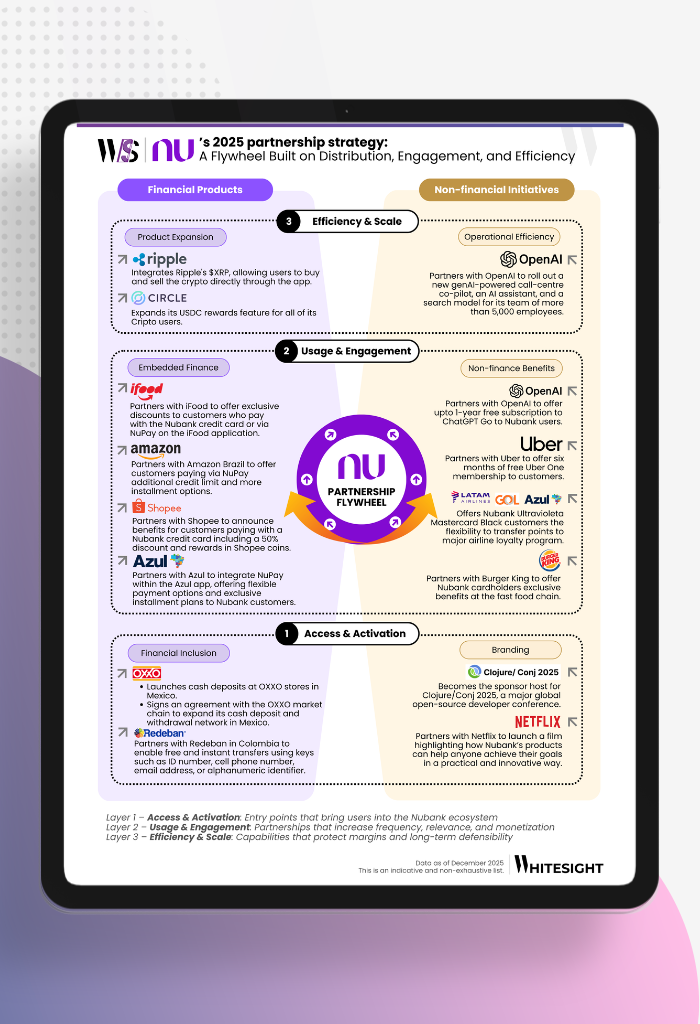

After cementing its dominance in Brazil’s retail banking with low-cost, digital-first offerings, Nubank is expanding its scope to serve the SME segment—specifically micro and small business owners who’ve long been underserved by traditional banks. This expansion is built on four tightly integrated offerings designed to address core operational pain points:

- Business Banking – The Foundation Layer: Launched in 2019, Nubank’s PJ (Pessoa Jurídica) account offers free, digital business banking tailored to sole proprietors and small entrepreneurs. As of 2023, Nubank onboarded over 3M PJ account holders, an indicator of the high demand for low-friction, no-fee accounts among Brazil’s SMBs, many of whom previously relied on personal accounts for business needs.

- Lending – Unlocking Credit Access Through Deposit-Backed and Hybrid Models: With over 1M business credit cards issued—600K of which represent customers accessing their first-ever business credit line—Nubank is bridging a major gap in SME financing. Products like Nu Limite Garantido (where users can lock deposits to secure credit) and the ability to transfer up to 99% of unused personal credit limits into business use are redefining creditworthiness for thin-file borrowers. Notably, 65% of SME borrowers were new to formal lending, and working capital loans saw a 150% QoQ growth in Q3 2024.

- 3. Payment Acceptance – Fee-Efficient Acceptance Without Hardware: In 2024, Nubank introduced Tap to Pay on iPhone, eliminating the need for POS hardware. The integration allows card and digital wallet acceptance via iPhones, reducing transaction costs by up to 30% compared to traditional card machines. This positions Nubank as a lean payments enabler for gig workers, street vendors, and mobile merchants.

- Financial Management – Simplified Tax Handling and Cash Flow Tools: Tools like Money Boxes (Caixinhas) let businesses allocate funds for specific goals while earning a 100% CDI return after 30 days—supporting disciplined cash flow management. Complementing this is the “My MEI Taxes” feature, enabling entrepreneurs to manage their formal tax filings directly from the Nubank app without external intermediaries. As of August 2024, these tools collectively held BRL 1.45B in assets under custody.

Want to understand how Nubank is reshaping SME banking with precision-engineered offerings across credit, compliance, and collections?

Find answers on Nubank’s modular product strategy, SME monetization models, and how it’s redefining financial access in Brazil by downloading the full Nubank Deep Dive Report:

Nubank's Deep Dive Report 📔

Nubank’s building a case as the most dominant fintech on the planet. With 114M+ users, $2B+ in net income, and metrics that legacy and challenger banks would kill for, Nu is proof that fintechs can scale and stay profitable. In a region where high cost-to-serve and low credit access are the norm, Nubank built a lean, digital-first platform that’s low-cost, hyper-scalable, and sticky.

Whether it’s cracking payroll loans, embedding telecom into its superapp, or using Open Finance to find low-risk borrowers at scale—Nu’s model is what sustainable fintech looks like in emerging markets. WhiteSight’s latest deep dive distills the plays, pivots, and product bets that fuel Nubank’s rise across LATAM.

Whether it’s cracking payroll loans, embedding telecom into its superapp, or using Open Finance to find low-risk borrowers at scale—Nu’s model is what sustainable fintech looks like in emerging markets. WhiteSight’s latest deep dive distills the plays, pivots, and product bets that fuel Nubank’s rise across LATAM.

Report

Unlock the deep dives into the winning strategies of Stripe, Apple, Starling Bank, and more with a WhiteSight Radar Membership.

Join 4,000+ fintech buffs already subscribed and get unparalleled access to expert reports, industry trend breakdowns, and exclusive insights on everything from Embedded Finance to Digital Banking, Open Finance and beyond—all at a fraction of the cost of market alternatives.

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! You’ll be joining a growing global community of fintech professionals. 🧭

Fintech's future on your radar

Actionable insights on fintech, delivered regularly. Join Radar for exclusive fintech content and member benefits.

Be the First to Know About the Next Big Fintech Strategies!

We’ve got a power-packed lineup of strategy playbooks coming soon—including Nubank, Affirm, Wise, and more. With 1,000+ report downloads and 100+ paid subscribers, we’re the go-to for fintech intelligence.

Want to be the first to access every new report, blog, and market insight as soon as it drops?

Subscribe to receive our updates directly in your inbox!

Don’t miss out on the next big fintech wave! Follow us on LinkedIn for daily updates and in-depth analysis. Subscribe to our weekly newsletter for curated insights delivered straight to your inbox. Unlock exclusive access to our membership plans for deeper dives into market trends, competitor analysis, and investment opportunities.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts